Top Advisors Corner February 29, 2016 at 09:41 AM

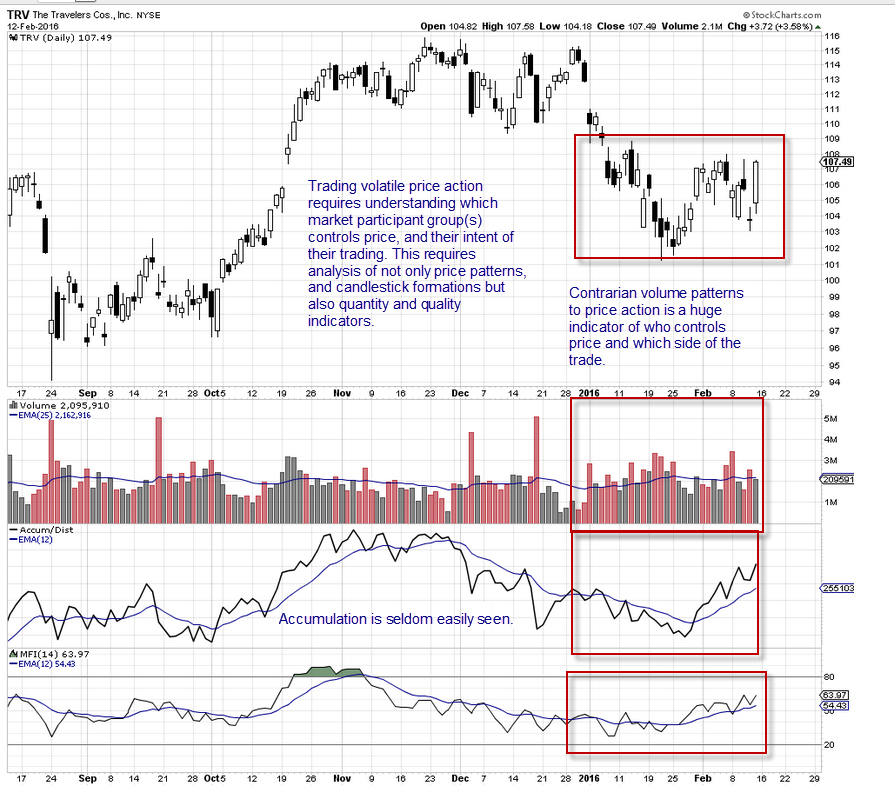

Recognizing and Understanding Price and Volume Patterns Swing Trading is a versatile style of trading that can be used by both Day Traders and Momentum Swing Traders... Read More

Top Advisors Corner February 24, 2016 at 09:00 AM

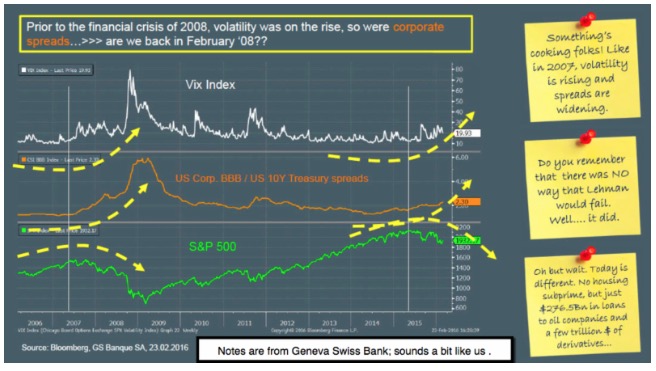

Stocks historically correlated pretty well - as a 'leading indicator' for the US economy. That is considerably less the case 'now', because of direct or indirect interventions by the U.S. Fed, as well as impacts from foreign central banks... Read More

Top Advisors Corner February 24, 2016 at 08:30 AM

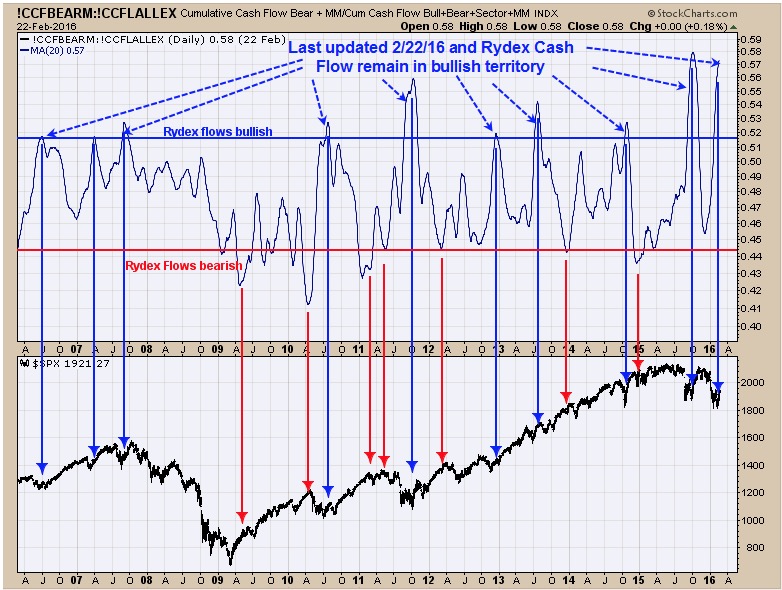

Monitoring purposes SPX: Long SPX on 2/19/16 at 1917.78. Monitoring purposes GOLD: Neutral Long Term Trend monitor purposes: Short SPX on 1/13/16 at 1890.28 Above is the Rydex bull and bearish cash flow... Read More

Top Advisors Corner February 19, 2016 at 11:45 PM

Profits During Volatile Market Conditions Volatility is a price action that often frustrates the Technical Trader. The markets appear “directionless,” “unpredictable,” or just plain confusing. Technical Traders often wonder whether they should be buying long or Selling Short... Read More

Top Advisors Corner February 19, 2016 at 10:00 AM

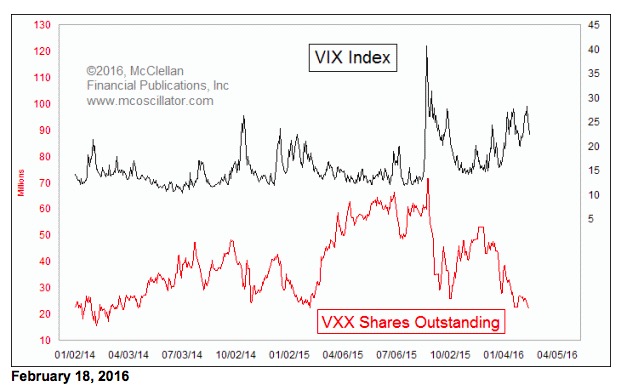

One of the more popular new market sentiment tools among technical analysts is to look at the changes in the number of shares outstanding in various ETFs and ETNs... Read More

Top Advisors Corner February 18, 2016 at 10:40 AM

Monitoring purposes SPX: covered SPX short on 2/11/16 at 1829.08, gain 1.31%; Short SPX on 2/8/16 at 1853.44. Monitoring purposes GOLD: Neutral Long Term Trend monitor purposes: Short SPX on 1/13/16 at 1890... Read More

Top Advisors Corner February 18, 2016 at 10:30 AM

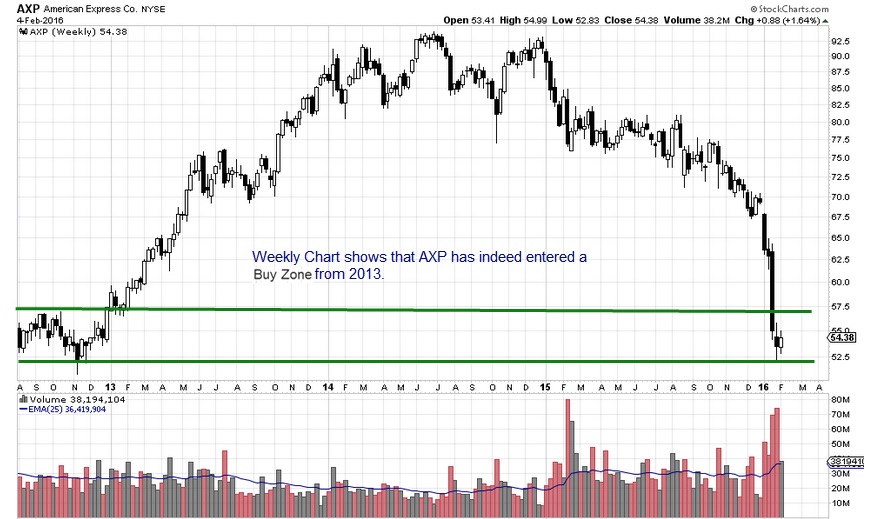

Throughout 2015 I felt the market was in a topping phase due to complacency along with massive, negative divergences on those key, monthly index charts. The market didn't fall much in 2015, but it refused to have sustainable upside action... Read More

Top Advisors Corner February 11, 2016 at 01:00 PM

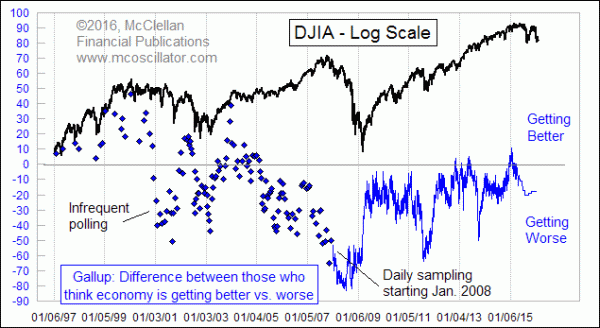

Americans are generally pessimistic about the economy. Perhaps that feature is our strength, and is what makes us work harder than the rest of the world to get ahead... Read More

Top Advisors Corner February 11, 2016 at 12:29 PM

The market is begging to move higher based on how far it has fallen in such a short period of time. Quite the intense move lower, but what makes it look so technically bullish short-term is the very powerful positive divergences that exist in many areas of the market... Read More

Top Advisors Corner February 10, 2016 at 03:00 PM

Monitoring purposes SPX: Short SPX on 2/8/16 at 1853.44. Monitoring purposes GOLD: Neutral Long Term Trend monitor purposes: Short SPX on 1/13/16 at 1890... Read More

Top Advisors Corner February 08, 2016 at 12:48 PM

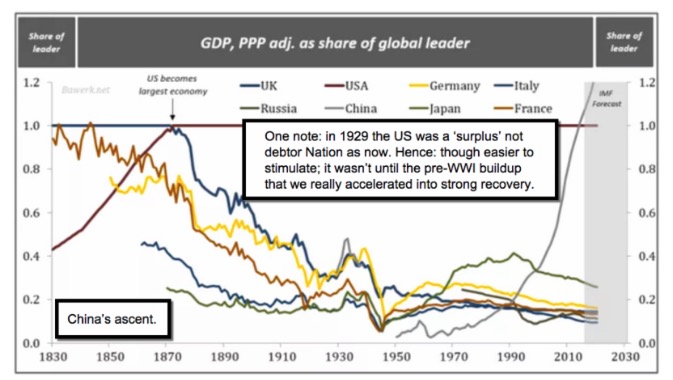

The perils of global monetarism - underlie our year-long bearishness related to 'distribution', which by the way occurred not only by insiders here, or money mangers in Europe; but we suspect 'sovereign' holders, responding defensively to the 'global competitive devaluation' race... Read More

Top Advisors Corner February 08, 2016 at 09:02 AM

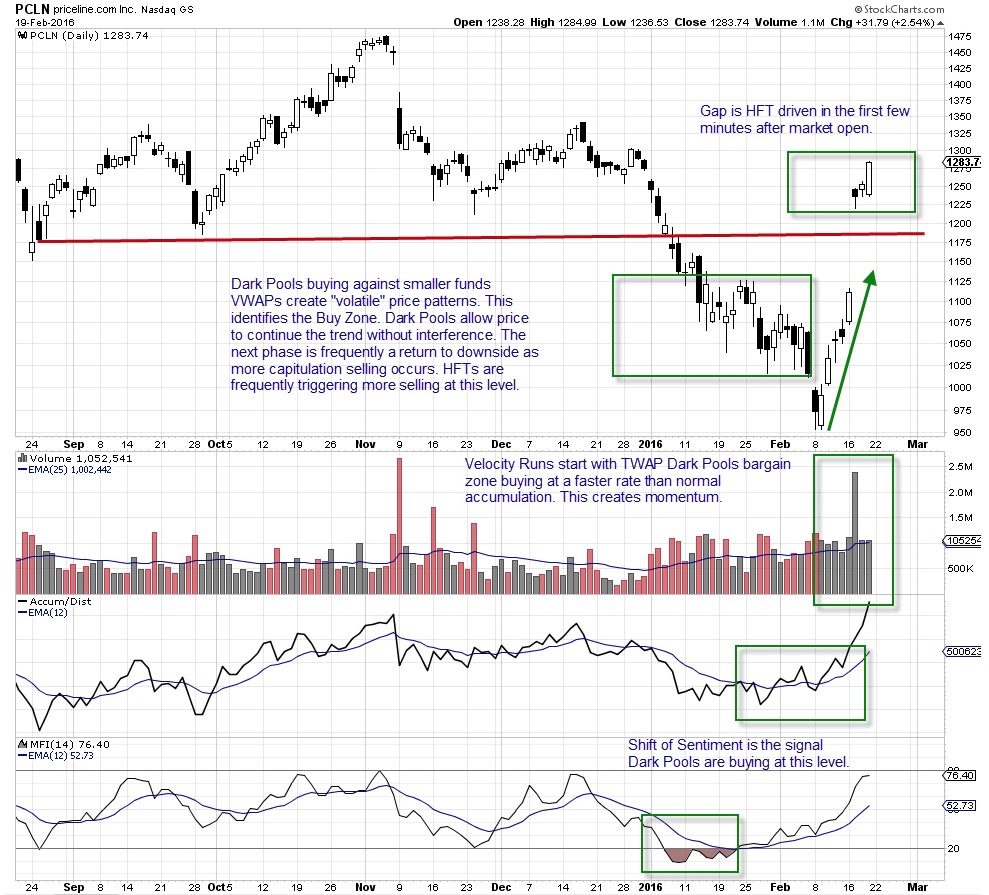

How to Identify Early “Shift of Sentiment™” Bottoms One question every Trader is asking right now is, “When will this Correction end?” A better question is, “How do I determine a particular stock will soon start a Bottom Formation?” Every Technical and Retail Trader knows that Bo... Read More

Top Advisors Corner February 05, 2016 at 01:27 PM

In spite of dollar strength, gold prices have rallied up from the low we saw back in mid-December. It took a while, but this rally has finally started to bring more interest from retail gold investors... Read More

Top Advisors Corner February 03, 2016 at 08:30 AM

Monitoring purposes SPX: Covered SPX 2/2/16 at 1903.03 gain of 1.92%; Short SPX 1/29/16 at 1940.24. Monitoring purposes GOLD: Neutral Long Term Trend monitor purposes: Short SPX on 1/13/16 at 1890... Read More

Top Advisors Corner February 01, 2016 at 10:39 AM

How to Determine when a Velocity Downtrend is Reversing Technical and Retail Traders need to be able to identify Reversal Patterns during a downtrend in order to avoid huge losses on selling short trades, and to be prepared and ready for early entry in the reversal of the trend... Read More