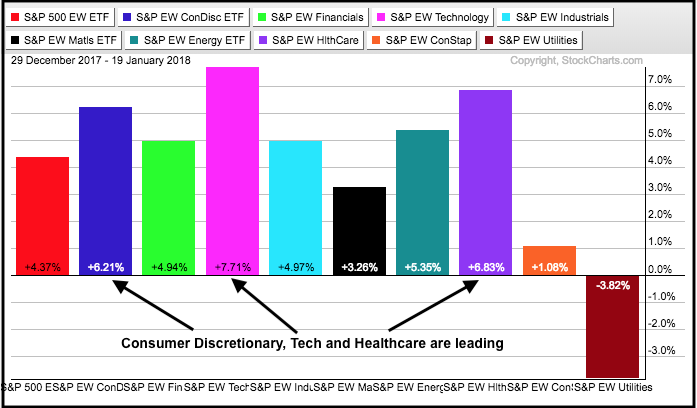

2018 is off to a great start with the S&P 500 SPDR (SPY) up 5% in just 13 trading days. The rally is quite broad with six of the nine equal-weight sectors up 5% or more. I am showing the equal-weight sectors first because they reflect performance for the "average" stock in the sector. The PerfChart below shows year-to-date Rate-of-Change for these sectors.

Technology (green) is the clear leader with a 7.71% gain and Healthcare (teal) is in second place with a 6.83% gain. Consumer Discretionary (red) and Energy (black) take third and fourth place, respectively. The Rate-of-Change for Finance (blue) and Industrials (magenta) rounds off to 5% for fifth and sixth place.

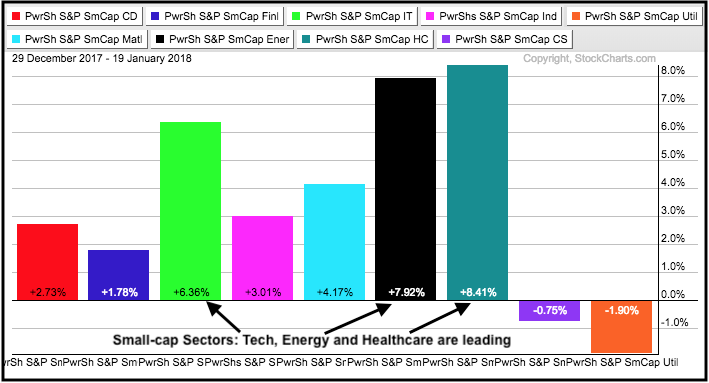

The next chart shows year-to-date Rate-of-Change for the nine small-caps sectors. Even though the S&P SmallCap iShares (+4.23%) is up less than SPY (+5%) year-to-date, three small-cap sectors really stand out this year. First, small-cap healthcare (teal) is the leader with an 8.41% gain. Energy (black) is not far behind with a 7.92% gain and technology is in third with a 6.36% gain.

The S&P SmallCap iShares finished the week strong with a 1.5% gain on Friday, which was three times the gain in SPY. Small-caps may get their mojo back in 2018. With healthcare, energy and technology showing leadership within the small-cap universe, these are the sectors to focus on for individual stock setups.

Plan Your Trade and Trade Your Plan.

- Arthur Hill, CMT

Senior Technical Analyst, StockCharts.com

Book: Define the Trend and Trade the Trend

Twitter: Follow @ArthurHill