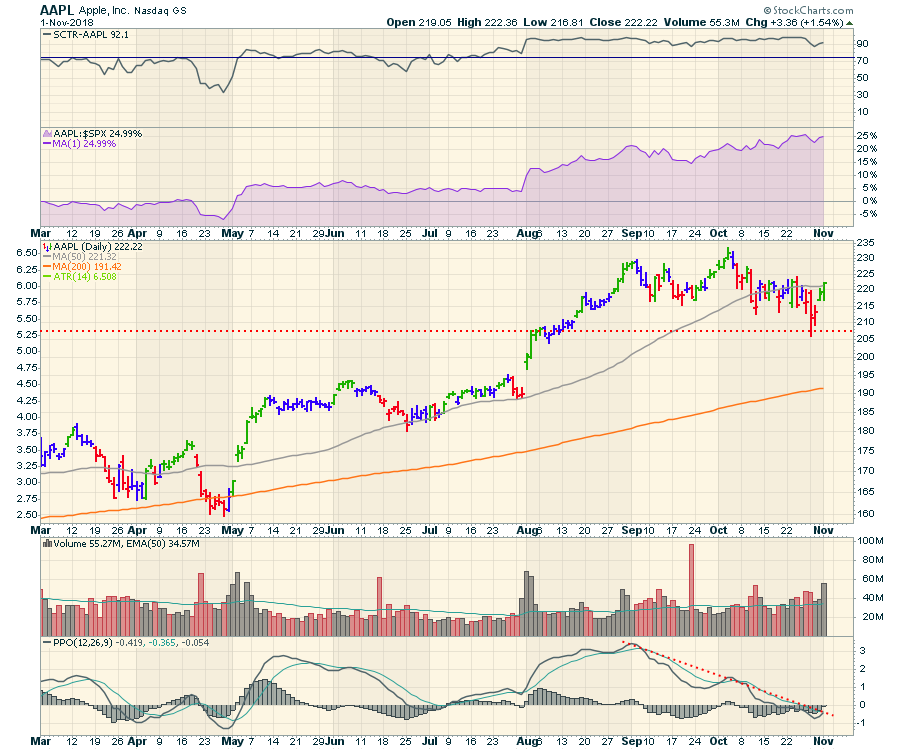

A significant bounce off the lows already has the indexes trying to repair some of the October damage. With a big up day on the NASDAQ, stocks are trying to rally. The $COMPQ was up 1.75% and the $RUT was up 2.2%! Apple gave us a great report after the close. Somehow the sellers always seem to sell it off. As one TV personality said, Warren Buffet and Tim Cook will buy the shares they're selling. Apple sold almost 46 million phones in the quarter which amounts to more than 500,000 a day. They missed estimates by 600,000 which amounts to 1 day of sales. The average selling price was up. Anyway, the stock was down 6% in the after hours...

With the stock market trying to rally, quite a few new retail stocks hit new highs. I covered Burlington and Nordstrom in another article earlier but we can add Deckers and Kohls to the list. On the Canadian side, Aritzia was hitting new highs.

With the stock market trying to rally, quite a few new retail stocks hit new highs. I covered Burlington and Nordstrom in another article earlier but we can add Deckers and Kohls to the list. On the Canadian side, Aritzia was hitting new highs.

The deckers chart was really nice. DECK doesn't need a lot of annotation here. New highs in relative strength, price surging on higher volume, suggests some muscle showing up to push this stock around. 1,000,000 extra shares at a $120 a share is not my family picking up shares! While it could breath out for a day or two, this looks like it is setting up for a nice retail season.

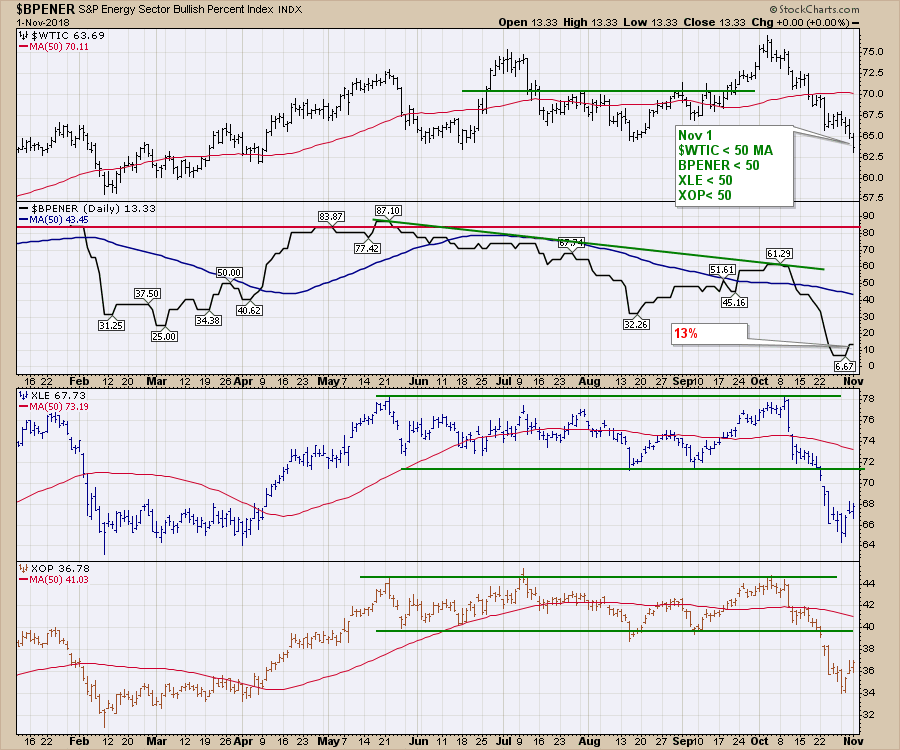

I continue to like the way the market is improving here. One area I would avoid is the energy sector. There are only 10% of the stocks on a buy signal and crude is off $13. This will need some time to stabilize. When it is above the 50 day moving average that is bullish. As you can see, every moving average on the chart is pointed down. So be cautious in the space.

I continue to like the way the market is improving here. One area I would avoid is the energy sector. There are only 10% of the stocks on a buy signal and crude is off $13. This will need some time to stabilize. When it is above the 50 day moving average that is bullish. As you can see, every moving average on the chart is pointed down. So be cautious in the space.

I continue to find strong stocks to trade here. But the volatility is always high near the lows. That makes it hard. I'll be recording a Market Roundup with Martin Pring which should be on the Vimeo channel Friday evening.

I continue to find strong stocks to trade here. But the volatility is always high near the lows. That makes it hard. I'll be recording a Market Roundup with Martin Pring which should be on the Vimeo channel Friday evening.

Good trading,

Greg Schnell, CMT, MFTA.