- Ag Commodities bounce

- Gold and Silver struggle

- Oil drips lower

- Round 3 of steel tariffs doesn't lift SLX

- Lithium, Rare Earths, Copper and Aluminum need buyers

- Video

The $CRB struggled to make progress in February. The zoom box shows the $CRB made a lower high and a lower low last month. That is not bullish as it brings into doubt the breakout above 196 we saw in January 2018. While the closing price for the month was significantly improved off the early February lows, it was not what technicians would like to see after a breakout month.

Gold and Silver continue to drift. Hard to get excited about them when they continue to range trade. However, the MACD has gently pulled back to zero. A turn higher here would be a bullish signal. There has been a lot of volume in the first two months of the year compared to 2017, but we have not been able to make new highs.

The chart of the silver miners ETF is similar to the chart of the gold miners ETF. It's important this support hold. GDX is shown below the SIL chart.

The chart of the silver miners ETF is similar to the chart of the gold miners ETF. It's important this support hold. GDX is shown below the SIL chart.

Oil drips lower. I expect lower lows will be upon us.

Oil drips lower. I expect lower lows will be upon us.

One of the clues that oil was probably not going to hold up was the oil exploration stocks started to fall away.

One of the clues that oil was probably not going to hold up was the oil exploration stocks started to fall away.

The news is awash with President Trump implementing new steel tariffs. Just a word of caution on this fulcrum of unanimous opinion. This is the third major round of tariffs going back to 2016. The previous dates were July 2016 and October /November 2016 as the US media focused on the November 2016 election. The tariffs flew virtually under the radar. From the Office of the White House Press Secretary: FACT SHEET: The Obama Adminstration's Record on the Trade Enforcement dated January 12, 2017.

The news is awash with President Trump implementing new steel tariffs. Just a word of caution on this fulcrum of unanimous opinion. This is the third major round of tariffs going back to 2016. The previous dates were July 2016 and October /November 2016 as the US media focused on the November 2016 election. The tariffs flew virtually under the radar. From the Office of the White House Press Secretary: FACT SHEET: The Obama Adminstration's Record on the Trade Enforcement dated January 12, 2017.

Anyway, while US Steel did rise higher, the SLX steel ETF was already running out of momentum on the most recent high. Look at the waning MACD while price tested the prior high.

Here is the US Steel chart (X).

Here is the US Steel chart (X).

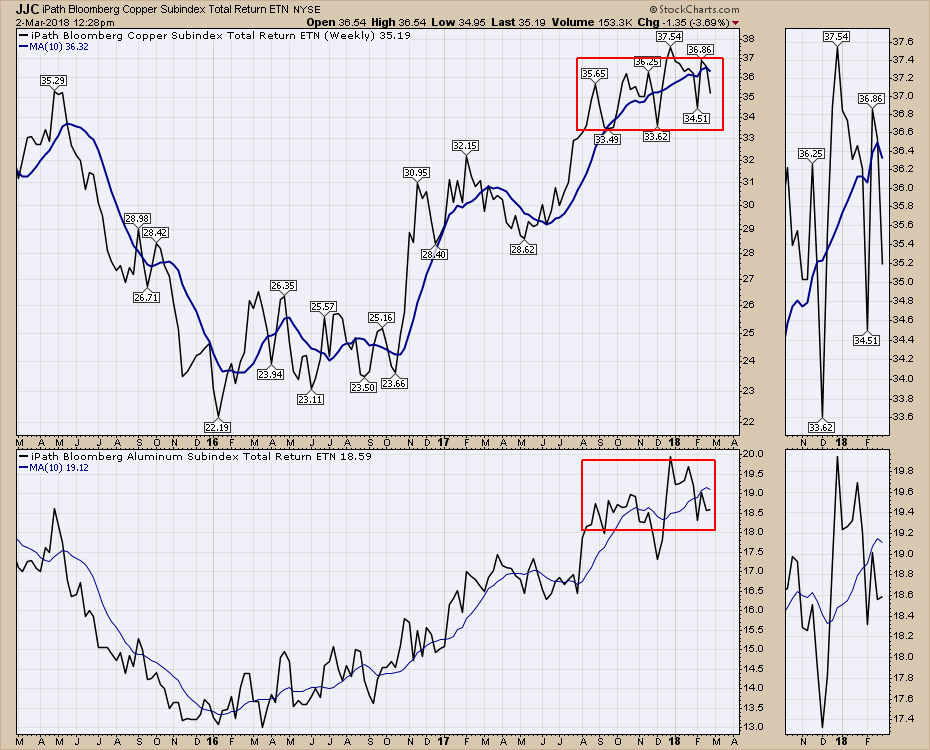

The bottom line is we have been tracking weakness in Commodities for over a month now. International markets like Germany double topped, Canada was falling significantly behind which is usually a pretty good store for perceptions around commodities, and the Shanghai is holding below its 200 DMA. All of this leads to some weak charts and I don't think the ice-breaker was the steel announcement. It was part of a wider issue. As well, the Copper chart is having an 8-month 'consolidation' and the raging Aluminum chart is back to August prices.

The bottom line is we have been tracking weakness in Commodities for over a month now. International markets like Germany double topped, Canada was falling significantly behind which is usually a pretty good store for perceptions around commodities, and the Shanghai is holding below its 200 DMA. All of this leads to some weak charts and I don't think the ice-breaker was the steel announcement. It was part of a wider issue. As well, the Copper chart is having an 8-month 'consolidation' and the raging Aluminum chart is back to August prices.

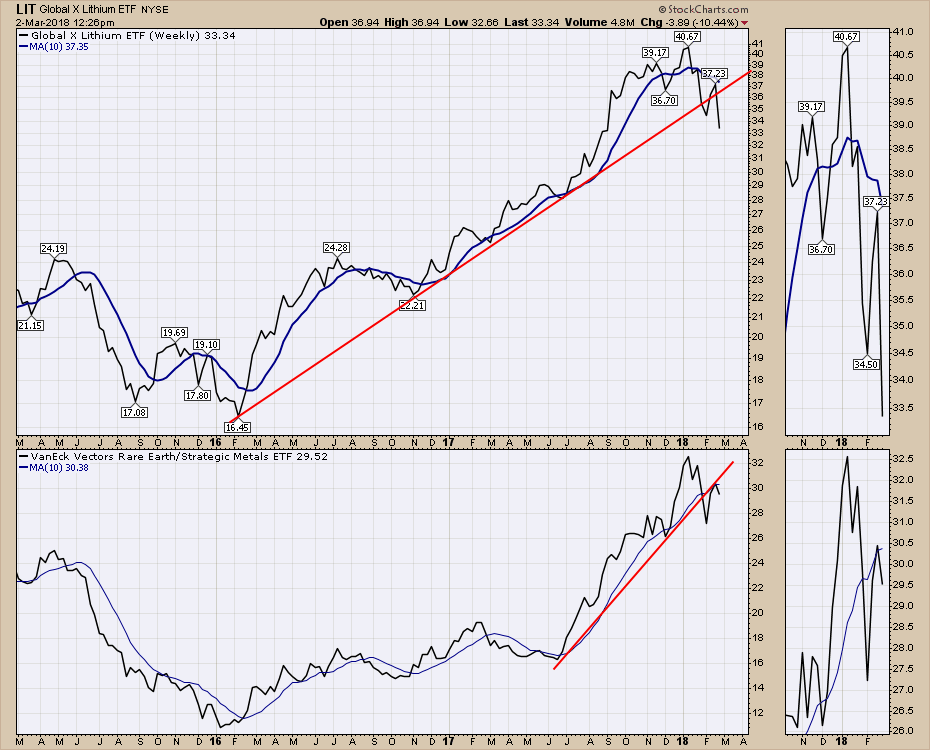

Check out the Lithium and Rare Earth Metals charts. In the metals complex, they look shaky. Lithium (LIT), all the electric car rage, as well as Rare Earth Metals (REMX) ETF have broken the uptrend.

Check out the Lithium and Rare Earth Metals charts. In the metals complex, they look shaky. Lithium (LIT), all the electric car rage, as well as Rare Earth Metals (REMX) ETF have broken the uptrend.

I would like to point out one winner in the commodity space! It was the Ag ETF (DBA).

I would like to point out one winner in the commodity space! It was the Ag ETF (DBA).

For lots of lively commentary, I would encourage you to grab the video and a coffee.

For lots of lively commentary, I would encourage you to grab the video and a coffee.

I will appear on the MarketWatchers Live show Tuesday March 6th with Tom Bowley and Erin Heim. It is a quick show as the time just flies. I will be doing some coverage of all things StockCharts. I also covered a lot in the Stock Charts For Dummies book, which is available wherever books are sold.

Also, I will be presenting at the Phoenix/Scottsdale MTA.

Date: Wed March 7, 2018

Time: 5:00 - 6:30 PM

Topic: How to Leverage the StockCharts platform

Presenter: Greg Schnell, CMT, MFTA

Location:

7600 Doubletree Ranch Road, Suite 100

Scottsdale, AZ 85258

This weekend is ChartWatchers Weekend! Look for a newsletter with StockCharts writers providing commentary on the market.

Chartcon 2018 registration is now open! Registration kicked off !

Chartcon 2018! Follow the link to register now!!!

Chartcon 2018! Follow the link to register now!!!

Good trading,

Greg Schnell, CMT, MFTA