The last two days have issued SIX new Intermediate-Term Trend Model (ITTM) BUY signals. It shouldn't be a surprise that the Energy SPDR (XLE) and Natural Gas (UNG) triggered given the buzz around that sector last week on MarketWatchers LIVE and headlines on our StockCharts.com Blogs page. Arthur Hill and I noted the push that small and mid-caps were making mid-week and today, the Financial sector was on fire. Take a look at these very bullish charts!

The last two days have issued SIX new Intermediate-Term Trend Model (ITTM) BUY signals. It shouldn't be a surprise that the Energy SPDR (XLE) and Natural Gas (UNG) triggered given the buzz around that sector last week on MarketWatchers LIVE and headlines on our StockCharts.com Blogs page. Arthur Hill and I noted the push that small and mid-caps were making mid-week and today, the Financial sector was on fire. Take a look at these very bullish charts!

Last week on MarketWatchers LIVE in our "Agree or Disagree" segment, Tom and I were asked if we agreed that XLE had made its low for the year back in August. Arthur Hill who happened to be a guest agree with me that XLE has likely bottomed for the year. If you've watched any of Greg Schnell's videos or listened to him today when he was on the program, you'll know he has been bullish on Energy early in this rally. I think there is near-term resistance that is causing problems for XLE, but we have had two consecutive closes above the 200-EMA and the indicators couldn't look much better. I think you could also make a case for a short-term flag forming in the thumbnail. I suspect that energy isn't done rallying.

In the energy space is Natural Gas (UNG). It also is struggling against overhead resistance, but today's gap up to test it for the first time since July is positive. The OBV looks good and this 20/50-EMA positive crossover (ITTM BUY signal) is icing on the cake. I might wait for a breakout before entering a position.

In the energy space is Natural Gas (UNG). It also is struggling against overhead resistance, but today's gap up to test it for the first time since July is positive. The OBV looks good and this 20/50-EMA positive crossover (ITTM BUY signal) is icing on the cake. I might wait for a breakout before entering a position.

The S&P 600 has now hit overhead resistance around 870. The PMO is confirming this rally, as is the OBV.

I notice that the ETF version of the $SML has made that breakout above overhead resistance. We don't have SCTR values for indexes, but for the ETF we see the great relative strength that has built up for the small caps as well.

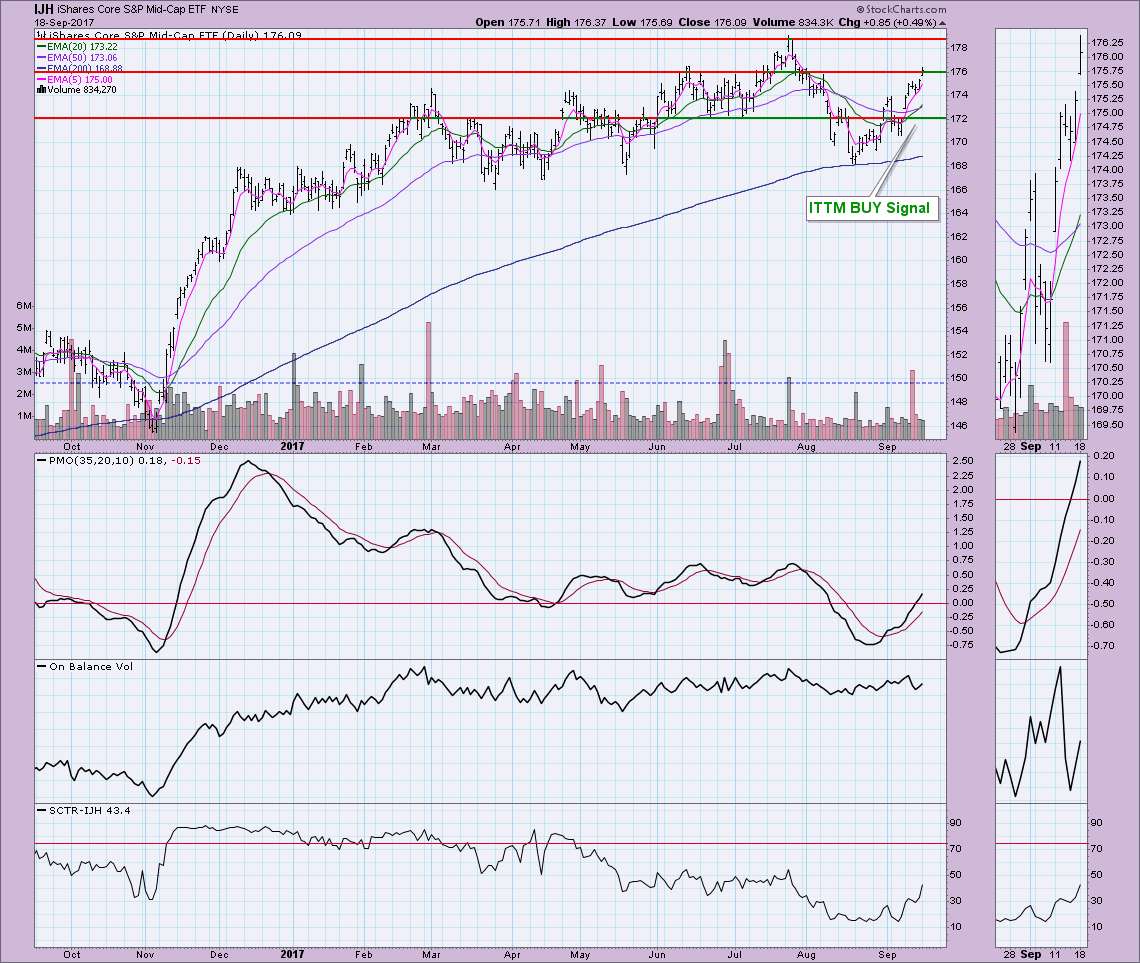

Mid-caps are very close to a breakout. I'm not a fan of the OBV, but the PMO and SCTR are hard to argue with. I suspect a test at the all-time high will arrive soon.

Mid-caps are very close to a breakout. I'm not a fan of the OBV, but the PMO and SCTR are hard to argue with. I suspect a test at the all-time high will arrive soon.

The last to look at is the Financial SPDR (XLF). This ITTM BUY signal arrived on Friday afternoon and apparently was quite timely. I would venture to say it is the execution of a very short-term flag. If the measurement is correct, the minimum upside target should be around $25.80. That is a "minimum" upside target. The SCTR has made a serious comeback and the new PMO BUY signal in oversold territory is excellent confirmation.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**