Welcome to the recap of Friday's MarketWatchers LIVE show, your antidote for the CNBC/FBN lunchtime talking heads. Listen and watch a show devoted to technical analysis of the stock market with live market updates and symbols that are hot. Remember! You can now watch the latest episode under the "Webinars" tab!

Welcome to the recap of Friday's MarketWatchers LIVE show, your antidote for the CNBC/FBN lunchtime talking heads. Listen and watch a show devoted to technical analysis of the stock market with live market updates and symbols that are hot. Remember! You can now watch the latest episode under the "Webinars" tab!

Information abounds in our Monday/Wednesday/Friday 12:00p - 1:30p shows, but the MWL Blog will give you a quick recap. Be sure and check out the MarketWatchers LIVE ChartList for many of today's charts.

Your comments, questions and suggestions are welcome. Our Twitter handle is @MktWatchersLIVE and/or #mktwatchers, email is marketwatchers@stockcharts.com and our Facebook page is up and running so "like" it at MarketWatchers LIVE. Don't forget to sign up for notifications at the end of this blog entry by filling in your email address.

What Happened Today?

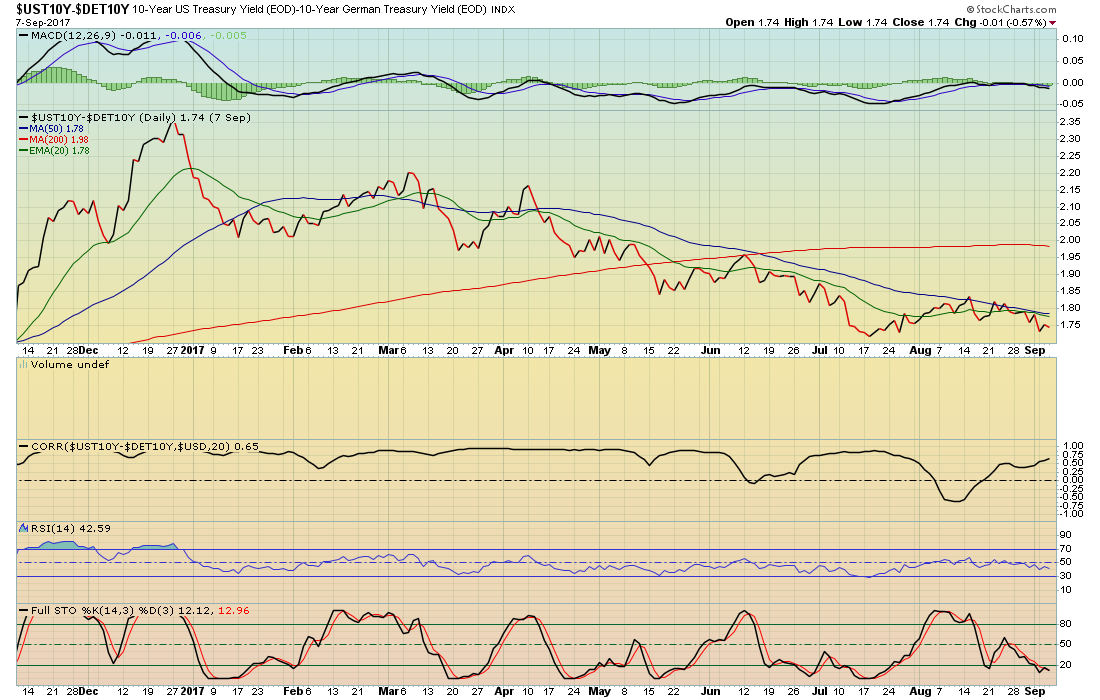

Talking Technically: On Friday Tom and Erin focus on interesting earnings news, upgrades/downgrades, etc. Tom looked at $TNX, 10-year Treasury Yield and noted that it is hitting a 2017 low. This means money is beginning to rotate into bonds and the Financial sector is beginning to breakdown. Tom talked about subtracting the 10-year treasury of Germany from the US Yield and then did a correlation with the US Dollar. He noted that the correlation stays near 1, so when we see the difference in the US and German yields decline, the Dollar is likely to decline as well.

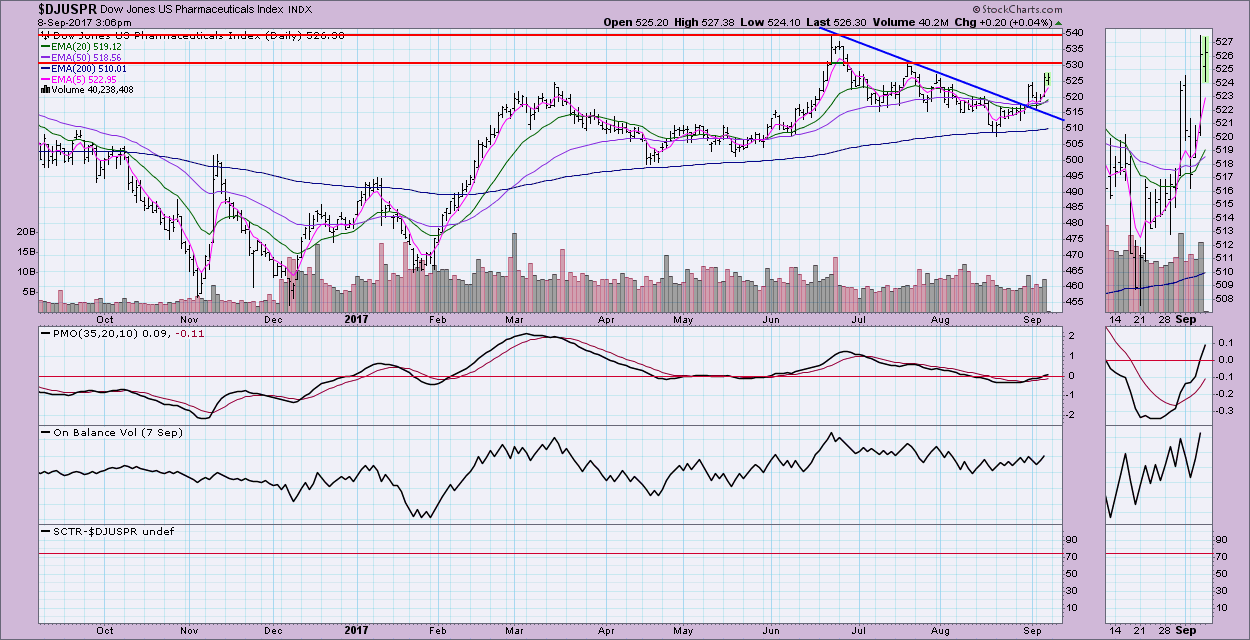

Healthcare Sector Drill Down: Tom and Erin reviewed the Health Care sector and industry groups with a few interesting stocks within the groups. Specifically, Erin annotated the $DJUSPR (Pharma Industry Group) and noted the nice breakout. To find stocks within a sector/industry, simply go to your member homepage, select "Sector Summary" from the Control Center tile on the left. Click on the sector you're interested in, and the Industry Groups come up. Click on an Industry Group and the individual stocks will be listed.

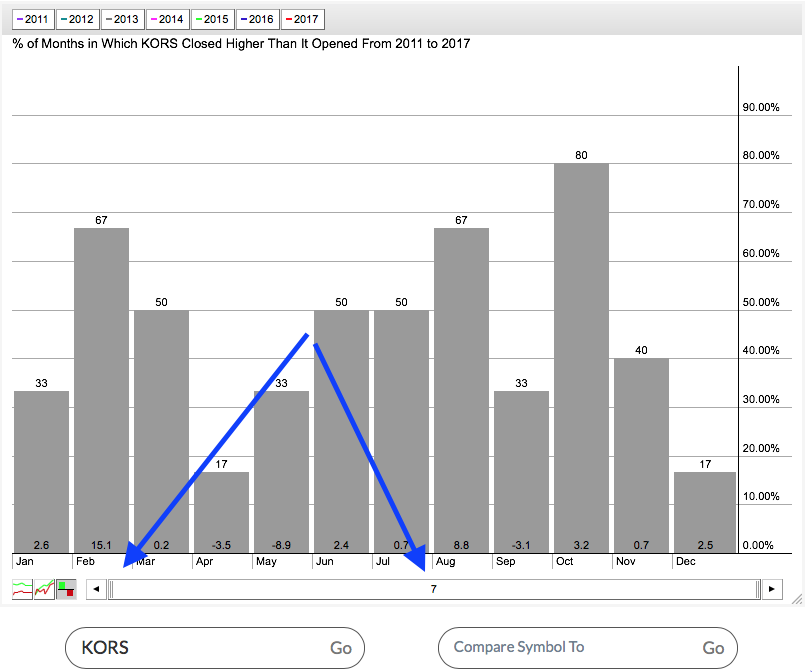

Earnings Spotlight - John Hopkins of EarningsBeats.com: Today's earnings spotlight and Chart of the Week for EarningsBeats.com was Michael Kors (KORS).

Tom and John discussed the SPY, the VIX and then finished with some interesting stocks to watch/consider. The first was Scientific Games (SGMS) which reported strong earnings, but since has consolidated nicely along the 20-MA.

Ten in Ten Before One: In this regular segment, Tom reviews ten charts in ten minutes with Erin's comments and comments from the Twitter "peanut gallery" peppered in there. Send in your symbol requests via Twitter (@mktwatcherslive) before the show and we'll try and add them. Symbols reviewed today: KTOS, KEM, LB, DIV.TO, $DJUSCA, BDX, MSTR, LOCO, SHOP, and HBM. You'll find all of the charts in the MarketWatchers LIVE ChartList by the end of the day, located at the top of the MarketWatchers blog homepage.

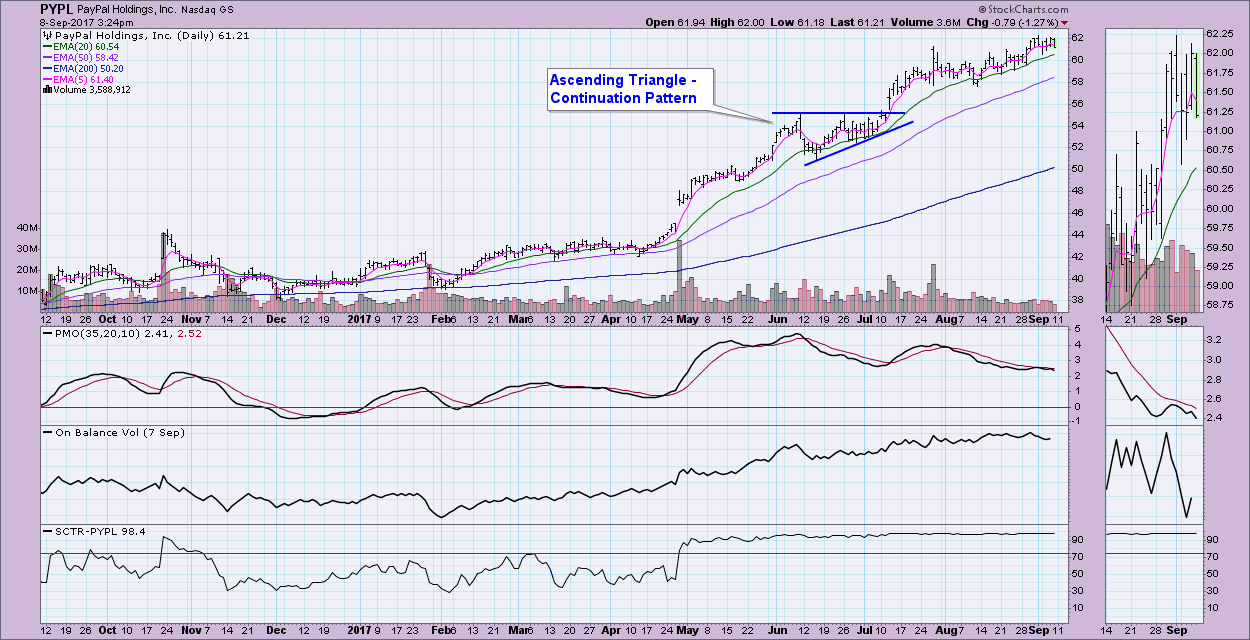

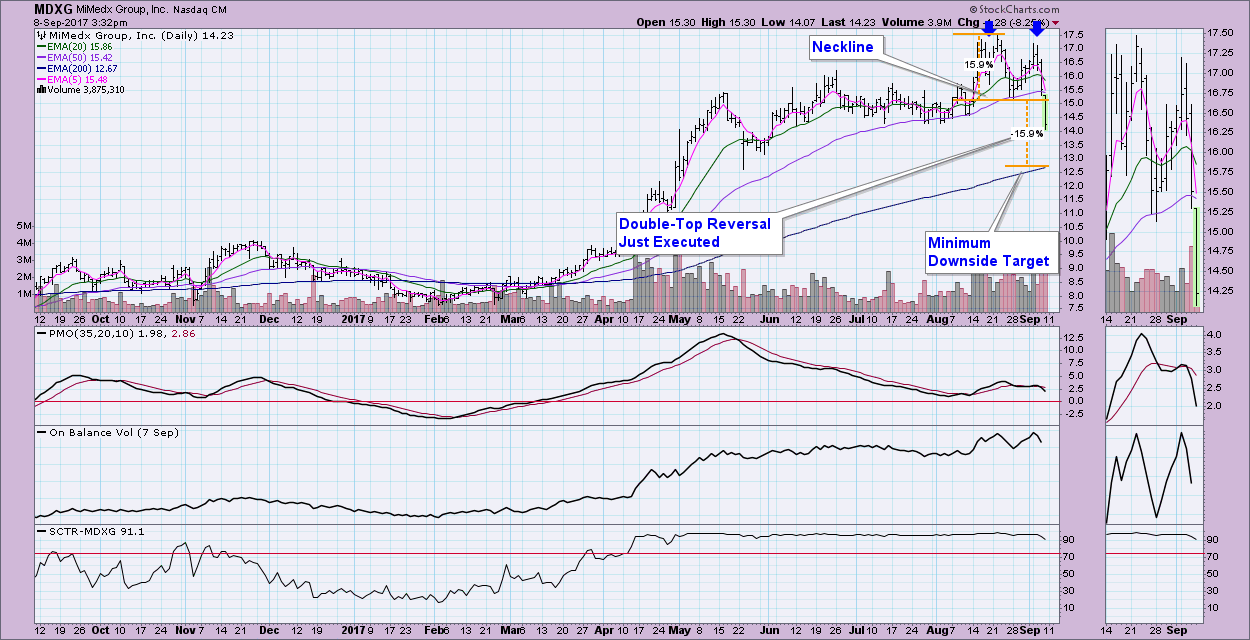

Chart Pattern Identification and Targets: Erin is often asked about how to identify chart patterns and more importantly how to calculate targets. Taking some of the symbols that didn't get picked for the Ten in Ten to One, she showed us how to identify various patterns and calculate their targets. For the detailed discussion go to the 1:15 mark on the show's replay. Also for an in-depth look at chart patterns, be sure to review the Chart School article here. Additionally, Erin recommended Thomas Bulkowski's book, Visual Guide to Chart Patterns found in the StockCharts Store. Here are a few examples:

Mailbag Segment: Each show Erin and Tom answer questions received via Twitter, Facebook and Email. Tom discussed how he uses the seasonality tool. He typed in "KORS" in the "Create a Chart" search box, but selected "seasonality" in the dropdown menu. He warned that if you have a stock like KORS with only 7 years of seasonality data, the integrity of the tool is weaker. StockCharts.com allows up to 20 years of back data, but on newer issues like KORS, the data isn't there. So be careful!

It's a Wrap! In closing Erin discussed the upcoming Twitter viewer sentiment poll to see if viewers feel the market will finish higher or lower next week. This week, Tom and Erin are in agreement. Both believe the market will finish lower next week. What do you think? Our viewer poll will be open on Twitter until showtime on Monday at noon EST.

Looking Forward:

Tune in on Monday at 12:00p - 1:30p EST on 9/11 for Monday Set-Ups. Tom and Erin will discuss which charts look hot or not for the upcoming week.

The regular segments, Ten in Ten to One and Mailbag are also on tap for Monday, where we look at your recent questions and symbol requests.

Don't miss it!!