Welcome to the recap of Wednesday's MarketWatchers LIVE show, your antidote for the CNBC lunchtime talking heads. Listen and watch a show devoted to technical analysis of the stock market with live market updates and symbols that are hot.

Welcome to the recap of Wednesday's MarketWatchers LIVE show, your antidote for the CNBC lunchtime talking heads. Listen and watch a show devoted to technical analysis of the stock market with live market updates and symbols that are hot.

Information abounds in our Monday/Wednesday/Friday 12:00p - 1:30p shows, but here's a quick recap. Be sure and check out the MarketWatchers LIVE ChartList for many of today's charts. Your comments, questions and suggestions are welcome. Our Twitter handle is @MktWatchersLIVE, Email is marketwatchers@stockcharts.com and our Facebook page is up so "like" it at MarketWatchers LIVE.

What Happened Today?

Talking Technically:

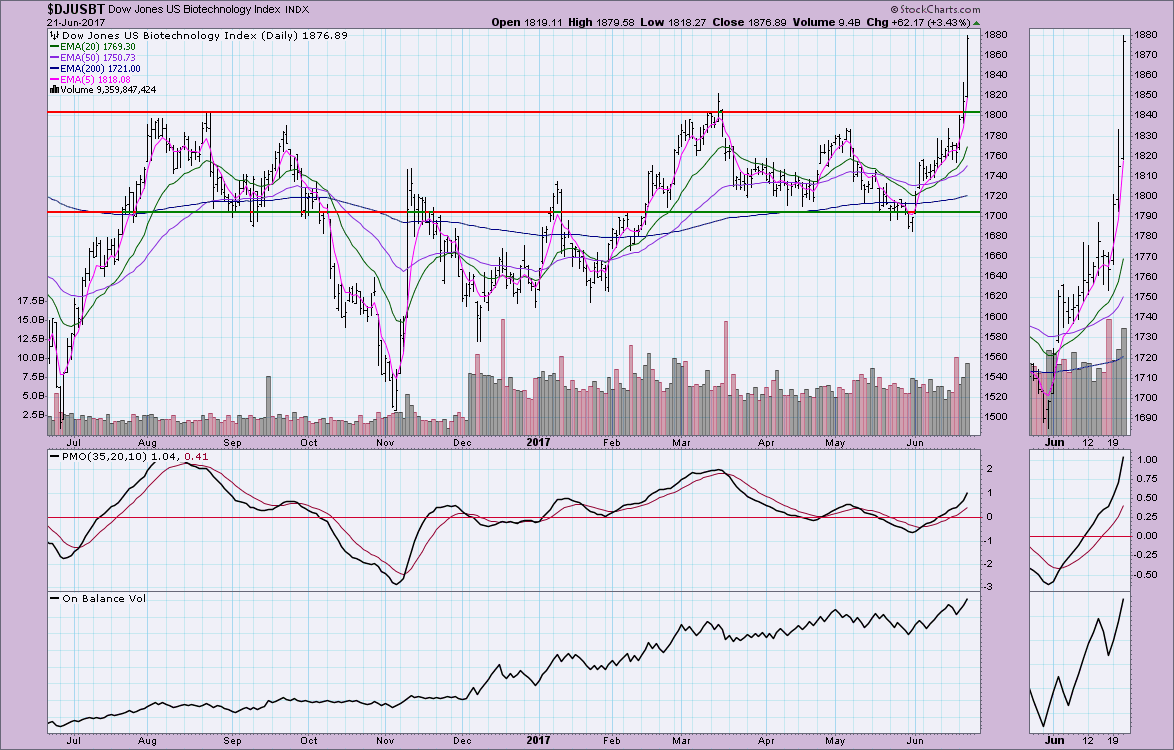

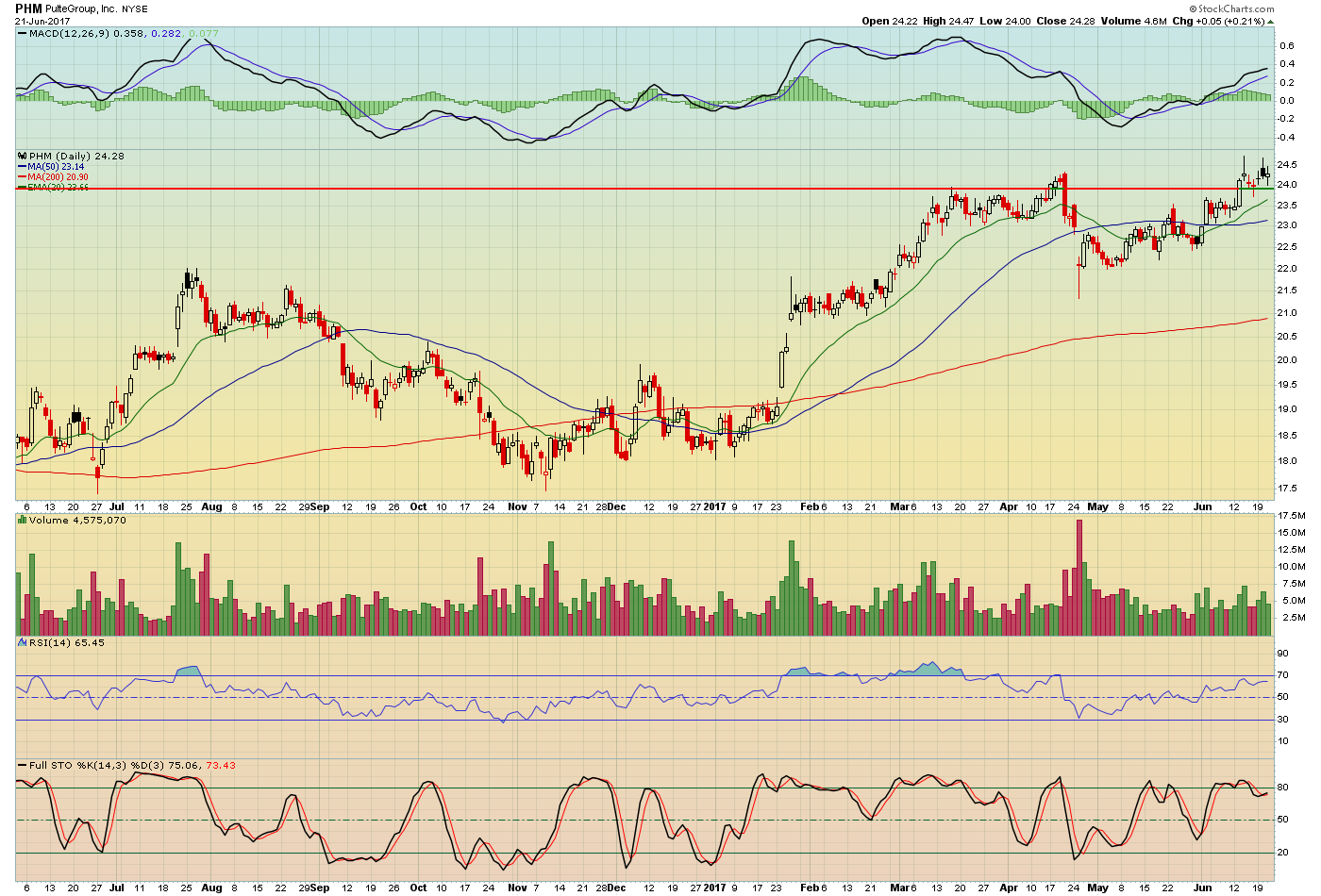

Tom and Erin start the show off with important earnings announcements, economic news and developing news in the major markets. Today the topic was Biotech Stocks and Home Builders. Below are some of the chart observations of Tom and Erin:

Favorite Chart Patterns: On Wednesday Tom and Erin look at which ETFs or sectors are leading/lagging using RRG charts and the International ETF Summary. Tom liked the ascending triangle. A bullish continuation pattern, you can calculate minimum upside targets by the height of the triangle.

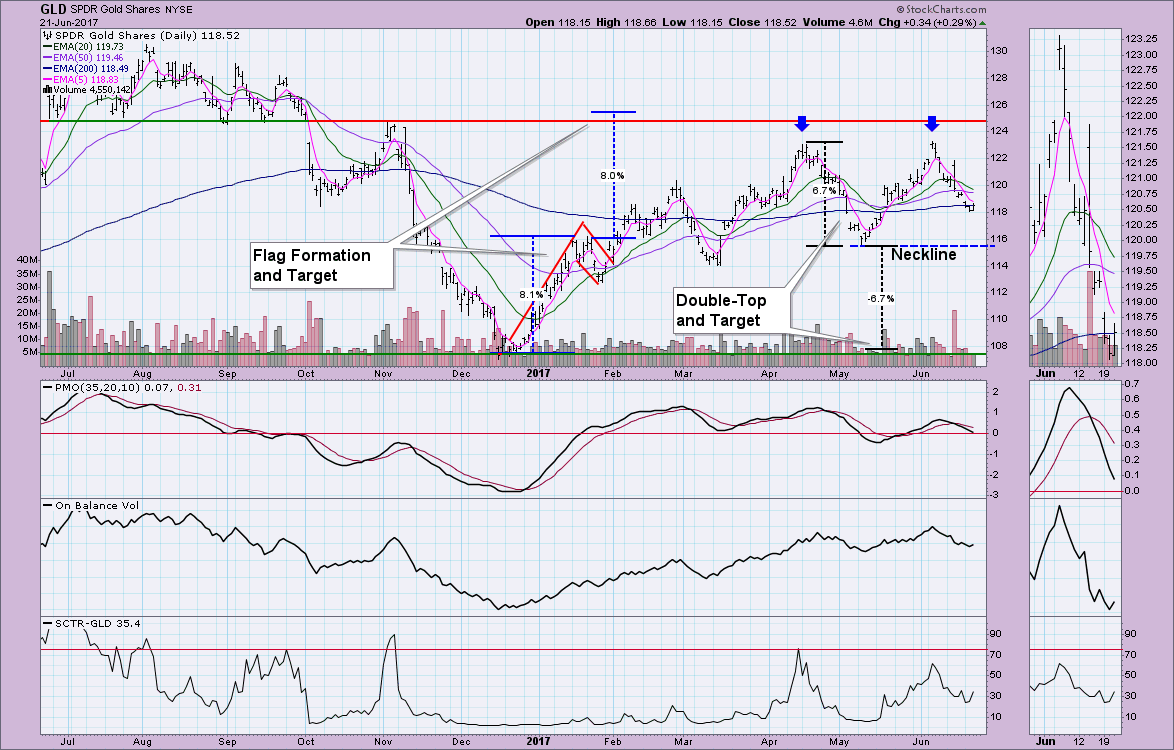

Erin's favorite is the bull flag, but since the GLD chart had an example of a possible double-top, she added that as well. Here's an example of how you can calculate the minimum upside/downside targets.

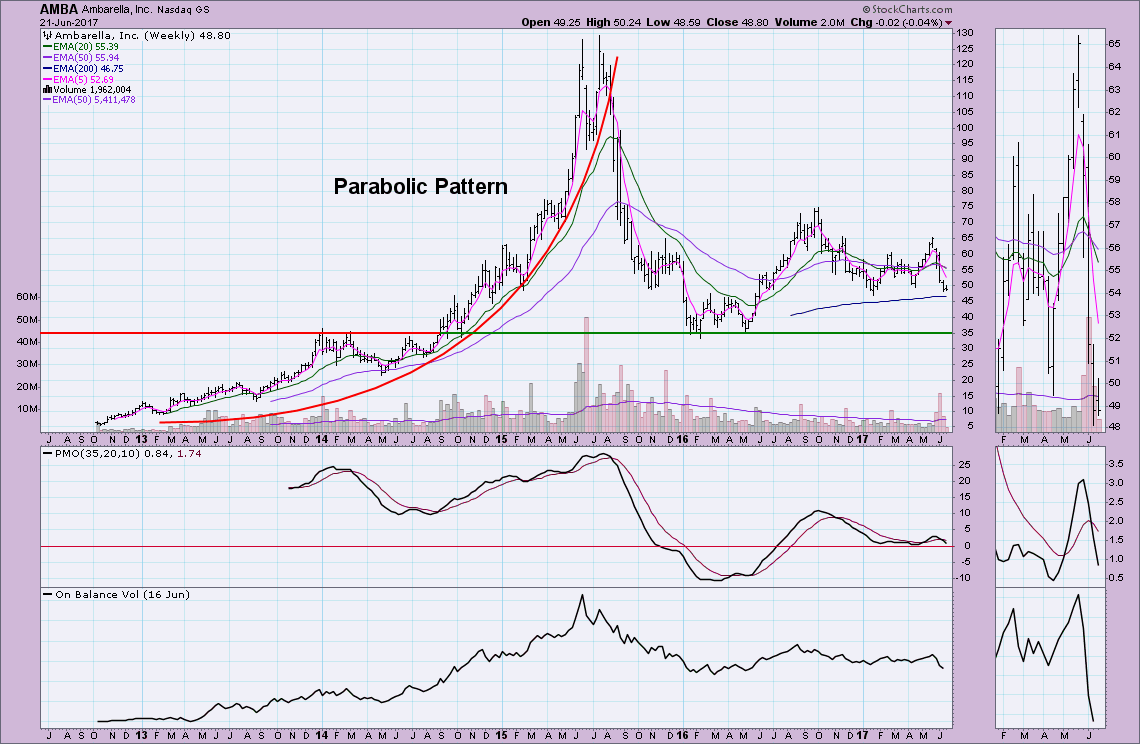

Since there was a little time, Erin wanted to point out a chart pattern to avoid. The parabolic pattern. While these are a joy to ride, when the ride is over, it's over...quickly and generally at a big loss for many investors. When a parabolic executes, it a quick and painful drop back to the original basing pattern or support/resistance area that was there before the parabolic move. Ambarella (AMBA) is a great example.

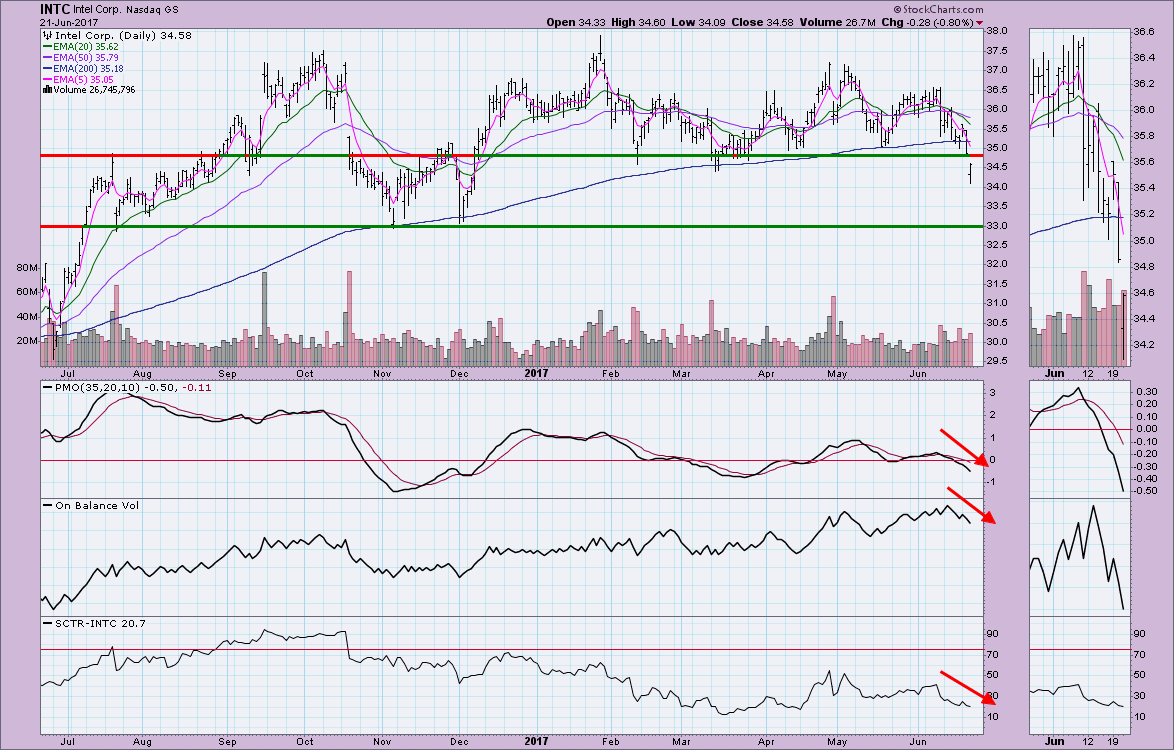

Market Movers: After the Market Update, Tom and Erin zeroed in on a few of the most active or biggest movers. A couple that caught their eye were INTC, CAT, ICPT, INCY and PFE.

Terrible gap down below support and very negative indicator configurations.

It's time for CAT to find some support soon now that it has broken below rising bottoms support.

Ten in Ten Before One: In this regular segment, Tom reviews ten charts in ten minutes with Erin's comments peppered in there. Send in your symbol requests with comment via Twitter (@mktwatcherslive) before the show and you could see it analyzed. If we missed them this show, we have many of them in the queue for Friday. Tom annotated and saved: V, JBT, TXN, ORCL, MFI.TO, SEA, ENDP, CMG, MRVL and MOMO. Tom and Erin laughed that MOMO was showing some "momo" momentum.

DecisionPoint Report: Erin walked us through her last DecisionPoint Alert article. Indicators in all three time frames are bearish, but she's expecting more consolidation, not necessarily a correction. To read her commentary and see all of the charts, check out her blog article here.

Mailbag Segment: Each show Erin and Tom answer questions received via Twitter, Facebook and Email. Today they discussed why they like to use their favorite indicators. For Tom it is the MACD and for Erin it is the PMO. To read more about these indicators, here are links to ChartSchool articles for the PMO and MACD.

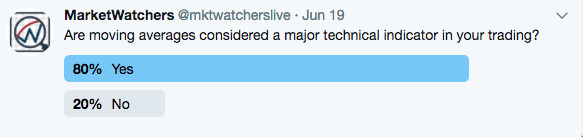

It's a Wrap! Erin discussed the Twitter viewer poll from Monday where you were asked, "Are moving averages considered a major technical indicator in your trading?" The results are below. Look for our Twitter polls at @mktwatcherslive. Today's Twitter poll is "Do you trade with options?" If you'd like to participate, just click on this Twitter link.

Looking Forward:

Tune in on Friday at 12:00p - 1:30p EST on 06/23 to see regular market updates, the popular 10 in 10 to 1 segment as well as a segment on sentiment!

Be sure to add your email address to the notification box below to receive an email when articles are published.