Why do investors / traders like predictions? The prediction industry is not just Wall Street, there are business forecasting companies, economic analysis and forecasting, sales forecasting, on and on. However, Wall Street seems to have the least talent of the bunch. Here are some reasons I think investors / traders like predictions:

Why do investors / traders like predictions? The prediction industry is not just Wall Street, there are business forecasting companies, economic analysis and forecasting, sales forecasting, on and on. However, Wall Street seems to have the least talent of the bunch. Here are some reasons I think investors / traders like predictions:

If the Investor loses money, they can blame the forecast. Sad!

Confidence in a forecast rises with the amount of information that goes into it.

But the accuracy of the forecast stays the same.

It’s that you can be a successful investor without being a perpetual forecaster.

Not only that, I can tell you from personal experience that one of the most liberating experiences you can have is to be asked to go over your firm’s economic outlook and say, ‘We don’t have one!’

An excellent book on forecasting is by William Sherden, “The Fortune Sellers,” published by John Wiley and Sons. His conclusions on forecasting after extensive research are not a surprise. I have shown this list a while back, but it bears to be repeated.

No better than guessing

No long-term accuracy

Cannot predict turning points

No leading forecasters

No forecaster was better with specific statistics

No one ideology was better

Consensus forecasts do not improve accuracy

Psychological bias distorts forecasters

Increased sophistication does not improve accuracy

No improvement over the years.

Another great website by Steve LeCompte is www.cxoadvisory.com. He maintains the track record of many gurus; and in fact, calls it “Guru Grades.” He explains in wonderful detail how he grades them along with other important information on how to accomplish this type of analysis. The following 4 items are what he lists as investor’s / trader’s problems when it comes to forecasts.

1. Conventional certitudes (conventional wisdom) – predictions (indicators) that experts generally accept as accurate, but are not necessarily accurate.

2. Dueling certitudes – two contradictory predictions that competing experts present as exact, with no expression of uncertainty (leading to conflicting strong investment strategy recommendations).

3. Conflating science and advocacy – developing arguments (assumptions) that support an investment strategy rather than an investment strategy that supports evidence-based arguments, while portraying the deliberative process as scientific.

4. Wishful extrapolation – drawing a conclusion about some future situation based on historical tendencies and untenable assumptions (ignoring differences between the historical and future situations, and emphasizing in-sample over out-of-sample testing).

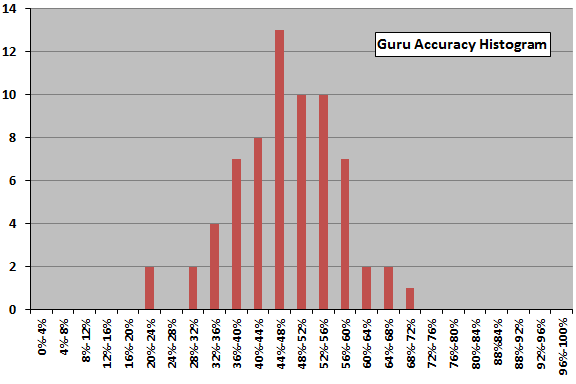

Chart A is from www.cxoadvisory.com. It shows that among the 68 gurus their accuracy distribution is only average to below average. He also lists and names of each guru along with their individual ranking HERE.

Chart A

Chart A

If you feel the need to pay attention to forecasters, I suggest instead that you study technical analysis and become proficient at using it. Then turn off the television and the internet and press on.

Dance with the Trend,

Greg Morris