Advisers are just as bad at predicting the prices of gold and bonds as they are at forecasting equities, if not worse. • Whenever financial gurus are especially confident in their guesses about the market, the assets tend to move in exactly the opposite way. You may not be able to time the market using this information, but at least you can avoid wasting money on predictions.

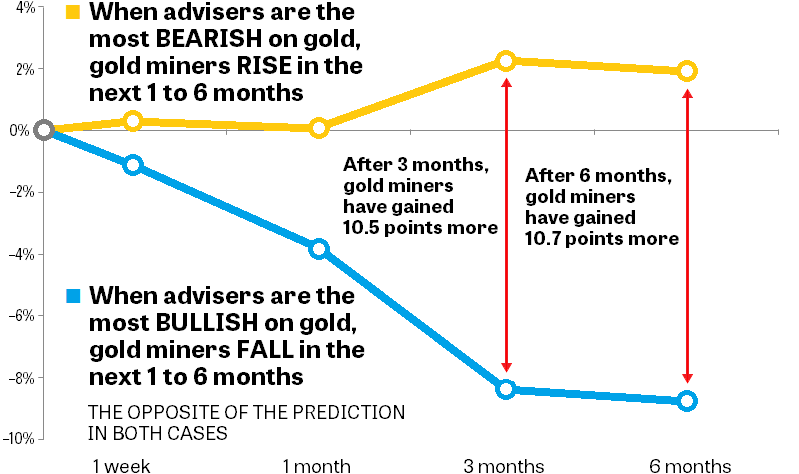

Figure 1. When advisers are most bearish on gold, the prices of gold-mining stocks tend to go up, not down — and vice versa.

• Parts 1, 2, and 3 of this column appeared on Dec. 18, 20, and 25, 2018.

Financial advisers and newsletter editors who sell predictions on the direction of the market may be wrong about indices like the Dow and the Russell 2000, as we’ve seen. But surely these professionals can get the direction right on assets that have a low correlation to stocks, such as gold and bonds, right? Dead wrong!

Figure 1 shows what happens when the advisers who are tracked by the Hulbert Sentiment Indices are the most confident in their bearish predictions for gold. Three months and six months later, on the average, there’s a rise in the stock prices of major gold-mining companies (represented by the gold miners’ exchange-traded fund GDX).

Hulbert explains that advisers are a better contrary indicator of gold-mining firms than they are of the shiny substance itself. Miners are highly sensitive to changes in the price of gold. After all, if gold drops below the cost of production, a mining company may become insolvent. By the same token, an increase in the world price of gold can send miners’ shares soaring, since mining companies may be leveraged (i.e., operating on borrowed money).

An even worse track record can be seen when advisers are the most bullish about gold. Miners of the precious metal actually drop more than 8% over the next 6 months, on average.

Gold-mining stocks do 10.7 percentage points better during the six months after advisers are the most bearish than they do when the gurus are the most bullish. Contrary indicators, indeed!

Predicting bond prices should be the easiest of all

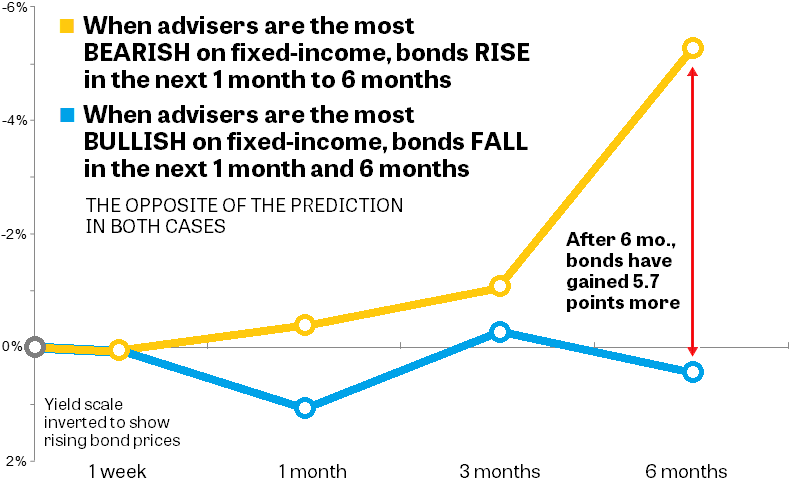

Figure 2. When interest rates fall, bond prices rise. But gurus can’t seem to use that fact to make bonds go up when feeling the most confident they’re going down.

Well, OK — it may be tricky to predict the prices of stocks and gold. But certainly advisers wouldn’t guess wrong about bonds! After all, everyone knows that when interest rates go down, bond prices go up. (The same is true in reverse: rising interest rates hurt bond prices.)

Sorry, but the predictions in the fixed-income world of bonds are no better than in equities or gold.

Figure 2 shows that bond prices (represented by 10-year Treasurys) rise about 5.7 percentage points more in the six months after gurus have been the most bearish, compared with when the predictions are the most bullish.

The above graphs are based on Hulbert’s presentation at the American Association of Individual Investors (AAII) National Conference in October 2018. I’ve simply added headlines and markers to his slides to make them as self-explanatory as possible. (I’ve also inverted the scale of the fixed-income graph to show bond prices rising as yields decline.)

To be clear, subscribing to the Hulbert Sentiment Indices and using them to time the market would be challenging for even expert quantitative analysts. It’s true that the 10% of the weeks when advisers are the most bearish — and the 10% when they are the most bullish — result in assets going exactly the opposite way. But what about the other 80% of the weeks? The periods when gurus do not have a consensus about market action are not as predictably contrary.

I find that Hulbert’s conclusions — that professional sentiment is actually a series of contrary indicators — strongly support the new field of behavioral science. When we’re presented with financial data, we often zig when we should zag. We buy what feels good, and we avoid what feels scary — even when we would have bigger gains if we did precisely the opposite.

For most individual investors — especially 401(k) account owners, the vast majority of whom can only buy from a menu of funds, not stocks or bonds — a diversified portfolio, changed no more than once a month, is the best path to long-term gains. (See my summary.)

You can save a lot of money by avoiding predictions — and you can invest that money to compound over the years in your favor.

With great knowledge comes great responsibility.

—Brian Livingston

Send story ideas to MaxGaines “at” BrianLivingston.com