“The way to pick an investor’s pocket is through the ear.” – Jason Zweig

“The way to pick an investor’s pocket is through the ear.” – Jason Zweig

There is a direct correlation between an investor’s profitability and his or her communication skills. I would be willing to wager you that I could ascertain the degree of your success as an investor within just a few minutes of speaking with you. That sounds arrogant, but if you do not speak the language of the markets, they have a way of skewering you.

It is a fact that Wall Street is dense with jargon that often means the exact opposite of what intuition would suggest. The purposeful pomposity and intentional complexity is all intended to convince you of how smart the professionals are, how undecipherable the markets are (except by them) and the need for you to give them your money to manage. Poppycock!

The reality is twofold. First, pantomime and ignorance don’t cut it with respect to investing. Secondly, call it the vernacular, dialect or idiom of finance, but if you want to play in my sandbox and make money, you’d better make the effort to learn my language.

I maintain that a strong financial vocabulary is an indispensible and essential item in your investor survival toolkit. It’s a hostile landscape out there if you try to get by on just your mother tongue. Here are a few reasons why:

- Did you ever notice at larger financial seminars how the more experienced investors find each other and congregate together while the novice investors remain with their own kind? It’s human nature that makes us want to spend time with other investors like ourselves who we can learn from. Our market jargon is the obvious filter here.

- Two investors who both embrace the same market vernacular are able to communicate more explicitly and more quickly. We traders are an impatient lot.

- If you have a command of the nuances of investing language, you will not only be better able to correctly absorb the news and formulate specific intentions but you will execute your trading goals more precisely.

Let me share a personal example from a similar arena. Last week, I attended the annual boat show here in Seattle. The marine world, much like the investment world, has a language of its own. When I approach boating salespeople, I always do so as a landlubber just to suggest to them that I don’t know much and I need their guidance and wisdom.

I had two interactions of note at this year’s show. The first salesperson clearly mixed up the bow (front) and the stern (rear) during his pitch to me. I moved on pretty quick after that. The next salesman I encountered was a total blowhard who tried to impress and overwhelm me with his marine expertise. He suggested that I’d be wise to place my trust in him and let him choose the perfect boat for me. Now, I’ve been around boating long enough to know that he was blowing smoke when he described the “gunwale cockpit”. I moved on once again.

My point here is that boating has legitimate safety reasons that require you to learn its language. “Man overboard, starboard side” offers unambiguous specificity that demands an immediate response. Financial markets are no different. You must take the time to learn the talk. Here is an easy and descriptive glossary for you to reference anytime you need some clarification.

https://stockcharts.com/school/doku.php?id=chart_school:glossary_a

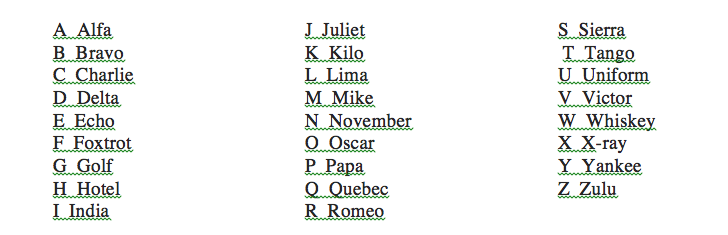

A successful investor’s communication and language skills must be unambiguous and specific. The Phonetic Alphabet is one example of an invaluable tool I use almost daily to ensure accurate communication. I want to be clearly understood because verbalizing an incorrect ticker symbol can spell disaster very quickly. Most of you already use this, but those who don’t might want to copy this and tack it to their bulletin boards.

The bottom line is that you don’t need a PhD in derivatives and algorithms to invest in the market, but as a start, please learn the difference between a market order and a limit order, or a bearish trend and a bullish trend. Only then will I welcome you to my sandbox.

Trade well; trade with discipline!

-Gatis Roze, MBA, CMT

Presenter of the Tensile Trading DVD, Stock Market Mastery.

Developer of the StockCharts.com Tensile Trading ChartPack.

P.S. Click HERE for information on my future appearances & seminars.