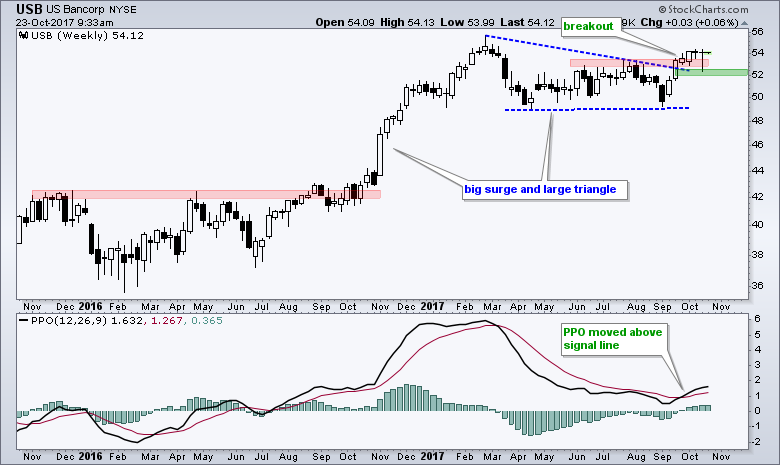

US Bancorp (USB) ended a long corrective period with an upside breakout and this breakout is holding. Note that USB is part of the Financials SPDR (XLF) and the Regional Bank SPDR (KRE). These two are up double digits over the last six weeks and this puts has sector and the industry group strength behind the stock. On the price chart, USB advanced some 50% from June 2016 to February 2017 and then embarked on a long consolidation period. Even though this consolidation seemed to overstay its welcome, it was perhaps necessary to digest the big gains. Also keep in mind that a consolidation after a sharp advance is a bullish continuation pattern. There are signs that the advance is set to continue because USB broke out of the triangle pattern and this breakout is holding. The resistance zone turns into the first support zone and chartists can watch 52 for the first signs of a failed breakout.

Follow me on Twitter @arthurhill - Keep up with my 140 character commentaries.

****************************************

Thanks for tuning in and have a good day!

--Arthur Hill CMT

Plan your Trade and Trade your Plan

*****************************************