DecisionPoint November 29, 2017 at 08:29 PM

Technology fell apart today as money appeared to be rotating out of technology and into financials which had a brilliant day. The PMO was yanked down below its signal line on the NDX. Yesterday, the PMO was rising and price looked strong. What a difference a day can make... Read More

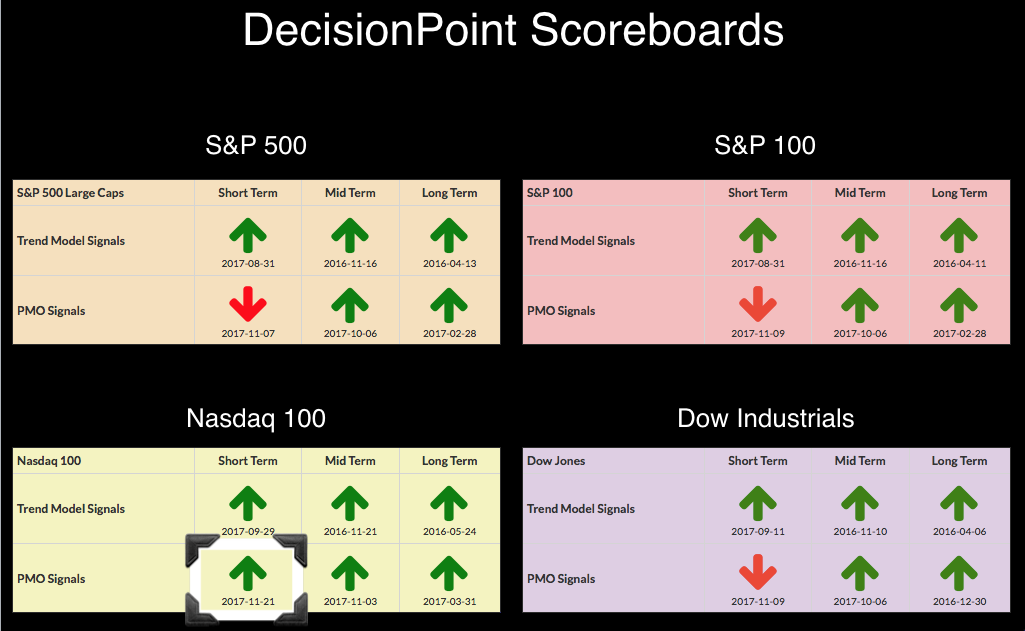

DecisionPoint November 28, 2017 at 07:14 PM

After today's rallies and big breakouts, it shouldn't surprise anyone that the OEX and SPX finally shed their PMO SELL signals. What is interesting is the Dow's 'laggard' status on triggering a PMO BUY signal. It is the last SELL signal standing... Read More

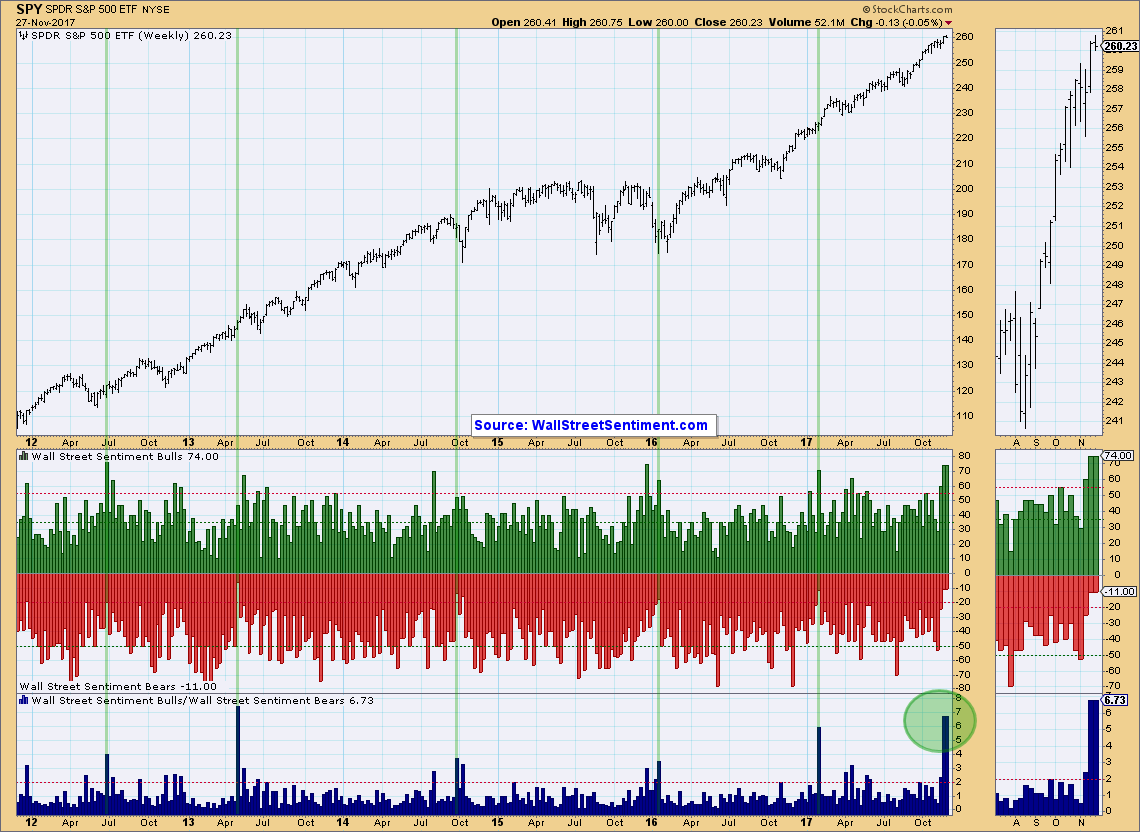

DecisionPoint November 27, 2017 at 07:17 PM

I have a few DecisionPoint charts that are "must-see" right now. Anytime I look at my ChartLists and a chart smacks me in the face, I always try to share it... Read More

DecisionPoint November 24, 2017 at 05:24 PM

Thanks mostly to a pop on Tuesday the market once again moved to new, all-time highs. Typical of holiday trading volume was lower than average, except for Tuesday, which had a surge confirming the price advance... Read More

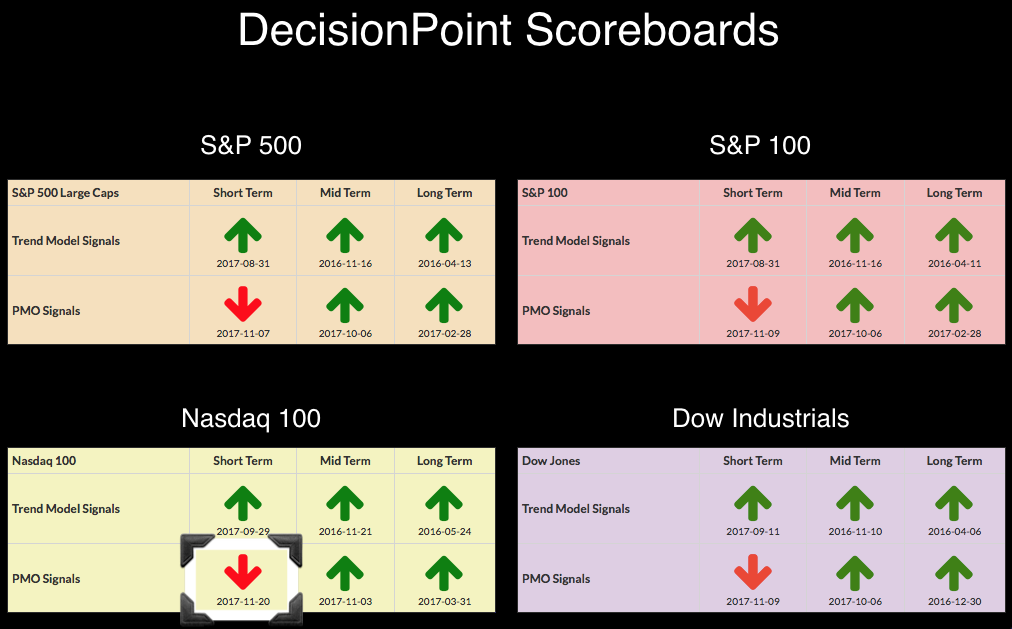

DecisionPoint November 21, 2017 at 06:48 PM

You know you're in trouble when you wake up and find a snarky tweet about the timeliness of a particular signal change. That was the case this morning when I got the tweet about the NDX PMO SELL signal that arrived after the market closed yesterday... Read More

DecisionPoint November 20, 2017 at 08:02 PM

As promised to the MarketWatchers LIVE viewers and my DecisionPoint Faithful, I am updating you on the latest DP Scoreboard signal change. The NDX's momentum finally deteriorated enough to generate a PMO SELL Signal... Read More

DecisionPoint November 17, 2017 at 06:04 PM

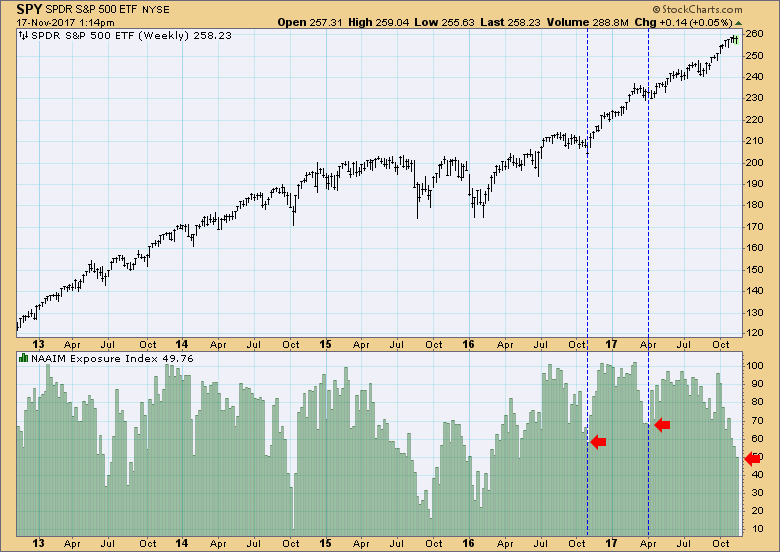

When I posted the NAAIM (National Association of Active Investment Managers) Exposure Index this week, I thought to myself, "What's wrong with this picture?"... Read More

DecisionPoint November 16, 2017 at 07:33 PM

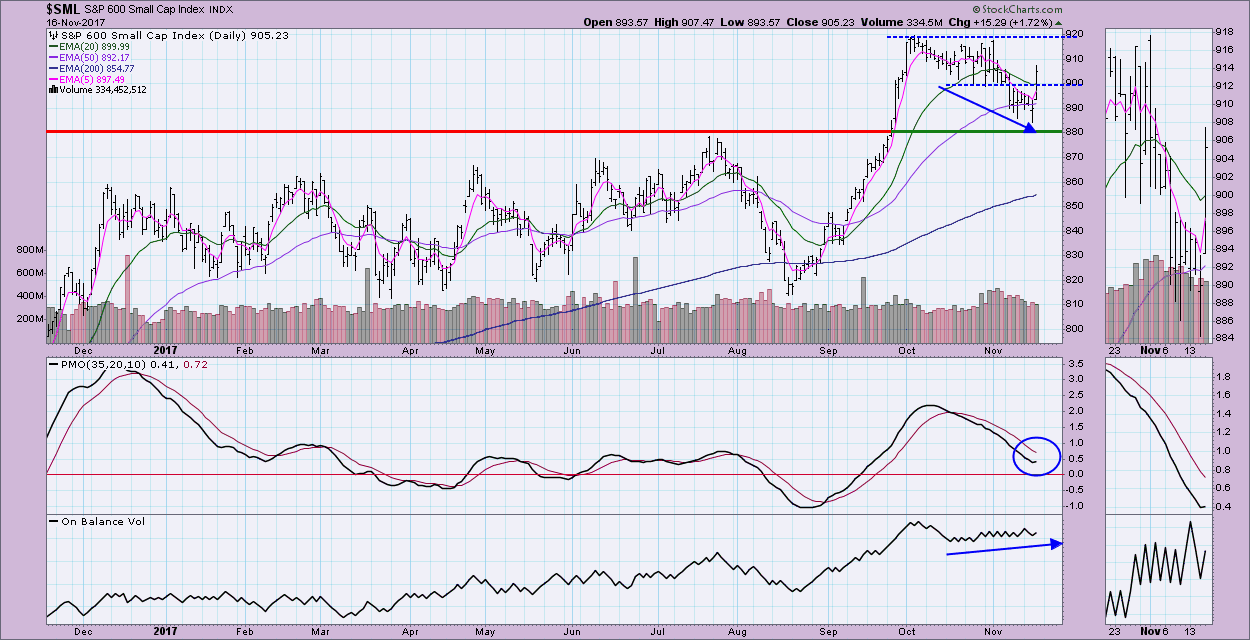

I had this article in the queue yesterday with the headline "S&P 600 Nearing Important Support". Well, it turned out to be a bounce off that support today. Small-caps have been hit hard while most large-cap indexes spent the last month consolidating and moving slightly lower... Read More

DecisionPoint November 14, 2017 at 07:00 PM

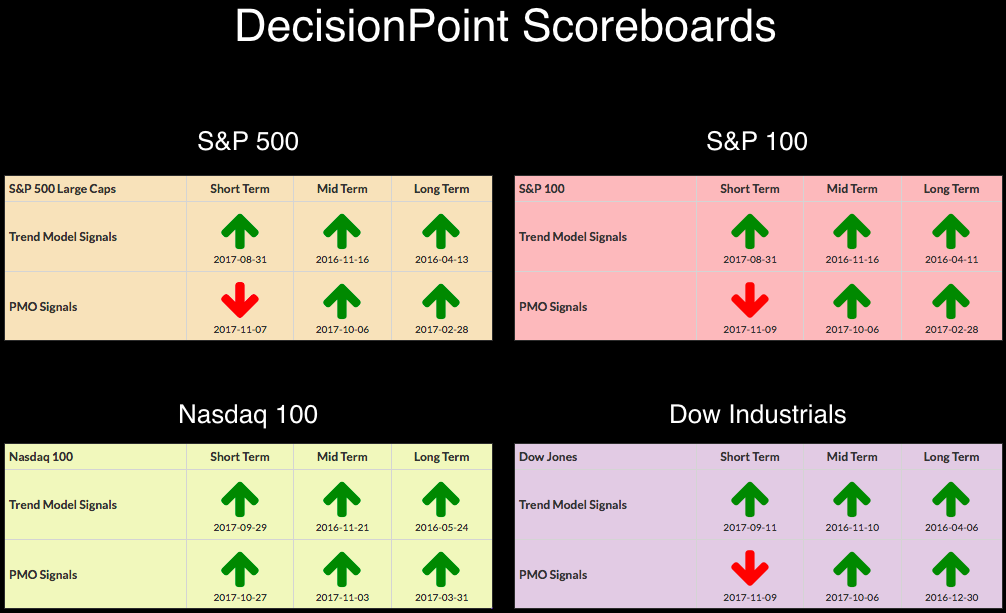

Since November 9th, the DP Scoreboards have been quiet. It isn't surprising to see the weakness on these Scoreboards to be short-term momentum given the recent decline. The SPY/SPX have now dropped below rising trend channels, but support remains... Read More

DecisionPoint November 13, 2017 at 06:28 PM

As part of the MarketWatchers LIVE show (airs M-F, 12p-1:30p - You'll find today's recording under the "Webinars" tab), Tom Bowley and I come up with set-ups on Monday. We call the segment "Monday Set-Ups"... Read More

DecisionPoint November 10, 2017 at 06:54 PM

I should probably watch less business news, but I only have it on to catch any big news developments, and the sound is usually off. Nevertheless, I can't avoid some stuff that I'd rather filter out... Read More

DecisionPoint November 09, 2017 at 05:34 PM

Today's decline was enough to push the OEX and Dow PMO BUY signals off the DP Scoreboards. The NDX is still looking good with the PMO actually rising right now. However, if the other indexes continue to decline, it is very likely the NDX will follow suit... Read More

DecisionPoint November 08, 2017 at 06:36 PM

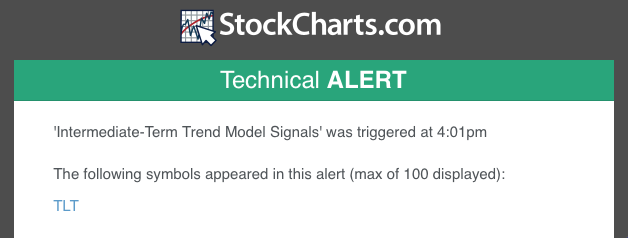

As noted, a new technical alert arrived in my email inbox this afternoon. I was surprised that I didn't receive word of any DP Scoreboard PMO signal changes, but seeing TLT grab an ITTM BUY signal wasn't surprising. I think TLT is at an interesting "decision point" right now... Read More

DecisionPoint November 07, 2017 at 08:09 PM

Yes, the PMO BUY signal on the SPX has already disappeared. Unfortunately with the margin so thin between the PMO and its signal line (thousandths of a point), this likely will change again tomorrow if the SPX can close higher. What is interesting..... Read More

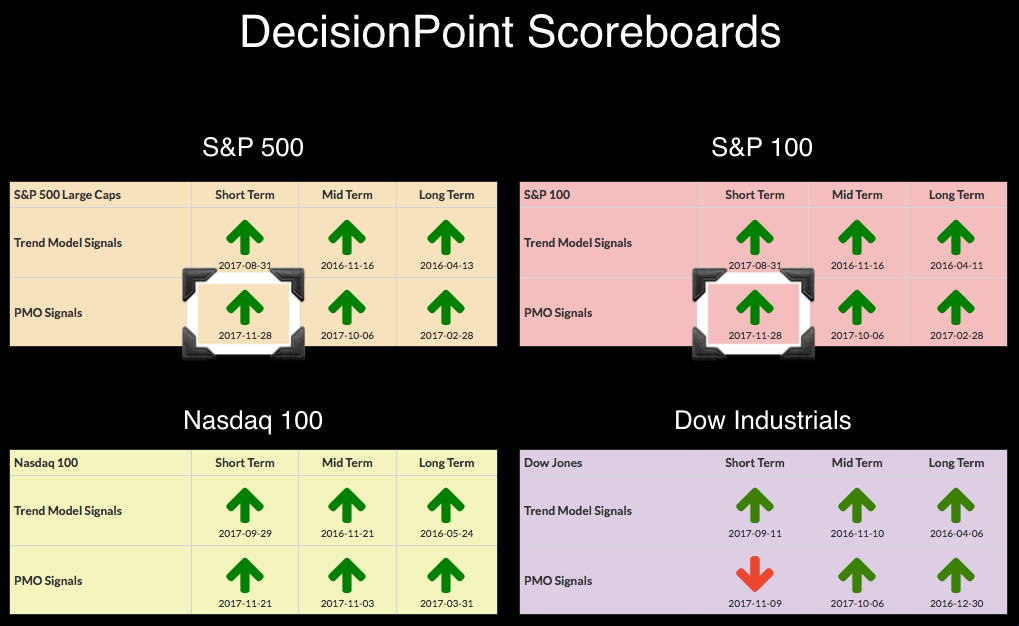

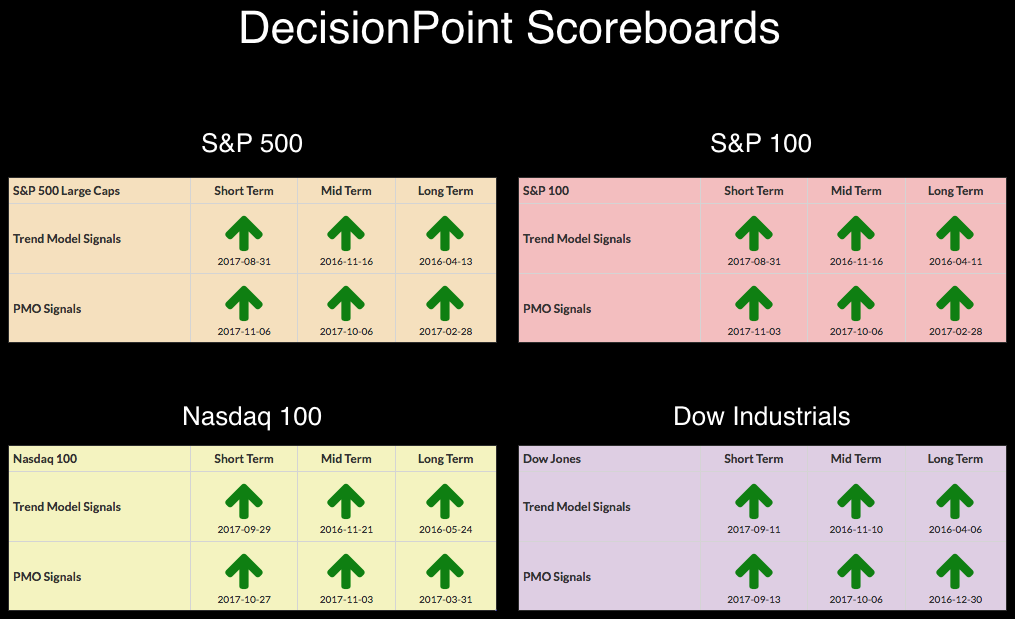

DecisionPoint November 06, 2017 at 06:56 PM

It's official! All four DecisionPoint Scoreboards are on BUY signals in all three timeframes on the PMO and Trend Models. Tom Bowley and I continue to discuss during the MarketWatchers LIVE show about the hurricane force bull market winds... Read More

DecisionPoint November 03, 2017 at 06:19 PM

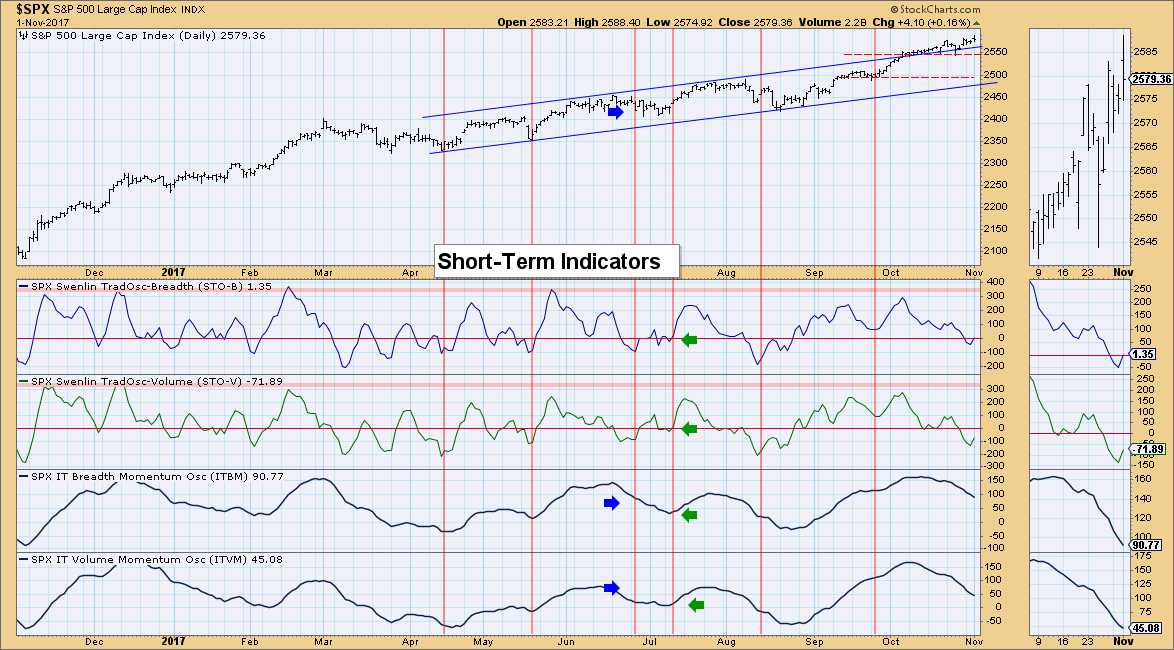

Of my comment, "Not out of the woods yet," you might ask, "What woods?" The market, after all, did manage to grind higher this week, so what's the problem? The problem that I see is a persistent weakness in our intermediate-term indicators, but we will get into that later... Read More

DecisionPoint November 02, 2017 at 03:50 PM

I know we all have seen the commercials for the newest or best investment of the decade... Read More

DecisionPoint November 01, 2017 at 06:07 PM

I promised to inform you when the Swenlin Trading Oscillators bottom in a concerted move to the upside and it happened already today. I pointed out in yesterday's blog article that the Swenlin Trading Oscillators (STOs) were now hitting oversold territory... Read More