Top Advisors Corner August 31, 2016 at 09:41 AM

It’s been a tough month for discount retailers as many stocks in that group have been hit hard. After recently reporting earnings that didn’t support some of their stretched prices, we’ve seen drops of up to 20% in names such as Dollar General (DG) and 13% in Dollar Tree (DLTR)... Read More

Top Advisors Corner August 29, 2016 at 10:55 AM

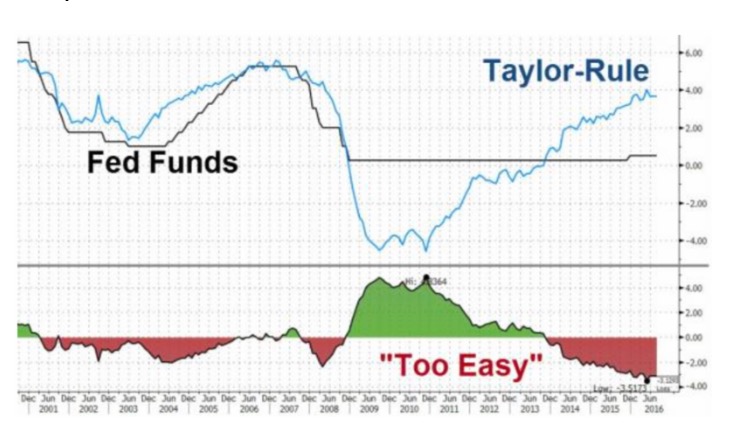

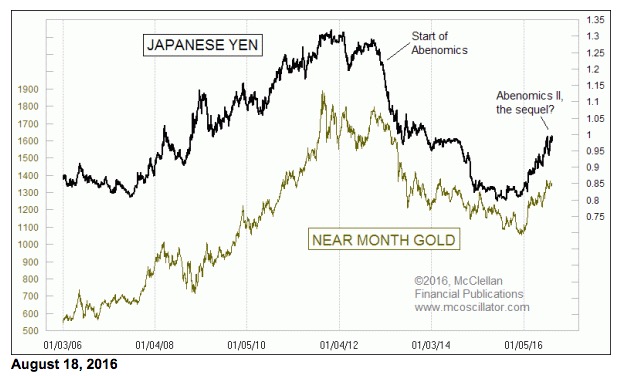

When the Fed has 'viable' strategies in-place - you don't need dozens of central bankers, an equivalent number of reporters, nor the backdrop of the Grand Tetons, to contemplate the 'fine-tuning' (which is what normal policies would allow; but not this), of monetary policy... Read More

Top Advisors Corner August 26, 2016 at 05:15 PM

When the Fed has 'viable' strategies in-place - you don't need dozens of central bankers, an equivalent number of reporters, nor the backdrop of the Grand Tetons, to contemplate the 'fine-tuning' (which is what normal policies would allow; but not this), of monetary policy... Read More

Top Advisors Corner August 26, 2016 at 10:21 AM

Among the hybrid technical indicators is the Accumulation/Distribution (A/D) line. It combines factors of volume with momentum, and price to reveal buying or selling pressure, often contradicting the immediate price trend or anticipating reversal... Read More

Top Advisors Corner August 25, 2016 at 10:20 AM

Observing a particular trend over a 6-week period often points to what might happen next, or what might not. A good case in point is the chart of Monsanto (MON). The two sessions of August 23 and 23 both opened above resistance of $107.50 but closed below... Read More

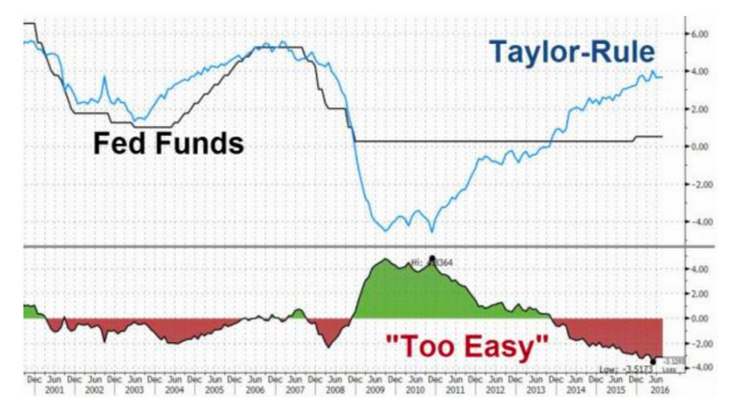

Top Advisors Corner August 25, 2016 at 10:08 AM

Housing related stocks are seeing an earlier than called for push to a higher high. But if lumber prices are right, there are lots more gains to come... Read More

Top Advisors Corner August 24, 2016 at 09:18 AM

The trigger line, or trend line, abbreviated as the “t-line” is a leading indicator that closely tracks price and anticipates short-term price movement and correction. It consists of an 8-day exponential moving average (8-EMA)... Read More

Top Advisors Corner August 23, 2016 at 11:00 AM

Tootsie Roll (TR) trading over the past year in a 10-point price increase. But it started out the 12 months range-bound between $29 and $32 per share. The dilemma for traders in this situation is determining when price will break out... Read More

Top Advisors Corner August 22, 2016 at 11:00 AM

Recent headlines about the Stock Market have been focused on the strength in Technology stocks which have led the Nasdaq to an 8-week period of positive returns. It’s been 6 years since that index has posted that many consecutive positive weeks... Read More

Top Advisors Corner August 22, 2016 at 10:30 AM

The use of two moving averages (MAs) provides useful confirming signals. However, they do not often serve as leading indicators. By definition, the MA is a reflection of price, thus is follows and only confirms what other signals reveal... Read More

Top Advisors Corner August 22, 2016 at 10:18 AM

Traders are on an unending quest for reliable, easily visible reversal signals. These do not always materialize. However, in one case, that of Netflix (NFLX), several island clusters provide exceptional reversal signaling. This is shown on the chart... Read More

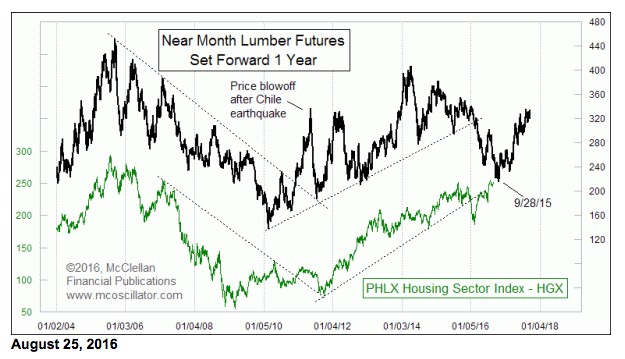

Top Advisors Corner August 18, 2016 at 12:28 PM

You might have to be a real inter-market analysis geek to know this, but for the past several years the fortunes of gold prices have been inexorably tied with those of the Japanese yen... Read More

Top Advisors Corner August 18, 2016 at 08:14 AM

Monitoring purposes SPX: Neutral Monitoring purposes GOLD: Sold GDX on 6/10/16 at 25.96 = gain 14.97%. Long GDX on 5/31/16 at 22.58. Long Term Trend monitor purposes: Short SPX on 1/13/16 at 1890.28 The bottom window is the 10 period average for the OEX put/call ratio... Read More

Top Advisors Corner August 18, 2016 at 08:03 AM

Traders who believe a stock’s price is likely to rise in the near future face a dilemma: Is a long call affordable enough so that the price move will be enough to produce a profit? One solution to this dilemma is the ratio calendar spread... Read More

Top Advisors Corner August 18, 2016 at 07:56 AM

Relative Strength Index is a momentum indicator measuring and simplifying price movement. It identifies when stock is overbought or oversold... Read More

Top Advisors Corner August 16, 2016 at 11:55 AM

Options traders like the ratio write. This is a strategy like the covered call, but when more calls are written than can be covered with stock. For example, if you own 300 shares of stock and you sell four calls, you have a 4:3 ratio write... Read More

Top Advisors Corner August 15, 2016 at 02:24 PM

Backfiring bearish bets - by rigidly negative money mangers (way different than a trader who uses a portion of assets in hit-and-run trading, realizing risks inherent in retaining broad short positions), are starting to become evident... Read More

Top Advisors Corner August 12, 2016 at 05:30 PM

After seven up weeks we see a candle printed on the Nasdaq this week that shows hesitation as we test a key pivot at the 2,031 year 2015 high Resistance area. I say normally because nothing about this market is normal any more... Read More

Top Advisors Corner August 12, 2016 at 05:30 PM

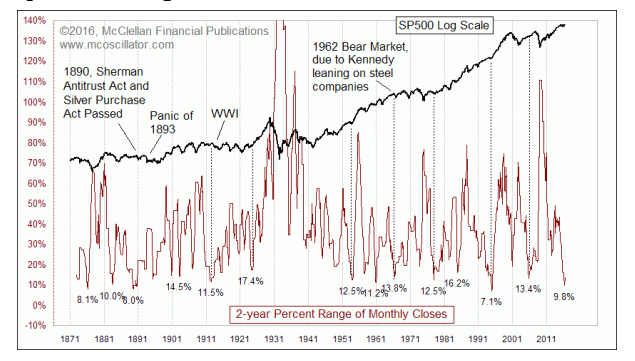

The history of the SP500 dates all the way back to 1871, thanks to the work of the Cowles Commission in the 1930s which reconstructed an index of stock prices back that far. That index eventually morphed into the SP500 we know today... Read More

Top Advisors Corner August 10, 2016 at 09:40 AM

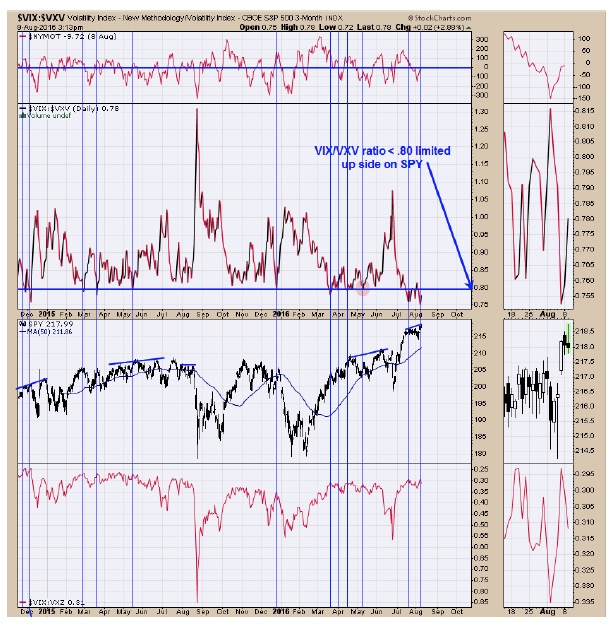

Monitoring purposes SPX: Neutral. Monitoring purposes GOLD: Sold GDX on 6/10/16 at 25.96 = gain 14.97%. Long GDX on 5/31/16 at 22.58. Long Term Trend monitor purposes: Short SPX on 1/13/16 at 1890.28 The chart above is the VIX/VXV ratio. When this ratio is ... Read More

Top Advisors Corner August 08, 2016 at 10:18 AM

In the very recent past we experienced a poor durable good report along with a poor Ism manufacturing report and weak GDP. This put a lot of doubt in todays jobs report and probably explains to some degree why the market was meandering the past few days... Read More

Top Advisors Corner August 04, 2016 at 08:30 PM

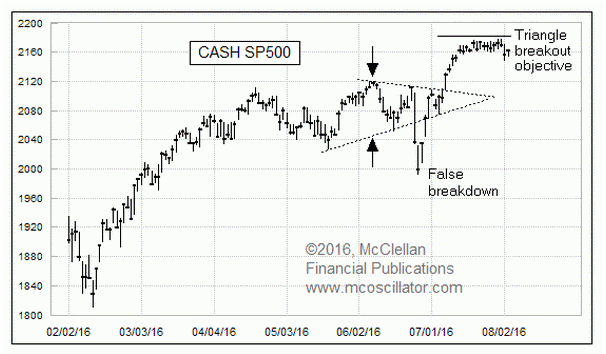

Finding a Triangle Hiding In The Chaos I rarely talk about price objectives, because I have found that there are only a few reliable tools for that, and they only appear infrequently... Read More

Top Advisors Corner August 01, 2016 at 11:03 AM

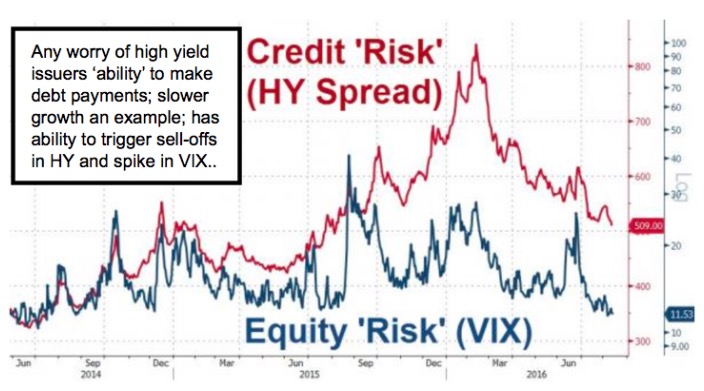

The only thing it seems that can hit this market hard to the down side in a sustainable fashion would be if the market smelled a rate hike cycle about to begin. Bad news on its own doesn't have any effect on how the market trades. The up trend remains in place... Read More