Much has been written about the power, effectiveness and necessity of having recurring investment routines. Much less has been written acknowledging the reality of irregular and non-recurring routines. There are two crucial elements to understand when it comes to investing. First, you must recognize that each of us has a particular time of day when we are the most productive and effective, and this time of day varies by individual. Secondly, we each have our own limited amount of time available each day to allocate to our investing endeavors, and this variable time allotment gets divided between our recurring and non-recurring routines.

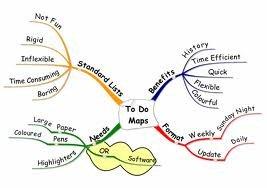

You need to consider these two elements on an individual and personal level. For myself, I know that I am most productive in the mornings. From the time I get up until the time markets close (1:00 PM here on the west coast), I am clearly in overdrive. I deal with my less important non-recurring To-Do list items appreciating that fact. Each evening, I write out a fresh To-Do list. My regular investment routine items are not listed here because, as recurring tasks, they are non-negotiable. Since these recurring routines have become second nature to me, there is no need to put them on the list. The next morning at the office, I inevitably add to the non-recurring list.

Herein lies the productive little habit I’ve gotten into. All items on the To-Do list are highlighted in either yellow or blue. Yellow means they are the high priority items that need my attention before the markets close when my morning energy and focus are at a peak. The blue highlighted items are meant for after the market closes, after I’ve had lunch and taken a break. Clearly these items are less imperative in importance.

Therefore, the first half of the aforementioned cliché “you’ve got to do what you have to do” applies to the important morning items on the To-Do list whereas the afternoon activities apply to the latter portion of the cliché “before you can do what you want to do.” As a trader, I have found that this simple little exercise yields admirable results.

Trade well; trade with discipline!

-- Gatis Roze