Market Recap for Friday, May 4, 2018

For many weeks, we've seen the stock market seemingly ignore great earnings news and retreat. Highly visible companies like Boeing (BA), Caterpillar (CAT), Intel (INTC) and Microsoft (MSFT) gained initially after blowout earnings, then stumbled after traders attempted to figure out where the after-earnings, "sell on the news" psyche might end. Then on Friday, perhaps the biggest monthly economic report - the April nonfarm payrolls report - disappointed, falling 27,000 jobs short of expectations......and the Dow Jones promptly rallied 332 points and with little intraday selling. It's the type of negative correlation that leaves many market participants left scratching their collective heads. Unfortunately, it's exactly how the stock market operates and why it's so inefficient in the short-term. But there is a silver lining. Eventually, prices gravitate where they should given the Fed's interest rate policy, economic conditions and earnings growth.

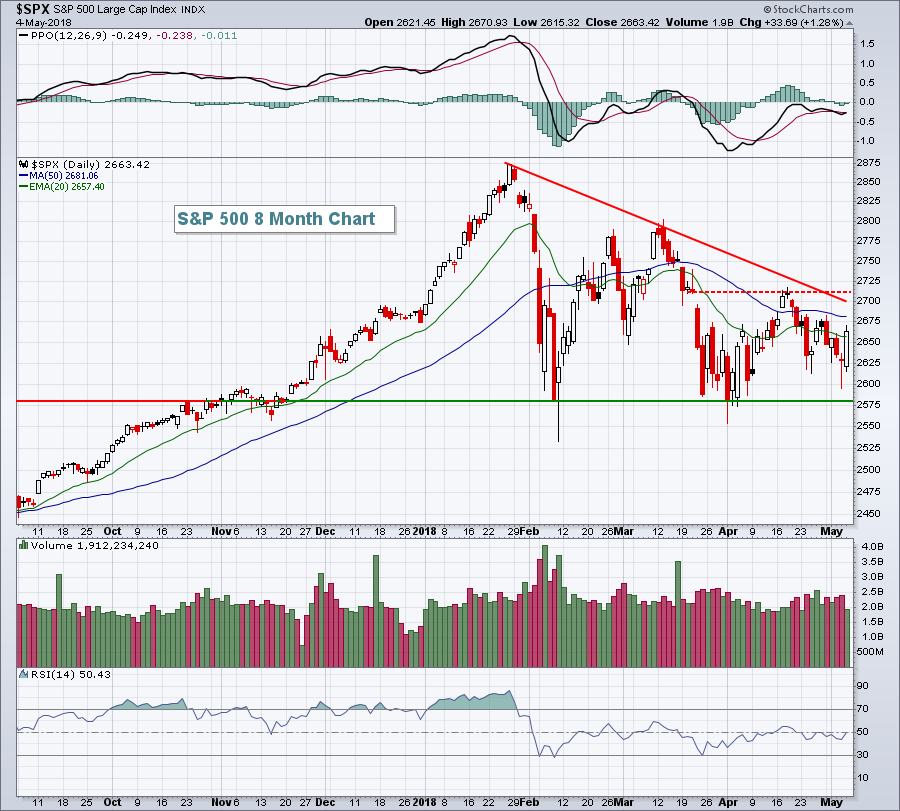

On Friday, traders elected to ignore the short-term shortfall in jobs and concentrate more on value as reward to risk developments justified buying. The S&P 500, after all, was very close to a major support level at 2581 and it bounced very close to where we would expect it to:

We remain mired in consolidation mode, but that range is narrowing in my opinion. The S&P 500 closed at 2663 on Friday, but I'm currently viewing support and resistance at 2581 (price support) and 2712 (gap and price resistance). The 20 day EMA and 50 day SMA reside at 2657 and 2681, respectively, but in trendless, sideways markets, these moving averages barely put up a fight as we've witnessed for the past few months.

We remain mired in consolidation mode, but that range is narrowing in my opinion. The S&P 500 closed at 2663 on Friday, but I'm currently viewing support and resistance at 2581 (price support) and 2712 (gap and price resistance). The 20 day EMA and 50 day SMA reside at 2657 and 2681, respectively, but in trendless, sideways markets, these moving averages barely put up a fight as we've witnessed for the past few months.

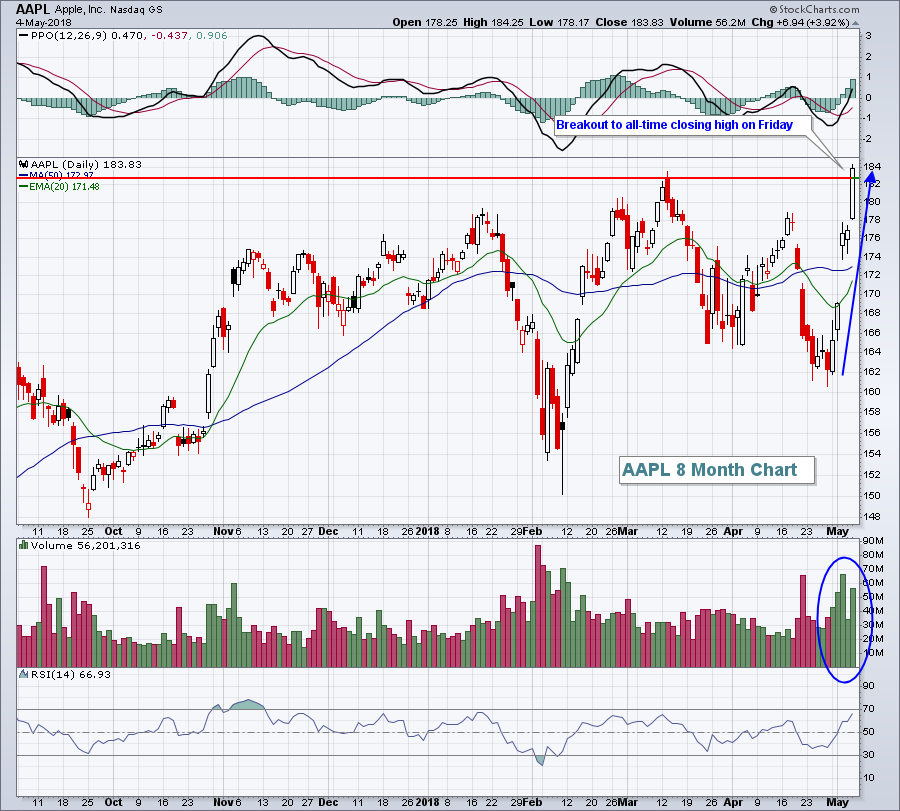

Despite the poor economic news on Friday, technology (XLK, +1.90%), consumer staples (XLP, +1.45%) and consumer discretionary (XLY, +1.31%) were solid leaders. Computer hardware ($DJUSCR, +3.56%) led the charge in technology as Apple (AAPL) broke to a new all-time closing high. AAPL's chart is featured in the Sector/Industry Watch section below.

Activision Blizzard (ATVI, +4.52%) reacted strongly on Friday after testing its recent low for the third time on Thursday. It helped to lead a very strong toy industry ($DJUSTY) to its highest level in the past 5-6 weeks.

Pre-Market Action

The 10 year treasury yield ($TNX) is hanging near 2.95% as it now trades in a 2.90%-3.05% range. Crude oil prices ($WTIC) are up 1.33% this morning to $70.65 per barrel. This represents crude oil's first visit above $70 per barrel since November 2014. Higher crude oil prices typically represent increasing global demand, although it can also rise due to limited supply. As global equity markets continue to rise, however, I'm banking on the former.

Asian markets were mixed and close to the flat line overnight, while we're seeing a bit of strength in Europe this morning. With a little less than 45 minutes to the opening bell, Dow Jones futures are higher by 66 points.

Current Outlook

The market typically looks for strength in financials (XLF, +1.30%). Financials don't have to lead the market, but historically it's important that they at least go along for the ride and perform equal to or better than the benchmark S&P 500. A failing financials sector, particularly banks ($DJUSBK) can lead to much trepidation in the stock market, even outright selling, so Friday's reversal at key support was important to the continuing bull market:

The Thursday reversing candle (hammer) and Friday's follow through surge (bullish engulfing candle) potentially marked a major bottom. Since gapping higher in late-November on very strong volume, the XLF has tested price and gap support near 26.65 on three separate occasions, holding each time. There is no guarantee this support holds in the future, but it does provide an exceptional reward to risk entry point as any close beneath this level would trigger a sell signal in my view.

The Thursday reversing candle (hammer) and Friday's follow through surge (bullish engulfing candle) potentially marked a major bottom. Since gapping higher in late-November on very strong volume, the XLF has tested price and gap support near 26.65 on three separate occasions, holding each time. There is no guarantee this support holds in the future, but it does provide an exceptional reward to risk entry point as any close beneath this level would trigger a sell signal in my view.

Sector/Industry Watch

Apple (AAPL) set a new all-time closing high on Friday after Warren Buffett disclosed that Berkshire Hathaway had recently purchased 75 million shares. At its Friday close, AAPL has a market cap of $932 billion and is looking to become the first company ever to hit the trillion dollar mark. Technically, it's poised to make a run at that historical level:

Off its intraday low from April 27th, AAPL has soared approximately 14% and that rise has been accompanied by very strong volume. Despite this clear technical strength in AAPL, however, technicians would like to see this breakout followed by many others to demonstrate the wide participation necessary to keep a bull market alive.

Off its intraday low from April 27th, AAPL has soared approximately 14% and that rise has been accompanied by very strong volume. Despite this clear technical strength in AAPL, however, technicians would like to see this breakout followed by many others to demonstrate the wide participation necessary to keep a bull market alive.

Monday Setups

For this week, I like a software stock, Teledoc (TDOC). Last week, TDOC reported a loss of .39, but it was better than the expected loss of .43. TDOC also reported revenues that exceeded expectations as it broke to a fresh new high on exceptionally high volume:

There definitely was a bit of whipsaw after its May 1st earnings report, but I believe the initial higher reaction will eventually be proven to be correct. I love the volume that accompanied the move higher and the reversal on Friday off of its key trendline support. A short-term stop could be considered at 40, while the longer-term uptrend remains intact so long as TDOC holds 37-38 support. I look for a target here of 48, based on the measurement of its inverse head & shoulders breakout. The neckline would be drawn from the late-March high across to the mid-April high with the breakout above 43 measuring five points to 48.

There definitely was a bit of whipsaw after its May 1st earnings report, but I believe the initial higher reaction will eventually be proven to be correct. I love the volume that accompanied the move higher and the reversal on Friday off of its key trendline support. A short-term stop could be considered at 40, while the longer-term uptrend remains intact so long as TDOC holds 37-38 support. I look for a target here of 48, based on the measurement of its inverse head & shoulders breakout. The neckline would be drawn from the late-March high across to the mid-April high with the breakout above 43 measuring five points to 48.

Historical Tendencies

The Dow Jones U.S. Toys Index ($DJUSTY) was mentioned above, having reached its highest level in more than a month. It comes at an interesting time seasonally as the DJUSTY has advanced during the month of May 78% of the time over the past two decades, producing an average May gain of 3.4%. If we look at just the past five Mays, the DJUSTY has risen every year and produced average gains of 8.3%.

Key Economic Reports

None

Key Earnings Reports

(actual vs. estimate):

CTSH: 1.06 vs 1.05

IFF: 1.69 vs 1.58

SRE: 1.43 vs 1.67

SYY: .67 vs .64

TSN: 1.27 vs 1.32

WLTW: 2.71 vs 2.63

(reports after close, estimate provided):

ANDV: .58

NTR: .17

Happy trading!

Tom