Welcome to the recap of Friday's MarketWatchers LIVE show, your antidote for the CNBC/FBN lunchtime talking heads. Listen and watch a show devoted to technical analysis of the stock market with live market updates and symbols that are hot. Remember! You can now watch the latest episode under the "Webinars" tab!

Welcome to the recap of Friday's MarketWatchers LIVE show, your antidote for the CNBC/FBN lunchtime talking heads. Listen and watch a show devoted to technical analysis of the stock market with live market updates and symbols that are hot. Remember! You can now watch the latest episode under the "Webinars" tab!

Information abounds in our Monday/Wednesday/Friday 12:00p - 1:30p shows, but the MWL Blog will give you a quick recap. Be sure and check out the MarketWatchers LIVE ChartList for many of today's charts.

Your comments, questions and suggestions are welcome. Our Twitter handle is @MktWatchersLIVE and/or #mktwatchers, email is marketwatchers@stockcharts.com and our Facebook page is up and running so "like" it at MarketWatchers LIVE. Don't forget to sign up for notifications at the end of this blog entry by filling in your email address.

What Happened Today?

Talking Technically: On Friday Tom and Erin focus on interesting earnings news, economic news, etc. In economic news, jobs report was a miss on estimates, PMI Manufacturing Index also came in below expectations, and at a final 96.8 for August, consumer sentiment fell back sharply vs the month's preliminary reading of 97.6. For more information on the latest economic reports, you can click here. Tom and Erin use the Bloomberg website calendar. Tom looked at how this seems to be effecting the market...which is not much. As of publishing, the SPX was only 2 points away from logging a new all-time high.

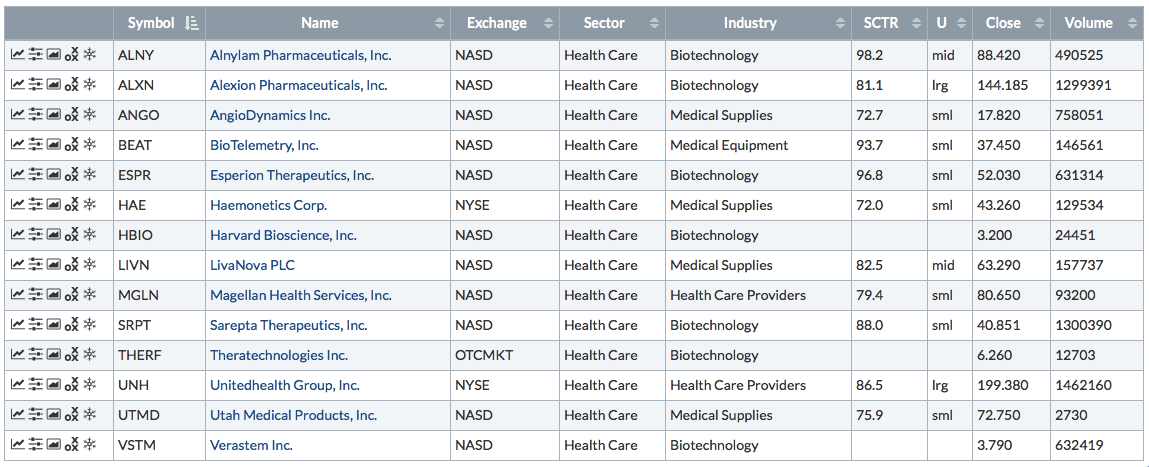

Industry Groups - Highlight on Health Sector: Tom did a quick review of some of the industry groups he's stalking and what he sees as the weak v. the strong. He believes the $DJUSCT (Telecom Equipment), $DJUSWC (Mobile Telecom), $DJUAP (Auto Parts) look like they were turning positive going into September. Health Care sector (XLV) is looking healthy (no pun intended). Erin performed one of her PMO scans to that sector in particular and came up with 14 stocks of interest. Here is the listing:

Earnings Spotlight with John Hopkins of EarningsBeats.com: John focused in on Scientific Games Corp (SGMS). Stock was up sharply earlier in the session and still up over 1.5% as it tries to break out of consolidation mode. A close above $36.20 would be bullish. Another stock on his watch list is NVIDIA (NVDA) - Stock is up another 1% today as it got to within 60 cents of their price target of $172.50. If you are long the stock you might want to raise your stop to help insure profits in case of a pullback.

Ten in Ten Before One: In this regular segment, Tom reviews ten charts in ten minutes with Erin's comments and comments from the Twitter "peanut gallery" peppered in there. Send in your symbol requests via Twitter (@mktwatcherslive) before the show and we'll try and add them. Symbols reviewed today: GIS, GE, NORW, JD, EMIF, FCG, WBC, COH, SAH and TRTN. You'll find all of the charts in the MarketWatchers LIVE ChartList, located at the top of the MarketWatchers blog homepage.

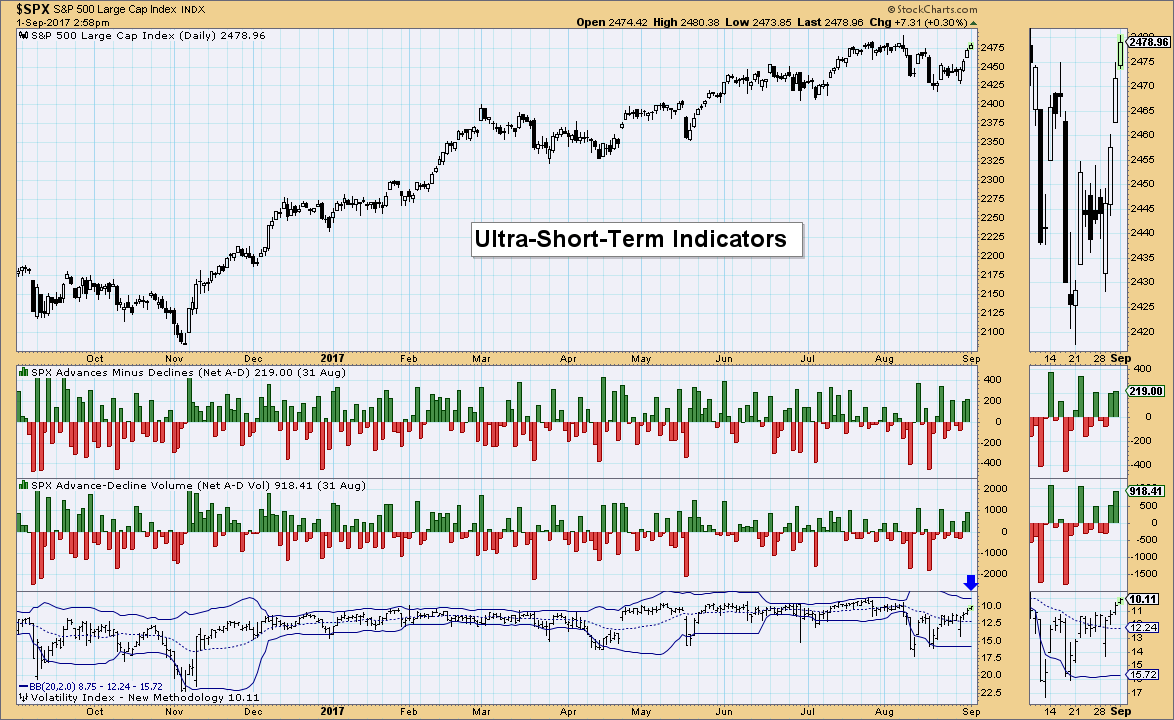

Sentiment Update: Sentiment charts were quite interesting today. So interesting, that Erin will be covering it in detail in this weekend's ChartWatcher's article that will be released on Saturday afternoon. In general, she noted that sentiment for the Put/Call ratios, American Association of Individual Investors (AAII) and National Association of Active Investment Managers (NAAIM) are showing a bearish bias. Remember, sentiment is contrarian so she sees this as an indication that intermediate term is bullish. However, a look at the VIX below and we see that sentiment is beginning to become overbought on an inverse scale. There were also spikes in breadth to the upside..also contrarian. This suggests a downside week ahead.

Mailbag Segment: Each show Erin and Tom answer questions received via Twitter, Facebook and Email. Tom discussed momentum trading definition and MACD divergences. Erin showed how to create an inverted scale for indicators and price windows (click on the chart above and scroll down to the indicator settings to see how to add "symbol,inverted". Erin and Tom also discussed some of their favorite books on technical analysis in the The StockCharts Store with any book by John Murphy topping both of their lists. Don't forget as a member of StockCharts.com you have access to John Murphy's Market Message where you can get "in the moment" analysis from this tech titan!

It's a Wrap! Be sure to take the weekly sentiment poll on Twitter. We want to know if you think the market will close higher or lower next week! Erin believes it will be lower based on her ultra-short-term indicators. Tom is waiting to see if the SPX will close above 2481 today in which case he would be bullish and vice versa.

Looking Forward:

With the upcoming market holiday on Monday, our next show will be on Wednesday at 12:00p - 1:30p EST on 9/5. Tom and Erin will discuss which charts look hot or not, talk about the latest news and have another "Agree or Disagree" segment and online poll.

The regular segments, Ten in Ten to One and Mailbag are also on tap for Wednesday, where we look at your recent questions and symbol requests.

Don't miss it!!