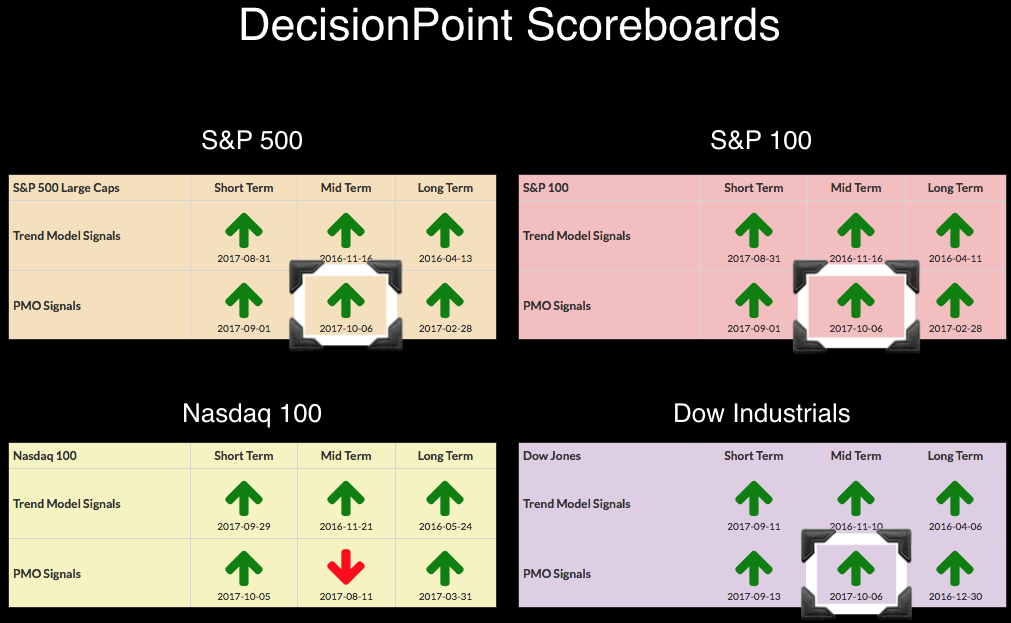

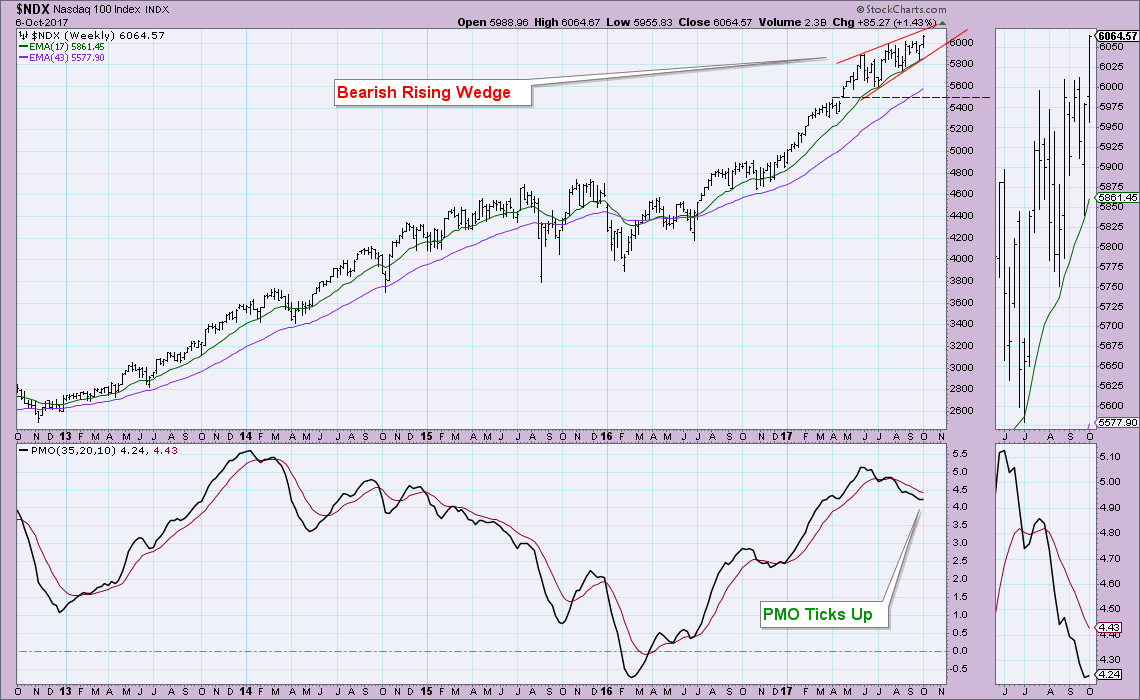

Today all but the NDX garnered new PMO BUY signals in the intermediate term. The intermediate-term PMO signals are gathered from the weekly chart PMOs and their crossovers. I'll give you a peek at the NDX weekly chart too, but it is much further away from a new weekly BUY signal. In fact, the NDX weekly chart looks surprisingly bearish.

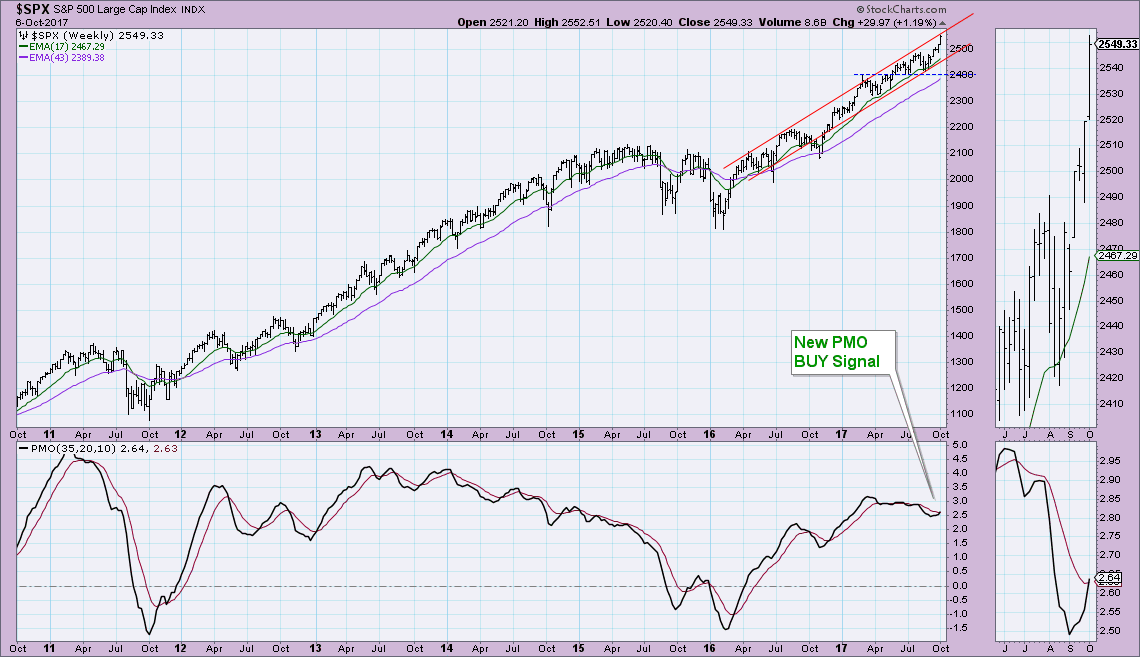

The SPX is in a rising trend channel. Trend lines are in the eyes of the beholder and remember, you can draw interior trendlines, tight trendlines to OHLC bars/line charts, or you can draw a trendline that hits most rising bottoms (or declining tops) but may miss a few. When I dragged the rising bottoms line upward, it lined up very well with price tops. So this week's hot rally brought price up to the top of the rising trend channel. I would normally be concerned about the clear negative divergence between PMO and price tops, but the bullish exuberance expressed this week and last didn't fulfill that divergence. It's hard to get bearish when you see rallies like this.

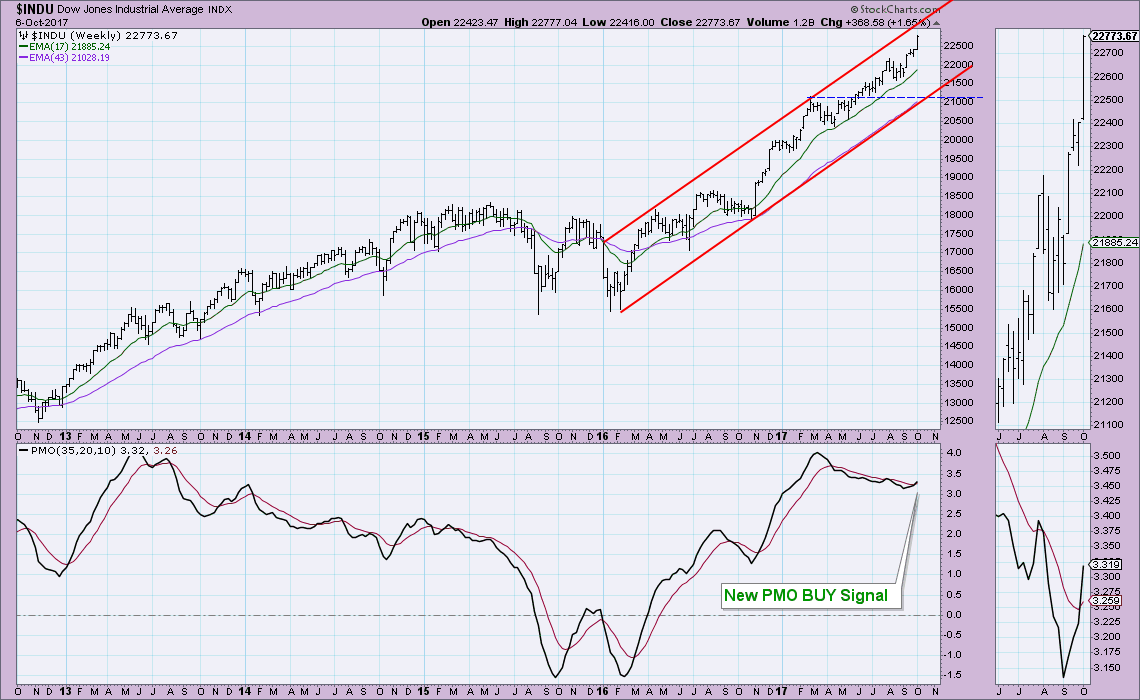

The Dow is in a nice rising trend channel as well, but hasn't quite reached the top of the channel. As with the SPX above, I'm not looking for a correction despite overbought conditions simply because the buy signal arrived and price isn't showing weakness despite being so overbought.

The Dow is in a nice rising trend channel as well, but hasn't quite reached the top of the channel. As with the SPX above, I'm not looking for a correction despite overbought conditions simply because the buy signal arrived and price isn't showing weakness despite being so overbought.

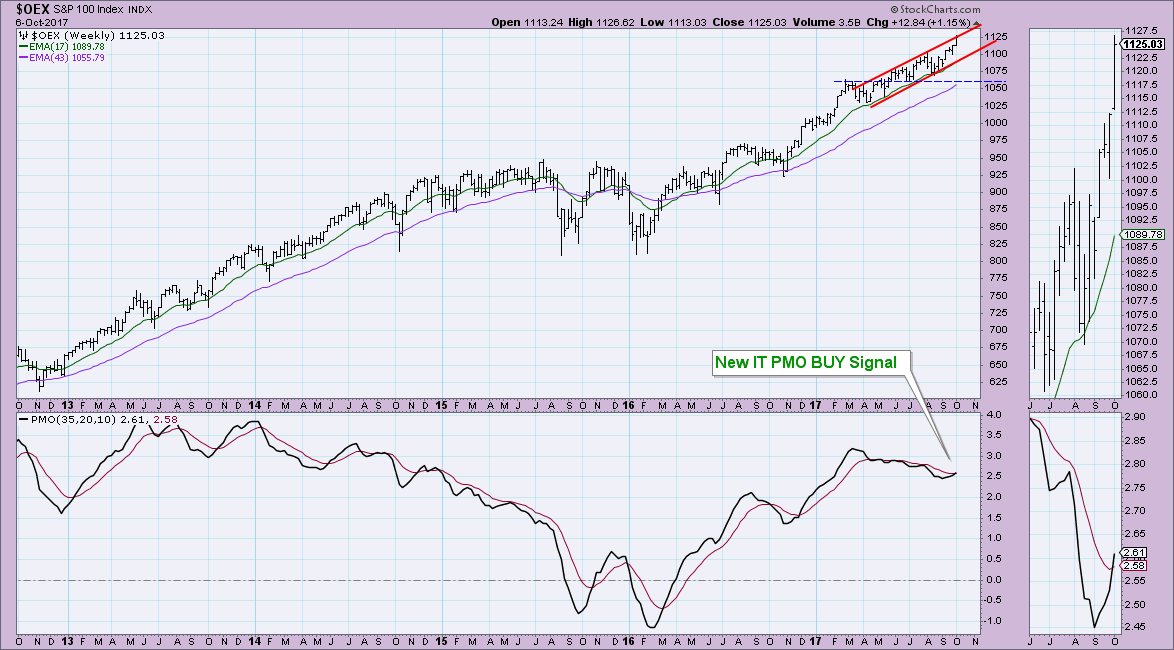

The OEX closed ever so slightly above the rising trend channel. I've marked major support just above 1050, but honestly, I wouldn't expect a decline to move much lower than 1100 given the current market environment.

The OEX closed ever so slightly above the rising trend channel. I've marked major support just above 1050, but honestly, I wouldn't expect a decline to move much lower than 1100 given the current market environment.

The NDX does point to some possible problems arriving in the future. First, it took until today to finally get the weekly PMO to turn up. It still has quite a bit of ground to make up before it can log a new PMO BUY signal. The bearish rising wedge is most concerning. The market is overbought and this chart could be hinting at the pullback that is going to be needed to clear overbought conditions and entice investors.

The NDX does point to some possible problems arriving in the future. First, it took until today to finally get the weekly PMO to turn up. It still has quite a bit of ground to make up before it can log a new PMO BUY signal. The bearish rising wedge is most concerning. The market is overbought and this chart could be hinting at the pullback that is going to be needed to clear overbought conditions and entice investors.  Conclusion: My Dad, Carl Swenlin, taught me long ago that in a strong bull market, expect bullish conclusions or better said, "Bull market rules apply". Despite the bearish rising wedge on the NDX, the new weekly PMO crossover BUY signals on the SPX, OEX and INDU don't suggest a decline. As far as the NDX, "bull market rules apply", so we shouldn't necessarily expect a bearish execution of its rising wedge pattern.

Conclusion: My Dad, Carl Swenlin, taught me long ago that in a strong bull market, expect bullish conclusions or better said, "Bull market rules apply". Despite the bearish rising wedge on the NDX, the new weekly PMO crossover BUY signals on the SPX, OEX and INDU don't suggest a decline. As far as the NDX, "bull market rules apply", so we shouldn't necessarily expect a bearish execution of its rising wedge pattern.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**