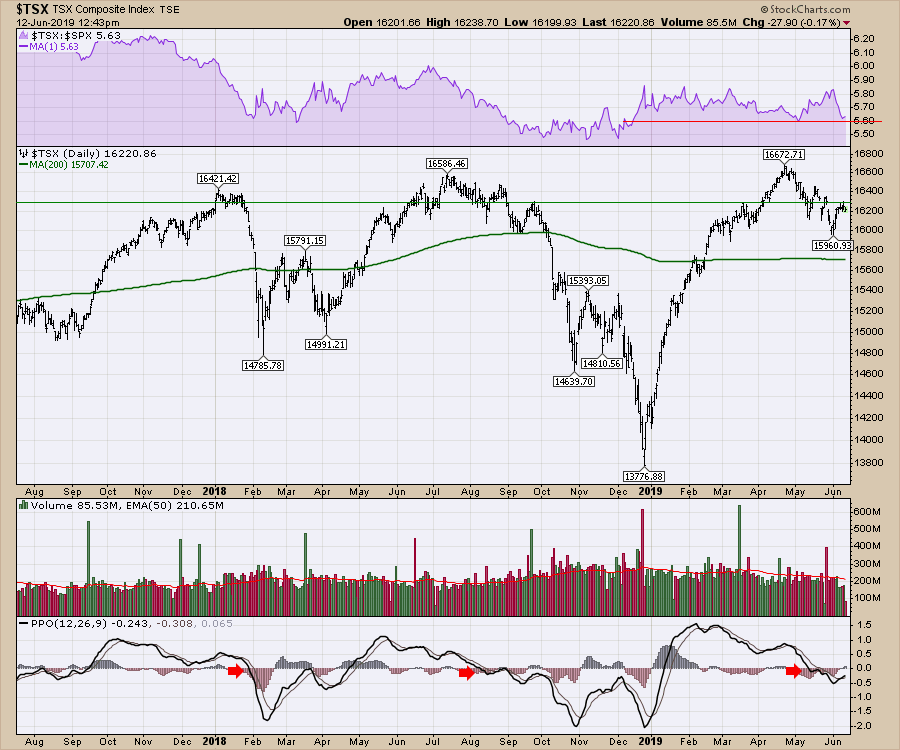

After the Canadian market drifted lower through the month of May, the first few days of June have seen a bounce. As the G20 finance people meet in Japan, with promises for more QE and Fed chairman Jay Powell offering up potential rate cuts as the market sits within a few percent of the all time highs, the markets have tried to avoid pricing in the ramifications from slower trade globally.

The Canadian market couldn't be more muted in the three big sectors, Financials, Energy and Materials. However, within Technology, Shopify (SHOP.TO) has soared in the 6 months since the December low. The software company has made a price surge up 150% and investors are clamoring to buy the small company, pushing the stock price higher.

The Canadian market couldn't be more muted in the three big sectors, Financials, Energy and Materials. However, within Technology, Shopify (SHOP.TO) has soared in the 6 months since the December low. The software company has made a price surge up 150% and investors are clamoring to buy the small company, pushing the stock price higher.

The chart looks beautiful. SHOP.TO has been the number one stock in Canada consistently this year.

The chart looks beautiful. SHOP.TO has been the number one stock in Canada consistently this year.

The Canadian Industrials are a mixed bag, but the heavy weighting of Railroads and Airlines are holding up nicely, with the two big airline deals (Westjet and Air Transat) and the railroads continuing to track higher highs. CN Rail is a few percent off the highs this week.

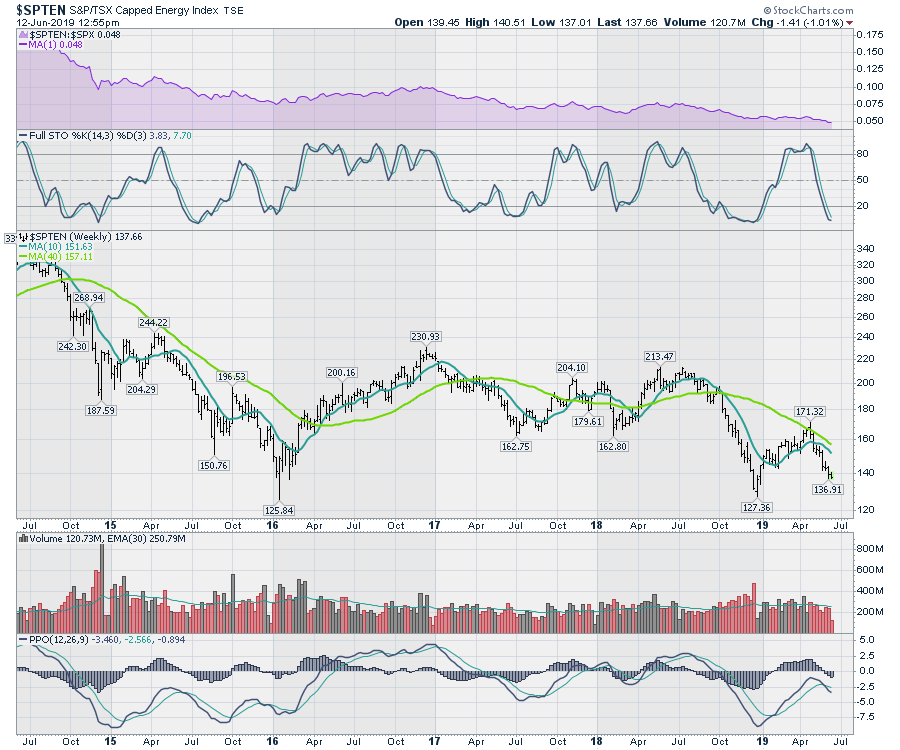

The Energy sector is testing 2016 lows; this looks like an interesting place to buy some energy names with a tight stop. Commodities need to be bought near their lows and sold near their highs. It is very hard to buy new 52-week high breakouts and make substantial money in commodities.

The Energy sector is testing 2016 lows; this looks like an interesting place to buy some energy names with a tight stop. Commodities need to be bought near their lows and sold near their highs. It is very hard to buy new 52-week high breakouts and make substantial money in commodities.

There is a complete review on this week's video, which you can watch by clicking this link.

There is a complete review on this week's video, which you can watch by clicking this link.

Good trading,

Greg Schnell, CMT, MFTA

Senior Technical Analyst, StockCharts.com

Author, Stock Charts For Dummies

Want to stay on top of the market's latest intermarket signals?

– Follow @SchnellInvestor on Twitter

– Connect with Greg on LinkedIn

– Subscribe to The Canadian Technician