Welcome to the recap of Wednesday's MarketWatchers LIVE show, your antidote for the CNBC lunchtime talking heads. Listen and watch a show devoted to technical analysis of the stock market with live market updates and symbols that are hot.

Welcome to the recap of Wednesday's MarketWatchers LIVE show, your antidote for the CNBC lunchtime talking heads. Listen and watch a show devoted to technical analysis of the stock market with live market updates and symbols that are hot.

Information abounds in our Monday/Wednesday/Friday 12:00p - 1:30p shows, but here's a quick recap. Be sure and check out the MarketWatchers LIVE ChartList for many of today's charts. Your comments, questions and suggestions are welcome. Our Twitter handle is @MktWatchersLIVE, Email is marketwatchers@stockcharts.com and our Facebook page is up so "like" it at MarketWatchers LIVE.

What Happened Today?

Talking Technically:

This morning Tom discussed relative strength among the various sectors and noted in particular he looked at the technology sector and industries. Highly recommend you read today's Trading Places article that covers this in detail.

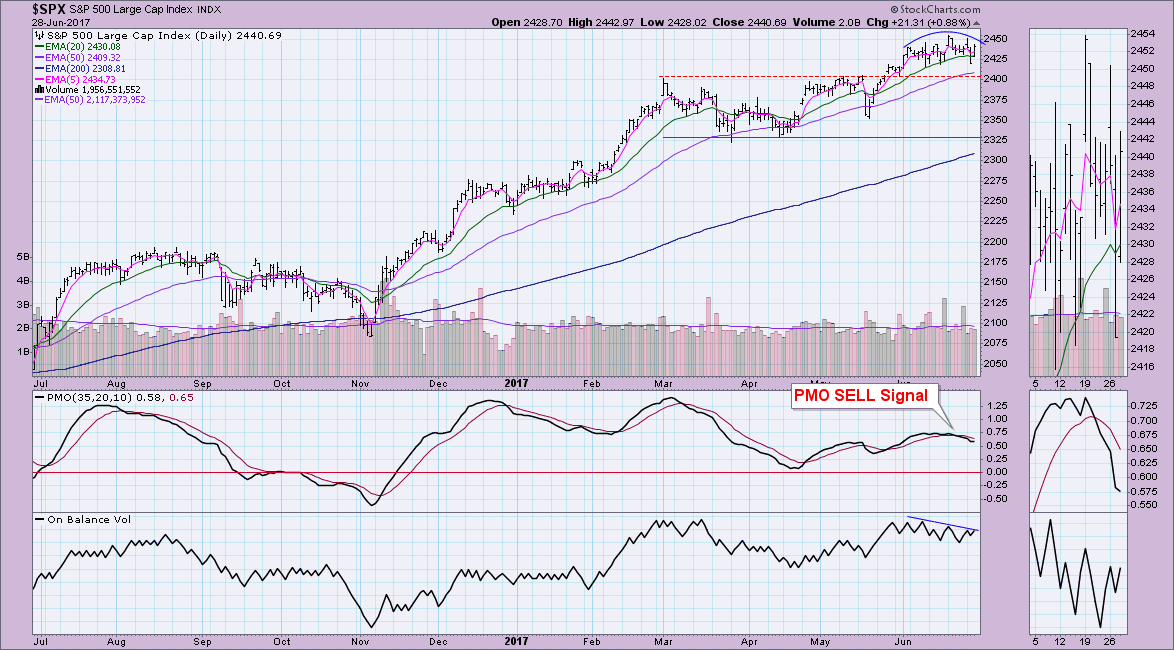

Additionally, Erin discussed the market in general and its bullish exuberance. She noted on her chart of the SPX that we are looking at a rounded top on a PMO SELL signal. The previous PMO BUY signal didn't produce much more than consolidation and consequently, the PMO SELL signal could mean a pullback or small correction.

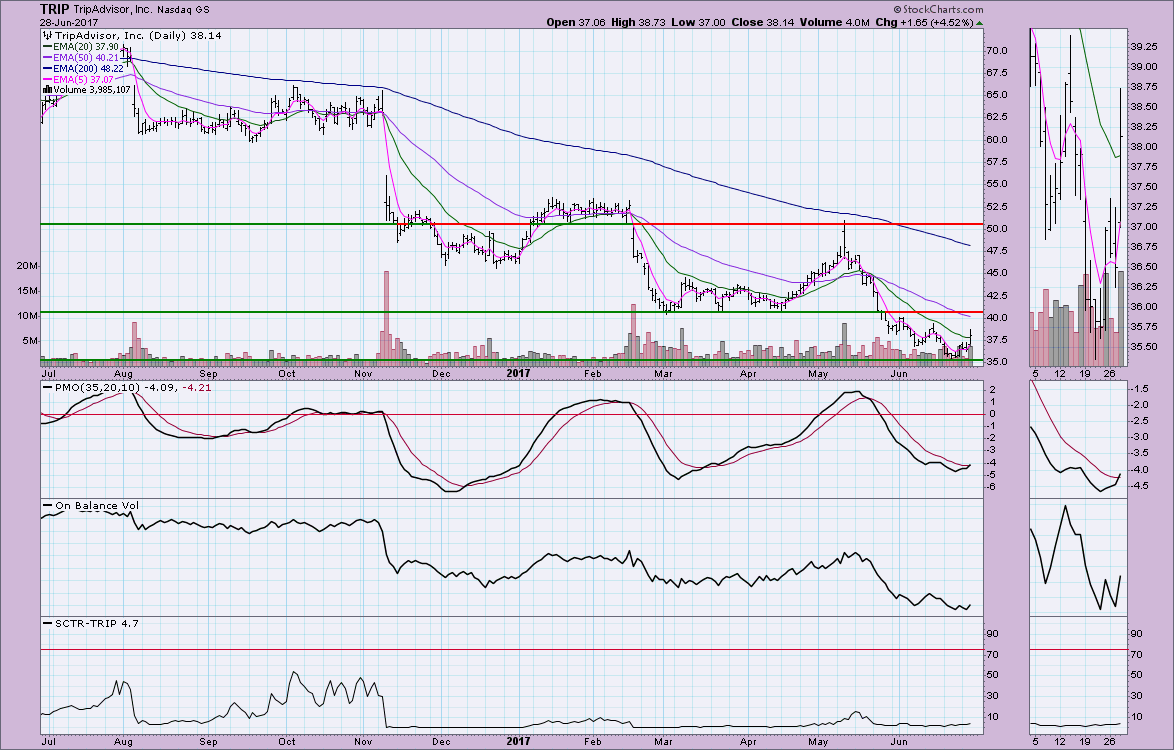

Market Movers: Tom and Erin reviewed charts of big SCTR movers across the markets. Erin showed TRIP, CNCR, TWTR, ALB, CY, UMC, MEOH and FARO. Tom reviewed CHTR, JBHT, FORM, HOV and TMST. The two in particular that Erin found interesting were TRIP and TWTR. TRIP was one of the big price movers. TRIP has just triggered a new PMO BUY signal in oversold territory. There's a nice short-term rounded bottom in play.

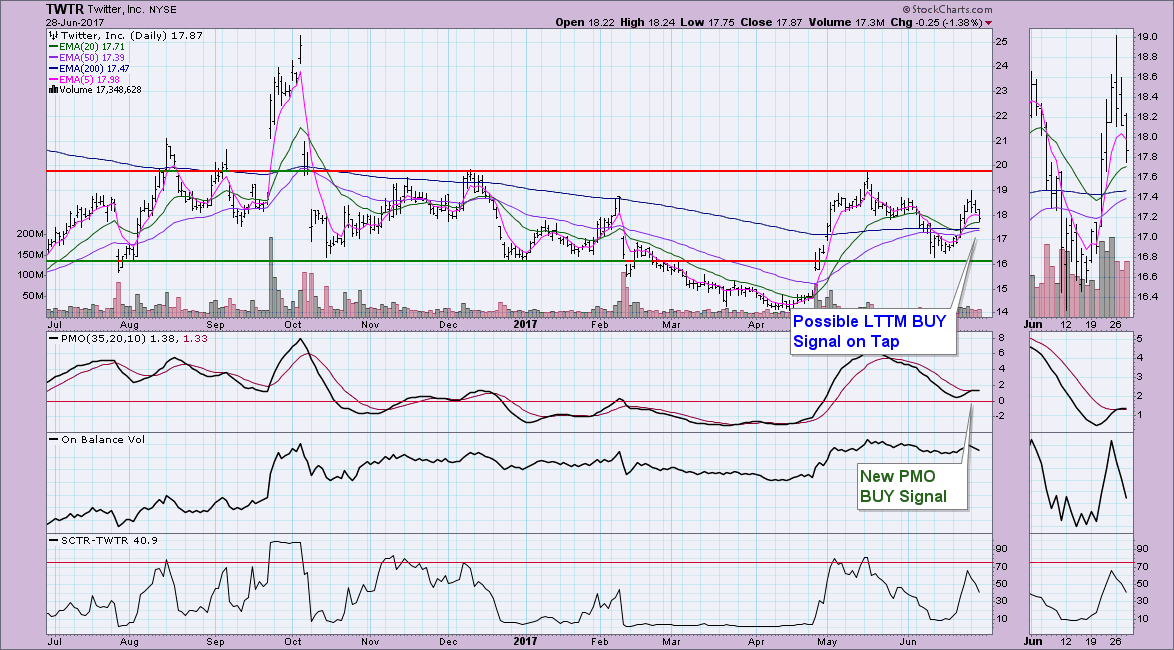

TWTR was on the negative SCTR movers but Erin said she wouldn't dump it yet. A new PMO BUY signal arrived and there is a possible 50/200-EMA positive crossover coming which would put TWTR on a LT Trend Model BUY signal.

Ten in Ten Before One: In this regular segment, Tom reviews ten charts in ten minutes with Erin's comments peppered in there. Send in your symbol requests with comment via Twitter (@mktwatcherslive) or email (marketwatchers@stockcharts.com) before the show and you could see it analyzed. If we missed them this show, we have many of them in the queue for Friday. Tom looked at CARA, HHL.TO, UNG, FL, T, WDC, SM, PKG, JPM and TSO. You'll find all of these charts in the MarketWatchers LIVE ChartList. The link is found at the top of the MarketWatchers blog homepage.

StockCharts.com Tool of the Week: Tom demonstrated the new "Settings" gears on the member homepage. You can adjust your homepage view using the toggles. For more information on this great new feature, you can read the recent ChartWatchers article written by Chip Anderson.

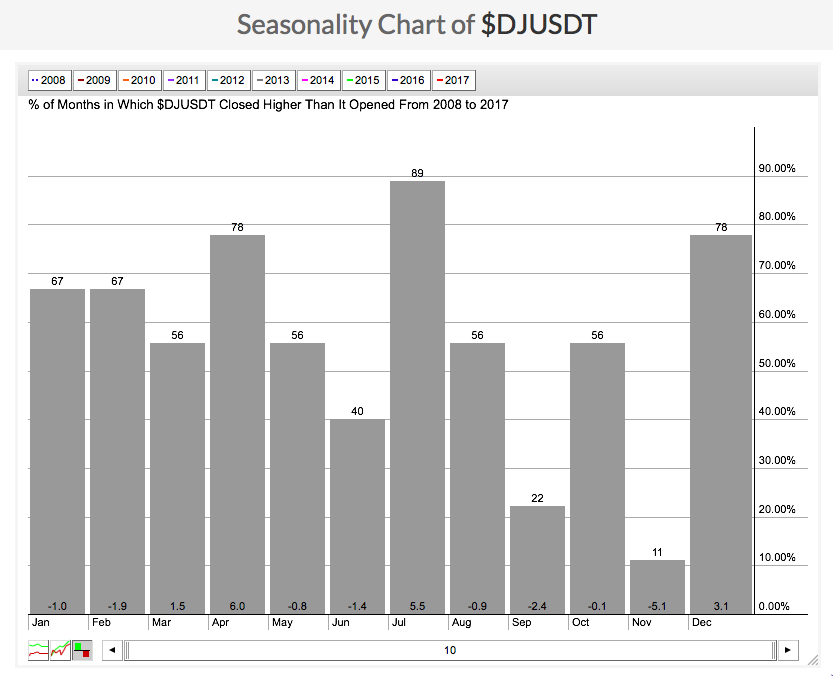

Seasonality: As we end June and begin July, Tom took a look at seasonality trends for July. Tom said that the top July industry group is Diversified REITs ($DJUSDT). Check out this seasonality chart!

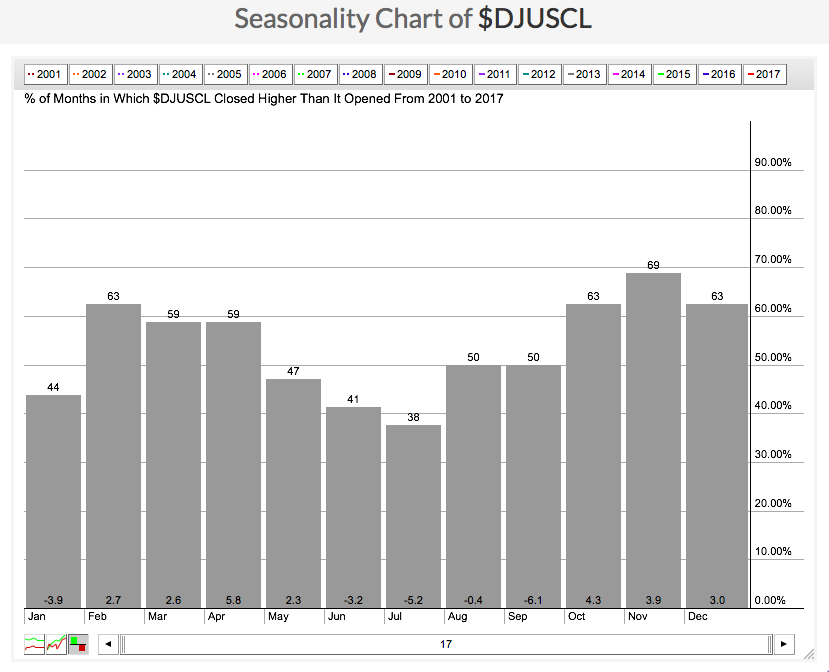

The worst July industry is Coal ($DJUSCL) which is fairly obvious when you look at this seasonality chart.

The worst July industry is Coal ($DJUSCL) which is fairly obvious when you look at this seasonality chart.

Mailbag Segment: Each show Erin and Tom answer questions received via Twitter, Facebook and Email. Today, they were asked two questions. First, how do you define the timeframes "short term, intermediate term and long term"? Erin explained she actually works in four timeframes. The ultra-short term, she considers as hours to a day or two; the short term, days to a week or two; the intermediate-term, weeks to a few months; and the long term, months to years. Tom explained that short term is on a 10-min or 60-min chart, the intermediate-term is on a daily chart over the past year and long term is on a weekly chart over a few years or more. The second question was whether Tom and Erin are always invested or is there a period of time where you sit on the sidelines and wait it out? Erin explained that yes she technically is always invested. She divides her investments in various accounts with various risk tolerance. She also agreed with Tom's answer that using sector rotation and finding the strong leaders, you don't necessarily have to sit completely on the sidelines.

It's a Wrap! In closing Erin said that she would be watching the current rounded top on the SPY and the PMO very closely as it seems the market could be ready for a pullback. As of publishing, she says the deceleration of the PMO on the SPY is encouraging. The current SELL signal could result in consolidation, rather than a deep pullback or correction. Tom was going to watch treasury yields and the financial sector, as well as technology. After market buzz is for the first time since the financial crisis, the Fed has cleared all big banks' capital return plans. Citibank dividends doubled.

Looking Forward:

Tune in on Friday at 12:00p - 1:30p EST on 6/30 for more market news and technical analysis. It's sentiment review time! Also the regular segments, 'Talking Technically' and 'Ten in Ten to One' will