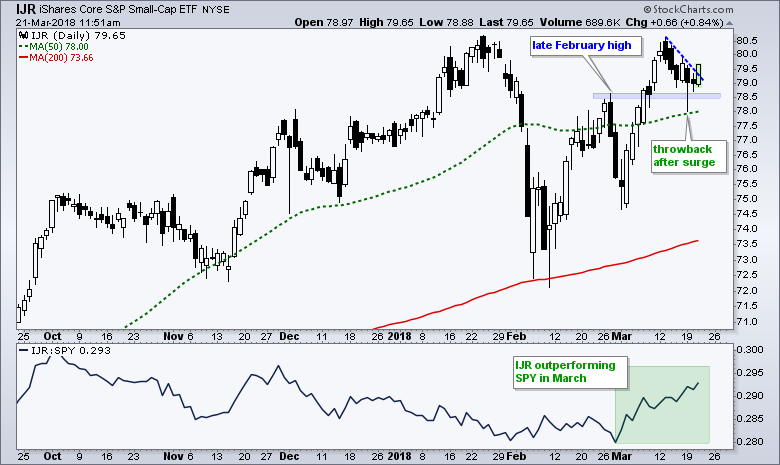

The S&P SmallCap iShares (IJR) held up better than the S&P 500 SPDR (SPY) during last week's decline and small-caps are outperforming large-caps in 2018.

The S&P SmallCap iShares (IJR) held up better than the S&P 500 SPDR (SPY) during last week's decline and small-caps are outperforming large-caps in 2018.

The chart shows IJR moving above its late February high with a surge above the blue zone in mid-March. The ETF fell back after this surge, but held above the rising 50-day SMA and did not close below the February high. SPY, in contrast, is below its late February high and its 50-day SMA.

Even though I cannot draw a picture-perfect wedge or flag, the throwback looks like a short correction after a sharp advance. IJR is leading again today with a nice gain and break above the blue trend line. It looks like the six-day downswing is reversing and IJR is may challenge its prior highs.

The indicator window shows the price relative (IJR:SPY ratio) surging to its highest level of the year this month. Note that this ratio rises when IJR outperforms SPY and falls when IJR underperforms SPY. The ratio fell from October to February and surged in March. The year is less than three months old, but small-caps are showing relative strength in 2018.

Plan Your Trade and Trade Your Plan.

- Arthur Hill, CMT

Senior Technical Analyst, StockCharts.com

Book: Define the Trend and Trade the Trend

Twitter: Follow @ArthurHill