Top Advisors Corner July 28, 2017 at 10:15 AM

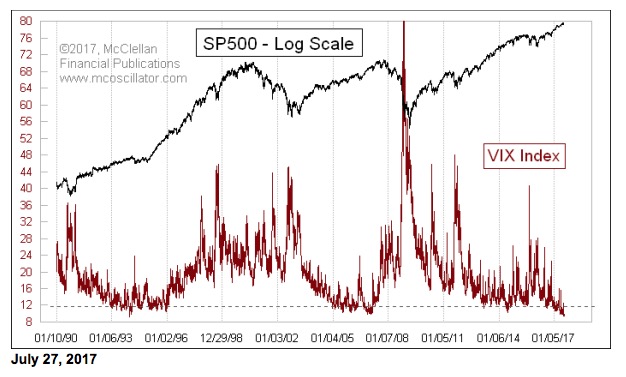

With the VIX Index down in the 9s, and with valuations at historic extremes, investors are wondering how long this all can last. The short answer is, MORE. The VIX Index made its all-time closing low of 9.31 back on Dec. 22, 1993... Read More

Top Advisors Corner July 26, 2017 at 01:00 PM

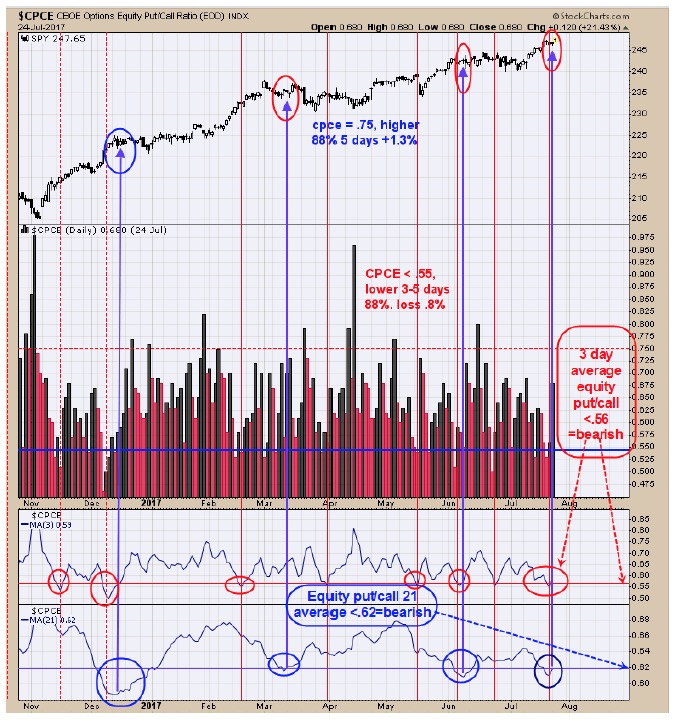

SPX Monitoring purposes; Covered short on 7/6 at 2409.75=gain 1.2%; Short SPX 6/26/17 at 2439.07. Monitoring purposes GOLD: Neutral Long Term Trend monitor purposes: Neutral... Read More

Top Advisors Corner July 21, 2017 at 06:00 PM

July 21, 2017 There is a 60-year cycle in bond yields which has existed since bonds first came about in the 1700s. It says that bond yields should have ideally bottomed in 2010, and by now we should be well into a 30-year rise in yields lasting until 2040... Read More

Top Advisors Corner July 20, 2017 at 04:00 AM

As of April 2017, twenty-six states and the District of Columbia currently have laws broadly legalizing marijuana in some form. Three other states will soon join them after recently passing measures permitting the use of medical marijuana... Read More

Top Advisors Corner July 18, 2017 at 12:23 PM

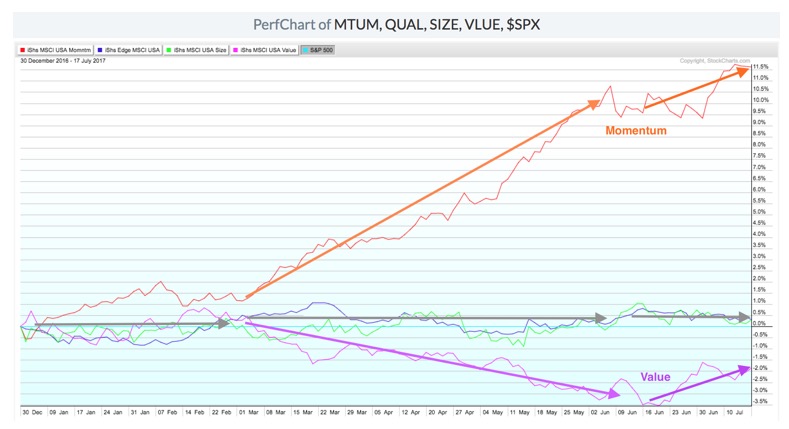

"The trend is evident to a man who has an open mind and reasonably clear sight." -Edwin Lefevre, in Reminiscences of a Stock Operator I have a series of ChartLists that I follow during the day as a way to get a sense of the overall market trend... Read More

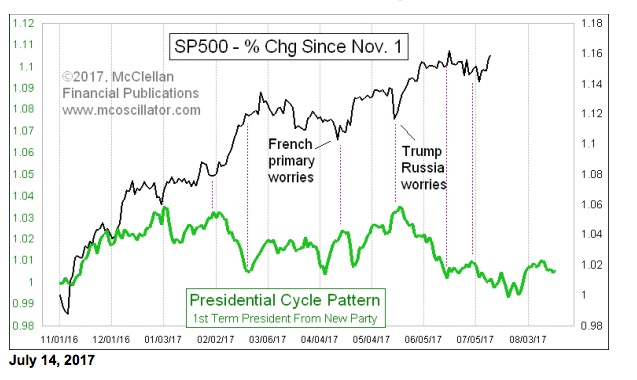

Top Advisors Corner July 14, 2017 at 10:30 AM

It is by now an overused phrase to say that we are in a different sort of presidency right now. And befitting that theme, we are seeing a really different sort of behavior of the market relative to the Presidential Cycle Pattern... Read More

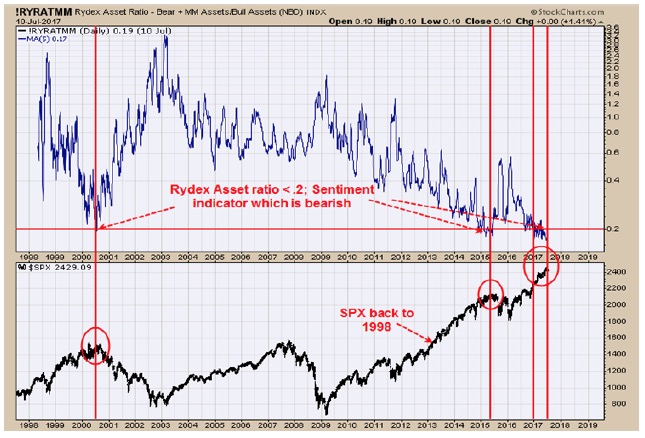

Top Advisors Corner July 12, 2017 at 11:05 AM

SPX Monitoring purposes; Covered short on 7/6 at 2409.75=gain 1.2%; Short SPX 6/26/17 at 2439.07. Monitoring purposes GOLD: Neutral Long Term Trend monitor purposes: Neutral... Read More

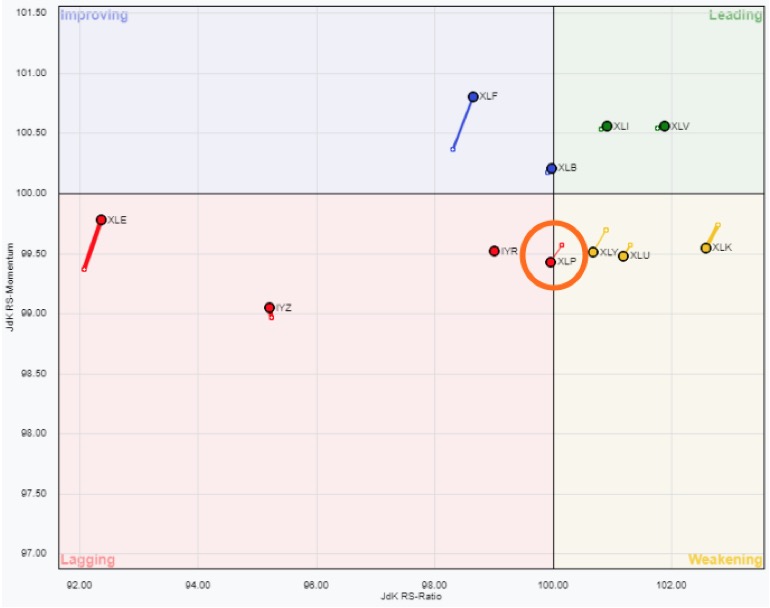

Top Advisors Corner July 11, 2017 at 01:40 PM

“When a stock doesn’t do what you expect it to do, sell it." -Justin Mamis I routinely track the Relative Rotation Graph for the broad S&P sectors to identify timely movements... Read More

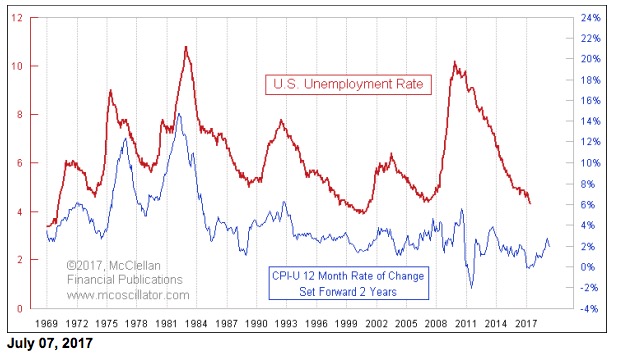

Top Advisors Corner July 07, 2017 at 08:42 AM

To paraphrase Wolfgang Pauli, the whole idea behind the Phillips Curve is “not even wrong”. A.W.H. Phillips studied the relationship between inflation and unemployment in the United Kingdom, and noticed that they were usually moving in opposite directions... Read More

Top Advisors Corner July 06, 2017 at 01:54 PM

Using Three Indicators With Three Different Chart “Time Periods” Will Guide Your Decisions. Semiconductor stocks rose 74% from June of last year to its recent peak in June with many individual stocks going even higher... Read More

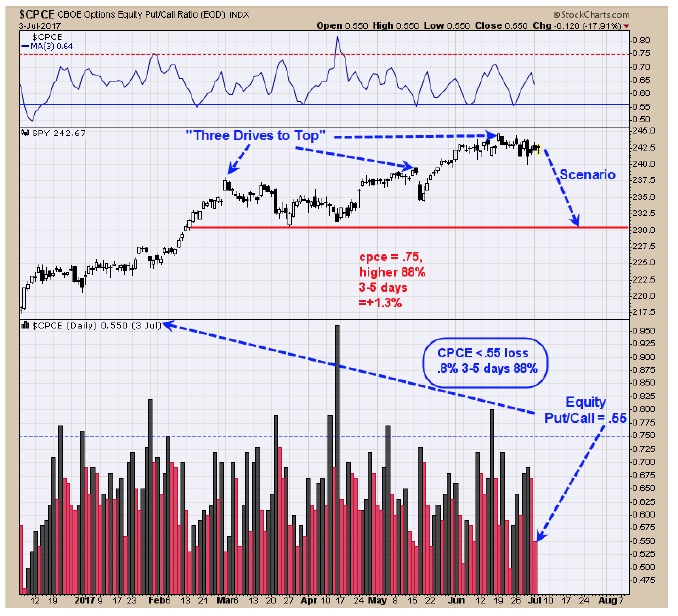

Top Advisors Corner July 06, 2017 at 10:31 AM

SPX Monitoring purposes; Short SPX 6/26/17 at 2439.07. Monitoring purposes GOLD: Long GDX on 6/22/17 at 22.36 Long Term Trend monitor purposes: Neutral. A possible “Three Drives to Top” that started back in March is still on the table... Read More