I have always been entertained when stocks find support and resistance at big round numbers. I’m not the only one to have noticed this phenomenon, as you can see from articles by stockcharts.com writers Arthur Hill and Greg Schnell.

Some have attributed this phenomenon to a behavioral bias called “round number bias” where people tend to gravitate to big round numbers such as 10, 100, and 1000 as anchors. In fact, academic research has even recognized price clustering around round numbers.

Why do big round numbers have such an influence on our thinking? One theory is that the addition of another digit (for example, going from 999 to 1,000) is way more significant than a move from 981 to 982. Even though it’s the same dollar move in price, the change in the first digit causes us to reflect on the true value of the asset.

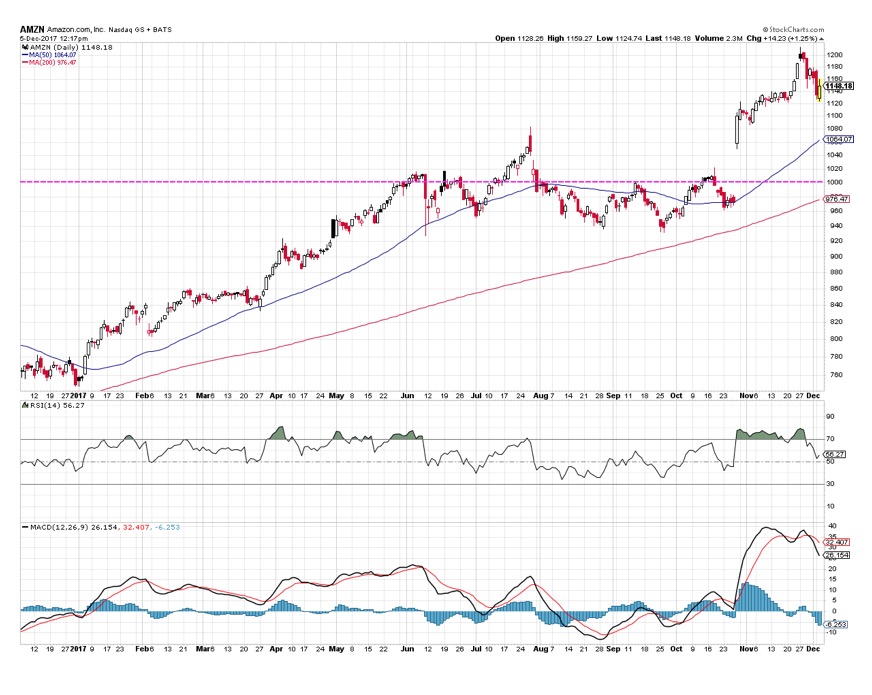

Regardless of the reason behind the phenomenon, you will indeed find it on many price charts across asset classes. Most recently, Amazon.com Inc (AMZN) found resistance around $1,000 a number of times from June to October before finally gapping up to new highs in October.

In a more recent example, Alphabet Inc. (GOOGL) also found resistance at $1,000 through the summer months before finally breaking higher in late October.

In a more recent example, Alphabet Inc. (GOOGL) also found resistance at $1,000 through the summer months before finally breaking higher in late October.

As the mega cap technology names have corrected recently, GOOGL has pulled back to the $1,000 level which also coincides with the 50-day moving average. If past patterns persist, this could serve as a meaningful support level going forward.

It is also worth noting that the RSI for GOOGL came right down to the 40 level, which often coincides with buyable points within larger uptrends.

Investing is all about getting inside the heads of other investors. By watching for stocks nearing big round number prices, you can anticipate where some investors will likely be taking action.

David Keller, CMT

President

Sierra Alpha Research LLC

David Keller, CMT is President of Sierra Alpha Research LLC, a boutique investment research firm focused on managing risk through market awareness. He is a Past President of the Market Technicians Association and currently serves as a Subject Matter Expert for Behavioral

Finance. David was formerly a Managing Director of Research at Fidelity Investments in Boston as well as a technical analysis specialist for Bloomberg in New York. You can follow his thinking at marketmisbehavior.com.

Disclaimer: This blog is for educational purposes only, and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.