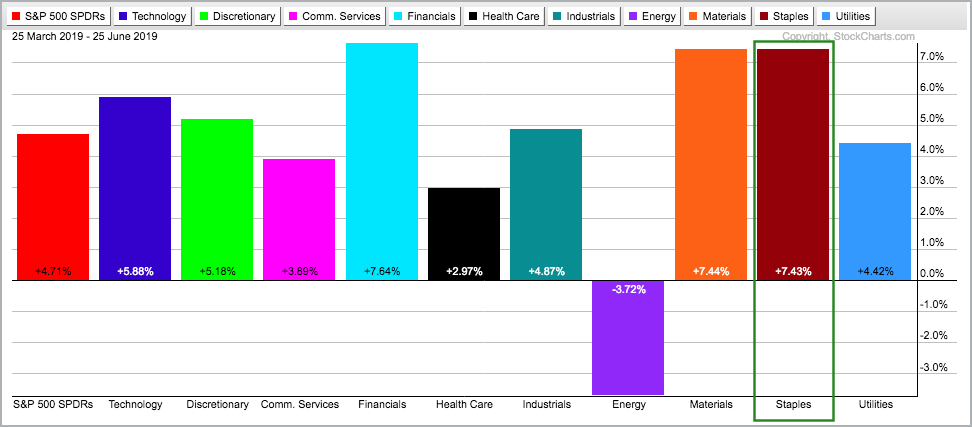

The Consumer Staples SPDR (XLP) is the third best performing sector over the last three months and one of only three sector SPDRs to record a new high here in June (along with XLU and XLRE). In addition, the S&P 500 is trading comfortably above its 200-day SMA. Overall, we can assume that the S&P 500 is in bull mode and consumer staples is a leading sector.

Looking within the sector, I came across Performance Food Group (PFGC) in my trend-momentum scan. The stock is in a long-term uptrend and consolidating with a bullish triangle taking shape.

First, the long-term trend is up because PFGC broke out with a big move in February and recorded a new high in April. The stock then moved into a trading range and established support in the 37-38 area over the last few months.

Most recently, the price range narrowed and a triangle formed. The prior move was up and this makes the triangle a bullish continuation pattern. A breakout in the 41 area would confirm the pattern and signal a continuation higher.

The indicator window shows the Percentage Price Oscillator (PPO) meandering around the zero line as the stock consolidates. A PPO move above its June high would show a momentum breakout of sorts and confirm a triangle breakout.

On Trend on YouTube (Tuesday, June 16th)

- Large-caps looks Fine, Small-caps Not (SPY, IWM)

- Charting the AD Line and AD Volume Line (IJR, XLF)

- Banking ETFs and Stocks are Underperforming

- Fintech ETFs and Stocks are Outperforming

- Click here to Watch

Arthur Hill, CMT

Senior Technical Analyst, StockCharts.com

Author, Define the Trend and Trade the Trend

Want to stay up to date with the latest market insights from Arthur?

– Follow @ArthurHill on Twitter

– Subscribe to Art's Charts

– Watch On Trend on StockCharts TV (Tuesdays / Thursdays at 10:30am ET)