SPX Monitoring purposes; Neutral

Monitoring purposes GOLD: Long GDX at 18.72 on 8/17/18

Long Term Trend SPX monitor purposes; Sold long term SPX 7/16/18 at 2798.43= gain 2.95%; Long 6/29/18 at 2718.37.

On Thursday and Friday of last week, the Volume on the SPY jumped over 30% from the previous day volume which implies short term exhaustion to the upside. Friday’s volume was higher than Thursday’s volume and most high volume highs are tested, suggesting that Friday’s price high will be tested again. The DIA was higher four days in a row going into last Friday, and the DIA closed higher at least once in the next five days 81% of the time. This condition suggests last Friday's high will be tested again with a probability of 81%. The McClellan Oscillator remains below “0” and a bearish sign. Tomorrow’s FOMC meeting announcement could produce the next setup.

On Thursday and Friday of last week, the Volume on the SPY jumped over 30% from the previous day volume which implies short term exhaustion to the upside. Friday’s volume was higher than Thursday’s volume and most high volume highs are tested, suggesting that Friday’s price high will be tested again. The DIA was higher four days in a row going into last Friday, and the DIA closed higher at least once in the next five days 81% of the time. This condition suggests last Friday's high will be tested again with a probability of 81%. The McClellan Oscillator remains below “0” and a bearish sign. Tomorrow’s FOMC meeting announcement could produce the next setup.

Above is the weekly VIX with its Bollinger band. The Weekly VIX Bollinger band is pinching suggests a large move for the SPY is not far off. The bottom window is the “Bollinger Band Width” which is at its lowest point since January. The January period produced the biggest decline for this year thus far. If the market does bounce and test Friday’s high, a sell setup could form. Also remember, “market has been down 6 days in a row going into September 7 and the market been lower 10 of 12 times (83%) on average of 3% over the next 30 days.” FOMC meeting is today and tomorrow and may have an effect on the market. Still neutral for now.

Above is the weekly VIX with its Bollinger band. The Weekly VIX Bollinger band is pinching suggests a large move for the SPY is not far off. The bottom window is the “Bollinger Band Width” which is at its lowest point since January. The January period produced the biggest decline for this year thus far. If the market does bounce and test Friday’s high, a sell setup could form. Also remember, “market has been down 6 days in a row going into September 7 and the market been lower 10 of 12 times (83%) on average of 3% over the next 30 days.” FOMC meeting is today and tomorrow and may have an effect on the market. Still neutral for now.

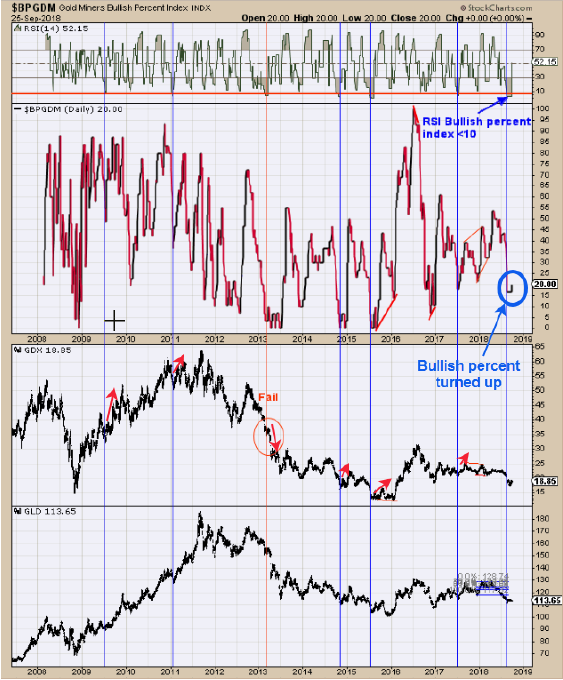

We posted this chart about a month ago. What it is is the RSI of the Bullish Percent Index. The Bullish Percent Index measures the percent of stocks in the Gold Miners Index that are on Point & Figure buy signals. Worthwhile lows have formed when the RSI of the Bullish Percent Index reaches below 10. This chart goes back to mid-2007 and shows the times when the RSI<10, which were seven times (not counting the current time) and six (87%) saw at least a short term low. The Gold commercials came in at +1615 last reported on Friday. The last time Gold Commercials were near these levels was back on November 2015, that last major low in gold. W. Long GDX at 18.72 on 8/17/18.

We posted this chart about a month ago. What it is is the RSI of the Bullish Percent Index. The Bullish Percent Index measures the percent of stocks in the Gold Miners Index that are on Point & Figure buy signals. Worthwhile lows have formed when the RSI of the Bullish Percent Index reaches below 10. This chart goes back to mid-2007 and shows the times when the RSI<10, which were seven times (not counting the current time) and six (87%) saw at least a short term low. The Gold commercials came in at +1615 last reported on Friday. The last time Gold Commercials were near these levels was back on November 2015, that last major low in gold. W. Long GDX at 18.72 on 8/17/18.

Tim Ord,

Editor

www.ord-oracle.com. New Book release "The Secret Science of Price and Volume" by Timothy Ord, buy at www.Amazon.com.