Welcome to the recap of Friday's MarketWatchers LIVE show, your antidote for the CNBC/FBN lunchtime talking heads. Listen and watch a show devoted to technical analysis of the stock market with live market updates and symbols that are hot.

Welcome to the recap of Friday's MarketWatchers LIVE show, your antidote for the CNBC/FBN lunchtime talking heads. Listen and watch a show devoted to technical analysis of the stock market with live market updates and symbols that are hot.

Information abounds in our Monday/Wednesday/Friday 12:00p - 1:30p shows, but the MWL Blog will give you a quick recap. Be sure and check out the MarketWatchers LIVE ChartList for many of today's charts. Remember! You can now watch the latest episode under the "Webinars" tab!

Your comments, questions and suggestions are welcome. Our Twitter handle is @MktWatchersLIVE and/or #mktwatchers, email is marketwatchers@stockcharts.com and our Facebook page is up and running so "like" it at MarketWatchers LIVE. Don't forget to sign up for notifications at the end of this blog entry by filling in your email address.

What Happened Today?

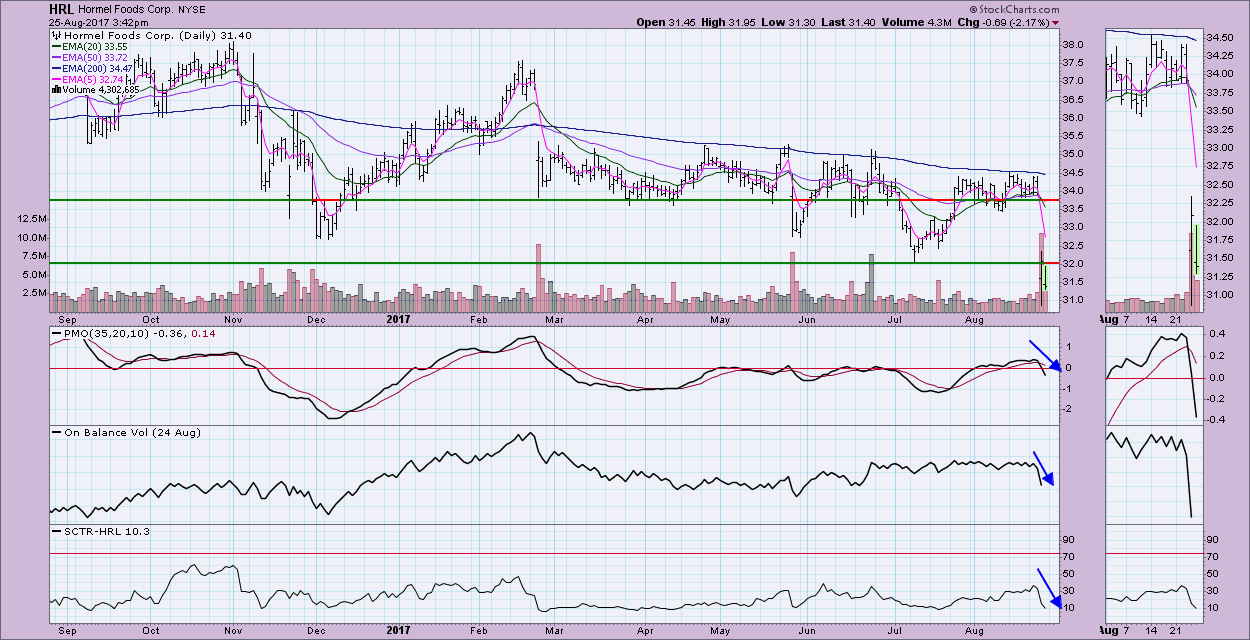

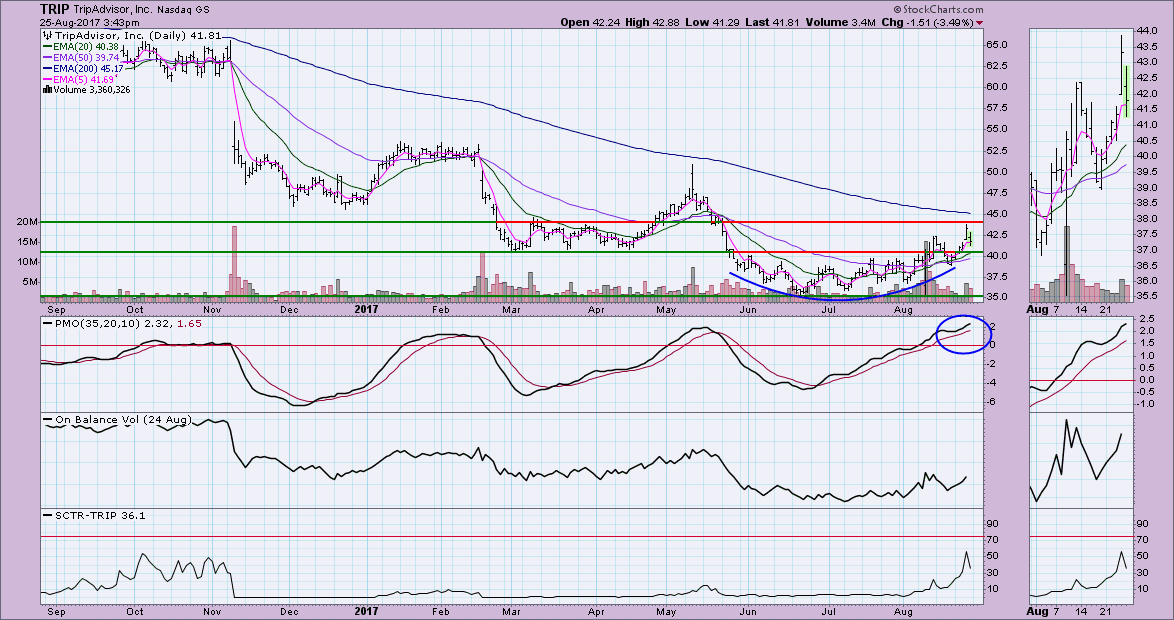

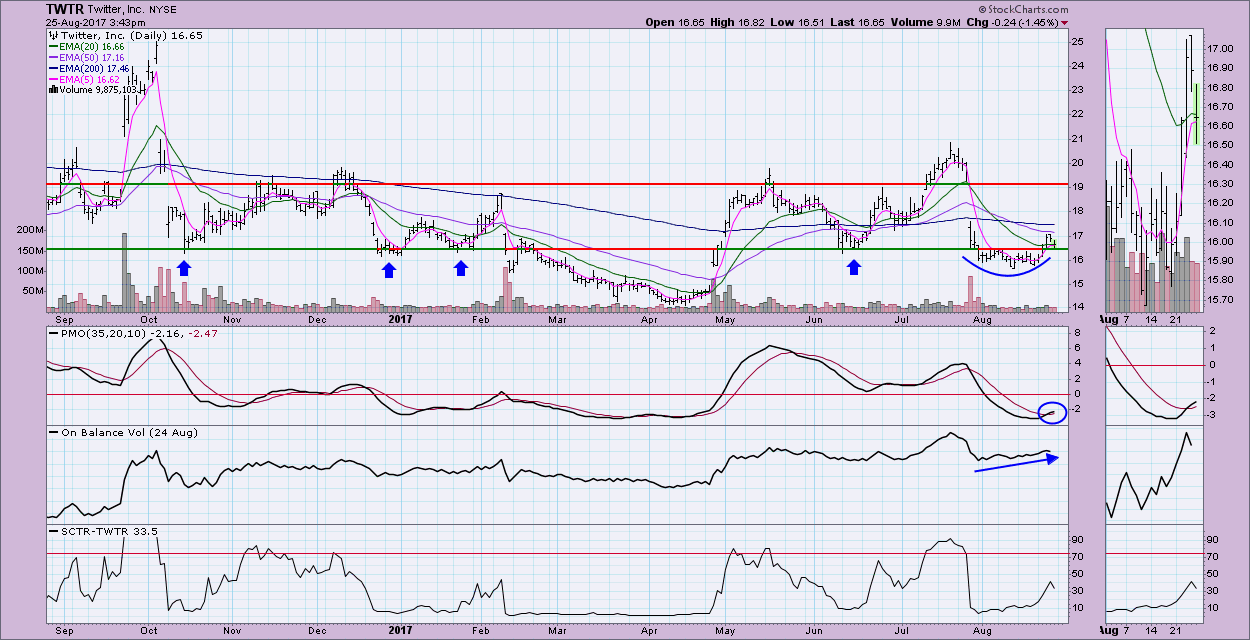

Talking Technically: On Friday Tom and Erin focused on interesting earnings news, charts to watch, etc. Tom reviewed Autodesk (ADSK) and the interesting movement after good earnings. Erin looked at three downgrades (TRIP, TWTR and HRL) and determined that HRL is looking more bearish while TripAdvisor (TRIP) and Twitter (TWTR) had some upside potential despite the drops on earnings. You'll find all three of those charts in the MarketWatchers ChartList (the link is at the top of the blog page).

Earnings Spotlight: Tom spent some time discussing the bullish possibilities that are now available after earnings announcement. You should definitely go to the recorded show to hear more of his commentary (37:45 on the recording).

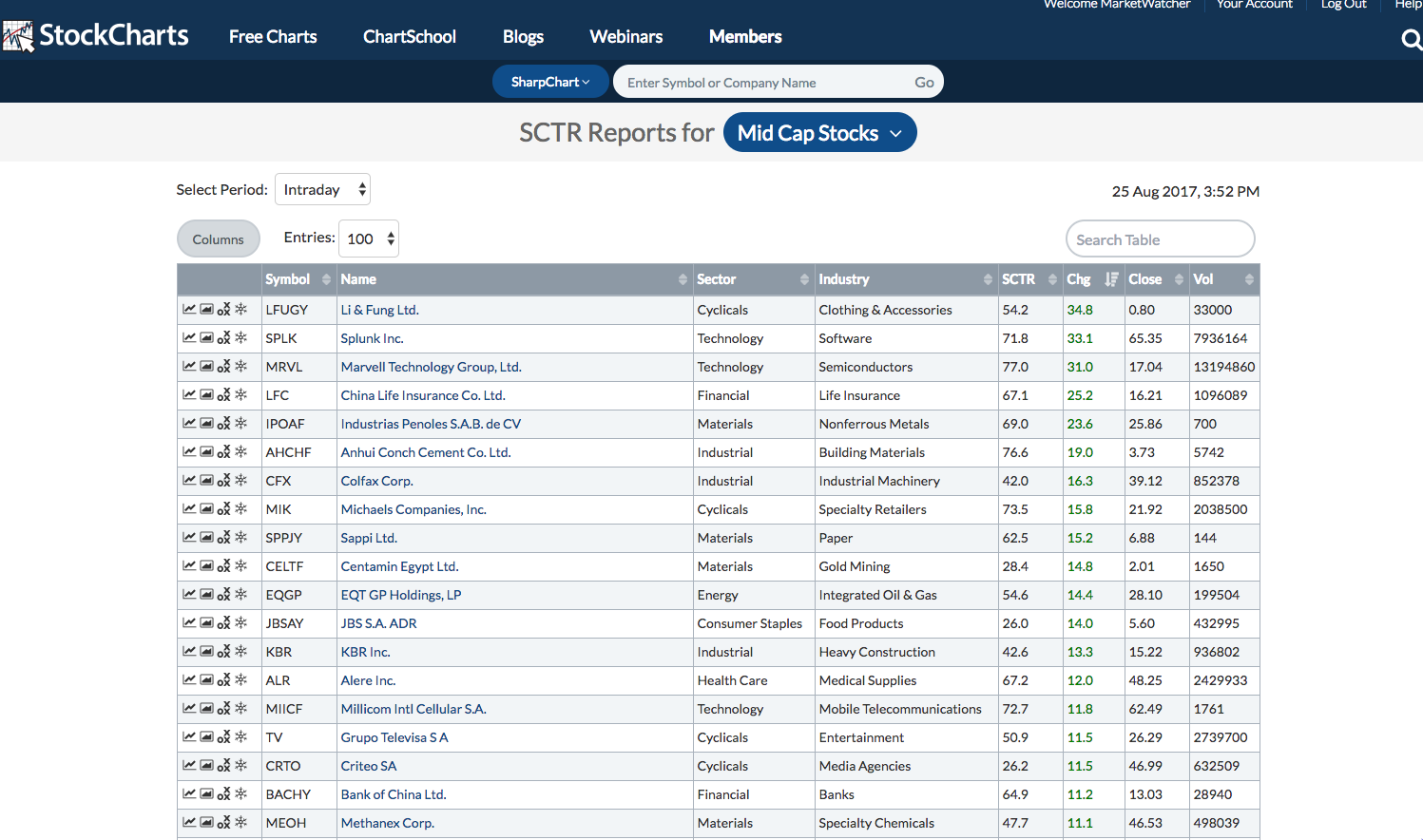

Market Movers Demo: Erin spent some time discussing how to use the "SCTR Report" in the Control Center tile. This provides an excellent way to see ALL of the SCTR movers in various lists. By using this report versus the "Market Movers" tiles on your member dashboard, you can sort by industry or SCTR ranking or percent change, among others.

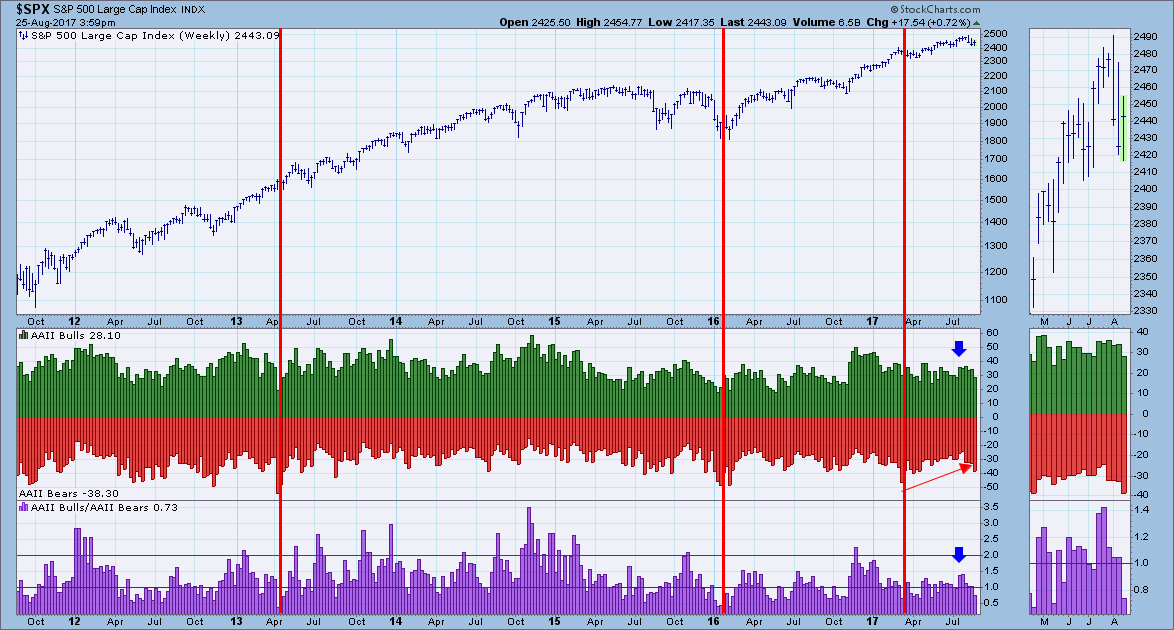

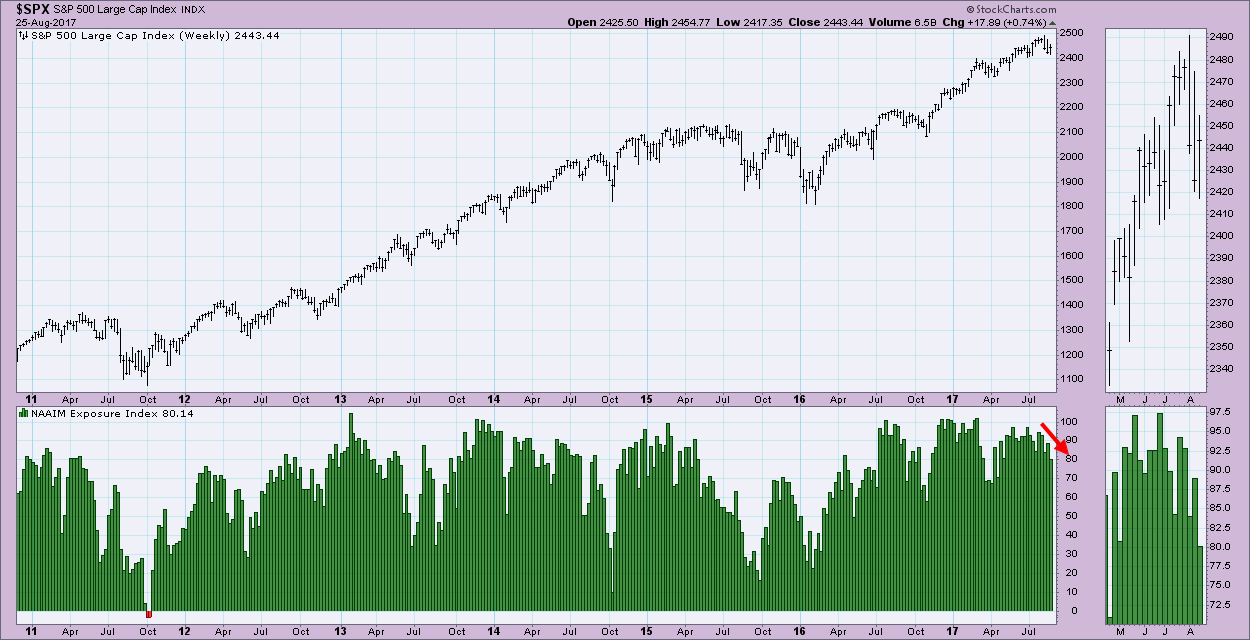

Sentiment: Erin reviewed the latest sentiment charts for AAII (American Association of Individual Investors) and NAAIM (National Association of Active Investment Managers) exposure index. Note that sentiment is moving bearish. It hasn't reached extremes. Remember that excessively bearish readings suggest a bottom will arrive soon.

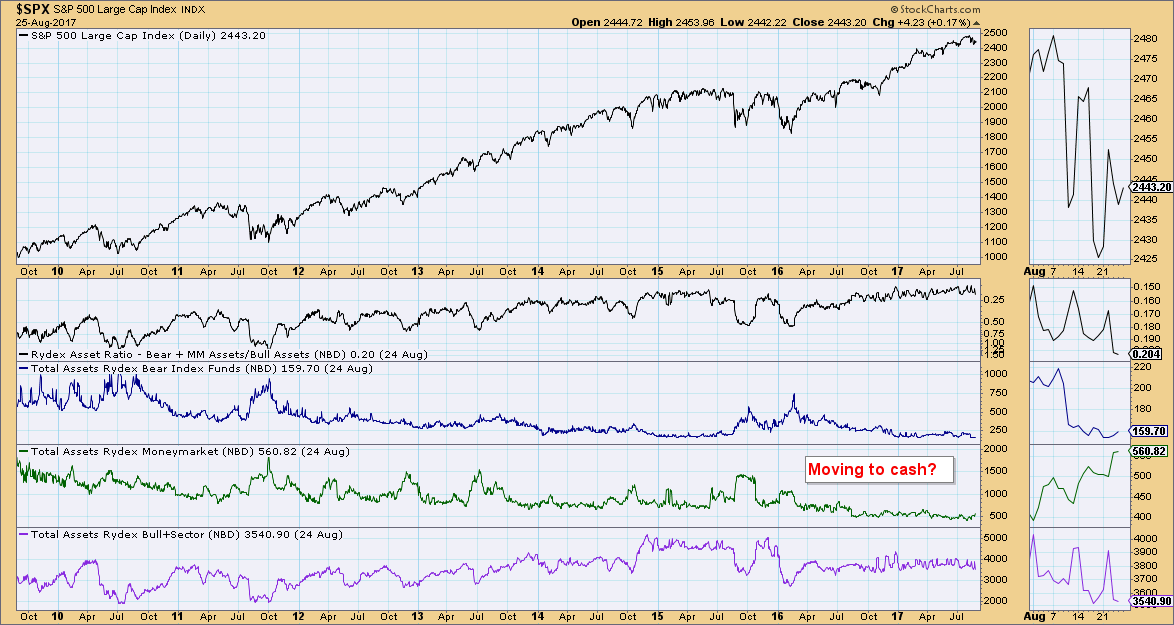

Rydex Assets Ratio is becoming a bit more interesting, but the most interesting was the increase in money market assets but not the corresponding increase in bear funds (look in the thumbnail). This would suggest investors in general are heading into cash. Erin sees this as neutral to somewhat bearish for the market.

Ten in Ten Before One: In this regular segment, Tom reviews ten charts in ten minutes with Erin's comments peppered in there. Send in your symbol requests via Twitter (@mktwatcherslive) before the show and we'll try and add them. We also take requests during the live show from the LiveStream chat box. Symbols reviewed today: ULTA, SPLK, RSX, ABB, BABA, MGM, EDU, GDX, IP and QCOM. You'll find all of the charts in the MarketWatchers LIVE ChartList, located at the top of the MarketWatchers blog homepage.

Seasonality Update: Tom discussed the outperformance of Akamai (AKAM) during the final quarter of the year. AKAM seasonality chart shows that 116% of its gains were achieved during the final four months of the year (over the last 19 years). To read more about this, you can see Tom's latest Trading Places article today.

Mailbag Segment: Each show Erin and Tom answer questions received via Twitter, Facebook and Email. Erin discussed the differences between the PMO and MACD. The ChartSchool article on the PMO will explain it in detail. Tom showed how he "drills down" to find which industry groups are hot and how to find the corresponding stocks within those groups. Check out the final 10 minutes of the show to learn more.

It's a Wrap! Tom will be watching what treasury yields do and how that will effect the market as it already struggles to breakout. Erin said that Dollar, Gold and Bonds are at "decision points" for a breakout or a failed test of resistance. She's looking to see if any "decisions" are made by the close today.

Looking Forward:

Tune in on Monday at 12:00p - 1:30p EST on 8/28 for Monday Set-Ups. Tom and Erin will discuss which charts look hot or not for the upcoming week.

The regular segments, Ten in Ten to One and Mailbag are also on tap for Monday, where we look at your recent questions and symbol requests.

Don't miss it!!