Market Recap for Wednesday, January 30, 2019

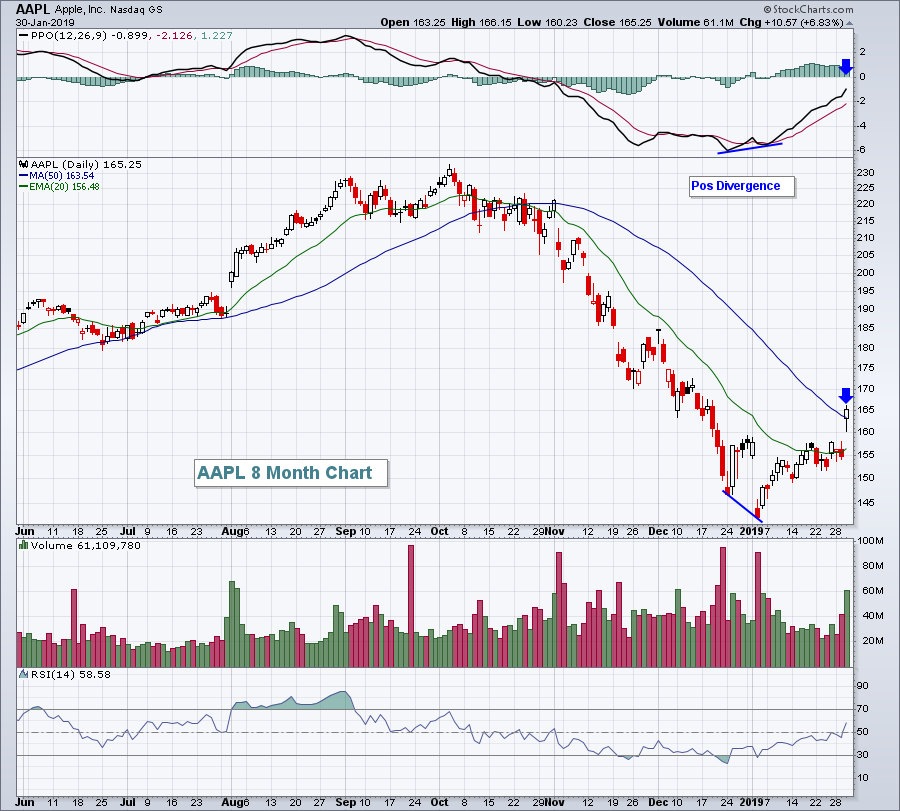

Wall Street had much to digest yesterday. There was fresh jobs data as the January ADP employment report was released. The news was much better than anticipated. There was the Apple (AAPL) earnings report from Tuesday evening. While the numbers reported were mostly in-line with AAPL's early January warning, there appeared to be a collective sigh of relief that AAPL didn't drop another bomb. (AAPL did indicate next quarter's revenue was likely to be in the lower end of the prior range provided.) AAPL has been quite conservative in their guidance in the past, so the lack of an EPS warning moving forward was received quite bullishly by traders. AAPL finished the day higher by 6.83%:

AAPL has now rallied back 15% or so since printing a positive divergence. The blue arrows mark the 50 day SMA test and the near centerline test of the PPO, which is what I look for after positive divergences print. I now view AAPL to be in an uptrend until proven otherwise. A close back beneath the now-rising 20 day EMA would suggest re-evaluation of the uptrend. Keep in mind that AAPL's weekly chart is much, much more bearish so a breakdown on the daily chart should most definitely be respected.

AAPL has now rallied back 15% or so since printing a positive divergence. The blue arrows mark the 50 day SMA test and the near centerline test of the PPO, which is what I look for after positive divergences print. I now view AAPL to be in an uptrend until proven otherwise. A close back beneath the now-rising 20 day EMA would suggest re-evaluation of the uptrend. Keep in mind that AAPL's weekly chart is much, much more bearish so a breakdown on the daily chart should most definitely be respected.

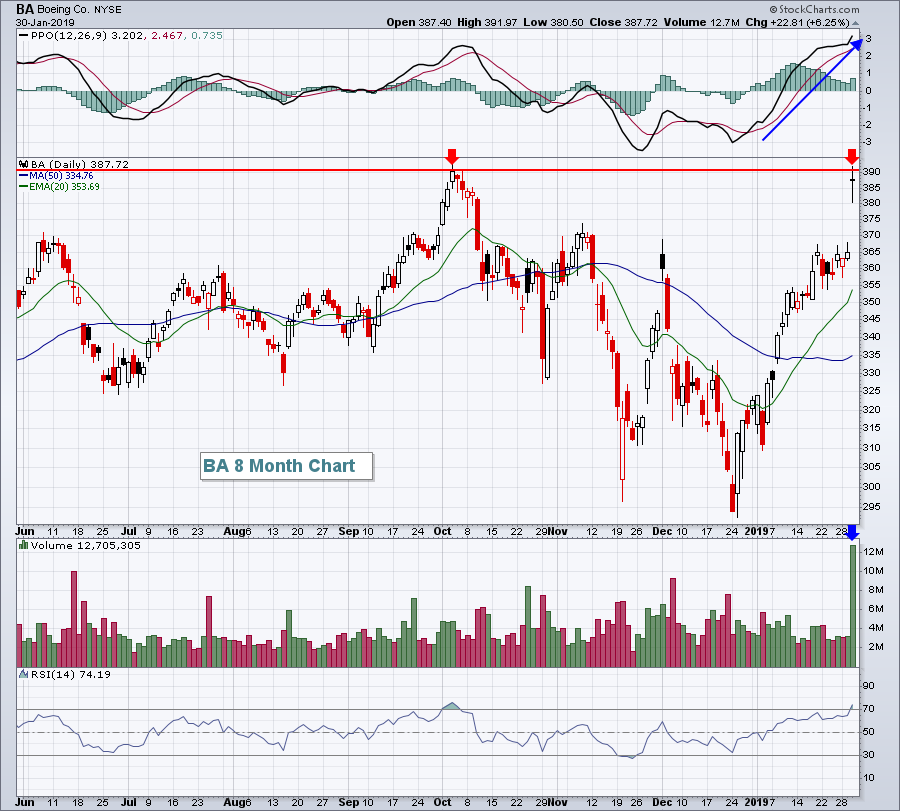

Besides jobs and AAPL, there were several other key earnings reports out, with one standout being Boeing (BA, +6.25%). BA reported revenues and EPS well above Wall Street consensus estimates and the stock soared to test overhead resistance from early October:

If you think that was a lot to digest, consider that the Federal Reserve chimed in with its latest FOMC policy statement that was released at 2pm EST. Fed Chair Powell indicated that the Fed would remain "patient" and the market loved that change from just a month or two ago when the Fed suggested there'd be three rate hikes in 2019, despite the bond and stock markets' message that we were heading for a rough economic patch.

So after all of that, the Dow Jones, S&P 500, NASDAQ and Russell 2000 gained 1.77%, 1.55%, 2.20% and 1.05%, respectively. All 11 sectors gained ground on the session, led by technology (XLK, +3.11%) and consumer discretionary (XLY, +1.97%). The bulls made a statement as all of our major indices are now trading above their 20 week EMAs, a positive signal for as long as they can hold above that key moving average.

Pre-Market Action

The biggest concern for me right now is the action taking place in the bond market. In my experience, the bond market usually gets it right more often than the stock market. And currently, the 10 year treasury yield ($TNX) is falling. It fell after the FOMC announcement yesterday and it's falling again this morning, down 3 basis points to 2.66%. Gold ($GOLD) is up more than 1% this morning to $1330 per ounce and appears headed higher. Crude oil ($WTIC) is back above $54 per barrel, challenging recent highs.

Asian markets were mostly higher overnight, while European markets are mixed. Most notably, the German DAX ($DAX) is trading lower by 0.55% at last check.

Dow Jones futures are trading down 90 points as we approach a new trading day. Initial jobless claims surged to 253,000 after just one week ago dipping beneath 200,000. Futures weakened after the release of this report.

Current Outlook

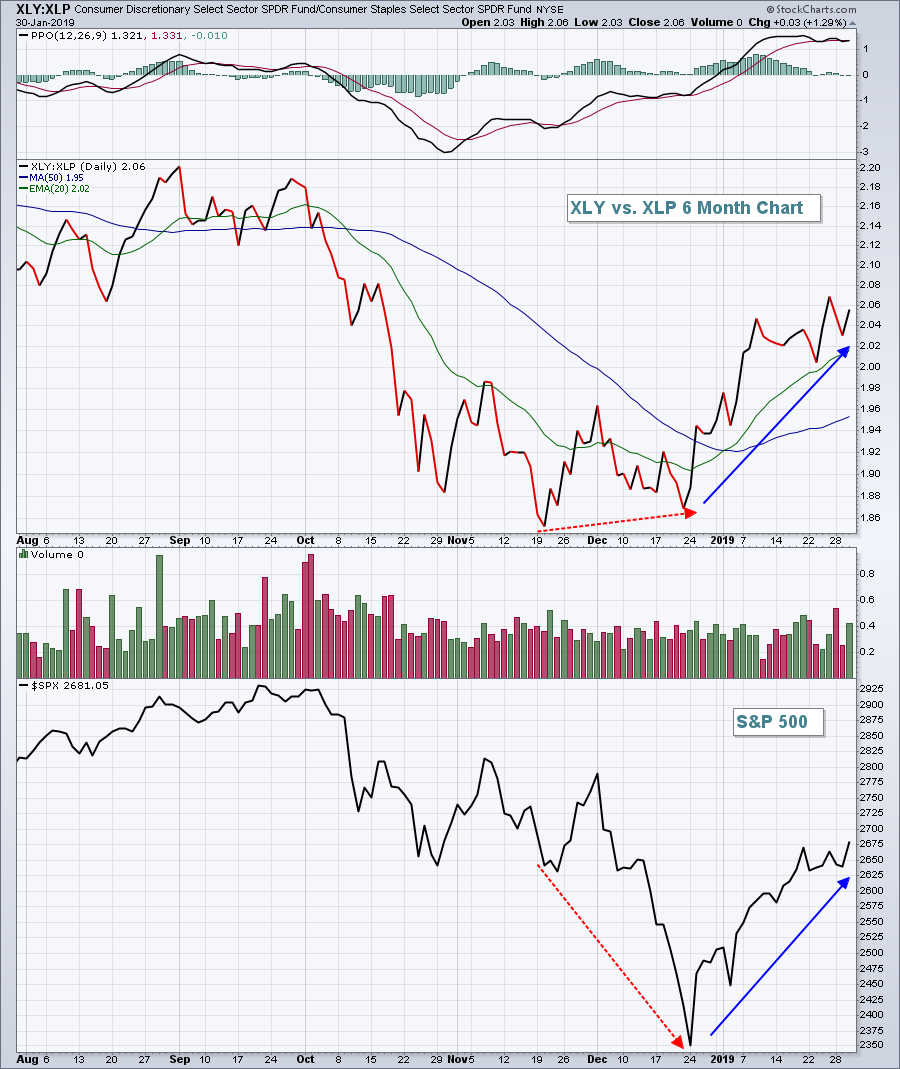

My favorite intermarket relationship, consumer discretionary vs. consumer staples (XLY:XLP), supports the move higher in equities. In other words, based on the current relationship between these two consumer groups, the rally is sustainable. Money continues to rotate more towards the aggressive discretionary sector and that's a good thing. If you look back at the December bottom in the S&P 500, you'll see that the XLY:XLP ratio actually held its previous low:

The red-dotted lines highlight this "positive divergence" in relative strength. Since the December low, the S&P 500 has rallied significantly and the XLY:XLP ratio has gone along for the ride. We didn't see a fresh new high on this ratio yesterday, but it did improve. A continuing move higher in the S&P 500 that is not supported by a rising XLY:XLP would be a potential warning sign.

The red-dotted lines highlight this "positive divergence" in relative strength. Since the December low, the S&P 500 has rallied significantly and the XLY:XLP ratio has gone along for the ride. We didn't see a fresh new high on this ratio yesterday, but it did improve. A continuing move higher in the S&P 500 that is not supported by a rising XLY:XLP would be a potential warning sign.

Sector/Industry Watch

Home construction ($DJUSHB, +1.27%) were dealt a blow yesterday when pending home sales came in well below expectations. The group was trading lower and lagging the overall market, but saw major relief after the FOMC announcement. Fed Chair Powell indicated that the Fed would be patient before raising rates and that was music to home builders' ears. Technically, the improvement continues for this industry:

The daily PPO has remained positive throughout much of January and price action has resided above the 20 week EMA (not shown above) the past few weeks as well. I expect to see a very solid 2019 performance from home construction.

The daily PPO has remained positive throughout much of January and price action has resided above the 20 week EMA (not shown above) the past few weeks as well. I expect to see a very solid 2019 performance from home construction.

Historical Tendencies

I provided the annualized returns for January 31st and February 1st on the NASDAQ yesterday. Today, check out the annualized returns on the Russell 2000 (since 1987) for today and tomorrow:

January 31st (today): +111.60%

February 1st (tomorrow): +167.77%

Key Earnings Reports

(actual vs. estimate):

ABC: 1.60 vs 1.50

ABMD: .97 vs .94

APTV: 1.34 vs 1.21

BAX: .78 vs .73

BBD: .20 (estimate, awaiting results)

BLL: .55 vs .56

BX: (.02) vs .03

CELG: 2.39 vs 2.32

CHTR: 1.29 vs 1.49

COP: 1.13 vs .99

DWDP: .88 vs .89

EPD: .59 vs .50

ETN: 1.46 vs 1.43

GE: .17 vs .18

HSY: 1.26 vs 1.27

IP: 1.65 vs 1.61

MA: 1.55 vs 1.53

MMC: 1.09 vs 1.03

MO: .95 vs .94

NOC: 4.93 vs 4.45

NOK: .15 vs .14

PH: 2.51 vs 2.41

RACE: .88 (estimate, awaiting results)

RDS.A: 1.37 vs 1.30

RTN: 2.93 vs 2.89

S: (.03) vs (.02)

SHW: 3.54 vs 3.56

UPS: 1.94 vs 1.91

VLO: 2.12 vs 1.03

XEL: .42 vs .42

(reports after close, estimate provided):

AFL: .94

AMZN: 5.55

EW: 1.17

MCK: 3.18

SYMC: .39

Key Economic Reports

Initial jobless claims released at 8:30am EST: 253,000 (actual) vs. 220,000 (estimate)

December personal income released at 8:30am EST: +0.4% (estimate - report delayed)

December personal spending released at 8:30am EST: +0.3% (estimate - report delayed)

January Chicago PMI to be released at 9:45am EST: 62.5 (estimate)

November new home sales to be released at 10:00am EST: 560,000 (estimate)

Happy trading!

Tom