ChartWatchers August 19, 2012 at 07:00 PM

Hello Fellow ChartWatchers! Last weekend's ChartCon conference in Seattle was amazing. Myself and the other newsletter authors met so many terrific people during the event and the feedback that we are getting from the attendees is extremely positive... Read More

ChartWatchers August 19, 2012 at 01:17 AM

First, let me say that it was AWESOME meeting so many of you at Chartcon 2012 in Seattle last week. It was also great to finally meet several of the co-authors of ChartWatchers. I've been to a LOT of trading conferences and this one surpassed all of the others on so many levels... Read More

ChartWatchers August 19, 2012 at 01:00 AM

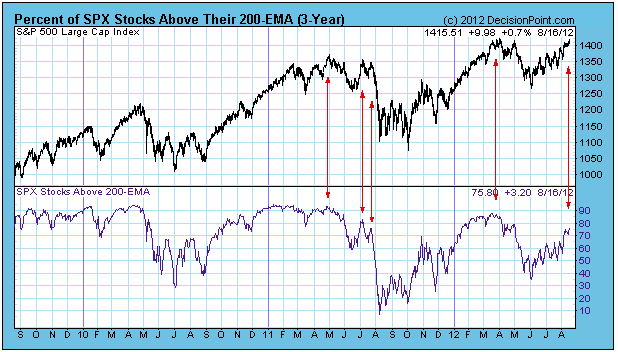

When a stock is above its 200-EMA, it is considered bullish, and in the broadest sense the stock can be considered to be in a long-term rising trend. A good way to determine the amount of support behind a rally is to analyze the percentage of stocks above their 200-EMA... Read More

ChartWatchers August 18, 2012 at 07:41 PM

FEATURES WE'VE ADDED SO FAR THIS MONTH: Eight new Technical Indicators Five new Chart Color Schemes Five new Time Period choices (2-, 3-, 120-minute as well as quarterly and yearly) The new Two Year Subscription Option (w/3 free months) The New "Best of s.c.a.n... Read More

ChartWatchers August 17, 2012 at 07:36 PM

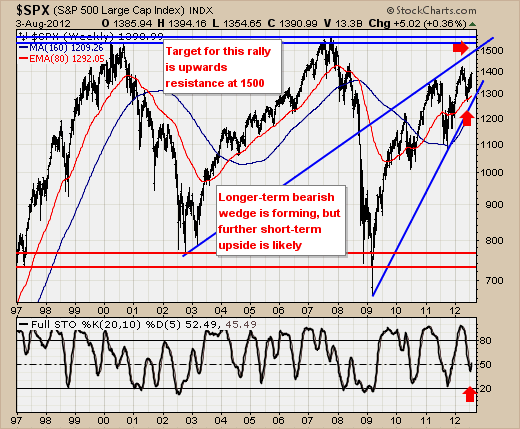

Large-caps continue to lead the market as the S&P 100 ($OEX) recorded a 52-week high this week. Thus far, the S&P 100 is the only major index to reach this milestone. The Nasdaq, Russell 2000, S&P 500 and Dow Industrials remain shy of their spring highs... Read More

ChartWatchers August 04, 2012 at 11:05 PM

Hello Fellow ChartWatchers! Today I'm happy to announce that we've started rolling out several important new features for our SharpCharts charting tool. These new features include more choices for bar periods and an improved version of our interactive "Inspector" tool... Read More

ChartWatchers August 04, 2012 at 05:04 PM

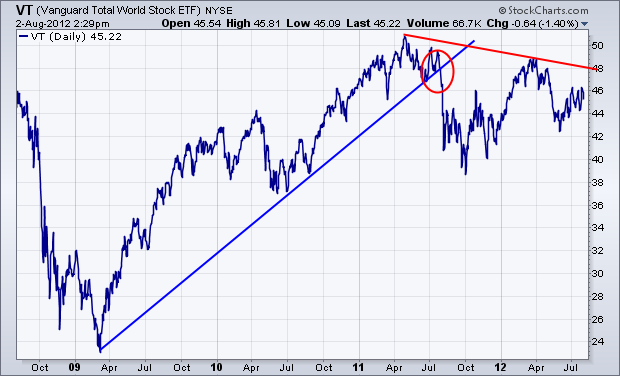

One of my previous messages showed a rotation out of small cap stocks into mega-caps in the middle of 2011 which continues to this day. That suggests that investors have been growing increasingly defensive over the last year... Read More

ChartWatchers August 04, 2012 at 04:58 PM

Decision Point publishes a daily Tracker report of our 152 Blue Chip list. This list is composed of the stocks in the S&P 100 Index, the Dow 65, and some large-cap Nasdaq stocks... Read More

ChartWatchers August 04, 2012 at 04:52 PM

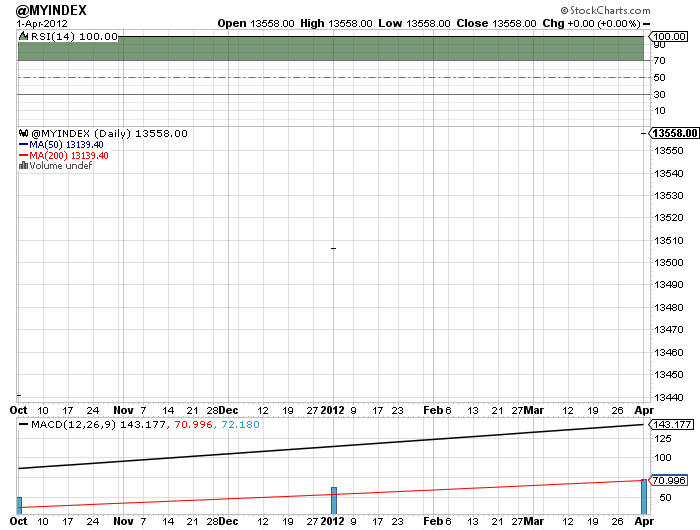

Any time the S&P 500 moves to fresh new highs, I try to determine the likelihood that the move is a sustainable one. Traders need to be in the right mindset to carry prices further. They need to be aggressive in terms of where they place their trading dollars... Read More

ChartWatchers August 04, 2012 at 04:44 PM

For now, the S&P 500 is rallying in a manner that is abrupt to say the least - several days higher, then several days lower, and then repeat... Read More

ChartWatchers August 04, 2012 at 04:10 PM

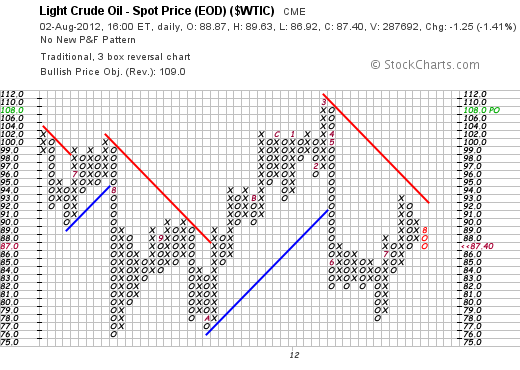

On Thursday August 2, $WTIC crude made an interesting turn. Currently crude is in a downtrend denoted by the red line. We have started August creating a downward column of O's. The Red 8 shows the first box in August with a move of at least $3... Read More

ChartWatchers August 04, 2012 at 06:40 AM

Stocks turned a negative week into a positive week with a sharp advance on Friday. The S&P 500 ETF, Dow Industrials SPDR and Nasdaq 100 ETF recouped their early week losses and exceeded their July highs... Read More