Market Recap for Wednesday, June 13, 2018

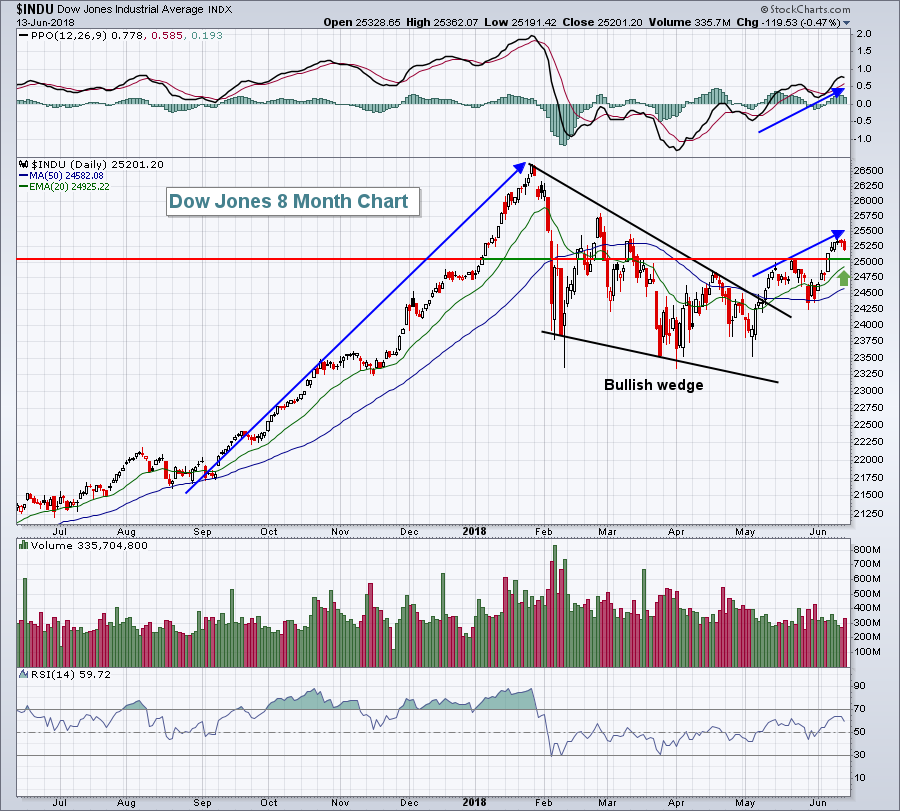

Another Fed day is in the rear view mirror and now we know the following. The Fed expects to raise interest rates two more times in 2018, bringing the total number of hikes to 4, as opposed to the 3 they discussed in prior meetings. Also, they describe the expected pace of economic growth to be "solid", replacing the "modest" wording in previous announcements. While volatility was high - as it usually is in the two hours following the FOMC announcement - the end result is that the 10 year treasury yield ($TNX) finished slighly higher for the session, rising 2 basis points to 2.97%. We remain in an uptrend with 3.11% now marking overhead yield resistance. Equity markets also were turbulent after the announcement with the Dow Jones falling in the final hour to close with a 119 point loss. Still, losses were contained and the Dow remains solid technically on its daily chart:

After the huge advance in late-2017 into early-2018, the Dow Jones, along with all of our other major indices, settled into a lengthy consolidation period. There was a bullish wedge that printed on the Dow Jones and we've since made a bullish breakout. Yesterday's selling was really not much more than a "buy on the rumor, sell on the news" type of event as the Fed announcement came and went. Economic conditions are strengthening and interest rates remain near historic lows. In my opinion, that's a combination that is likely to result in much higher equity prices over time. This isn't a sprint, but rather a marathon, so look for pullbacks along the way (like yesterday afternoon) to test your mettle.

Only two sectors were able to hang onto gains on Wednesday. Consumer discretionary (XLY, +0.15%) and healthcare (XLV, +0.02%) both gained ground, but closed well off their earlier intraday highs. Specialty retailers ($DJUSRS) led the consumer discretionary group as both a large cap and small cap name led another all-time high in the group:

Netflix (NFLX) remains one of the best performing stocks. Big 5 Sporting Goods (BGFV) doesn't "sport" the long-term track record of NFLX (far from it actually), but it nonetheless set a new 2018 high and did so with confirming volume the past two trading sessions. Retail is very hot right now and the DJUSRS is a big reason why.

Netflix (NFLX) remains one of the best performing stocks. Big 5 Sporting Goods (BGFV) doesn't "sport" the long-term track record of NFLX (far from it actually), but it nonetheless set a new 2018 high and did so with confirming volume the past two trading sessions. Retail is very hot right now and the DJUSRS is a big reason why.

Pre-Market Action

Futures were down earlier, but have rebounded and currently Dow Jones futures are higher by 87 points with 45 minutes left to the opening bell. The Fed meeting and announcement are behind us and now the market will deal with the Fed's comments and quarter point rate hike. Retail sales were released a few moments ago and were very strong, rising 0.8%, well ahead of the expected 0.4% increase.

Key Asian markets were down close to 1% overnight, including both the Tokyo Nikkei ($NIKK) and Hong Kong Hang Seng ($HSI). European equities have turned positive after being mixed earlier this morning as they digest the Fed's latest announcement and the stronger-than-expected retail sales report.

Crude oil ($WTIC) is rising back above $67 per barrel as it continues to point to a recent bottom at $64 per barrel.

Current Outlook

The reaction of banks ($DJUSBK) to the FOMC announcement was head scratching, to say the least. We saw the expected quarter point rate hike in the fed funds rate from 1.75% to 2.00%. In addition, the Fed's indication that we'd see two more hikes in 2018 instead of one should have sparked buying interest in banks, whose bottom lines generally increase with rising interest rates due to rapidly expanding net interest margins. But after looking at the chart, you'd be hard-pressed to see any buying enthusiasm:

Let me be clear. I believe that banks are consolidating in its current channel after a significant rise just prior. Still, the prospects of rising interest rates should be a catalyst for stocks in this space. The regional banking ETF (KRE) has been wildly outperforming the DJUSBK, but even the KRE pulled back to rising 20 day EMA support yesterday after the Fed decision.

Let me be clear. I believe that banks are consolidating in its current channel after a significant rise just prior. Still, the prospects of rising interest rates should be a catalyst for stocks in this space. The regional banking ETF (KRE) has been wildly outperforming the DJUSBK, but even the KRE pulled back to rising 20 day EMA support yesterday after the Fed decision.

Sector/Industry Watch

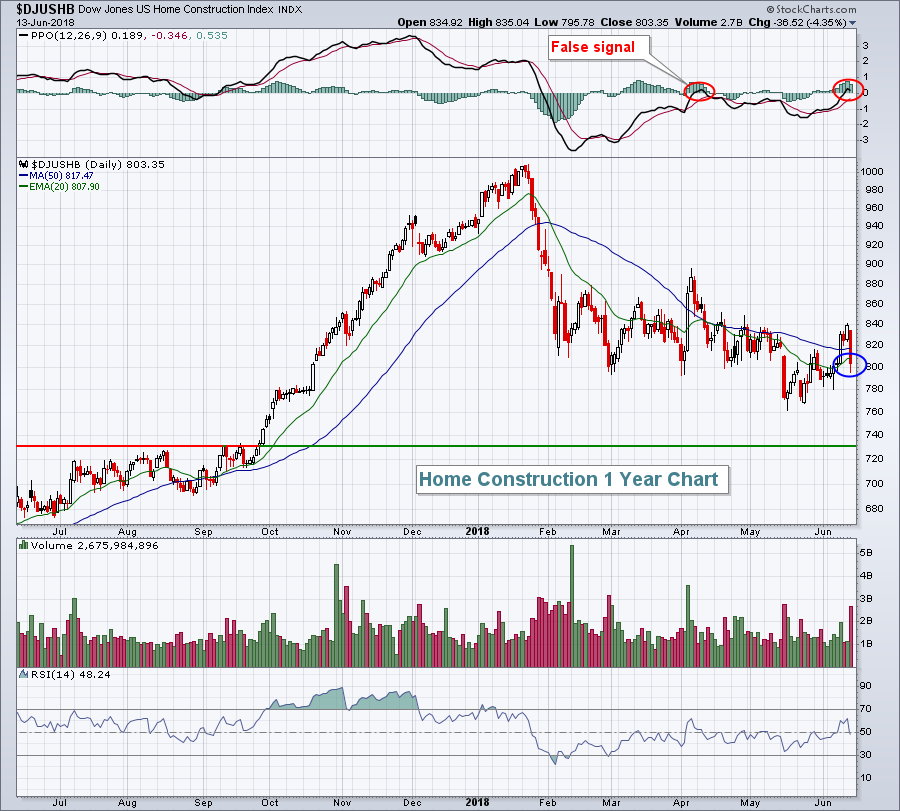

Home construction ($DJUSHB) was hammered on Wednesday, falling from key price resistance at 840 ahead of the FOMC announement, then stabilizing after it:

I discussed in a recent MarketWatchers LIVE show on StockCharts TV that PPO centerline crossovers, while bullish in nature, can be misleading at times. The red circle on the April PPO centerline crossover was a perfect example of this. As prices accelerate and the PPO rises, pullbacks should hold rising 20 day EMA support. The April pullback did not and the DJUSHB rolled over and continued pushing lower. Now let's fast forward to recent days where the DJUSHB has been uptrending and approaching overhead price resistance at 840. Note the PPO had just turned positive, another bullish centerline crossover. However, yesterday's selling resulted in the loss of rising 20 day EMA support (blue circle). I had grown bullish home construction in recent days, but this group needs a quick recovery to hang onto the bullish momentum established off the mid-May bottom.

I discussed in a recent MarketWatchers LIVE show on StockCharts TV that PPO centerline crossovers, while bullish in nature, can be misleading at times. The red circle on the April PPO centerline crossover was a perfect example of this. As prices accelerate and the PPO rises, pullbacks should hold rising 20 day EMA support. The April pullback did not and the DJUSHB rolled over and continued pushing lower. Now let's fast forward to recent days where the DJUSHB has been uptrending and approaching overhead price resistance at 840. Note the PPO had just turned positive, another bullish centerline crossover. However, yesterday's selling resulted in the loss of rising 20 day EMA support (blue circle). I had grown bullish home construction in recent days, but this group needs a quick recovery to hang onto the bullish momentum established off the mid-May bottom.

Historical Tendencies

Summer hasn't always been kind to apparel retailers ($DJUSRA) as the 20 year track record will show. However, the DJUSRA has moved higher in June during four of the last five years, averaging a 1.6% monthly gain over that stretch.

Key Earnings Reports

(reports after close, estimate provided):

ADBE: 1.54

JBL: .45

Key Economic Reports

Initial jobless claims released at 8:30am EST: 218,000 (actual) vs. 225,000 (estimate)

May retail sales released at 8:30am EST: +0.8% (actual) vs. +0.4% (estimate)

May retail sales less autos released at 8:30am EST: +0.9% (actual) vs. +0.5% (estimate)

Happy trading!

Tom