Market Recap for Tuesday, May 8, 2018

There are days when the stock market seems to go nowhere and are relatively meaningless. Tuesday wasn't one of those days. While the Dow Jones and NASDAQ gained a measly 2.89 and 1.69 points, respectively, and the S&P 500 lost less than one point, there was still plenty of noteworthy action taking place. Have you been watching the small cap Russell 2000? It gained another half percent yesterday and has been swamping the S&P 500 for more than two months now. It's partly due to the time of the year as small caps tend to do quite well in the first half of the year. The best news is that over the past two decades, June has been the best month for relative strength in small caps. I've provided more on small caps in the Current Outlook section below.

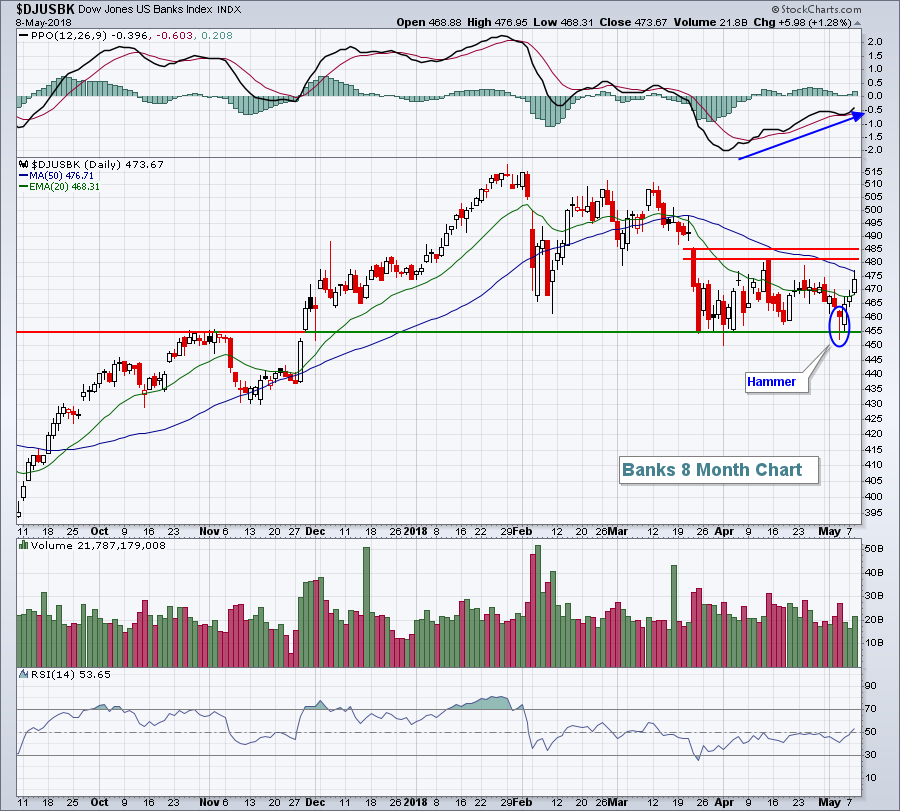

On Tuesday, energy (XLE, +0.78%), industrials (XLI, +0.71%) and financials (XLF, +0.69%) led to the upside. If you recall, it was strength in the XLI and XLF that powered the market's last bull market rally. Up until late last week, both of these sectors had been struggling. It's welcome news to the bulls that they've begun to outperform once again. Specifically, banks ($DJUSBK) appear to be rolling again, having successfully tested a key price support level:

While the three day rally off of key price support is encouraging, there's much more technical work to be done here. Overhead price/gap resistance resides in the 480-485 area. I believe the group will break through, however, given that the 10 year treasury yield ($TNX) remains in its uptrend. Higher treasury yields typically result in higher bank profits, so expect the breakout to occur.

While the three day rally off of key price support is encouraging, there's much more technical work to be done here. Overhead price/gap resistance resides in the 480-485 area. I believe the group will break through, however, given that the 10 year treasury yield ($TNX) remains in its uptrend. Higher treasury yields typically result in higher bank profits, so expect the breakout to occur.

Pre-Market Action

The 10 year treasury yield ($TNX) is up 3 basis points to 3.00% this morning, once again taking aim on a 4 year high near 3.05%. The rising yield should further enable financials, particularly banks, to outperform in the near-term. Crude oil prices ($WTIC) are surging 2.43% to near $71 per barrel and that should provide tailwinds for the energy sector today.

Asia was mixed overnight as is Europe this morning. Dow Jones futures, however, are pointing to a higher open as they're up 106 points with 45 minutes left to the opening bell.

Current Outlook

So why all the love for the smaller companies? The rising dollar, it's as simple as that. The Russell 2000 was shunned in 2017 with a falling dollar, but signs began pointing to a massive rally in the dollar earlier this year and now that strength has materialized. Check out this chart:

The Russell 2000 is just 1.5% below its all-time high close. We know that the S&P 500 has struggled to resume the relative strength it enjoyed during 2017 and, in my opinion, this inability to outperform is very likely to continue on the S&P 500. I believe the S&P 500 will perform ok, but not as well as its smaller cap counterparts. Treasury yields here in the U.S. continue to strengthen against foreign treasury yields, particularly German treasury yields, and that will most likely result in further appreciation in the greenback. That, in turn, should keep the buying pressure on small cap stocks.

The Russell 2000 is just 1.5% below its all-time high close. We know that the S&P 500 has struggled to resume the relative strength it enjoyed during 2017 and, in my opinion, this inability to outperform is very likely to continue on the S&P 500. I believe the S&P 500 will perform ok, but not as well as its smaller cap counterparts. Treasury yields here in the U.S. continue to strengthen against foreign treasury yields, particularly German treasury yields, and that will most likely result in further appreciation in the greenback. That, in turn, should keep the buying pressure on small cap stocks.

Sector/Industry Watch

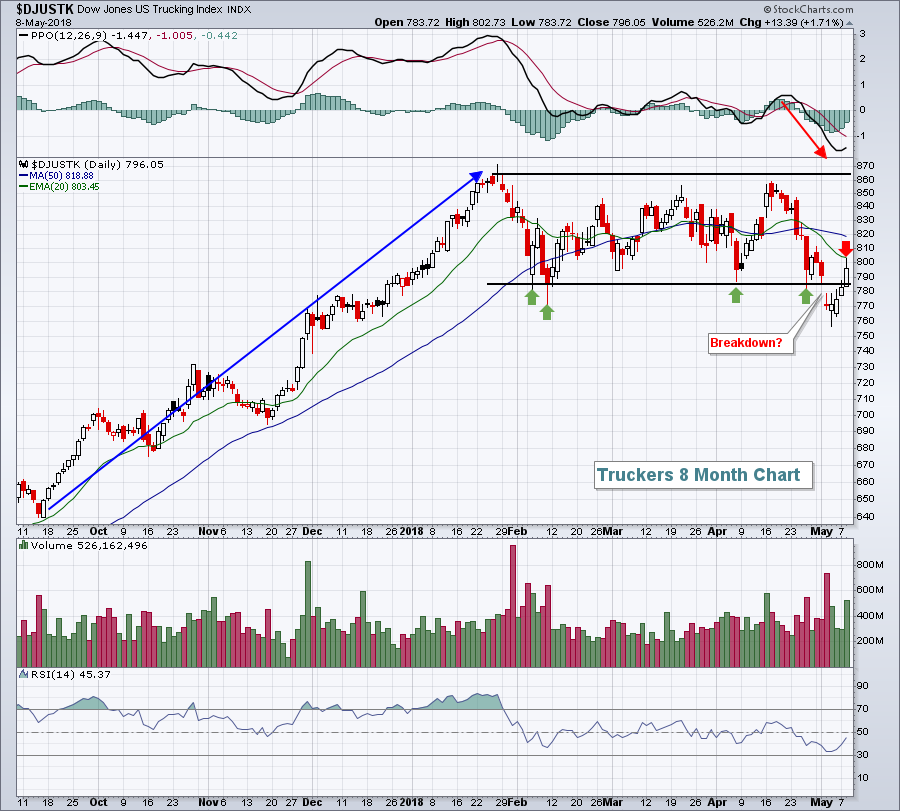

A key area within industrials is truckers ($DJUSTK). In an improving domestic economy, I'd expect to see a strong trucking group. They had held in a bullish rectangular consolidation pattern until dropping just below support last week. We've seen a rebound since, reclaiming that support level, but trading just beneath a critical declining 20 day EMA. This is a significant test for truckers and a move back above the 20 day EMA would be a bullish signal:

The loss of support with a PPO that points lower is normally a very bearish development. But I believe we're in a consolidation phase of a bull market. Therefore, the likelihood of false breakdowns is high. If this is a true breakdown, that declining 20 day EMA should act as a wall of resistance, aiding the sellers/shorts. Let's see how truckers react from here. A move to fresh new lows would be unquestionably bearish, while a close back above the 20 day EMA would help to restore confidence in the group.

The loss of support with a PPO that points lower is normally a very bearish development. But I believe we're in a consolidation phase of a bull market. Therefore, the likelihood of false breakdowns is high. If this is a true breakdown, that declining 20 day EMA should act as a wall of resistance, aiding the sellers/shorts. Let's see how truckers react from here. A move to fresh new lows would be unquestionably bearish, while a close back above the 20 day EMA would help to restore confidence in the group.

Historical Tendencies

I mentioned banks above and how they should be expected to move higher given the higher treasury yield environment. I should also point out one bearish argument - that seasonally banks really struggle during the month of June. I don't have the answer why, but a quick look at a StockCharts.com seasonality chart reveals that banks have risen during June only 28% of the time over the past two decades and their average return during that period is -2.9%, by far their worst calendar month.

Key Earnings Reports

(actual vs. estimate):

MYL: .96 vs .99

TM: 3.00 vs 2.61

WB: .50 vs .48

(reports after close, estimate provided):

BKNG: 10.68

FOXA: .52

MELI: .48

Key Economic Reports

April PPI released at 8:30am EST: +0.1% (actual) vs. +0.3% (estimate)

April Core PPI released at 8:30am EST: +0.2% (actual) vs. +0.2% (estimate)

March wholesale trade to be released at 10:00am EST: +0.5% (estimate)

Happy trading!

Tom