Market Recap for Tuesday, April 17, 2018

Futures were solid heading into Tuesday's pre-market action as Netflix reported stellar Q1 results after the closing bell on Monday. Then, on Tuesday morning, home construction ($DJUSHB) received great news as both March housing starts and building permits easily exceeded expectations. Just before the market opened, the March industrial production report was released and it too beat expectations. All of this set the market up for strength and the bulls took full advantage as our major indices continued their climb toward those January highs.

All of our major indices were strong, but the NASDAQ and NASDAQ 100 were clearly the indices benefiting the most from fresh money and rotation. The latter gained more than 2% with leadership from the likes of Netflix (NFLX, +9.19%) and Amazon.com (AMZN, +4.32%). In all, 84 of the NASDAQ 100's components posted gains on the session as the bulls swamped the bears. There was other key leadership outside of the NASDAQ 100, however, as Twitter (TWTR) appears to have ended its consolidation with gusto:

Gap and trendline support held on TWTR as 27.00 now become MAJOR support. A close below 27.00 would have me running for the exit here, but I don't expect that to happen. Eventually, I look for TWTR to make another run at its March high in the 36-37 range.

Gap and trendline support held on TWTR as 27.00 now become MAJOR support. A close below 27.00 would have me running for the exit here, but I don't expect that to happen. Eventually, I look for TWTR to make another run at its March high in the 36-37 range.

Technology stocks (XLK, +1.86%), with help from the internet space ($DJUSNS, +2.98%), and consumer discretionary stocks (XLY, +1.86%), with help from specialty retailers ($DJUSRS, +4.45%), tied atop the sector leaderboard. From a bullish perspective, it's always good to see these two aggressive sectors leading an advance.

If there was one somewhat surprising development on Tuesday, it was the fact that the bond market reacted so nonchalantly to solid economic news. The 10 year treasury yield ($TNX) actually dropped to 2.81% as treasury prices gained ground despite the much-better-than-expected housing news. Normally we'd see rotation away from bonds (sending yields higher) with solid economic news. Had that happened, even more money would have found its way into equities. Still, equities performed quite well on Tuesday and the bulls ended the day very pleased.

Pre-Market Action

There's little on tap as far as economic news goes, so traders definitely will be watching earnings very closely. Thus far, earnings have been better than expected and it's the combination of earnings, anticipated economic activity and Fed policy that drive equity prices.

The 10 year treasury yield ($TNX) has regained ground lost on Tuesday as the TNX has jumped back to 2.85% this morning. Crude oil prices ($WTIC) also have jumped this morning (+1.76% to $67.69 per barrel) to challenge the 3 1/4 year high established last Friday. Rising crude oil prices are a signal of strengthening global economic conditions, another development supporting a continuing bull market.

There's fractional weakness in Germany this morning. Otherwise, we saw global stock market strength overnight in Asia and this morning in Europe. And despite this morning's slight weakness, the German DAX closed yesterday at a 2 1/2 month high.

With a bit more than 30 minutes left to the opening bell, Dow Jones futures are up by 83 points.

Current Outlook

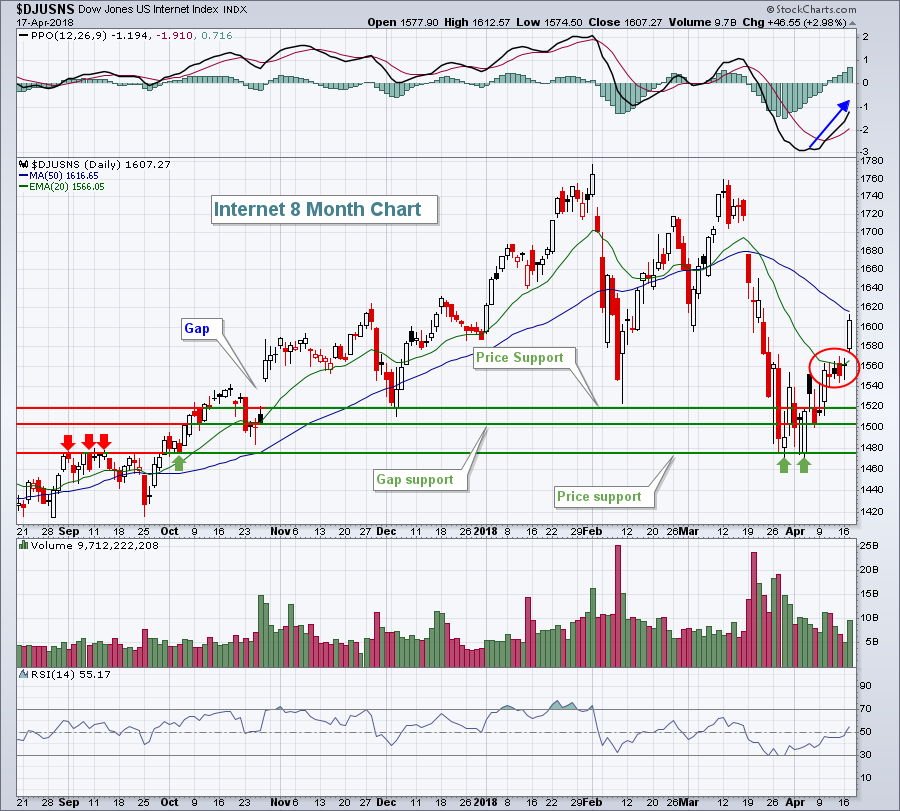

Technology (XLK) looks to internet stocks for leadership. On the 60 minute chart below, the DJUSNS showed slowing selling momentum on its late March low and that has ultimately proven to be the final low for the group - at least thus far. Check out how the group progressed over the past 2-3 weeks:

The bottom began like many others - with a positive divergence printing on the last low. A higher PPO with a lower price simply suggests price momentum is slowing to the downside. When that occurs, I no longer expect 20 hour EMA resistance to hold. Instead, I look for a "reset", where the PPO climbs back to centerline resistance and price action moves to test its overhead 50 hour SMA (blue arrows). A positive divergence can mark a significant bottom or the move to test 50 hour SMA can simply be a pause in a downtrend before another swoosh lower occurs. Subsequent price action will tell us the difference. In this particular case, early April selling sent the DJUSNS lower to test that prior low and establish a double bottom. Double bottoms can be very bullish if the next high clears the previous one. That's exactly what happened last week and the DJUSNS has been trending higher with excellent support at its rising 20 day EMA ever since.

The bottom began like many others - with a positive divergence printing on the last low. A higher PPO with a lower price simply suggests price momentum is slowing to the downside. When that occurs, I no longer expect 20 hour EMA resistance to hold. Instead, I look for a "reset", where the PPO climbs back to centerline resistance and price action moves to test its overhead 50 hour SMA (blue arrows). A positive divergence can mark a significant bottom or the move to test 50 hour SMA can simply be a pause in a downtrend before another swoosh lower occurs. Subsequent price action will tell us the difference. In this particular case, early April selling sent the DJUSNS lower to test that prior low and establish a double bottom. Double bottoms can be very bullish if the next high clears the previous one. That's exactly what happened last week and the DJUSNS has been trending higher with excellent support at its rising 20 day EMA ever since.

There will be resistance ahead, but it certainly appears that the DJUSNS has finally bottomed and reversed and that's excellent news for technology specifically and the nine year old bull market in general.

Sector/Industry Watch

Let's focus on the Dow Jones U.S. Internet Index ($DJUSNS). After stalling beneath its 20 day EMA for several days (red circle below), the DJUSNS finally caught fire and cleared that key short-term moving average. Momentum is strengthening, evidenced by the rapidly improving PPO. It was a scary drop for this space, however, after multiple price support and gap support levels were tested before finally holding:

History favors the group this time of year (see Historical Tendencies below), but there remain technical obstacles. The first will be clearing its 50 day SMA for the first time in a month. Then there'll be multiple gap resistance levels.

History favors the group this time of year (see Historical Tendencies below), but there remain technical obstacles. The first will be clearing its 50 day SMA for the first time in a month. Then there'll be multiple gap resistance levels.

Historical Tendencies

Internet stocks made a big move on Tuesday, perhaps beginning another run to the upside. History would tend to help as the DJUSNS is one of the best performing industry groups during the month of May, which is only a couple weeks away. The DJUSNS has moved higher during May 69% of the time over the past 18 years and it averages gaining 3.6% in May.

Key Earnings Reports

(actual vs. estimate):

ABT: .59 vs .58

ASML: 1.55 vs 1.38

MS: 1.45 vs 1.28

TXT: .72 vs .46

USB: .95 vs .94

(reports after close, estimate provided):

AXP: 1.71

CCI: 1.34

CP: 2.16

KMI: .21

URI: 2.38

Key Economic Reports

Beige Book to be released at 2:00pm EST

Happy trading!

Tom