DecisionPoint January 30, 2018 at 05:46 PM

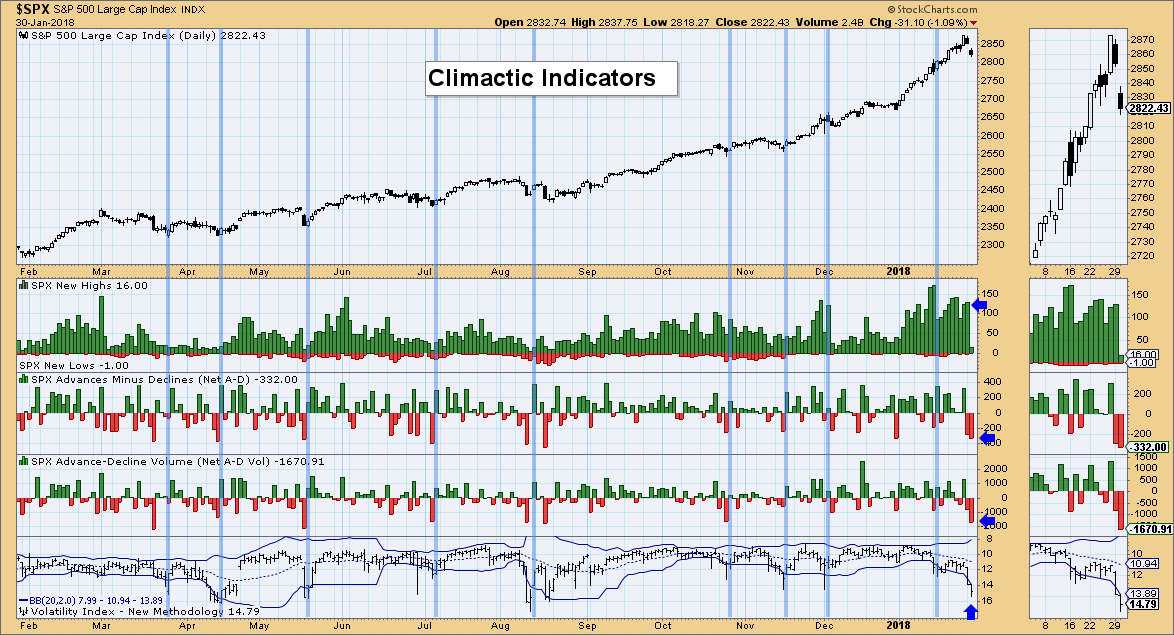

One chart that I have been watching very closely is the DecisionPoint Climactic Indicator chart. I use this chart to give me an idea of very short-term sentiment and how to use it to determine possible tops and bottoms... Read More

DecisionPoint January 29, 2018 at 07:30 PM

It is very tough to find weakness in the major indexes as they continue to fly higher. However, I was reviewing my DecisionPoint LIVE ChartList and noted that we are seeing a few warning signs on the small and mid-cap ETFs, IJR and IJH... Read More

DecisionPoint January 26, 2018 at 06:06 PM

This week the market underwent a horrifying intraday reversal. Just kidding. There was a surprising reversal on Wednesday, but by the close SPY was virtually unchanged. We can see on the chart that at the intraday low the steep January rising trend line was barely tested... Read More

DecisionPoint January 25, 2018 at 07:42 PM

Many of you may not be aware, but DecisionPoint has charts for most of the volatility indexes in the DecisionPoint Market Indicator ChartPack... Read More

DecisionPoint January 24, 2018 at 06:32 PM

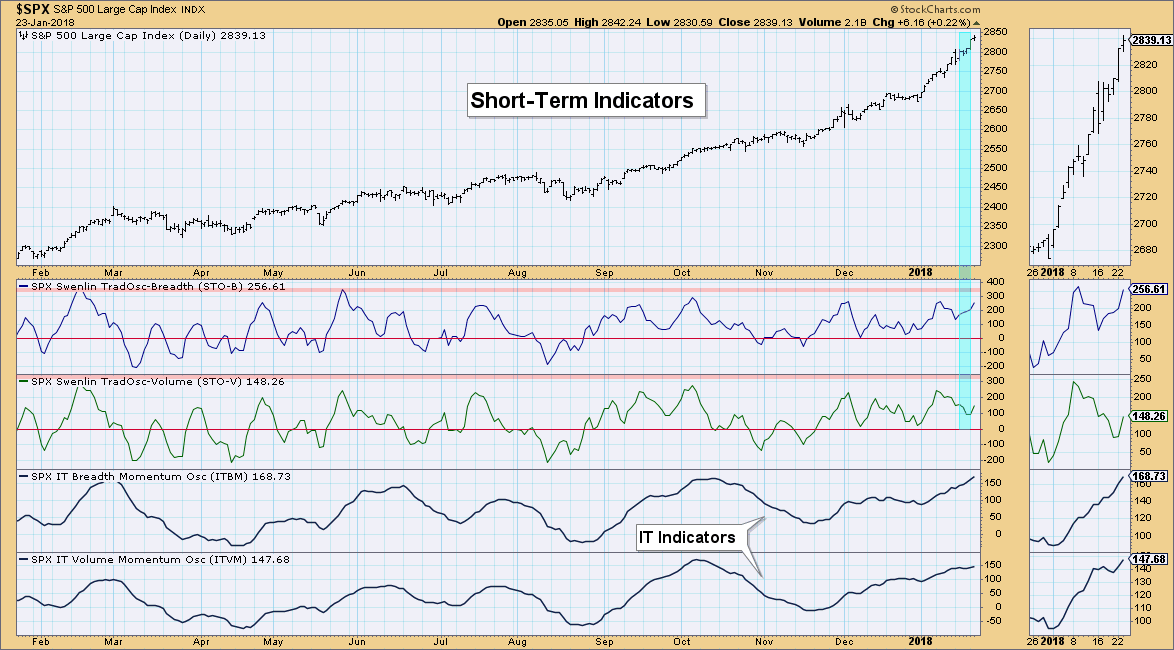

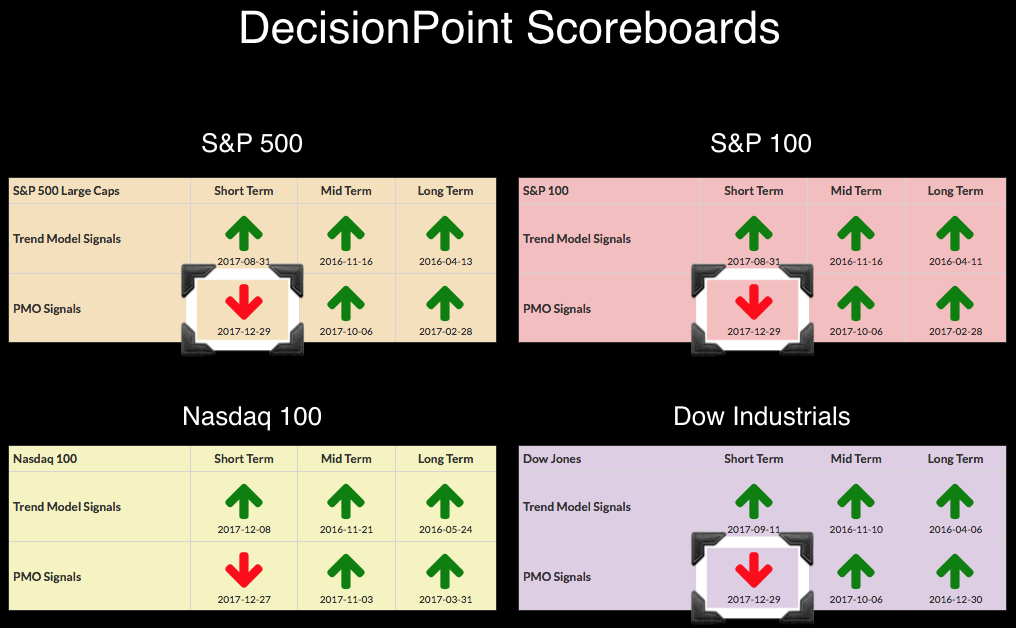

The DecisionPoint Scoreboards remain green as momentum is positive and price trends continue higher in this seemingly unending bull market rally. I'm seeing a few cracks in the pavement right now in the short-term indicators with a negative divergence between breadth and volume... Read More

DecisionPoint January 23, 2018 at 06:31 PM

On Monday's MarketWatchers LIVE program during the "DecisionPoint Report", I highlighted a divergence between the Swenlin Trading Oscillators (STOs). I admitted that I hadn't seen a divergence lasting over a day or two... Read More

DecisionPoint January 19, 2018 at 06:39 PM

Friday was the last trading day before options expiration, so higher than normal volume should be attributed to that, not to other interpretations of volume versus price movement... Read More

DecisionPoint January 18, 2018 at 07:29 PM

One of my favorite segments to do and watch on the MarketWatchers LIVE show M-F 12:00p - 1:30p EST is the "Anatomy of a Trade". Tom Bowley, my co-host, is a very short-term trader and generally has a handful of trades to discuss... Read More

DecisionPoint January 17, 2018 at 07:16 PM

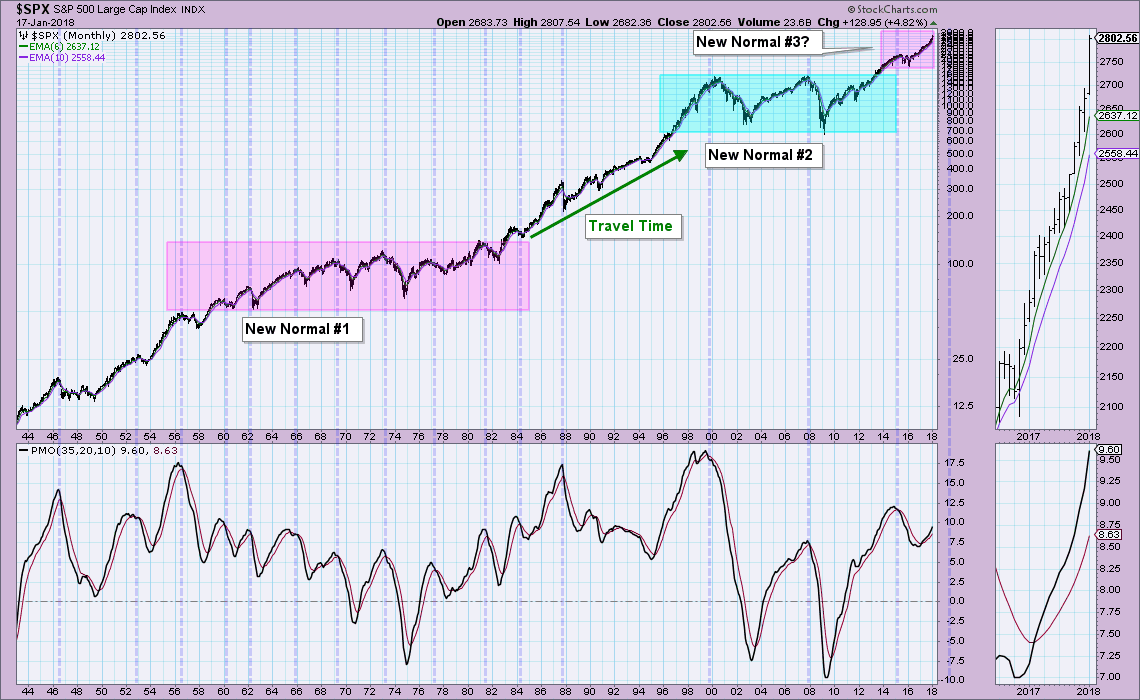

As we watch the SPX continue to move higher in parabolic fashion, it's of course natural to begin to worry about a market collapse. During today's MarketWatchers LIVE show, Tom and I went over what we think are good "alerts" to the bear market switchover... Read More

DecisionPoint January 12, 2018 at 06:16 PM

Positive events resulting from the recent tax cut legislation continued to lift the market this week, bonuses and pay raises being most prominent in the headlines... Read More

DecisionPoint January 11, 2018 at 07:45 PM

Today I received notice that TLT had triggered a new Intermediate-Term Trend Model (ITTM) Neutral signal. I decided to take a look at $TYX to see if yields were lining up with the action on TLT... Read More

DecisionPoint January 08, 2018 at 06:29 PM

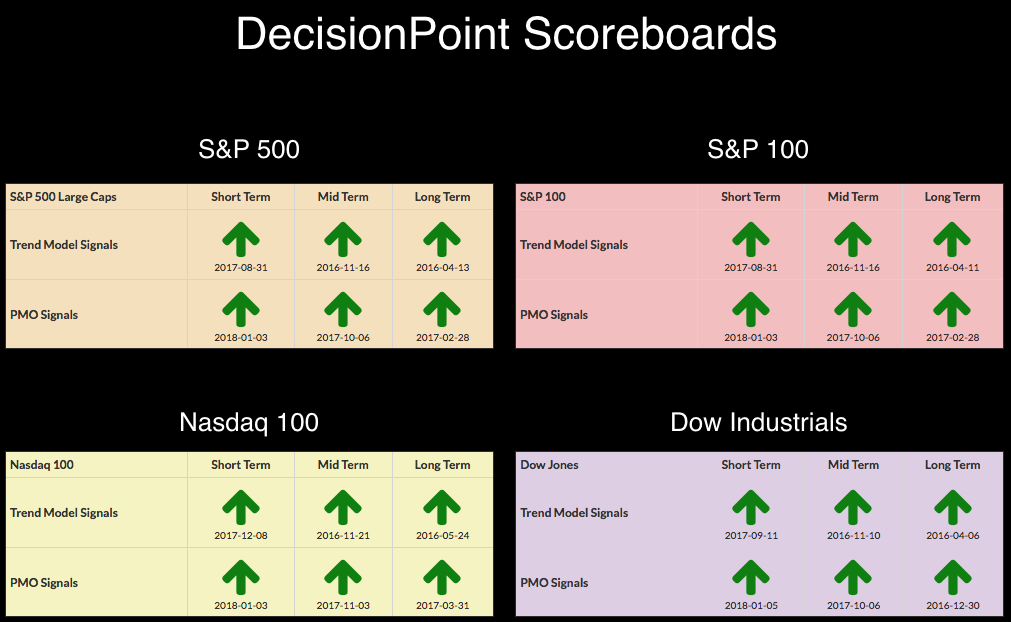

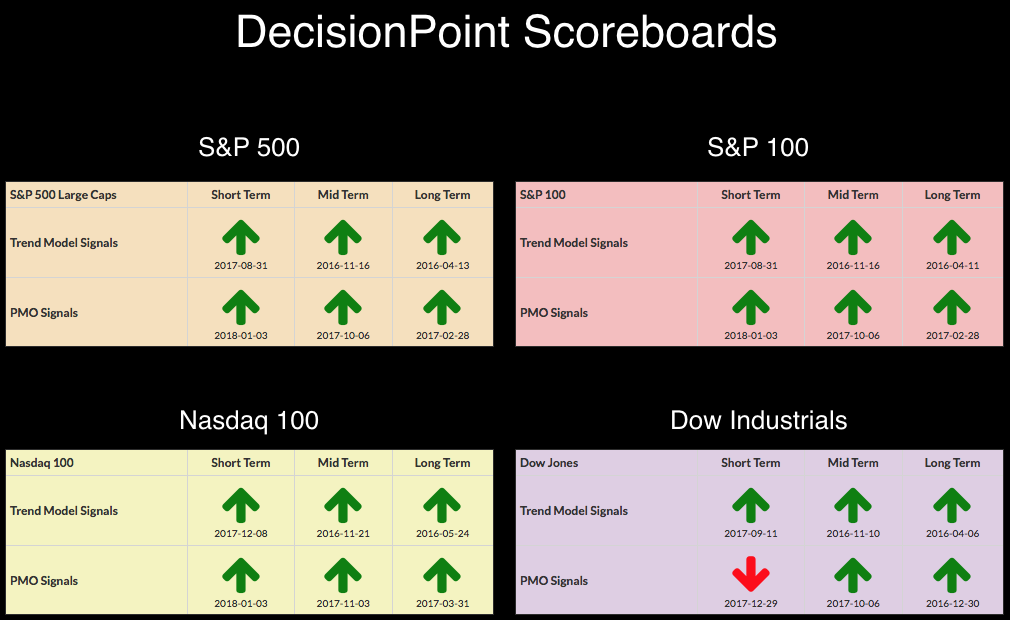

Carl always told me that you shouldn't put questions in the title of your articles unless you plan on answering them. I will. First, I want to point out the all green DecisionPoint Scoreboards... Read More

DecisionPoint January 05, 2018 at 06:50 PM

The market was flat for the last two weeks of December, and I thought that might be a sign that it was hanging on by its fingernails until the first of the year, when we might see some profit taking. But, no... Read More

DecisionPoint January 05, 2018 at 06:28 PM

A quick bulletin to let you all know that we got a new PMO BUY signal on the Dow. I've been writing about this the past few days so no one should be surprised. At this point my concern again is for more whipsaw if the market takes a breath or pulls back in a holiday hangover... Read More

DecisionPoint January 04, 2018 at 08:17 PM

If you look at the DP Scoreboards below, you'll note that the Dow is the only Scoreboard with "red" on it. It is highly likely that red arrow or PMO SELL signal will evaporate tomorrow if we see a follow-on rally or even a slight rise... Read More

DecisionPoint January 03, 2018 at 08:10 PM

I had a bad feeling about the array of PMO SELL signals that appeared Friday and Tuesday. It wasn't worry about an upcoming decline, more the concern we'd see a whipsaw right back to BUY signals, which we did... Read More

DecisionPoint January 02, 2018 at 06:29 PM

On Friday, the SPX, OEX and Dow logged new PMO SELL signals. This was a function of the market consolidating and holiday trading, but it is important to note that these signals are arriving in overbought territory for these PMOs... Read More