Market Recap for Thursday, June 7, 2018

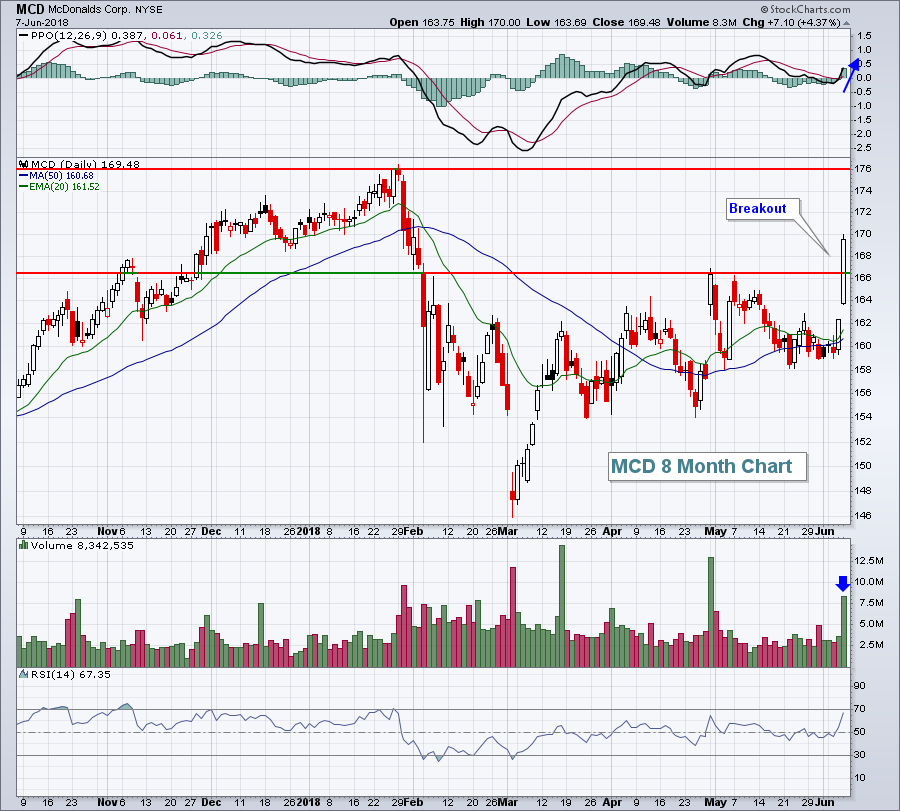

The Dow Jones gained 95 points, extending its recent rally, on the strength of McDonalds Corp (MCD) and Chevron Corp (CVX). MCD announced layoffs and Wall Street cheered the likely improvement to its bottom line by sending MCD higher by 4.37%:

MCD headlined the strength in restaurants & bars ($DJUSRU), but others had very strong days as well. Sonic Corp (SONC) pre-announced a stronger-than-expected sales forecast and a $500 million share repurchase program and that jumpstarted a group that's been lagging many of its consumer discretionary peers. More on that in the Sector/Industry Watch section below.

MCD headlined the strength in restaurants & bars ($DJUSRU), but others had very strong days as well. Sonic Corp (SONC) pre-announced a stronger-than-expected sales forecast and a $500 million share repurchase program and that jumpstarted a group that's been lagging many of its consumer discretionary peers. More on that in the Sector/Industry Watch section below.

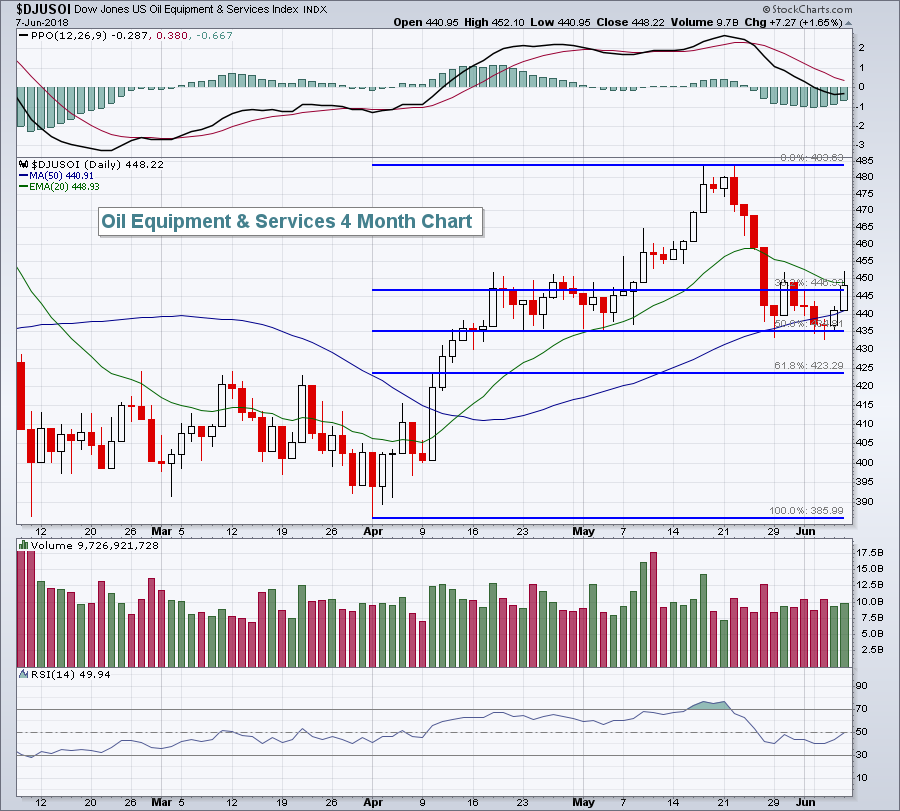

Energy (XLE, +1.52%) was the clear sector leader on Thursday as CVX spiked nearly 3% on the session. Exploration & production ($DJUSOS) led the energy sector higher, but I was most impressed technically with the oil equipment & services group hanging onto recent price support at 435:

In addition to price support near the 435 level, note that the Fibonacci 50% retracement support level resides there as well. Turning higher from this support is critical. We want to make sure this area continues to hold on bouts of selling.

In addition to price support near the 435 level, note that the Fibonacci 50% retracement support level resides there as well. Turning higher from this support is critical. We want to make sure this area continues to hold on bouts of selling.

Pre-Market Action

Apple (AAPL) has warned its global suppliers that iPhone shipments would likely decrease by 20% this year. That has put pressure on both AAPL (-1.33% in pre-market) and its suppliers and could be a drag on technology and the major U.S. stock indices today. Futures are definitely being impacted as Dow Jones futures are down 81 points this morning after its recent solid advance has carried this benchmark back above 25000. Traders will be trying to hold onto this psychological support level.

Bonds, gold and crude oil are all relatively flat this morning. Equities were hit rather hard in Asia overnight, but Europe is performing much better and mostly flat.

Current Outlook

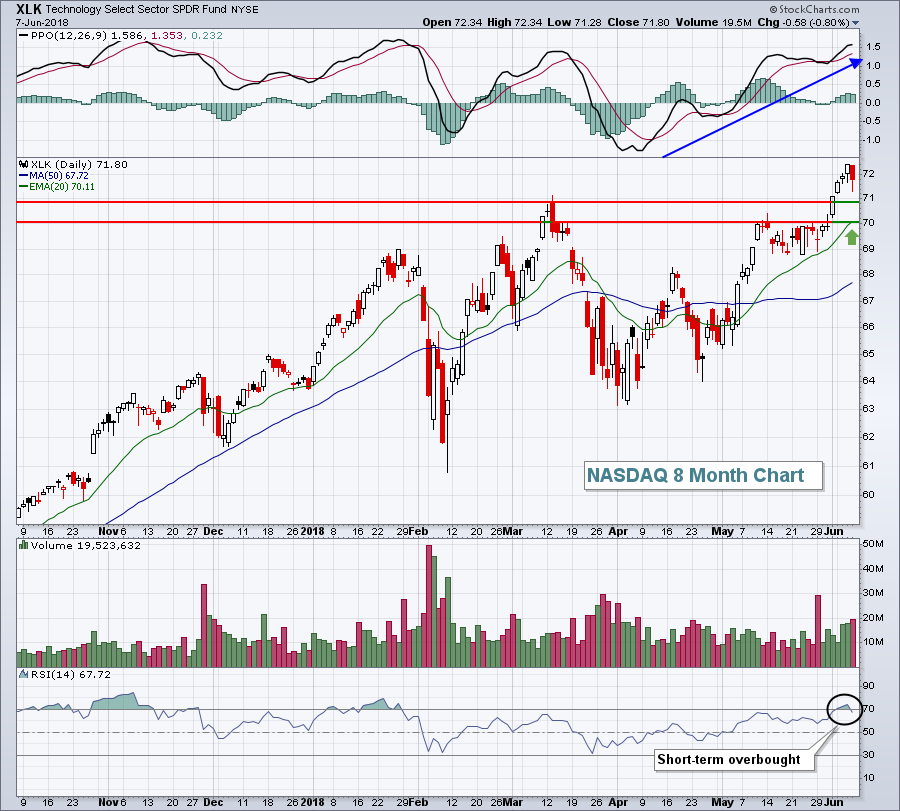

It's generally important to have a strong technology sector as these stocks represent a higher-risk, aggressive area in the market. The NASDAQ struggled mightily on a relative basis on Thursday as this recent high-flying technology group (XLK, -0.80%) stumbled. I wouldn't read too much into this as an uptrend is clearly in place and profit taking will occur from time to time:

The RSI (black circle) had moved into overbought territory above 70 so profit taking should be expected. There appears to be solid price support in the 70-71 range and the rising 20 day EMA, currently at 70.11, should provide solid support as well. Additional short-term weakness only sets up a better reward to risk entry in my view.

The RSI (black circle) had moved into overbought territory above 70 so profit taking should be expected. There appears to be solid price support in the 70-71 range and the rising 20 day EMA, currently at 70.11, should provide solid support as well. Additional short-term weakness only sets up a better reward to risk entry in my view.

Sector/Industry Watch

Consumer discretionary (XLY) began to outperform the benchmark S&P 500 in November 2017. It had little to do with the performance of restaurants & bars, however. That industry has been very weak relative to its discretionary counterparts over the past year:

The top of this chart shows the absolute performance of the DJUSRU over the past two years. At first glance, it might appear to be fairly solid with rising tops and bottoms. But the middle part of this chart reveals a much different picture. The DJUSRU has been a major laggard within the consumer discretionary sector. It's simply been a case of "a rising tide lifts all boats". There is a silver lining here, though. The DJUSRU has printed a possible relative double bottom as it begins to outperform its peers. The DJUSRU's breakout above 1510 certainly provides the group a technical opportunity to extend Thursday's rally.

The top of this chart shows the absolute performance of the DJUSRU over the past two years. At first glance, it might appear to be fairly solid with rising tops and bottoms. But the middle part of this chart reveals a much different picture. The DJUSRU has been a major laggard within the consumer discretionary sector. It's simply been a case of "a rising tide lifts all boats". There is a silver lining here, though. The DJUSRU has printed a possible relative double bottom as it begins to outperform its peers. The DJUSRU's breakout above 1510 certainly provides the group a technical opportunity to extend Thursday's rally.

Historical Tendencies

McDonalds (MCD) was featured above as a key leader in the Dow Jones' advance yesterday, but June hasn't always been kind to one of the most recognizable companies in the world. MCD has risen just 40% of Junes over the past two decades and its average return during the month over that span is -0.3%. The fast food chain does, however, perform well in July as it averages gaining 1.2% during that month. And I'm waaaaaay early on this one, but MCD has advanced during November in every year this century.

Key Earnings Reports

None

Key Economic Reports

April wholesale inventories to be released at 10:00am EST: +0.1% (estimate)

Happy trading!