Latest News

ChartWatchers2h ago

A Grand Slam: Broader Stock Market Indexes Soar to New Highs

The bull market hasn't gone anywhere. Despite of worrying about the possibility of a correction and a long wait for movement in either direction, the stock market has finally showed its prowess Read More

Stock Talk with Joe Rabil4h ago

Powerful Entry Strategy Using One Moving Average

On this week's edition of Stock Talk with Joe Rabil, Joe explains how to use one SMA to pinpoint great entries in pullback plays, demonstrating how it can develop in slightly different ways Read More

OptionsPlay10h ago

Master The Most Underutilized Options Income Strategy: Cash-Secured Puts

In this exclusive interview, StockCharts' David Keller, CMT, sits down with Jessica Inskip, Director of Education and Product at OptionsPlay Read More

The Final Bar1d ago

China Tariffs Drive Upside for Rare Earth Minerals

In this edition of StockCharts TV's The Final Bar, Dave welcomes Mish Schneider of MarketGauge. Mish breaks down one materials name that could benefit from recently announced China tariffs, and describes how regional banks could benefit from Fed actions in 2024 Read More

OptionsPlay1d ago

Salesforce Falls Out of Favor: Trade the Bear Put Spread Options Strategy

Once a darling of the tech industry, Salesforce (CRM) had fallen out of favor until recently, when it hit a new all-time high earlier this year Read More

Members Only

Larry Williams Focus On Stocks1d ago

Larry's LIVE "Family Gathering" Webinar Airs THIS WEEK - Thursday, May 16 at 2 PM EDT!

ChartWatchers1d ago

Meme Stock Frenzy Back In the Spotlight: Are Traders Losing Patience?

It's CPI and PPI week, and traders seem to be waiting for the data before making investment decisions. While that's happening, surprising action is brewing in meme stocks Read More

Members Only

Martin Pring's Market Roundup2d ago

Four Reasons Why Emerging Markets are Headed Higher

Last February, I wrote an article on emerging markets, using the iShares MSCI Emerging Markets ETF (EEM) as my benchmark. I pointed out that this sector was close, but had not quite broken out to the upside Read More

The Final Bar2d ago

Watch for Higher Lows in These Three Tech Stocks

In this edition of StockCharts TV's The Final Bar, Dave uncovers strength in SQSP using the Stochastics Oscillator and the StochRSI indicator Read More

OptionsPlay2d ago

This is the #1 Options Income Strategy You Should Master

In this exclusive interview, StockCharts' Grayson Roze sits down with Tony Zhang, Chief Strategist at OptionsPlay Read More

DecisionPoint2d ago

DP Trading Room: Bonds & Yields At An Inflection Point

Today's focus was on the current and long-term conditions of Bonds and Yields which are at an inflection point. Yields are attempting to hold onto a rising trend and Bonds are plodding along to the upside for now Read More

GoNoGo Charts2d ago

$SPY FLAGS NEW "GO" TREND IN THE FACE OF DEFENSIVE STRENGTH

Good morning and welcome to this week's Flight Path. We saw some resolution of the uncertainty in the markets this past week. Equities came out of a string of amber "Go Fish" bars to paint an aqua "Go" bar on Friday. The $SPY is a "Go" Read More

Analyzing India3d ago

Week Ahead: Markets to Stay Tentative; This Defensive Sector May Start Showing Relative Outperformance

In the previous technical note, we had expressed concerns over the Nifty and VIX rising in the same direction simultaneously. As mentioned earlier, in such circumstances, the VIX often ends up acting as a leading indicator and a precursor to an impending corrective move Read More

GoNoGo Charts4d ago

Top 5 Stocks in "Go" Trends

Top 5 Stocks in "Go" Trends Trend Continuation on Rising Momentum GoNoGo Charts® highlight low-risk opportunities for trend participation with intuitive icons directly in the price action Read More

The MEM Edge5d ago

MEM TV: This Stealth AI Stock is Ready to EXPLODE Higher

In this episode of StockCharts TV's The MEM Edge, Mary Ellen reviews the bullish bias in the broader markets, along with the sector rotation into cyclical areas as growth areas languish Read More

The Mindful Investor5d ago

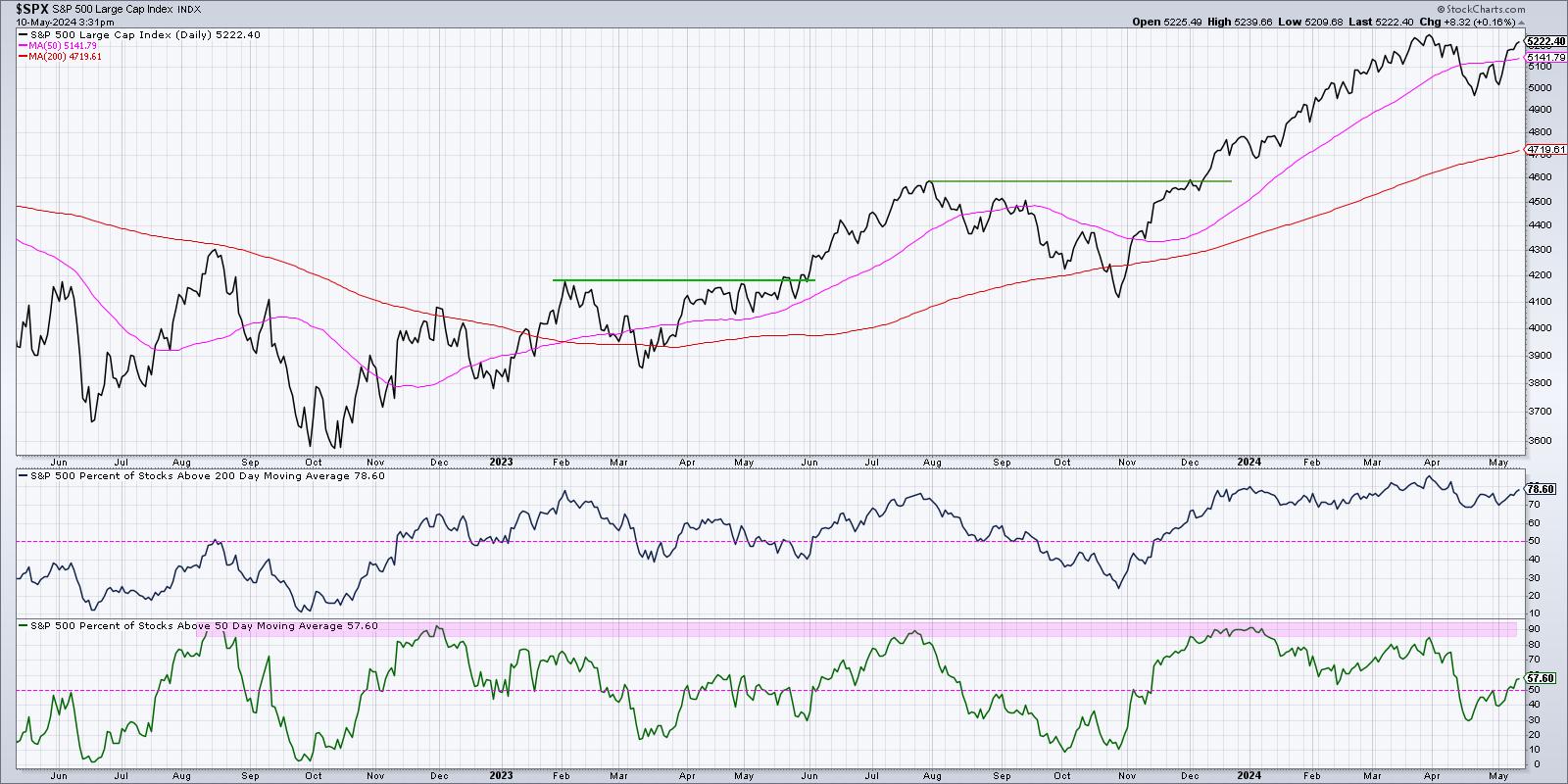

Three Breadth Indicators to Confirm a Bullish Market Trend

There's no denying the strength the major averages have displayed off their April lows. The S&P 500 finished the week within a rounding error of the previous all-time high around 5250 Read More

The Final Bar5d ago

Relative Strength Screams Bullish for This Tech Stock

In this edition of StockCharts TV's The Final Bar, Dave uncovers strength in SQSP using the Stochastics Oscillator and the StochRSI indicator Read More

Art's Charts5d ago

Six Leaders, but One Is Getting Real Frothy

After sharp declines into mid April, stocks rebounded over the last three weeks and the S&P 500 SPDR (SPY) came within 1% of its March high. This March high acts as a benchmark high that chartists can use to compare performance Read More

The Final Bar6d ago

Stocks Pop Higher as Defensive Sectors Thrive

In this edition of StockCharts TV's The Final Bar, Dave breaks down an unusual day for stocks Read More

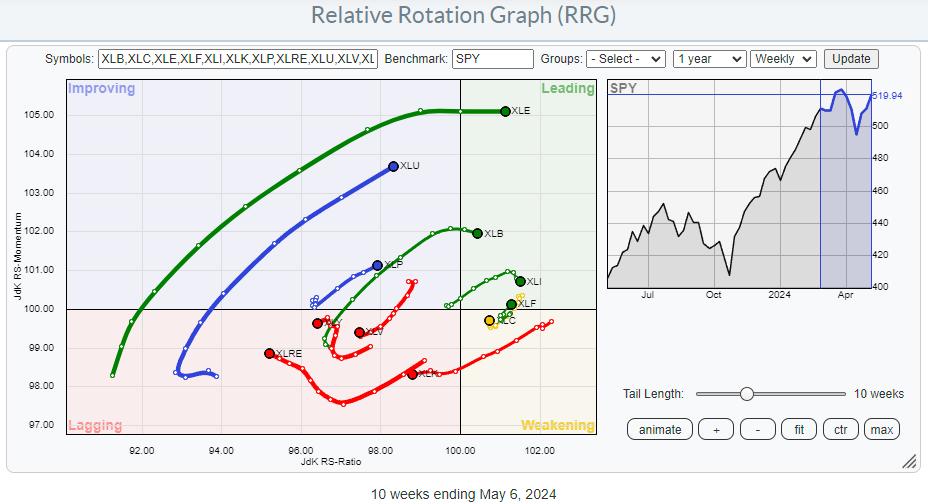

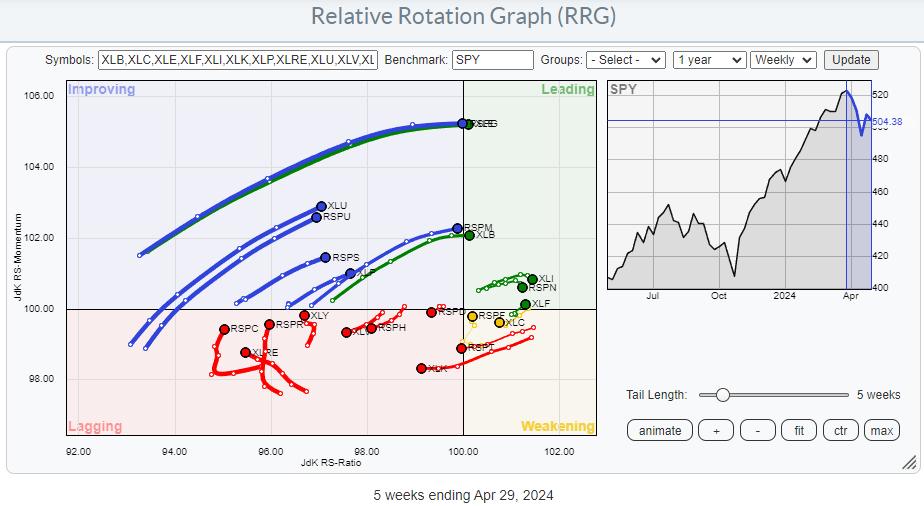

RRG Charts6d ago

These Three Strong Financial Stocks Look Ready To Surge Higher

The Relative Rotation Graph for US sectors shows long tails for XLE and XLU. Both are on a strong RRG-Heading toward or into the leading quadrant. Also inside the leading quadrant are XLB and XLI, though they have rolled over and are starting to lose a bit of relative momentum Read More

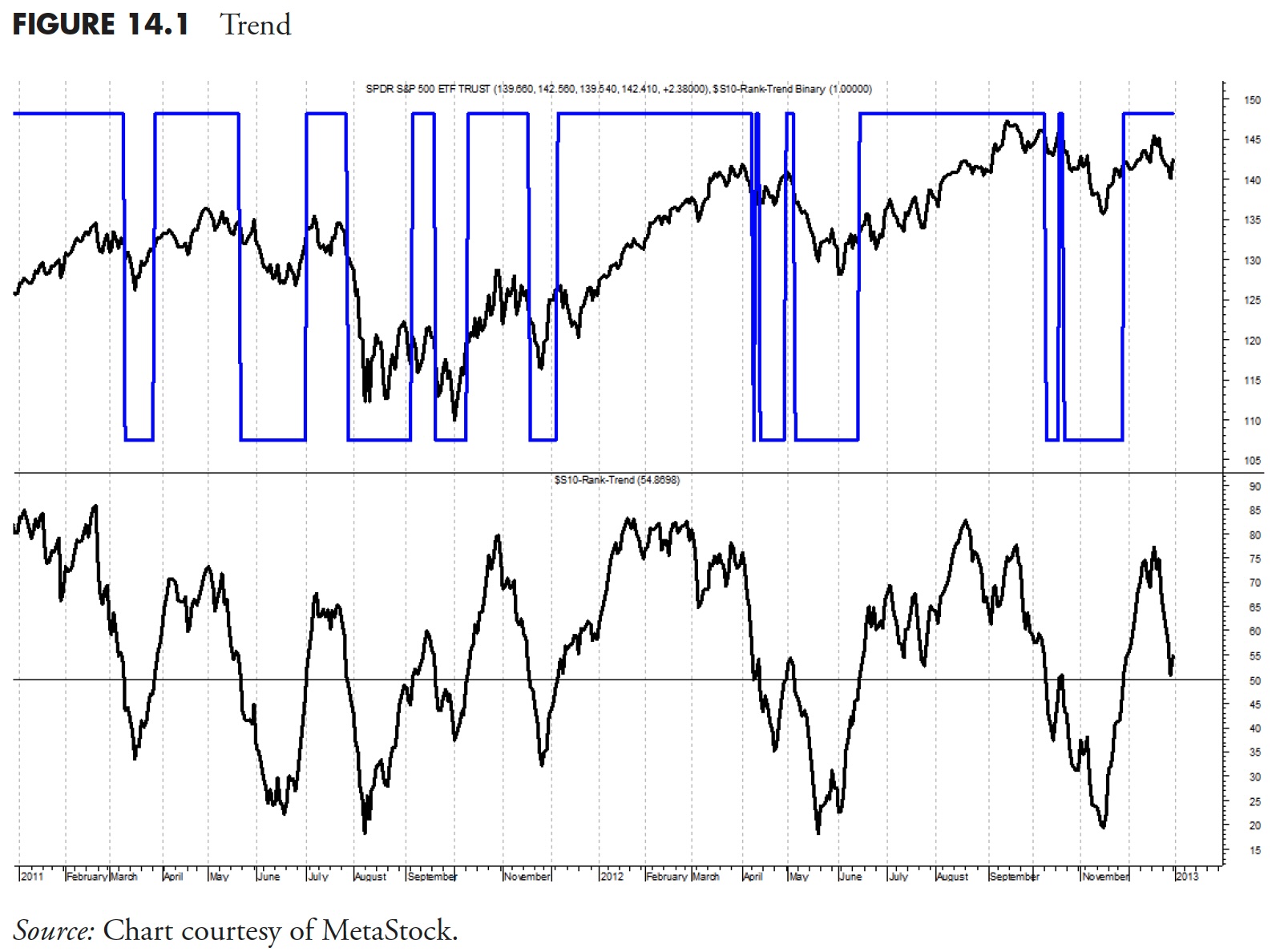

Dancing with the Trend6d ago

Rules-Based Money Management - Part 4: Security Ranking Measures

Note to the reader: This is the twentieth in a series of articles I'm publishing here taken from my book, "Investing with the Trend." Hopefully, you will find this content useful Read More

Trading Places with Tom Bowley6d ago

This Is What I Mean By Leading Stocks In Leading Industry Groups

Sample Report A few days ago, I provided a sample of our Weekly Market Report (WMR), which is sent to our EarningsBeats.com members on Mondays. Below is a sample of our Daily Market Report (DMR), sent out to members on Tuesdays through Thursdays Read More

The Final Bar6d ago

The Top Performing Sector is Utilities?!?

In this edition of StockCharts TV's The Final Bar, Dave recaps a choppy day for equities, with utilities remaining atop the leaderboard for a second straight session Read More

DecisionPoint1w ago

Silver Cross BUY Signals on the Dow (DIA) and Russell 2000 (IWM)

The Dow Jones Industrial Average ETF (DIA) 20-day EMA crossed up through the 50-day EMA (a Silver Cross), generating an IT Trend Model BUY Signal. The Dow saw a better rally today than the SPY, but, under the hood, it isn't quite as strong as the SPY Read More

Stock Talk with Joe Rabil1w ago

What Rising Volatility Means to the Current Market

On this week's edition of Stock Talk with Joe Rabil, Joe explains how he uses a rising volatility condition to signal increased risk Read More

The Final Bar1w ago

Is the S&P 500 Forming a Bear Flag Pattern?

In this edition of StockCharts TV's The Final Bar, Dave focuses in on price pattern analysis for the S&P 500, then reflects on the emergence of defensive sectors like consumer staples. He also recaps earnings movers, including DIS, SHOP, and more Read More

Members Only

Martin Pring's Market Roundup1w ago

NYSE and Global A/D Lines Trade at New All-Time Highs

The magnitude and duration of corrections are largely determined by the direction of the prevailing primary trend. If it's bearish, they tend to be more severe and last longer Read More

Don't Ignore This Chart!1w ago

Why Novo Nordisk's Stock Price Recovery Makes It a Promising Buy

Novo Nordisk (NVO) reported Q1 earnings on May 2. Even though it was a positive report, sales of its weight-loss drug Wegovy came in below expectations, causing the NVO stock price to fall lower Read More

The Final Bar1w ago

The Market Breadth Indicator You Should Be Following

In this edition of StockCharts TV's The Final Bar, Dave recaps another strong day for stocks as the S&P 500 regains its 50-day moving average Read More

Trading Places with Tom Bowley1w ago

Here's My Long-Term Perspective on U.S. Stocks

EB Weekly Market Recap Video If you haven't seen our latest weekend recording, it's now available HERE at YouTube.com. Sample - EB Weekly Market Report This is a sample of our Weekly Market Report that is sent to EB members every Monday Read More

DecisionPoint1w ago

DP Trading Room: Two Industry Groups To Watch!

Today Erin uncovers two industry groups that are showing strength and potential in the short term. She takes a look "Under the Hood" to reveal participation and trends that are quite bullish Read More

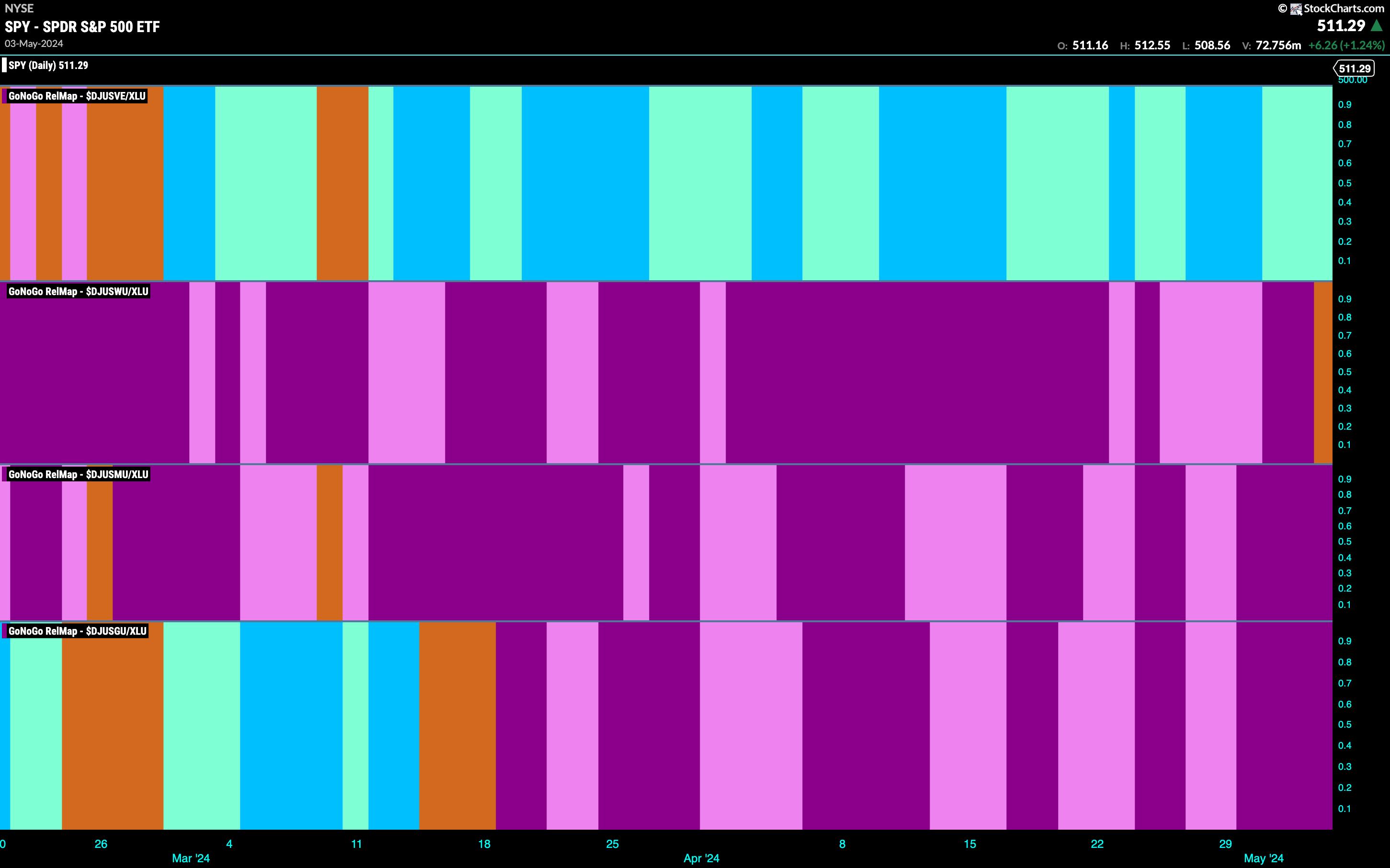

GoNoGo Charts1w ago

DEFENSE TRIES TO HELP EQUITIES MOVE OFF LOWS

Good morning and welcome to this week's Flight Path. The equity "NoGo" trend struggled this week as prices climbed from lows. We see an amber "Go Fish" bar as the market tries to understand the trend Read More

Trading Places with Tom Bowley1w ago

It's May, So Should We Go Away?

We've all heard that popular Wall Street adage, "Go away in May", right? It's cute and it rhymes, so why wouldn't we make the HUGE decision to liquidate all of our stock holdings? Did I mention it rhymes? One of the biggest disservices to investors everywhere is the "al Read More

Analyzing India1w ago

Week Ahead: NIFTY Stays Vulnerable to Disruption of Primary Trend; Volatility Likely to Stay

The markets traded in a much wider range in the past trading week. Over the past few days, we had seen the markets and the VIX inching higher, i.e. moving in the same direction Read More

The MEM Edge1w ago

MEM TV: NVIDA is Setting Up To SURGE

In this episode of StockCharts TV's The MEM Edge, Mary Ellen reviews the key drivers for this week's volatile period, including Core PCE and GDP numbers. She takes a look at where the S&P 500 and NASDAQ closed for the week and whether it's safe to put new money to work Read More

Art's Charts1w ago

Is this a Dead-Cat Bounce or a Bounce with Legs?

Stocks fell sharply into late April and then rebounded over the last two weeks. SPY fell 5.34% from March 28th to April 19th and then rebounded with a 3.26% gain the last two weeks Read More

ChartWatchers1w ago

Technology Stocks Back In the Lead: Are Inflation Fears Behind Us?

The weaker-than-expected jobs report gave the stock market some direction, a nice treat before the 150th Kentucky Derby. Job growth slowed, and the unemployment rate ticked up to 3.9%. If this trend continues, the market may price in more than one interest rate cut this year Read More

The Final Bar1w ago

Key Breadth Indicator Flashes Buy Signal for Nasdaq 100

In this edition of StockCharts TV's The Final Bar, Dave opens The Final Bar mailbag to answer viewer questions on the Nasdaq Bullish Percent Index, the value of long-term technical analysis techniques, how sentiment indicators relate to the market trend, and how the CMT program h Read More

The Mindful Investor1w ago

The Bull Case for Buffett's Biggest Holding

As investors flock to Omaha, Nebraska in their annual pilgrimage to learn from the great Warren Buffett, it seems an opportune time to reflect on the technical evidence for Berkshire's biggest holding, Apple (AAPL) Read More

RRG Charts1w ago

Diverging Tails on This Relative Rotation Graph Unveil Trading Opportunities

All on the Same Track or? The difference between equal-weighted sectors and cap-weighted sectors is obvious. Namely, the cap-weighted variant is much heavier and is impacted by the changes in some heavy-weight, often mega-cap, stocks Read More