Academics like to write lots of papers proving that investors ascribe much more value to a position they already own than to one they don’t. They call this the endowment effect. I confess – I fell prey to exactly that effect. I’ve been trading the biotech run profitably for over 2 years. I knew it was long in the tooth. I saw the industry begin to underperform the market. I saw the lower peaks and negative money flows amongst the sister stocks.

But these biotechs had become good friends and very profitable winners for so long that I failed to embrace a change in the winds. In essence, I wanted to alter the weather and fueled my emotional sunny visions with hope and a fondness for my biotech friends. I was in fact chasing unnatural returns. It had already started to rain, but there I was hoping for more sunshine and refusing an umbrella.

My point is that I diminished my returns (albeit still locking down wonderful gains) because:

- I grew too friendly with these biotechs and that is unhealthy.

- I began to personally filter what the market charts were telling me.

- I stood in the rain getting wet while hoping for sunny skies again.

- I got greedy. I enjoyed the 2 year status quo. I was slower to change than I should have been.

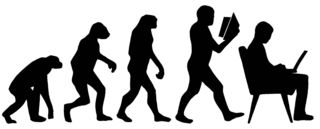

Now I better understand and embrace what Darwin meant. The solemn pledge I made to myself is that next time it will be different. When I see change happening, I will act upon it.

Trade well; trade with discipline!

-- Gatis Roze