Trading Places with Tom Bowley December 29, 2017 at 09:00 AM

Special Note Happy New Year to all and thanks so much for your support of me and StockCharts.com in 2017 (and please subscribe at the bottom of my article - it's FREE!). If you're not a member, your first resolution should be to become one... Read More

Trading Places with Tom Bowley December 28, 2017 at 09:00 AM

Market Recap for Wednesday, December 27, 2017 Wednesday's action was characterized by thin volume and low volatility, normal for trading during the holidays... Read More

Trading Places with Tom Bowley December 27, 2017 at 09:01 AM

Market Recap for Tuesday, December 26, 2017 Energy stocks (XLE, +0.88%) continued their merry way higher, which really isn't surprising after the sector made a very significant price breakout above the 70 level... Read More

Trading Places with Tom Bowley December 26, 2017 at 09:00 AM

Market Recap for Friday, December 22, 2017 The major indices all fell back slightly during Friday's pre-Christmas holiday, light volume trading session. Materials (XLB, +0.38%) was the best performing sector, while healthcare (XLV, -0.32% and financials (XLF, -0.28%) lagged... Read More

Trading Places with Tom Bowley December 22, 2017 at 09:02 AM

Market Recap for Thursday, December 21, 2017 In afternoon trading, all of the major indices except the NASDAQ appeared headed for another record all-time high close. But a late afternoon selling bug hit Wall Street and much of those earlier gains disappeared... Read More

Trading Places with Tom Bowley December 21, 2017 at 09:00 AM

Market Recap for Wednesday, December 20, 2017 It's been a rough road for oil equipment & services stocks ($DJUSOI, +2.33%). They haven't broken down below summer lows, but they also haven't kept pace with the energy sector as a whole either... Read More

Trading Places with Tom Bowley December 20, 2017 at 09:00 AM

Market Recap for Tuesday, December 19, 2017 Housing data released the past couple days has been extremely hot with the housing price index well above expectations and then yesterday housing starts and building permits both easily surpassing Wall Street consensus estimates... Read More

Trading Places with Tom Bowley December 19, 2017 at 08:50 AM

Market Recap for Monday, December 18, 2017 Rotation is powerful during bull markets and Monday's action was a perfect illustration... Read More

Trading Places with Tom Bowley December 18, 2017 at 09:01 AM

Market Recap for Friday, December 15, 2017 Friday's action was extremely bullish. I always love to see "trend days", where prices rise across the board from opening to closing bells... Read More

Trading Places with Tom Bowley December 15, 2017 at 09:03 AM

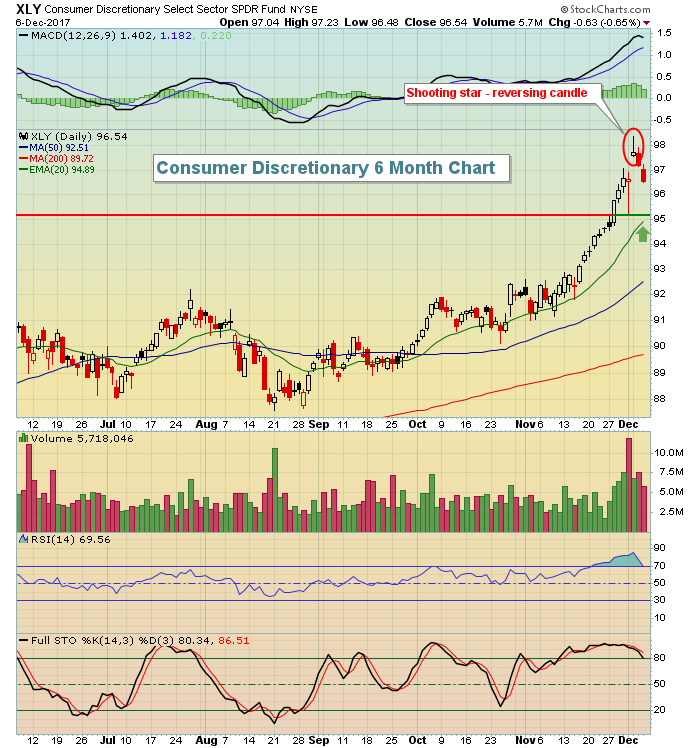

Market Recap for Thursday, December 14, 2017 Walt Disney (DIS) announced plans to purchase $52 billion of 21st Century Fox (FOXA) assets and that lifted both the broadcasting & entertainment index ($DJUSBC) and the consumer discretionary sector (XLY, +0... Read More

Trading Places with Tom Bowley December 14, 2017 at 09:00 AM

Market Recap for Wednesday, December 13, 2017 It was a simple case of "buy the rumor, sell the news". Financials (XLF, -1.24%) slumped on Wednesday after the Fed decided to raise interest rates another quarter point... Read More

Trading Places with Tom Bowley December 13, 2017 at 09:04 AM

Market Recap for Tuesday, December 12, 2017 It was mixed and bifurcated action on Tuesday. The Dow Jones and S&P 500 continued their assault on the record books, but the NASDAQ and Russell 2000 both paused and pulled back... Read More

Trading Places with Tom Bowley December 12, 2017 at 09:04 AM

Market Recap for Monday, December 11, 2017 The Russell 2000 remained in true December form as it continues to struggle during the first half of the month, despite records being set on both the Dow Jones and S&P 500 on a daily basis. It truly is an anomaly... Read More

Trading Places with Tom Bowley December 11, 2017 at 09:03 AM

Market Recap for Friday, December 8, 2017 While we didn't set intraday all-time highs, we did manage to close at record levels on both the Dow Jones and S&P 500, which rose 0.49% and 0.55%, respectively, on Friday. The NASDAQ tacked on 0... Read More

Trading Places with Tom Bowley December 08, 2017 at 09:00 AM

Market Recap for Thursday, December 7, 2017 December began with a huge intraday selloff and recovery and since then, it's been mostly down action. Yesterday was the first day this month that the bulls could celebrate and feel good... Read More

Trading Places with Tom Bowley December 07, 2017 at 09:02 AM

Market Recap for Wednesday, December 6, 2017 It was a bifurcated day on Wall Street with the NASDAQ being lifted by an improving technology sector (XLK, +0.64), while a very weak energy group (XLE, -1.30%) put the brakes on both the Dow Jones and S&P 500... Read More

Trading Places with Tom Bowley December 06, 2017 at 09:00 AM

Reminder If you enjoy my blog articles, I'd love for you to subscribe. It's the only way I know that I'm providing you with useful and thought-provoking information... Read More

Trading Places with Tom Bowley December 05, 2017 at 09:04 AM

Market Recap for Monday, December 4, 2017 Recent bullish themes continued on Monday. Outperformance by the Dow Jones (+0.24%) and S&P 500 (-0.11%) overshadowed ugly relative performance from technology (XLK, -1.61%) and the NASDAQ (-1.05%)... Read More

Trading Places with Tom Bowley December 04, 2017 at 09:00 AM

Market Recap for Friday, December 1, 2017 An early selloff on Friday quickly became a buying opportunity as the bulls jumped back on board for what they hope will be another big upturn... Read More

Trading Places with Tom Bowley December 01, 2017 at 09:01 AM

Market Recap for Thursday, November 30, 2017 It was another broad-based rally on Wall Street with traders ditching bonds and rushing into equities. The Dow Jones rallied 331.67 points to easily close above 24,000 for the first time in its history. The records just keep piling up... Read More