Market Recap for Wednesday, July 25, 2018

All of our major indices finished higher on Wednesday, as did all sectors. Relative strength was found in several areas including industrials (XLI, +1.52%), healthcare (XLV, +1.28%) and technology (XLK, +1.25%). Waste & disposal services ($DJUSPC, +5.04%) surged on the back of Waste Management's (WM) strong quarterly earnings report. Similarly, United Parcel Service (UPS) lifted the delivery services ($DJUSAF) space, gaining 6.90%. Both stocks ended the day well above where they started it as buying persisted throughout the session. Here are the charts:

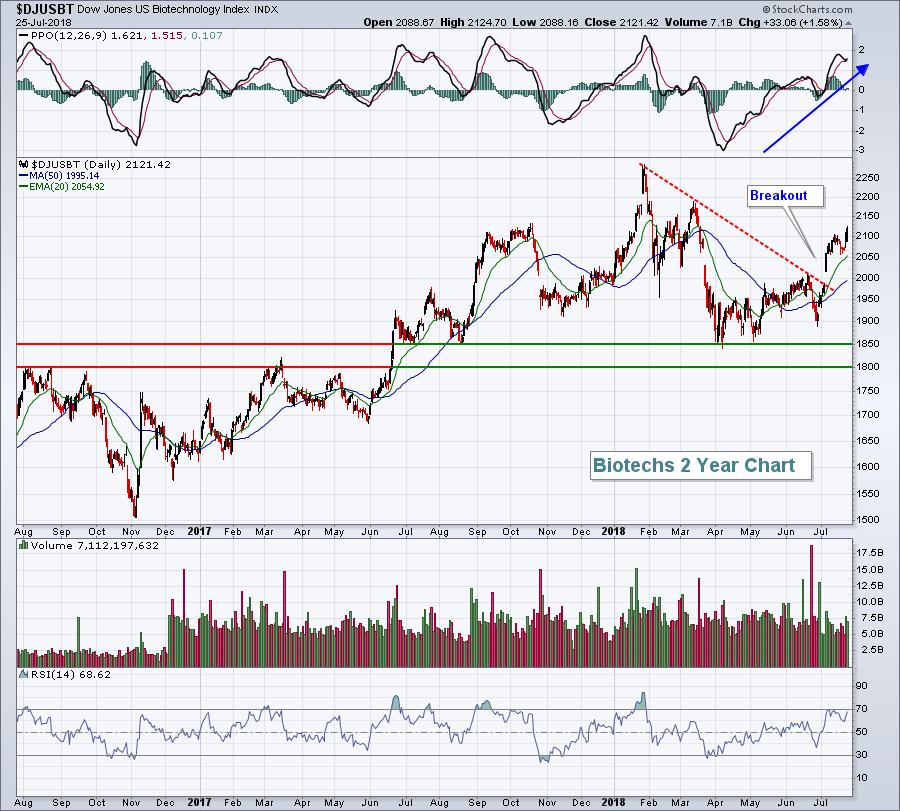

In other earnings-related news, Biogen (BIIB) posted results that easily beat Wall Street forecasts and biotechs ($DJUSBT) rallied to lead the healthcare group. I've posted on many occasions that biotechs love the calendar month of July and technical conditions have been improving throughout the month:

In other earnings-related news, Biogen (BIIB) posted results that easily beat Wall Street forecasts and biotechs ($DJUSBT) rallied to lead the healthcare group. I've posted on many occasions that biotechs love the calendar month of July and technical conditions have been improving throughout the month:

The daily PPO has strengthened during the month as biotechs look to challenge the March reaction high, which could establish the right side of an inverse head & shoulders neckline.

The daily PPO has strengthened during the month as biotechs look to challenge the March reaction high, which could establish the right side of an inverse head & shoulders neckline.

The 10 year treasury yield ($TNX) pulled back slightly on Wednesday and that was enough to send financials (XLF, +0.21%) to the bottom of the sector leaderboard. Industry groups in this area have strengthened considerably in July, especially within banks ($DJUSBK). The TNX is up this morning, so I'd look for leadership from banks and other areas of financials today.

Pre-Market Action

I rarely hold any stock into its earnings report as it's just too much of a crap shoot. It's similar to a spin on the roulette wheel and calling red or black. Facebook (FB) landed on red last night after the bell, reporting disappointing revenues and lowering future revenue growth targets. FB is down 44 bucks, or 20%, in pre-market trading and that is understandably pressuring tech stocks.

Dow Jones futures are holding up well, however, pointing to a slightly higher open as we approach the opening bell. The NASDAQ 100 ($NDX) will be under pressure at the opening bell due to the selloff in FB shares.

The 10 year treasury yield ($TNX) is up a couple basis points to 2.96%, which should help the financials continue their recent absolute and relative strength.

Asian markets were lower overnight, but European markets are rallying (especially in Germany) after trade discussions between the U.S. and Europe proved mostly encouraging.

Current Outlook

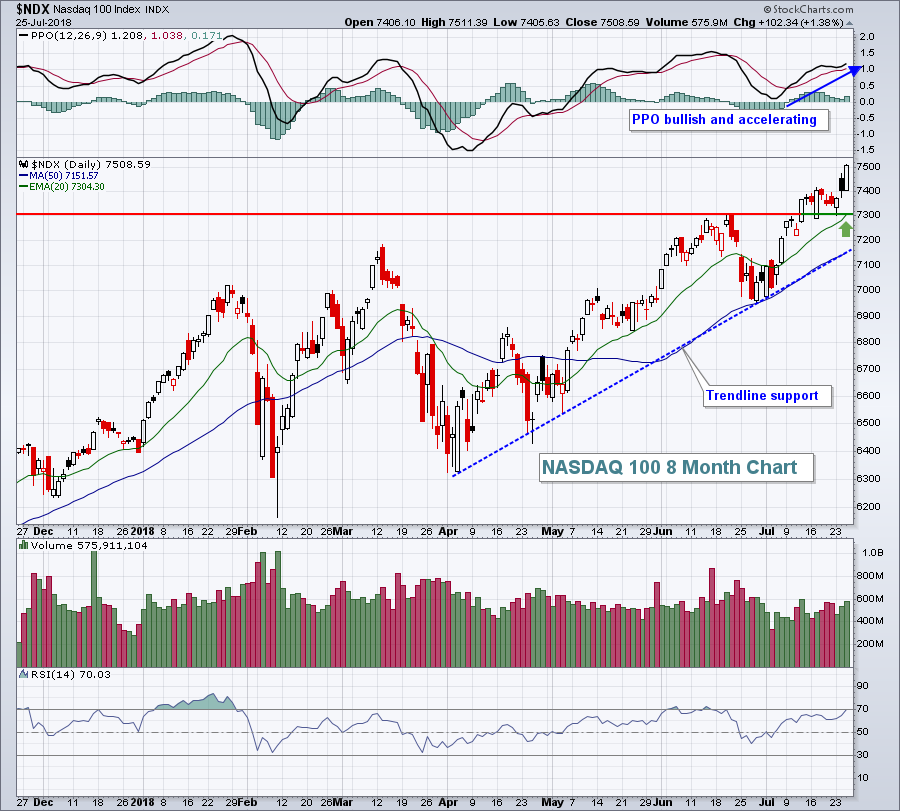

The NASDAQ 100 ($NDX) promises to be under early pressure given the uninspiring quarterly earnings results from Facebook (FB), so it's a good opportunity to take a look at how much short-term downside we might see in this index:

The NDX is quite healthy and can withstand selling pressure among one or a few components. So while FB will certainly put pressure on the NDX today, I'd watch two key levels of support. First, both the rising 20 day EMA and price support reside near 7300. Any selling to that level should be considered very normal and healthy. Below that would be more important resistance. Trendline and 50 day SMA support coincide near 7150. A confirmed close beneath 7150 would be much more problematic technically, in my opinion.

Sector/Industry Watch

Railroads ($DJUSRR, +3.01%) are quite strong technically and suggest a strengthening U.S economic picture. There's really no other reason to see relative strength in this group. Check out the latest on the DJUSRR:

The absolute and relative trendlines remain intact. So long as that remains, I'd be very bullish railroads....and transportation stocks ($TRAN) in general.

The absolute and relative trendlines remain intact. So long as that remains, I'd be very bullish railroads....and transportation stocks ($TRAN) in general.

Historical Tendencies

August has been a rough calendar month for U.S. equities historically. The S&P 500 has produced an annualized return of -1.04% over the past 67 years during August and the month has produced net gains 37 of those years, while declining 30 times.

Key Earnings Reports

(actual vs. estimate):

AAL: 1.63 vs 1.59

ABEV: .04 vs .05

AGN: 4.42 vs 4.13

ALXN: 2.07 vs 1.69

APD: 1.95 vs 1.84

AZN: .69 vs .31

BAX: .77 vs .71

BMY: 1.01 vs .87

BUD: 1.10 vs 1.05

CAJ: .65 vs .61

CELG: 2.16 vs 2.10

CMCSA: .65 vs .61

CME: 1.74 vs 1.72

COP: 1.09 vs 1.06

DHI: 1.18 vs 1.08

EQNR: 42 (estimate - awaiting results)

IP: 1.19 vs 1.09

LLL: 2.47 vs 2.30

LUV: 1.26 vs 1.25

MA: 1.66 vs 1.53

MCD: 1.99 vs 1.92

MCK: 2.90 vs 2.89

MMC: 1.10 vs 1.11

MO: 1.01 vs 1.00

MPC: 2.27 vs 1.98

MPLX: .55 vs .57

NEM: .26 vs .24

NOK: .04 vs .04

PX: 1.72 vs 1.70

RDS.A: 1.12 vs 1.41

ROP: 2.89 vs 2.70

RTN: 2.45 vs 2.32

SPGI: 2.17 vs 2.13

SPOT: (.61) vs (.63)

TAL: .14 vs .10

TOT: 1.31 vs 1.50

VLO: 2.15 vs 2.00

XEL: .52 vs .47

(reports after close, estimate provided):

AFL: .98

AMGN: 3.52

AMZN: 2.49

DFS: 1.89

DLR: 1.61

EA: .07

EIX: .82

EW: 1.13

EXPE: .91

FTV: .89

INTC: .99

LRCX: 4.98

RSG: .73

SBUX: .60

WDC: 3.52

Key Economic Reports

June durable goods released at 8:30am EST: +1.0% (actual) vs. +3.2% (estimate)

June durable goods ex-transports released at 8:30am EST: +0.4% (actual) vs. +0.5% (estimate)

Initial jobless claims released at 8:30am EST: 217,000 (actual) vs. 219,000 (estimate)

June wholesale inventories released at 8:30am EST: +0.0% (actual) vs. +0.3% (estimate)

Happy trading!

Tom