Trading Places with Tom Bowley November 30, 2017 at 09:01 AM

Market Recap for Wednesday, November 29, 2017 One quick glance at the S&P 500's meager 1 point loss on Wednesday and you might assume that Wall Street meandered through another one of its boring days... Read More

Trading Places with Tom Bowley November 29, 2017 at 09:01 AM

Market Recap for Tuesday, November 28, 2017 It was party day on Wall Street. The bullish environment accelerated into a much faster gear as all nine sectors advanced and the small cap Russell 2000 soared 23 points, or 1... Read More

Trading Places with Tom Bowley November 28, 2017 at 09:01 AM

Market Recap for Monday, November 27, 2017 We saw bifurcated action in the major indices on Monday as the Dow Jones tacked on another 23 points after nearly closing above 23600 for the first time ever. Instead, the bulls had to settle for an all-time intraday high of 23638.92... Read More

Trading Places with Tom Bowley November 27, 2017 at 09:00 AM

Market Recap for Friday, November 24, 2017 Wall Street was only open for half a day on Friday, but that didn't stop the bulls' momentum as all the major indices closed at fresh all-time highs. Amazon... Read More

Trading Places with Tom Bowley November 22, 2017 at 09:00 AM

Market Recap for Tuesday, November 21, 2017 I am traveling for the Thanksgiving Day holiday, so today's article will be brief. I hope everyone has a very Happy Thanksgiving! Enjoy your family and friends and please be safe. :-) It was a very bullish day on Wall Street yesterday... Read More

Trading Places with Tom Bowley November 21, 2017 at 09:00 AM

Market Recap for Monday, November 20, 2017 It had been awhile since financials (XLF, +0.46%) and industrials (XLI, +0.45%) were the top two performing sectors during a market session, but that's exactly what we saw on Monday... Read More

Trading Places with Tom Bowley November 20, 2017 at 09:02 AM

Market Recap for Friday, November 17, 2017 It was an interesting day on Friday. While most of our major indices struggled and finished in negative territory with the Dow Jones, S&P 500 and NASDAQ falling 0.43%, 0.26% and 0... Read More

Trading Places with Tom Bowley November 17, 2017 at 09:01 AM

Market Recap for Thursday, November 16, 2017 U.S. indices spiked sharply higher on Thursday's open in contrast to many recent days where the bulls have found themselves underwater in early action, trying to reclaim control of the action throughout the balance of the session... Read More

Trading Places with Tom Bowley November 16, 2017 at 09:01 AM

Market Recap for Wednesday, November 15, 2017 Eight of nine sectors lost ground on Wednesday and while that, along with a couple major indices closing beneath their respective 20 day EMAs, might be cause for concern, I actually thought much of the action was bullish... Read More

Trading Places with Tom Bowley November 15, 2017 at 09:03 AM

Market Recap for Tuesday, November 14, 2017 For the third time in the last four days, we saw U.S. equities gap lower, only to reverse intraday to close near their highs of the session... Read More

Trading Places with Tom Bowley November 14, 2017 at 09:00 AM

Reminder If you enjoy my blog, be sure to subscribe at the bottom of this article! Just type in your email address and click on the green "Notify Me!" button. My articles will then be sent to your email immediately upon publishing! It's 100% free and you won't be spammed... Read More

Trading Places with Tom Bowley November 13, 2017 at 09:00 AM

Market Recap for Friday, November 10, 2017 Generally speaking, I'm not a big fan of defensive areas leading the market to the upside. But I'll make an exception for last week. Consumer staples (XLP, +1.02%) was not only the clear leader on Friday, but it's weekly gain of 2... Read More

Trading Places with Tom Bowley November 10, 2017 at 09:01 AM

Market Recap for Thursday, November 9, 2017 Energy (XLE, +0.30%) returned to the top of the leaderboard and this is what's likely to irritate the bears in the future. We now have another sector that's technical capable to take on new money as money rotates elsewhere... Read More

Trading Places with Tom Bowley November 09, 2017 at 09:02 AM

Market Recap for Wednesday, November 8, 2017 It was another day of records for most of our major indices with the Dow Jones, S&P 500 and NASDAQ all closing at their highest levels ever. Consumer staples (XLP, +1... Read More

Trading Places with Tom Bowley November 08, 2017 at 09:00 AM

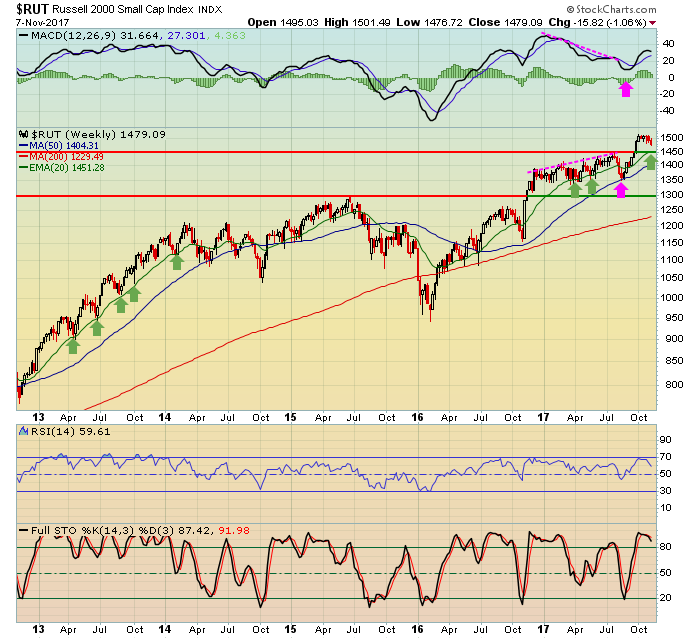

Market Recap for Tuesday, November 7, 2017 Small cap stocks felt a slight tremor on Tuesday as the Russell 2000 ($RUT, -1.26%) suffered its worst day in nearly three months... Read More

Trading Places with Tom Bowley November 07, 2017 at 09:00 AM

Market Recap for Monday, November 6, 2017 Energy (XLE, +2.29%) shares made a huge advance on Monday as money rotated to this once-forgotten sector in a very big way. Bull markets thrive on broad participation in rallies and the XLE had been one sector not participating... Read More

Trading Places with Tom Bowley November 06, 2017 at 09:01 AM

Special Notes First, please join me and Erin Swenlin for MarketWatchers LIVE every day from Noon EST to 1:30pm EST. We discuss key technical developments that you need to be aware of as you manage your wealth... Read More

Trading Places with Tom Bowley November 03, 2017 at 09:00 AM

Market Recap for Thursday, November 2, 2017 Financials (XLF, +0.94%) and industrials (XLI, +0.57%) led a Dow Jones rally on Thursday... Read More

Trading Places with Tom Bowley November 02, 2017 at 09:00 AM

Market Recap for Wednesday, November 1, 2017 U.S. stocks jumped higher out of the gates at Wednesday's open, but was unable to hang onto those gains - especially on the NASDAQ... Read More

Trading Places with Tom Bowley November 01, 2017 at 09:00 AM

Market Recap for Tuesday, October 31, 2017 Don't look now, but crude oil prices ($WTIC) are on the verge of moving to a 2 1/2 year high. Energy (XLE, +0.33%) has shown life since ending its downtrend that began back in December 2016... Read More