Welcome to the recap of Monday's MarketWatchers LIVE show, your antidote for the CNBC/FBN lunchtime talking heads. Listen and watch a show devoted to technical analysis of the stock market with live market updates and symbols that are hot. Watch the latest episode here!

Welcome to the recap of Monday's MarketWatchers LIVE show, your antidote for the CNBC/FBN lunchtime talking heads. Listen and watch a show devoted to technical analysis of the stock market with live market updates and symbols that are hot. Watch the latest episode here!

Information abounds in our Monday/Wednesday/Friday 12:00p - 1:30p shows, but the MWL Blog will give you a quick recap. Be sure and check out the MarketWatchers LIVE ChartList for many of today's charts.

Your comments, questions and suggestions are welcome. Our Twitter handle is @MktWatchersLIVE and/or #mktwatchers, email is marketwatchers@stockcharts.com and our Facebook page is up and running so "like" it at MarketWatchers LIVE. Don't forget to sign up for notifications at the end of this blog entry by filling in your email address.

ANOUNCEMENTS:

** Wednesday (11/1) - Professor Bruce Fraser on Wyckoff Method **

** Friday (11/3) - Reversing Candle Workshop **

What Happened Today?

Monday Set-Ups:

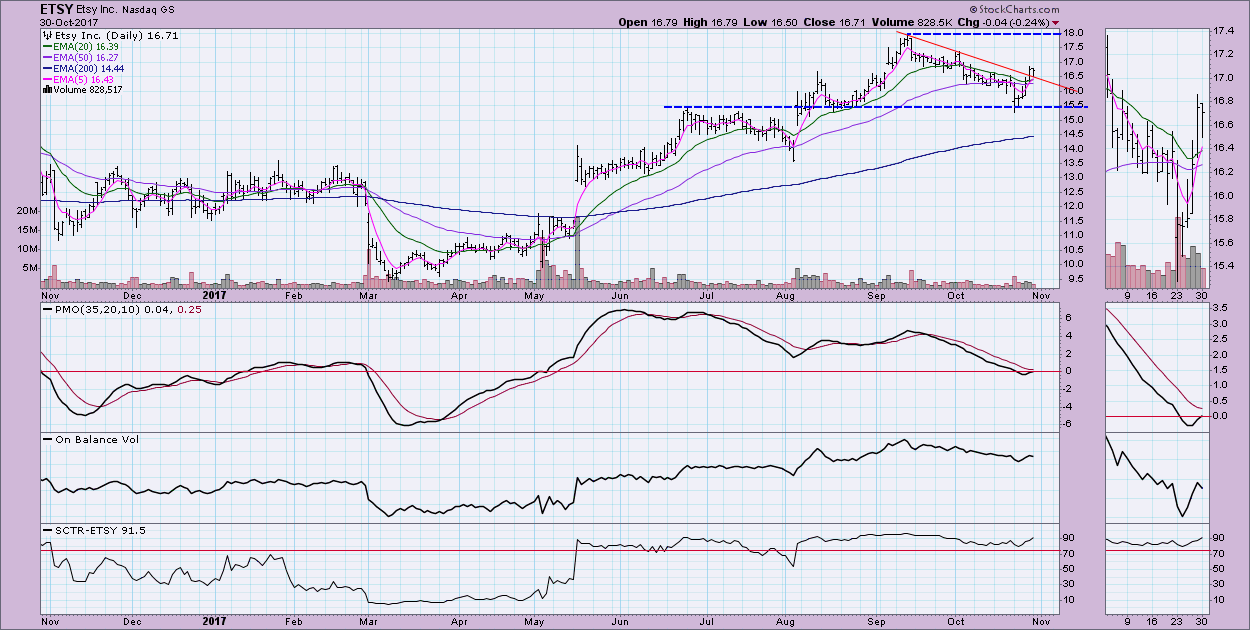

Every Monday, Tom and Erin look at which charts are shaping up as "ones to watch" for the week, but to start, they reviewed last week's Monday Set-Ups "picks", Aetna (AET) for Erin was the big winner up over 13%; but Tom had a great pick in EXTR which was up over 5%. Today's Set-Ups: For Erin, she is choosing ETSY at $16.58 and For Tom, he picked JD at $37.12.

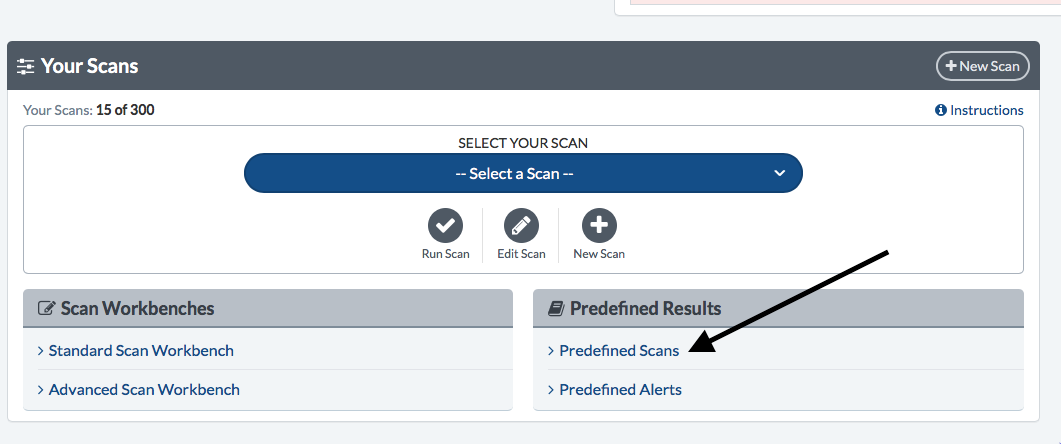

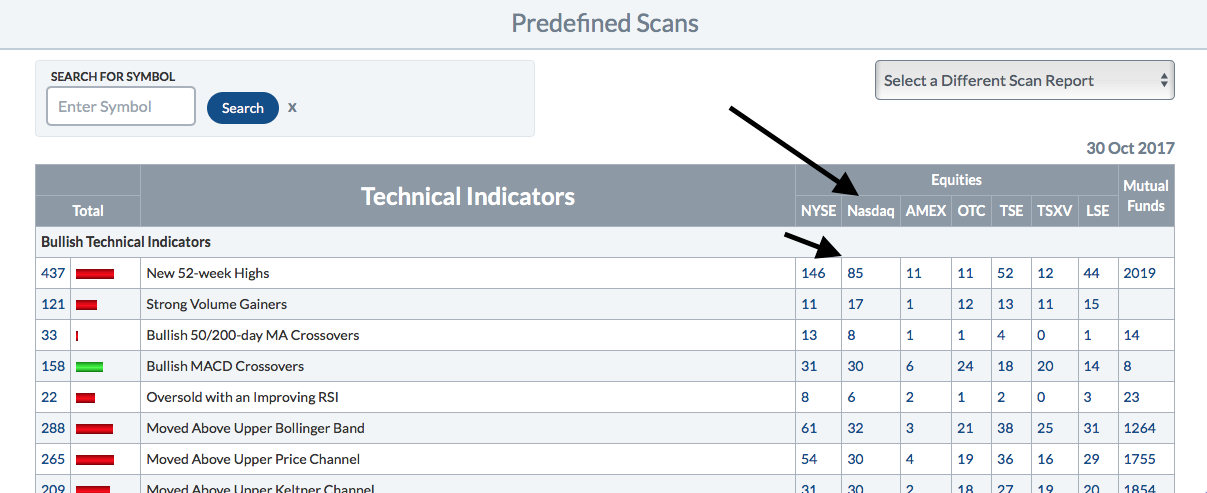

Chart Breakouts: Tom demonstrated how you can find chart breakouts by using the pre-defined scan for New 52-week Highs. Click on "Pre-defined Scans" from Scan Center on your member dashboard.

You can easily select whichever group within you'd like to look at:

In particular, Erin looked at the large-cap giants: AAPL, INTC, NVDA, AMZN, CY and FSLR. Tom looked at small-caps: SPCB, XNET and BUFF.

Ten in Ten Before One: In this regular segment, Tom reviews ten charts in ten minutes with Erin's comments and comments from the Twitter "peanut gallery" peppered in there. Send in your symbol requests via Twitter (@mktwatcherslive) before the show and we'll try and add them. Symbols reviewed today: WDC, FCX, CNQ, LN, XEL, ICHR, WEED.TO, CMCSA, TSCO and FCG. You'll find all of the charts in the MarketWatchers LIVE ChartList, located at the top of the MarketWatchers blog homepage.

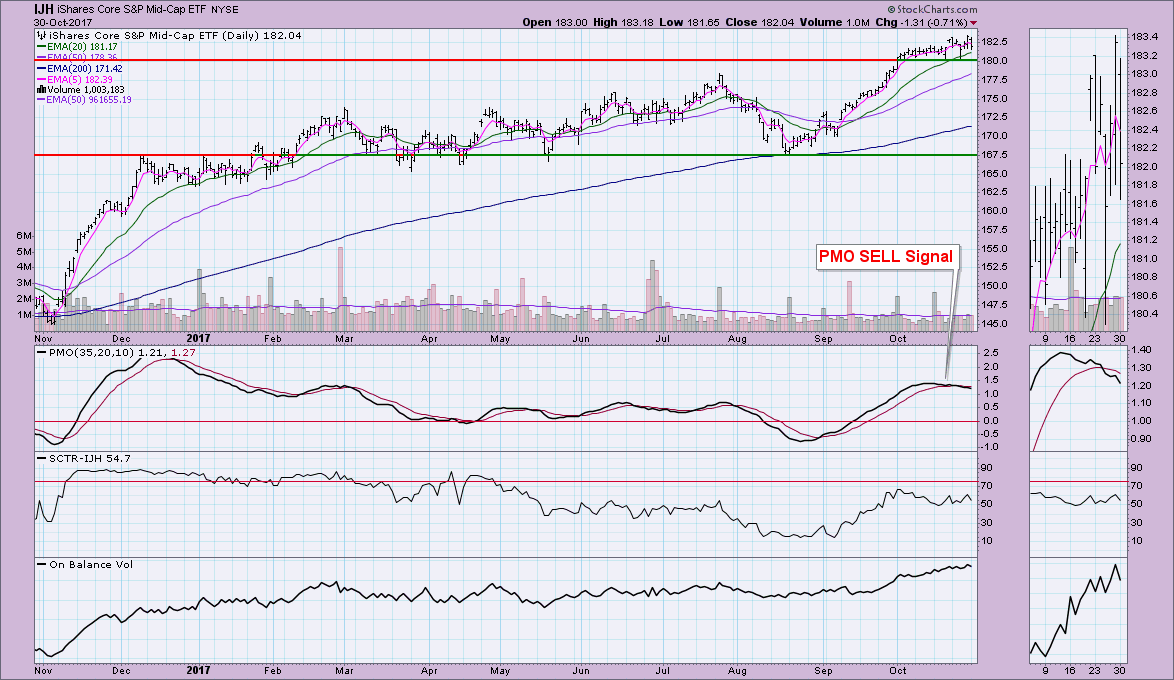

DecisionPoint Report: On Monday Erin analyzes DP indicators to give us a heads up on the market conditions as we start the week. She also reviewed the "big four": Dollar, Oil, Gold & Bonds. Today Erin took a closer look at IJH (S&P 400 ETF) and IJR (S&P 600 ETF). IJH is holding support at $180. The PMO is on a SELL and in decline, but we need to see some consolidation.

IJR looks a bit more choppy, but it is still holding support at $74. The PMO is accelerating downward, but if it can hold support AND unwind the PMO, that would be an excellent base for price to rally off again.

Erin reviewed the major DecisionPoint indicators, but she recommends reading Carl's DecisionPoint Weekly Wrap from last Friday in the DecisionPoint blog. He also reviewed weekly charts.

A quick tally of Erin's position on the "Big Four": Dollar - bullish, Gold - bearish, Oil - bullish and Bonds - neutral to bearish.

Looking Forward:

Tune in on Wednesday at 12:00p - 1:30p EST on 11/1. Professor Bruce Fraser from Golden Gate University will be on the program to talk about Wyckoff Method trading. Don't miss it!