As the market pulled back this week, one of the areas of the market underperforming in momentum is the Financial sector. $SPTFS.

The purple area shows that the financial sector never really outperforms the $SPX consistently. Recently we saw Sunlife and a few of the banks break out to new highs, but the sector continues to have trouble making a sustained breakout. The MACD continues to drift lower as the momentum continues to slowly deteriorate. Today's bounce off the trendline on both the price and the relative strength looks important. If this level fails to hold, we'll probably see a larger downside shock. Today's bounce has not reversed the downtrend, so we are on soft support here.

On the webinar, I discussed some of the safer, stronger areas of the market. Martin Pring also joined me this week as he had been speaking in Asia last week. Here is the webinar link. The Canadian Technician Replay 2016-06-15.

"The Canadian Technician LIVE!" with Greg Schnell - 2016-06-14 17:00 from StockCharts.com on Vimeo.

Webinar // Review of Top Ranked SCTR list // Martin Pring US Index Analysis 15:00 // Global Market 30:00 // Stock: Bond Ratio 33:00 // Credit Markets 37:00 // US Dollar 47:00 // Discussion of Asian Markets 52:00 //

The Utilities Sector ($SPTUT) continues to perform nicely. The trend is up, but it looks like a bearish wedge is building on the sector. This can also resolve with a bullish move to the upside to expand the range for top line of the channel. With the Utilities paying reasonable yields and the bond market continuing to be under pressure on yields, there is a large investor base focused on these stocks for income.

Canada has a few strong performers in the Consumer Staples $SPTCS group, but the chart for the sector is starting to fail. The Relative Strength has been underperforming for 3 months and the momentum is already negative. If we are going lower in the indices and the Consumer Staples can't hold up, that will cause upheaval if the defensive areas can't hold up.

The Energy sector is a huge sector for Canada. The $SPTEN chart has recently broken an uptrend line. So far it is maintaining the uptrend vs. the $SPX in purple, but the momentum is waning with lower highs on the MACD. Interestingly, the last three days have seen consolidation and not continuous selling.

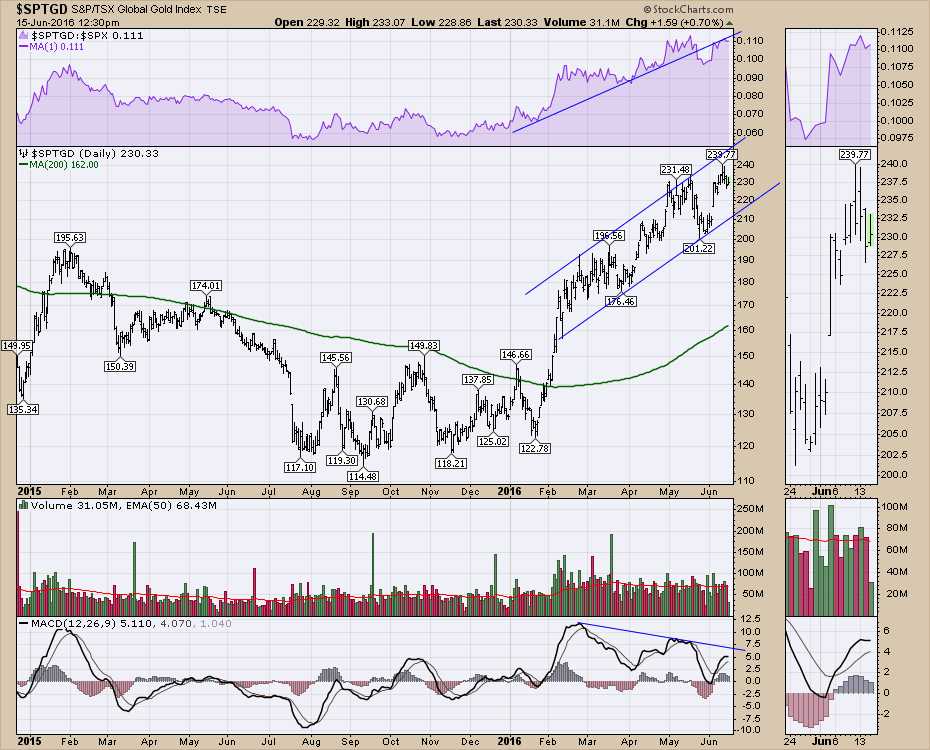

The gold stocks ($SPTGD) continue to pause here. The chart looks like weakness is creeping in as the relative strength is starting to make lower highs after breaking the trendline. It is a little early to be real pessimistic, but the MACD rolling over just above zero would probably confirm the relative strength trend break.

The gold stocks ($SPTGD) continue to pause here. The chart looks like weakness is creeping in as the relative strength is starting to make lower highs after breaking the trendline. It is a little early to be real pessimistic, but the MACD rolling over just above zero would probably confirm the relative strength trend break.

The Gold Miners ratio to Gold (GDX:GLD) remains in an uptrend but over the last three days, Gold has been up and the miners have drifted lower and the ratio has closed at the low half of the range every day. It is an important time to focus on this area.

The Gold Miners ratio to Gold (GDX:GLD) remains in an uptrend but over the last three days, Gold has been up and the miners have drifted lower and the ratio has closed at the low half of the range every day. It is an important time to focus on this area.

I'll be diving into the Commodities on Thursday for the Commodities Countdown Webinar 2016-06-16. After a week of charts going lower in just about every stock, we'll analyze some support areas and talk about some of the changing trends.

I'll be diving into the Commodities on Thursday for the Commodities Countdown Webinar 2016-06-16. After a week of charts going lower in just about every stock, we'll analyze some support areas and talk about some of the changing trends.

I will be in Toronto for the Canadian Society Of Technical Analysts Annual Meeting in Toronto at the Sheraton Centre Wednesday, June 22, 2016. Perhaps you can make plans to join us. If so, please take the time to introduce yourself to me. You can click here to register. www.CSTA.org. Please click on the Yes button below if you would like to receive these articles directly to your inbox.

Good trading,

Greg Schnell, CMT, MFTA.