For the currencies, the $USD has wound sideways for 9 weeks. However, it is a change from downtrend to sideways that is creating pressure on the $USD chart. This chart does not include Monday. The real question is if the Dollar pushes higher here, it will turn the momentum to the upside. If the PPO breaks this downtrend line, I would be more concerned that the dollar is not going to continue the bear market run. Currently there is positive divergence on the chart which also suggests a higher dollar.

There is a lot of information on the currencies in the video link at the bottom of this article on Currencies and Bonds. There are so many setups on the global crosses.

Bonds

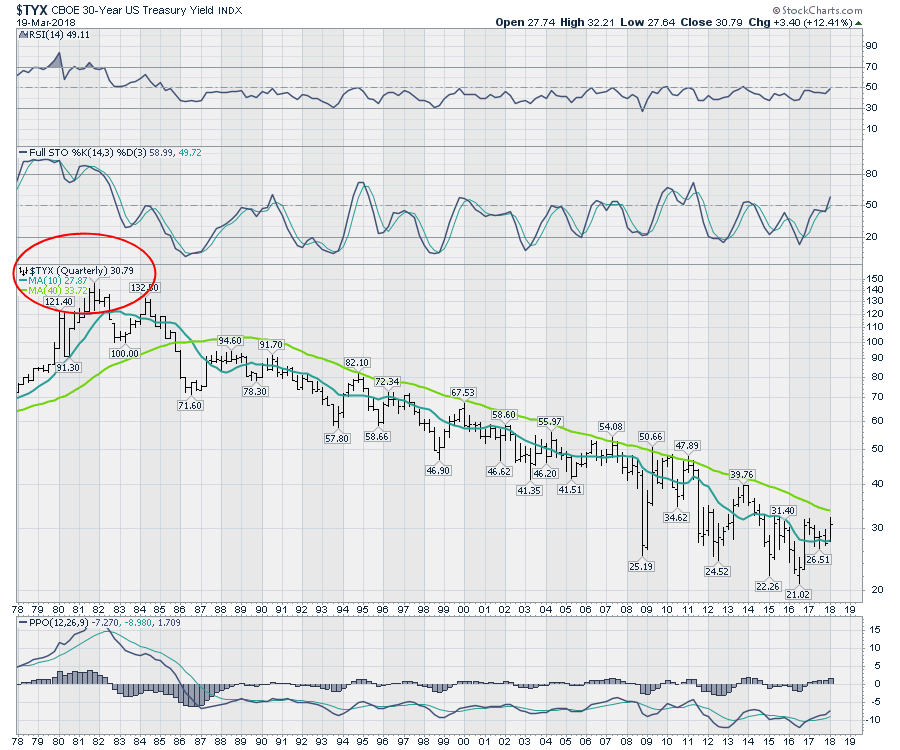

The next chart is an example of extreme resistance for the thirty year bond yield at this level. The full Stochastics have rolled over, the price has stalled at the resistance level and it is also problematic that the PPO (momentum) is rolling over with a significantly lower high. Comparing the last two highs in the price, we can see that the PPO has a lot less momentum (6 on the first vs. 2.5) on this high. This major divergence will need to be watched closely.

Below is a very long term chart of the 30-year bond yield. Do you see anything on this chart on any indicator that suggests the big trend has changed? I don't, but if the bond market wanted to roll over the yields here it would be extremely important. This would probably enable a return to utilities and defensive stocks.

Below is a very long term chart of the 30-year bond yield. Do you see anything on this chart on any indicator that suggests the big trend has changed? I don't, but if the bond market wanted to roll over the yields here it would be extremely important. This would probably enable a return to utilities and defensive stocks.

The StockCharts for Dummies book is now available wherever books are sold!

The video below spends less than 20 minutes describing the current situation for currencies and bonds.

I will be speaking to the CMT Association in Minneapolis March 20th, 2018 by webinar with some very exciting charts (heck- they even keep me up after midnight!). If you would like to join in person at 4 PM CDT, please register for the CMT Association meeting. CMT Association Network Events.

I will also be attending the Calgary CSTA meeting March 20th at 5:30 MDT. CSTA members can register here for in-person or here for online access.

Good trading,

Greg Schnell, CMT, MFTA.