DecisionPoint January 31, 2016 at 12:33 PM

Really? Something interesting about mutual funds? Well, I had to put some kind of hook in the title, because the subject matter doesn't normally induce a rapid pulse rate, but there are some interesting things to be known... Read More

DecisionPoint January 28, 2016 at 06:07 PM

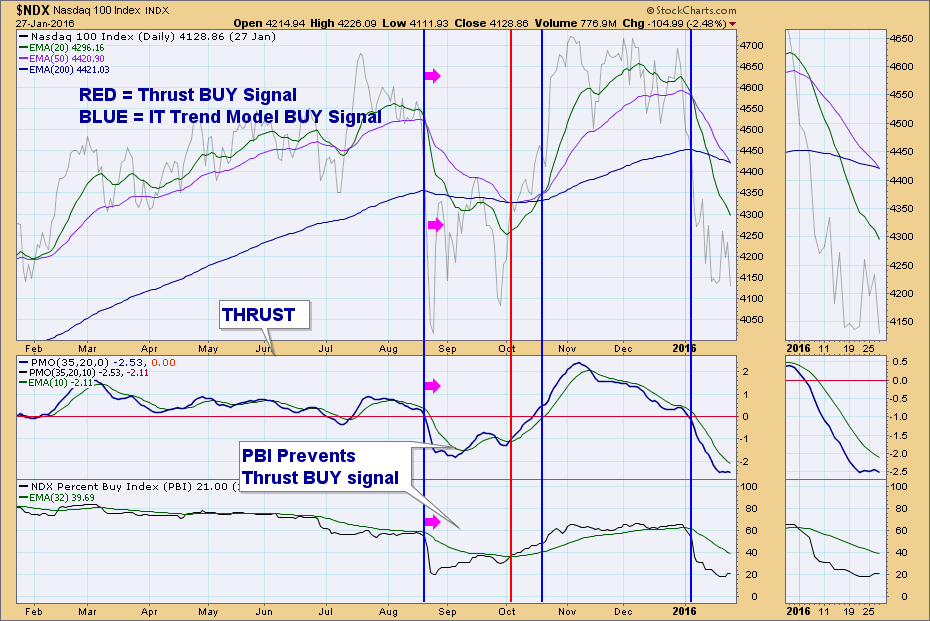

During yesterday's webinar, I stirred up some renewed interest in the DecisionPoint Thrust/Trend Model with a reader request for the model analyzed on the Nasdaq 100... Read More

DecisionPoint January 26, 2016 at 08:21 PM

I received a comment on one of my blog articles from a long-time follower, John Latta... Read More

DecisionPoint January 23, 2016 at 10:48 PM

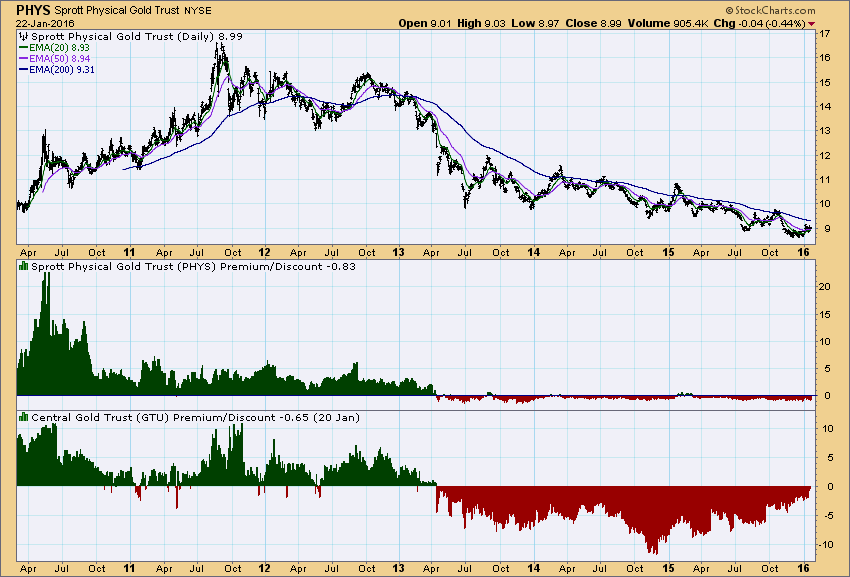

One of the best sentiment indicators we had for gold was the premium/discount for Central Gold Trust (GTU), a closed-end fund which owned only gold bullion... Read More

DecisionPoint January 21, 2016 at 08:32 PM

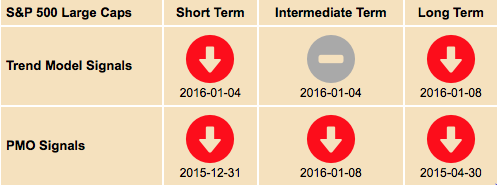

I'm asked frequently, especially now that we use the DecisionPoint Scoreboards, "What is a Neutral signal?" You'll see on the DecisionPoint Scoreboard for the S&P 500 (found in the DP Chart Gallery) that all sections are red except for the Intermediate-Term Trend Model (ITTM) whi... Read More

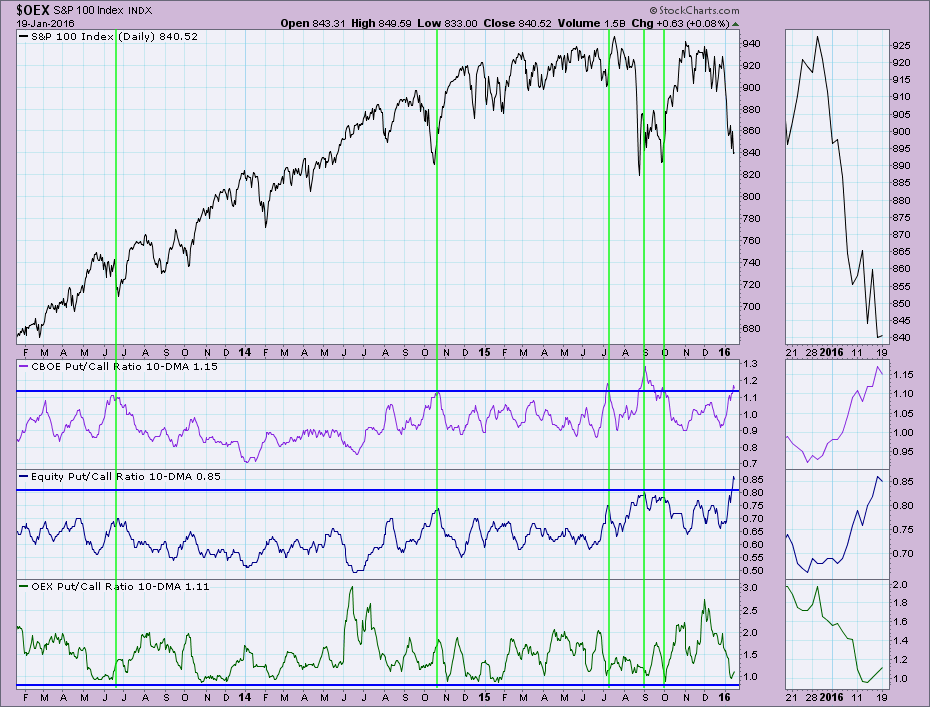

DecisionPoint January 19, 2016 at 06:51 PM

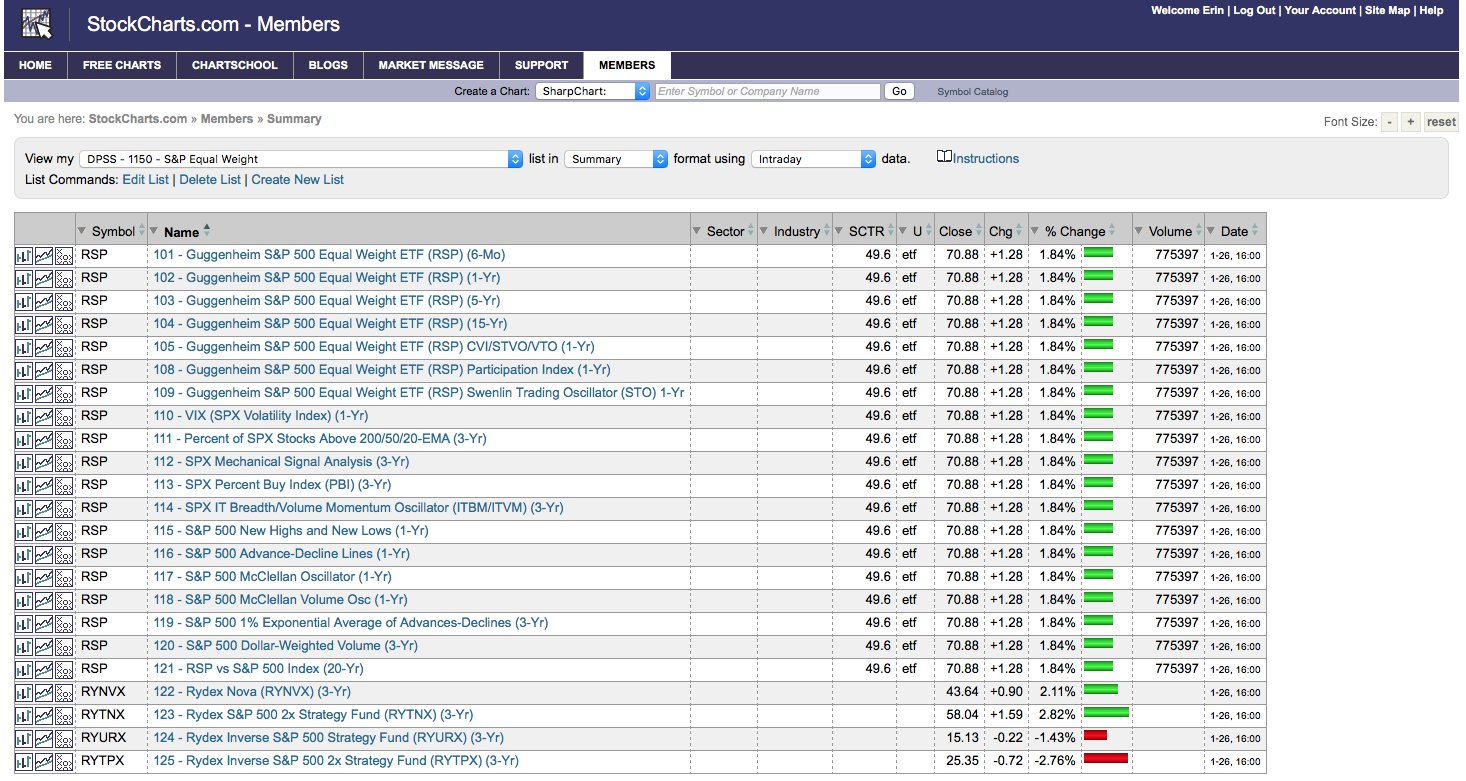

DecisionPoint with StockCharts.com offer numerous ready-to-go indicators and charts. The easiest way to observe them is by downloading the DecisionPoint Market Indicators ChartPack... Read More

DecisionPoint January 17, 2016 at 10:23 AM

It was an unbelievably choppy week, with Friday delivering a stunning reversal from the strong advance of the previous day. Intraday SPY was down -12% from its all-time high last July, and with Friday's intraday low, SPY may have found support at the September low... Read More

DecisionPoint January 14, 2016 at 08:02 PM

First, I am not encouraging anyone to buy stocks in a bear market. If you are evaluating investments in a bear market, you do need to keep a few things in mind. In a bear market the majority of stocks are in decline (hence it being a bear market)... Read More

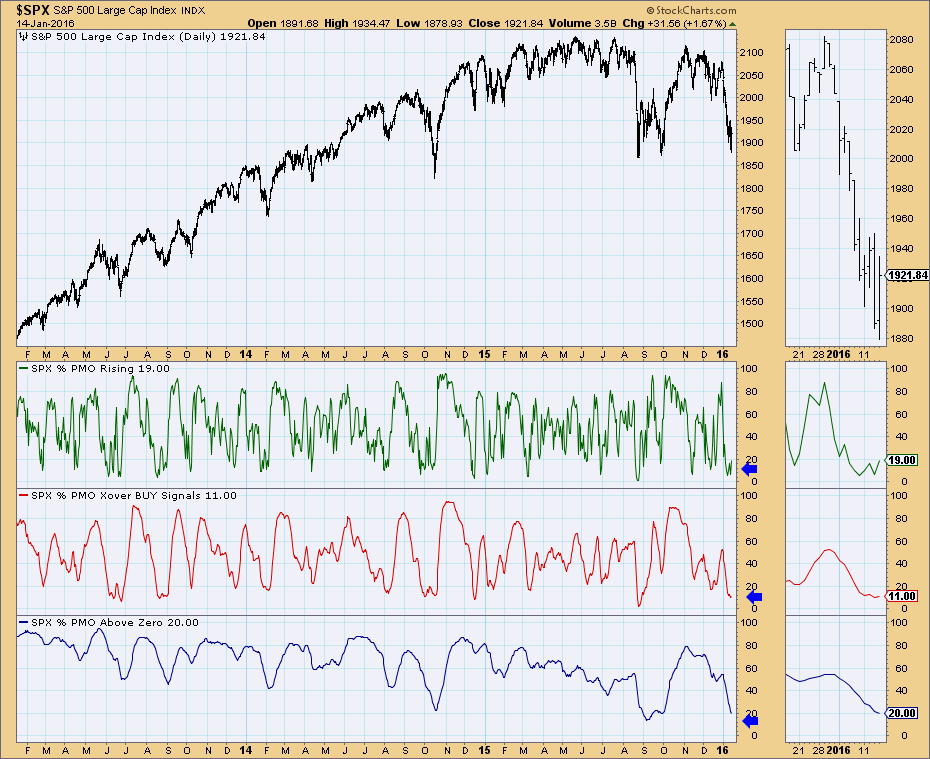

DecisionPoint January 12, 2016 at 07:27 PM

The S&P 500 entered a Long-Term Trend Model SELL signal last Friday. This occurred when the 50-EMA crossed below the 200-EMA... Read More

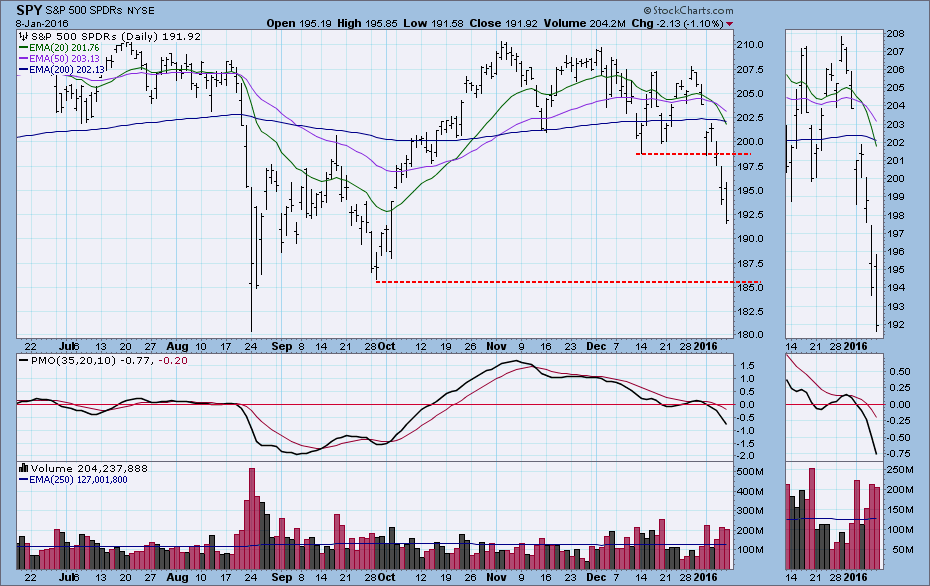

DecisionPoint January 09, 2016 at 11:20 PM

After a particularly brutal week, a lot of people are wondering if the correction is about over. The first place I look is the daily chart to see if there are any obvious support levels coming into play... Read More

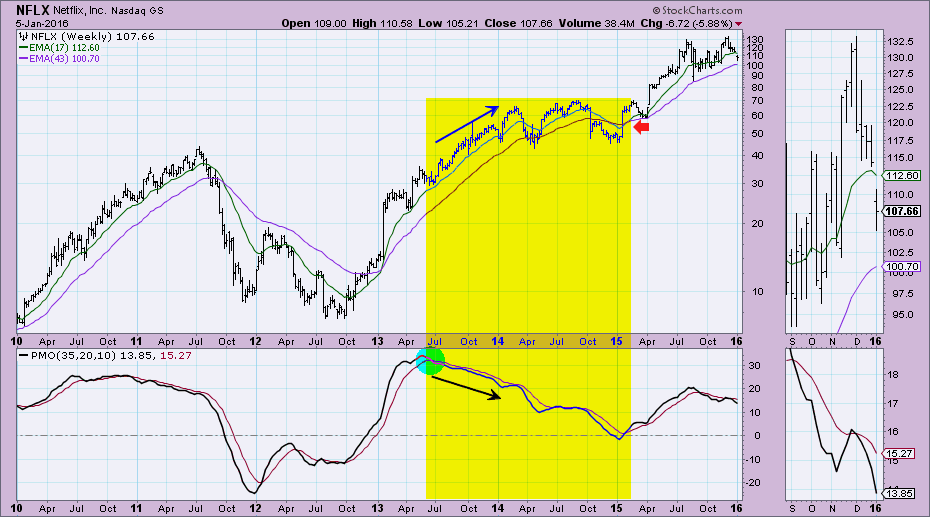

DecisionPoint January 07, 2016 at 08:47 PM

The Nasdaq 100 (NDX) and technology stocks in general have avoided serious damage through the past year. The corrective move on the NDX in August never caused a 50/200-EMA negative crossover, meaning it avoided the DecisionPoint "bear market" label... Read More

DecisionPoint January 05, 2016 at 08:25 PM

My favorite part of my webinars is the "Question of the Day". I welcome emails and comments from my readers as you challenge me to think outside of the box or clarify my analysis... Read More

DecisionPoint January 03, 2016 at 01:57 PM

There is an inverse relationship between gold and the dollar, but it is far from exact... Read More