Oh no! He is losing it! I have stated a few times that the well seems to be running low; this article might confirm that. Here is an attempt to turn basic aerodynamics into an investment process.

Oh no! He is losing it! I have stated a few times that the well seems to be running low; this article might confirm that. Here is an attempt to turn basic aerodynamics into an investment process.

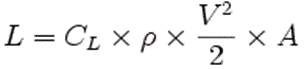

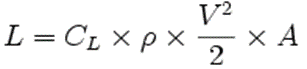

Where:

Where:

CL is the coefficient of Lift

p is the density of air

V is the freestream velocity

A is the surface area of the lifting surface

L is the life force produced

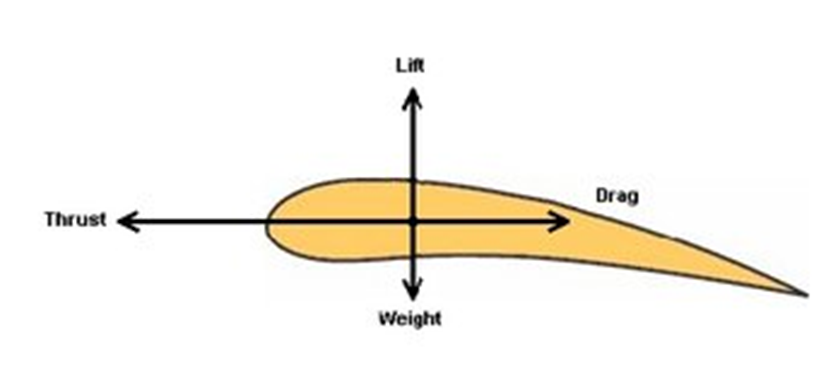

Airfoil Forces

Alpha = Angle of Attack

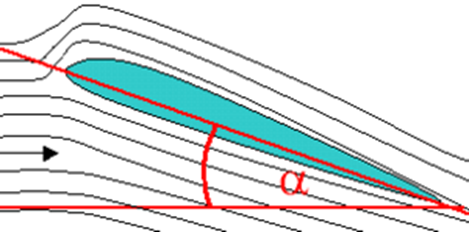

Aerodynamics

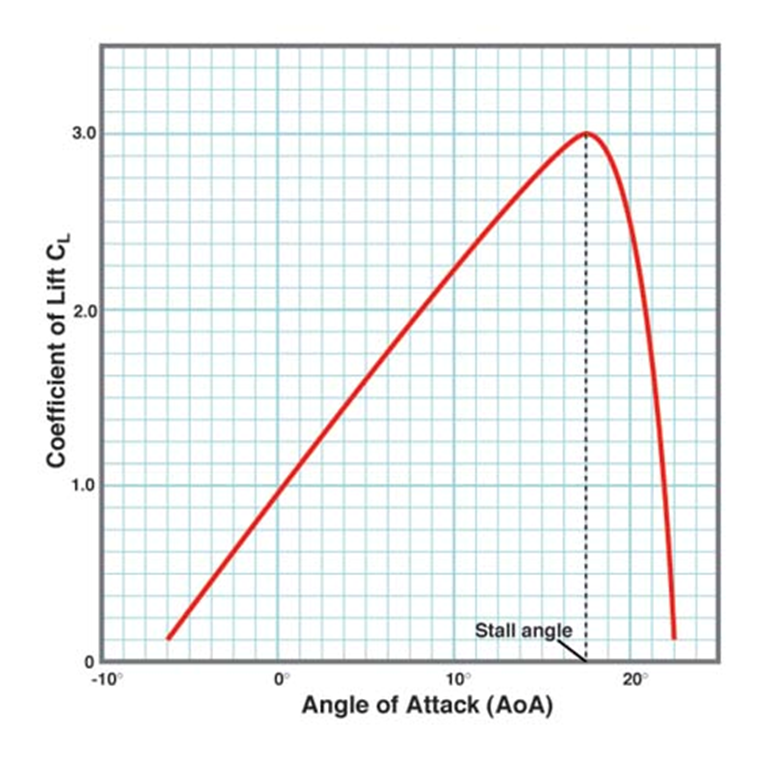

The amount of lift generated by a wing is directly related to the angle of attack (alpha), with greater angles generating more lift and more drag as it increases the frontal area. This remains true up to the stall point, where lift starts to decrease again because of airflow separation. Planes flying at high angles of attack can suddenly enter a stall if, for example, a strong wind gust changes the direction of the relative wind, an effect that is seen primarily at low airspeeds.

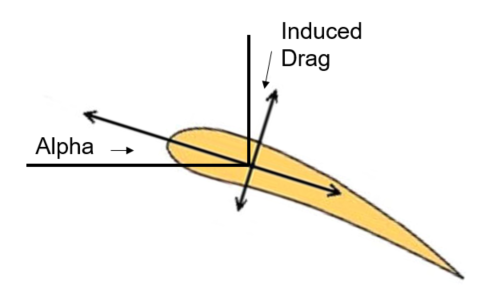

Aerodynamic Alpha (angle of attack)

Aerodynamic Alpha (angle of attack)

Subsonic flight has optimal angle of attack (alpha) for a number of different flight patterns

- Most economical

- Best rate of climb

- Best range

- Best endurance

The more alpha, the more drag (induced)

Too much alpha and the wing will stall

- Stall is not good

- You can recover - most of the times in straight wing aircraft. Very different in swept wing.

Aerodynamics for Investors

Translation into a Technical Model

Translation into a Technical Model

L = Model Goals (returns over time)

CL = Technical Rules-based Model (driven by various components)

p = Environment (changes over time – gives you an edge)

V = Risk (kinetic energy – faster moving)

A = Assets (capital to commit for investment)

Investment Aerodynamics

Alpha (investment)

A risk-adjusted measure of the so-called "excess return" on an investment. It is a common measure of assessing active manager’s performance.

The difference between the fair and actually expected rates of return on a stock is called the stock's alpha.

Investment Angle of Attack

- aggressive attempts to add alpha raise the risk of failure.

- most portfolios have a “best” alpha method.

- just like airfoil alpha, too much can be dangerous.

- a 50% loss takes a 100% gain to get even. Can you do that?

- If you live long enough

- You capture exceptional returns in a short period of time.

- Oh, and getting even should not be a goal.

Instrument Flying 101

What is one of the first things you learned when starting to fly instruments?

- Your inner ear will give you bad information

- Believe your instruments

- Do NOT believe what you feel

A Technical Model is like your Investment Instruments (IFR – investment financial rules)

- Removes the emotions

- Eliminates the current market hype

- Something you can believe in

Note: The top graphic is an F-4J Phantom launching off the waist catapult on the USS Independence sometime in the mid-1970s. When landing an F-4 on an aircraft carrier you used Angle of Attack for speed control instead of airspeed. I promise I’ll try to get back to technical analysis next time.

Fly Your Model,

Greg Morris