ChartWatchers January 20, 2018 at 01:12 PM

The direction of currency markets tells us a lot about the relative strength (or weakness) of global markets. As a rule, stronger economies have stronger currencies, while weaker economies have weaker currencies. As a result, the direction of the U.S... Read More

ChartWatchers January 20, 2018 at 01:03 PM

Earnings season is about to kick into high gear. Over the next few weeks thousands of companies will report their numbers. Some will beat expectations and some will disappoint... Read More

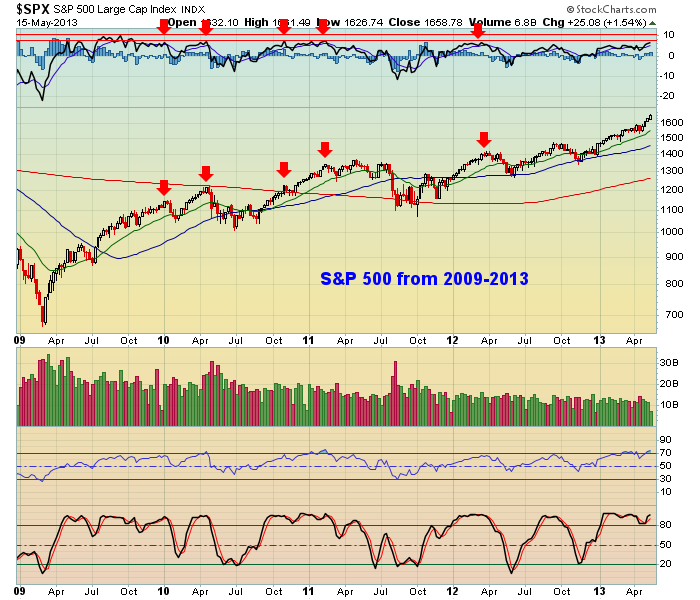

ChartWatchers January 20, 2018 at 11:36 AM

Bull markets can advance very quickly and can become extremely overbought. It's a challenge psychologically at times to commit new money t0 a stock or ETF, knowing that just days or weeks ago prices were so much cheaper... Read More

ChartWatchers January 20, 2018 at 10:49 AM

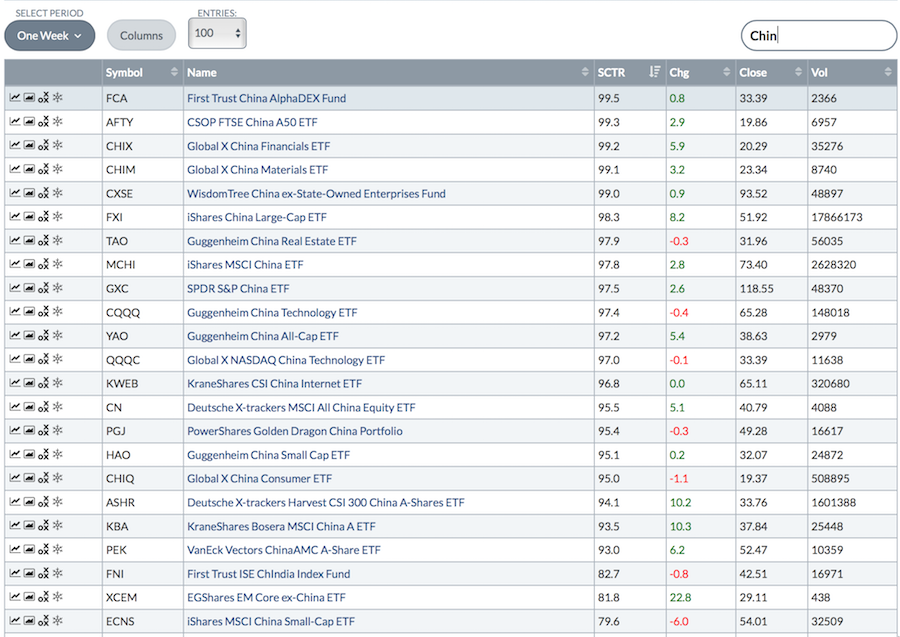

China has been improving in performance over the last few months. The various ETFs that track China have really started to dominate the SCTR list. Part of this is in US Dollar weakness, but we are also seeing the broader Asian markets start to kick it up a gear... Read More

ChartWatchers January 20, 2018 at 03:58 AM

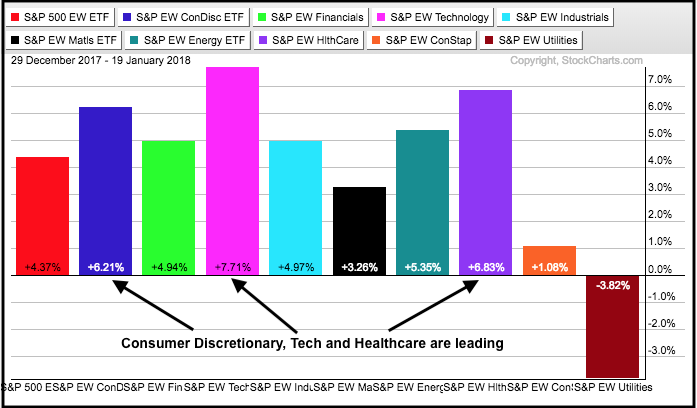

2018 is off to a great start with the S&P 500 SPDR (SPY) up 5% in just 13 trading days. The rally is quite broad with six of the nine equal-weight sectors up 5% or more... Read More

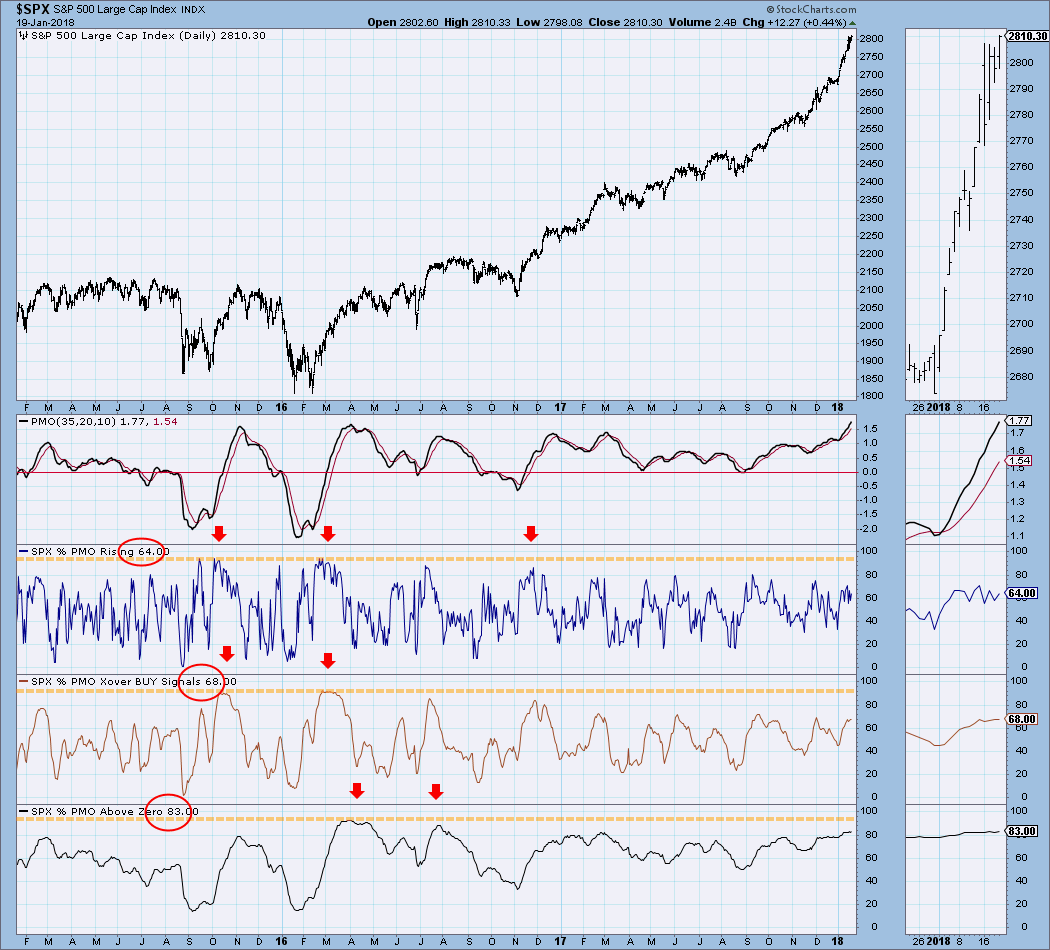

ChartWatchers January 19, 2018 at 07:12 PM

Most of you are familiar with the Price Momentum Oscillator (PMO) and its use on my individual stock, ETF, index charts. However, by analyzing the health of the PMOs within an index, we are able to get a reliable market indicator... Read More

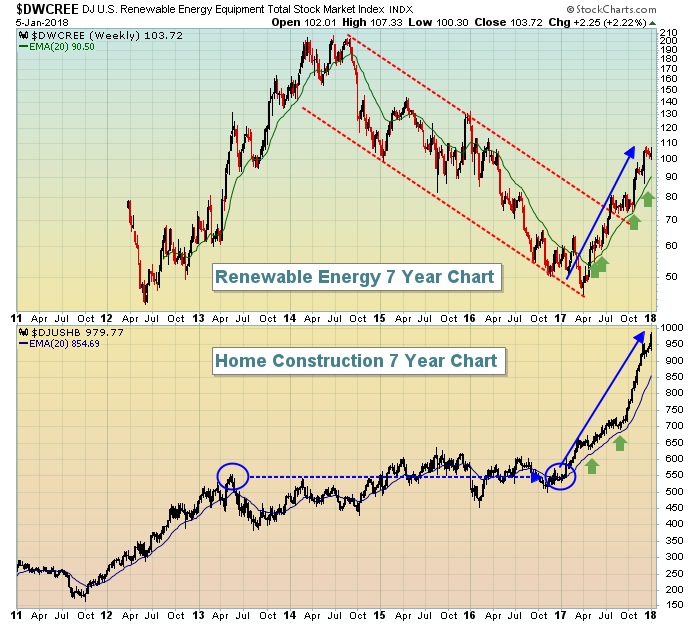

ChartWatchers January 06, 2018 at 03:56 PM

HAPPY NEW YEAR! In my first Trading Places blog article of 2018, "Here's One Chart That Screams BUY As We Begin 2018", I highlighted my favorite relative chart in the Current Outlook section... Read More

ChartWatchers January 06, 2018 at 03:13 PM

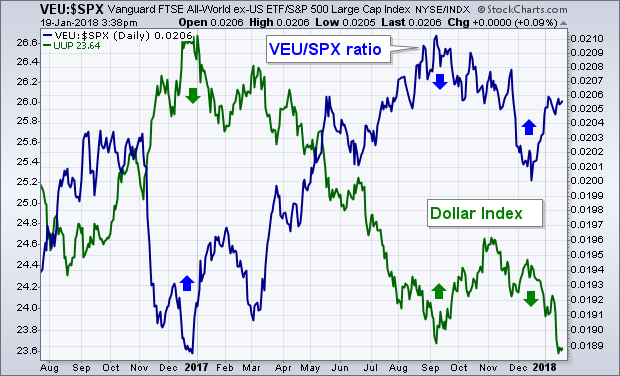

Global stock markets started off the new year with a bang. U.S. stock indexes exploded to record highs for the best start in years. Foreign stock benchmarks did the same, including the FTSE All World Stock Index which also hit a new record... Read More

ChartWatchers January 06, 2018 at 02:58 PM

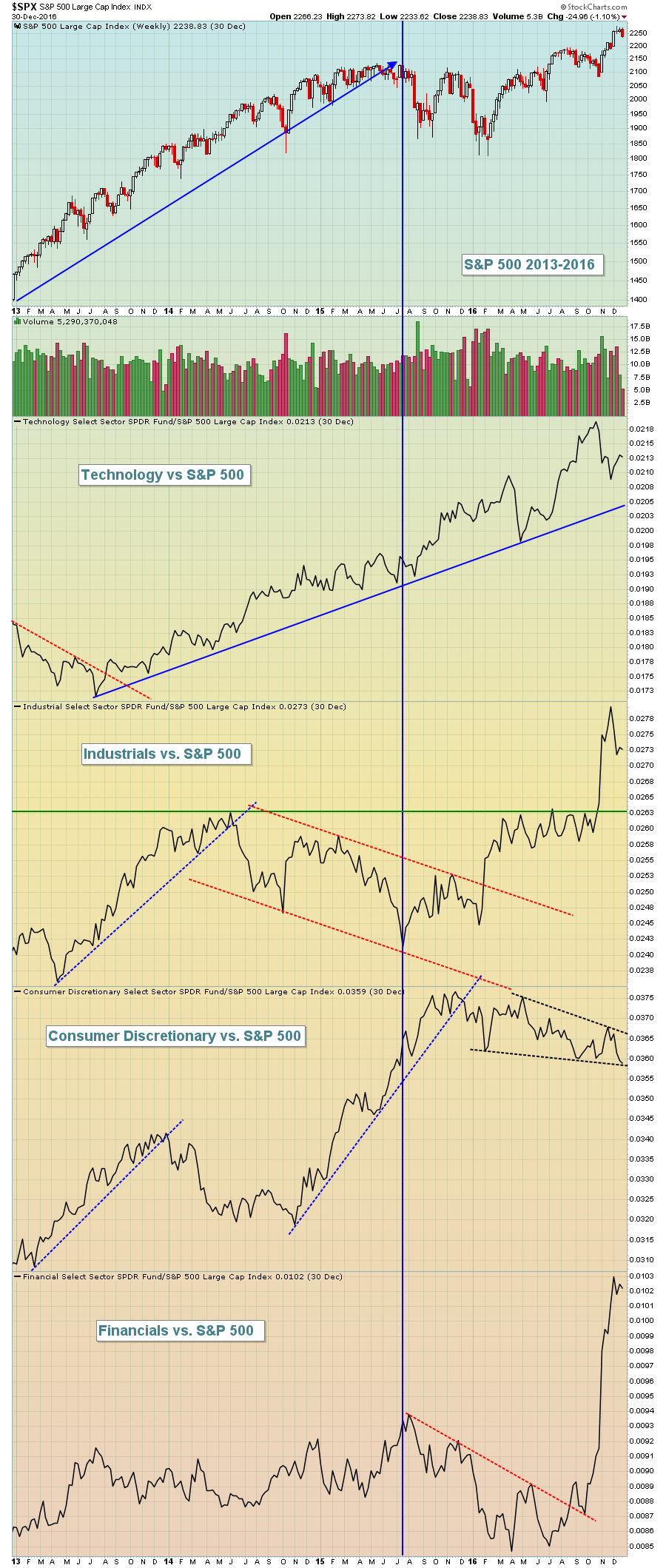

Ultimately, the U.S. stock market lives and dies by the performance of its economy and how that translates into earnings growth of U.S. companies. Nearly every economic report that we've seen of late has been strong or strengthening... Read More

ChartWatchers January 06, 2018 at 09:01 AM

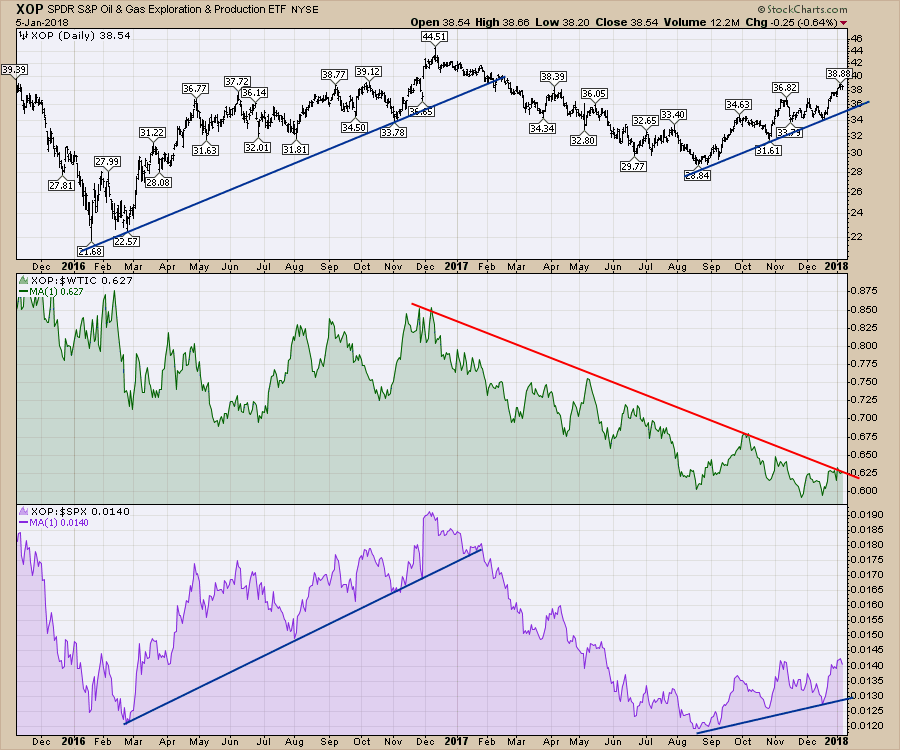

Oil trades have had a big beautiful run from June into early January. The commodity related stocks have also run since August. But there are some relative strength relationships we need to see break out to launch the next phase of stock runs... Read More

ChartWatchers January 06, 2018 at 02:32 AM

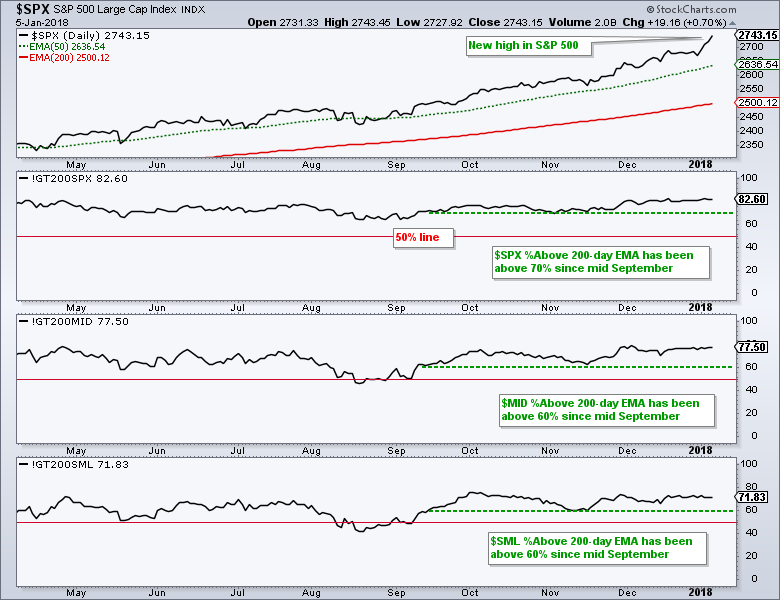

The stock market is never 100% bullish with all stocks participating in an uptrend. There are always some holdouts and pockets of weakness, but the broader market can continue higher as long as the pockets of strength are greater than the pockets of weakness... Read More

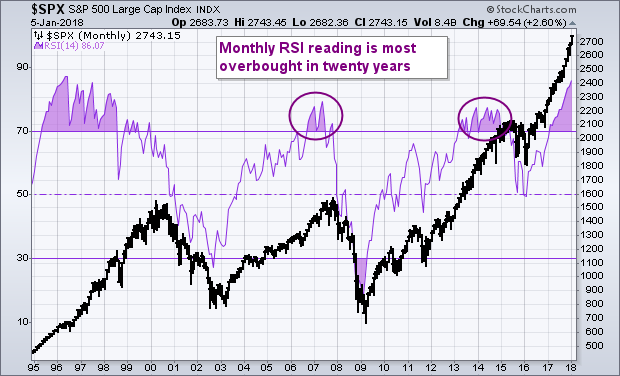

ChartWatchers January 05, 2018 at 03:25 PM

Earnings for 2017 Q3 will be finalized soon, but on a preliminary basis the S&P 500 has a P/E of 25, which is extremely overvalued... Read More