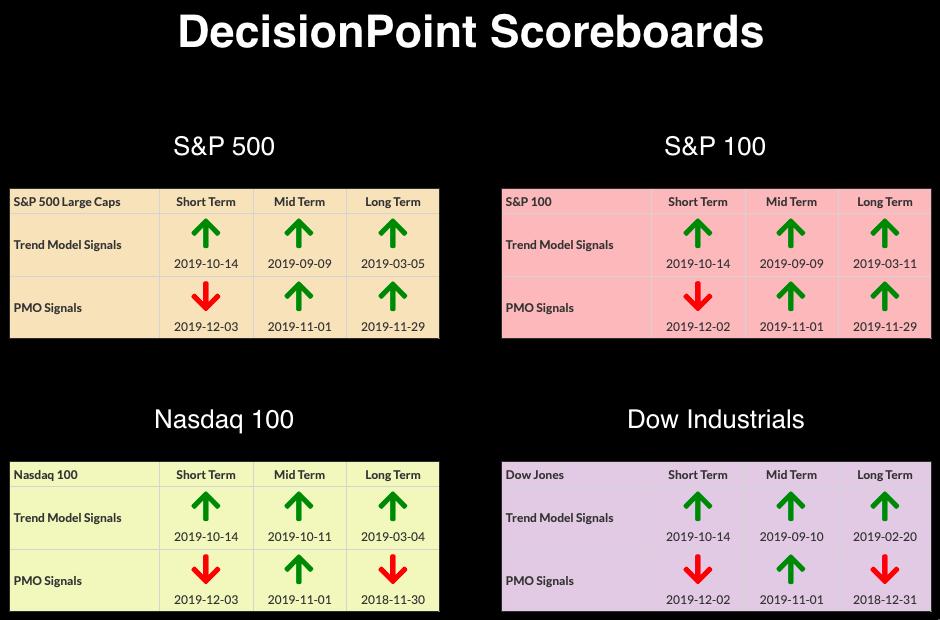

The market is beginning to act "toppy" again and could be forming a bearish double-top. In the meantime, the Dollar is falling fast, Oil is hitting resistance, Gold is limping along and Bonds are looking particularly bullish right now. Indicators are perking up somewhat, but overall there are still quite a few mixed messages. The Long-Term PMO SELL signals on the DP Scoreboards are getting "green" again. These signals are generated by the monthly PMO, which moves exceedingly slowly. The problem at hand are the ST PMO SELL signals; despite rising trends, momentum is negative. I would like to see the PMOs at least turn back up.

The DecisionPoint Alert presents a mid-week assessment of the trend and condition of the stock market (S&P 500), the U.S. Dollar, Gold, Crude Oil and Bonds.

Watch the latest episode of DecisionPoint on StockCharts TV's YouTube channel here!

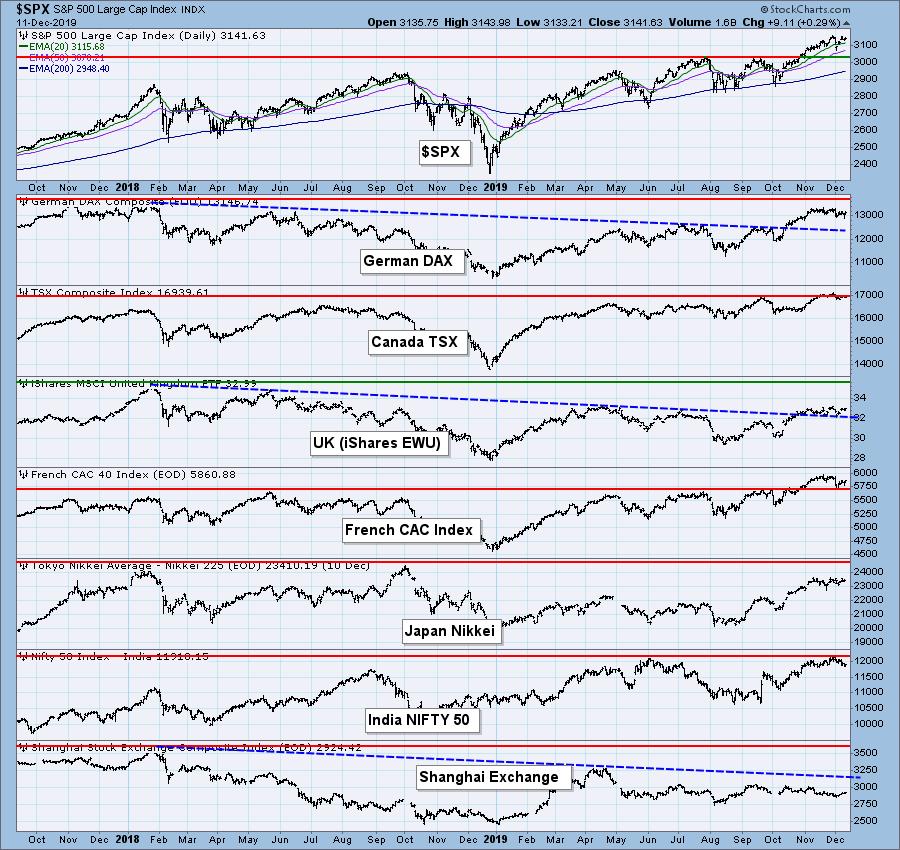

GLOBAL MARKETS

Note that China is still in a bear market.

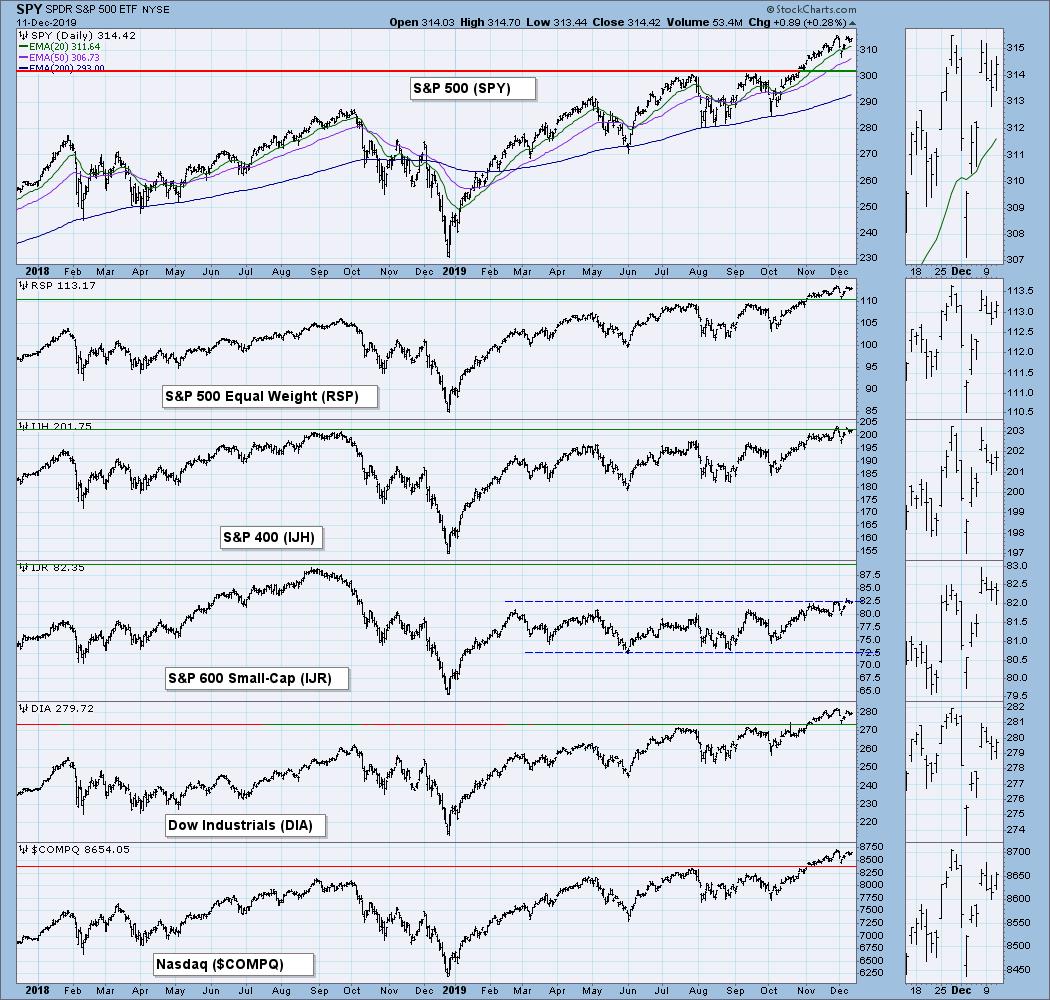

BROAD MARKET INDEXES

Small-caps did finally break out from last month's high, but they are still well below all-time highs, unlike the other indexes.

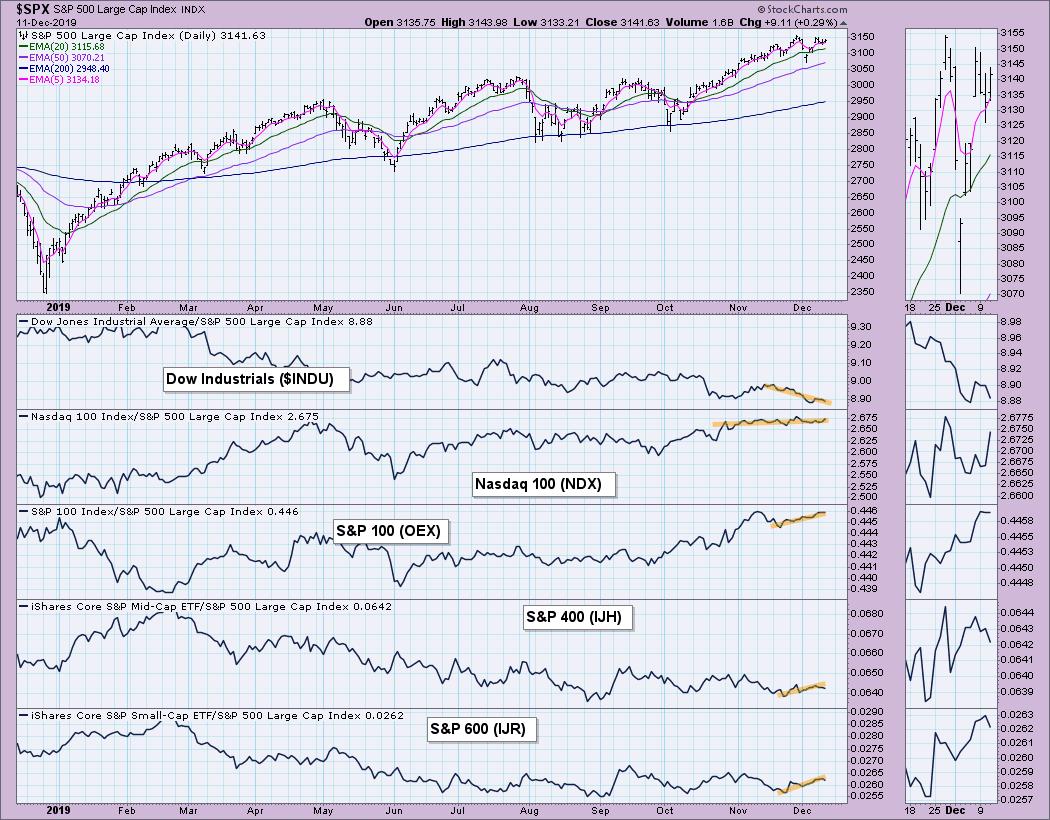

MARKET INDEXES PRICE RELATIVE TO SPX

I'm happy to see the Mid-Caps and Small-Caps outperforming once again.

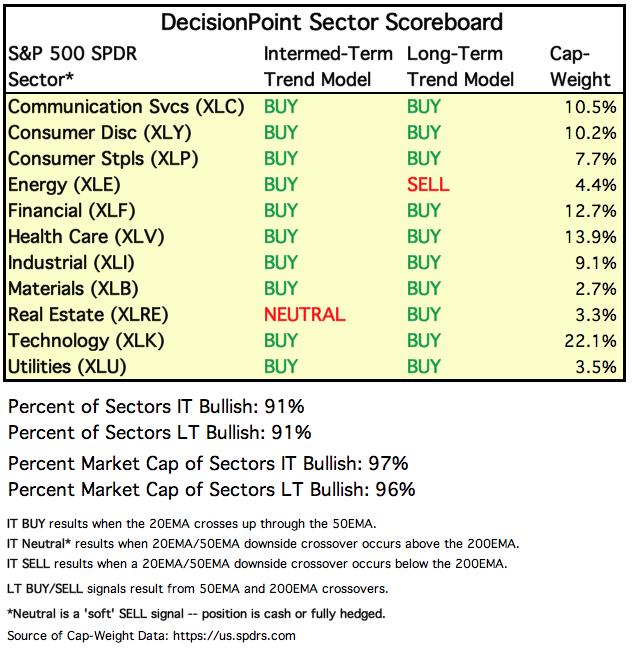

SECTORS

Each S&P 500 Index component stock is assigned to one, and only one, of eleven major sectors. This is a snapshot of the Intermediate-Term and Long-Term Trend Model signal status for those sectors.

STOCKS

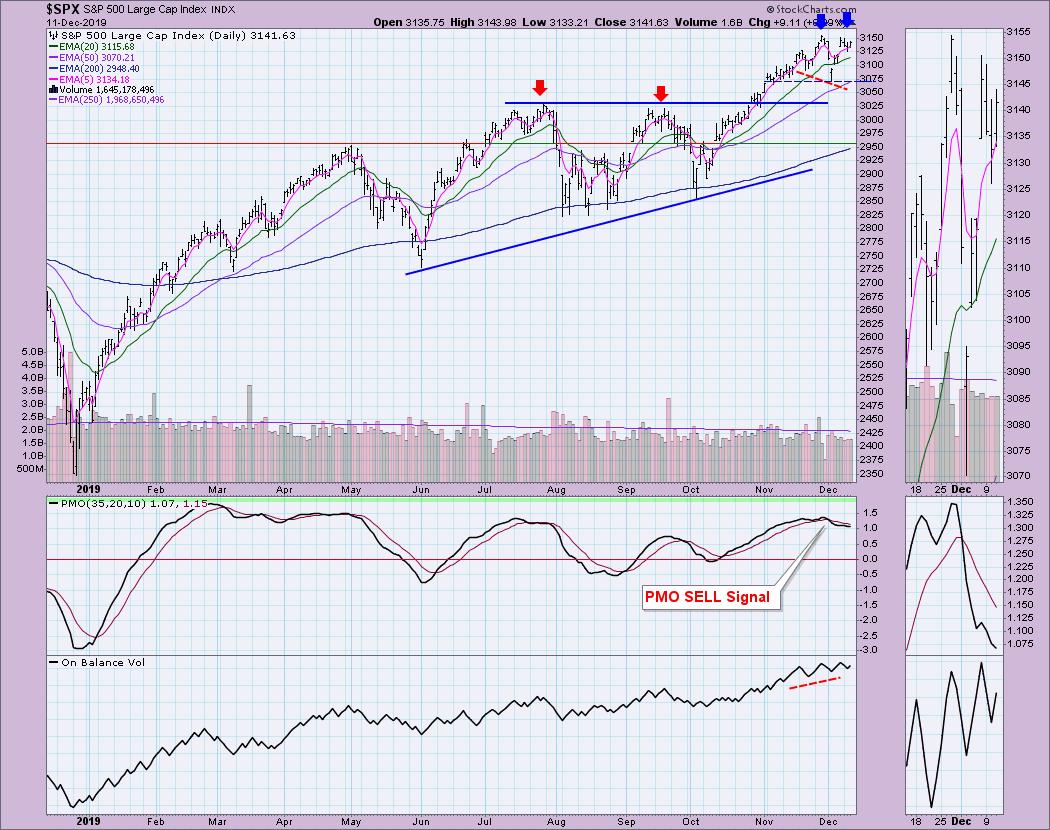

IT Trend Model: BUY as of 9/4/2019

LT Trend Model: BUY (SPY) as of 2/26/2019

SPX Daily Chart: There are quite a few problems here. First, it appears the positive divergence with the OBV played out with the rally last week; price is now beginning to trend lower. The bullish ascending triangle broke to the upside as expected. We are currently looking at the formation of a possible double-top. The expectation right now to complete the pattern is a move to test support at last week's low. Price looks toppy, so I am expecting the declining trend to continue. Momentum has been bearish since the end of November.

Climactic Market Indicators:

Not much to talk about on this chart as far as breadth is concerned, but the VIX has pierced the bottom Bollinger Band and is now headed higher. Typically, this is good for the market. When fears rise, so does the VIX (or, on our chart, falls, since we invert it for use with overbought and oversold analysis). Sentiment is contrarian; when we see rising fear or a bottom on the inverted VIX, that generally results in short-term upside movement. The problem I see is that the VIX has remained under its average since the beginning of December. Therefore, I wouldn't really be thinking rally, unless we see a rally pop and then fail.

Short-Term Market Indicators: We have seen a great deal of improvement on the short-term indicators as the have nearly broken their declining trend. They are not overbought, but they are beginning to decelerate.

Intermediate-Term Market Indicators: The ITVM looks healthier, but it hasn't had a positive crossover yet. The ITBM is decelerating but hasn't turned up so far.

Conclusion: Short-term indicators look fairly healthy and the VIX is suggesting some short-term upside. However, I am not impressed. I'm concerned about primarily the double-top formation, as well as declining momentum. Hard to start a nice rally with no upside momentum.

DOLLAR (UUP)

IT Trend Model: BUY as of 11/7/2019

LT Trend Model: BUY as of 5/25/2018

UUP Daily Chart: The double-top has executed. The minimum downside target is just below October lows. This seems a good place for a rebound, but with negative momentum, declining OBV and the SCTR in the basement, I am not looking for a rebound just yet.

GOLD

IT Trend Model: Neutral as of 11/8/2019

LT Trend Model: BUY as of 1/8/2019

GOLD Daily Chart: Gold is traveling in a bullish falling wedge. The expectation of this pattern is an upside breakout. The PMO is showing promise and we are starting to see higher discount rates this month. That is a sentiment measure. Higher discounts suggest bearish sentiment. Sentiment being contrarian, that could be good for Gold.

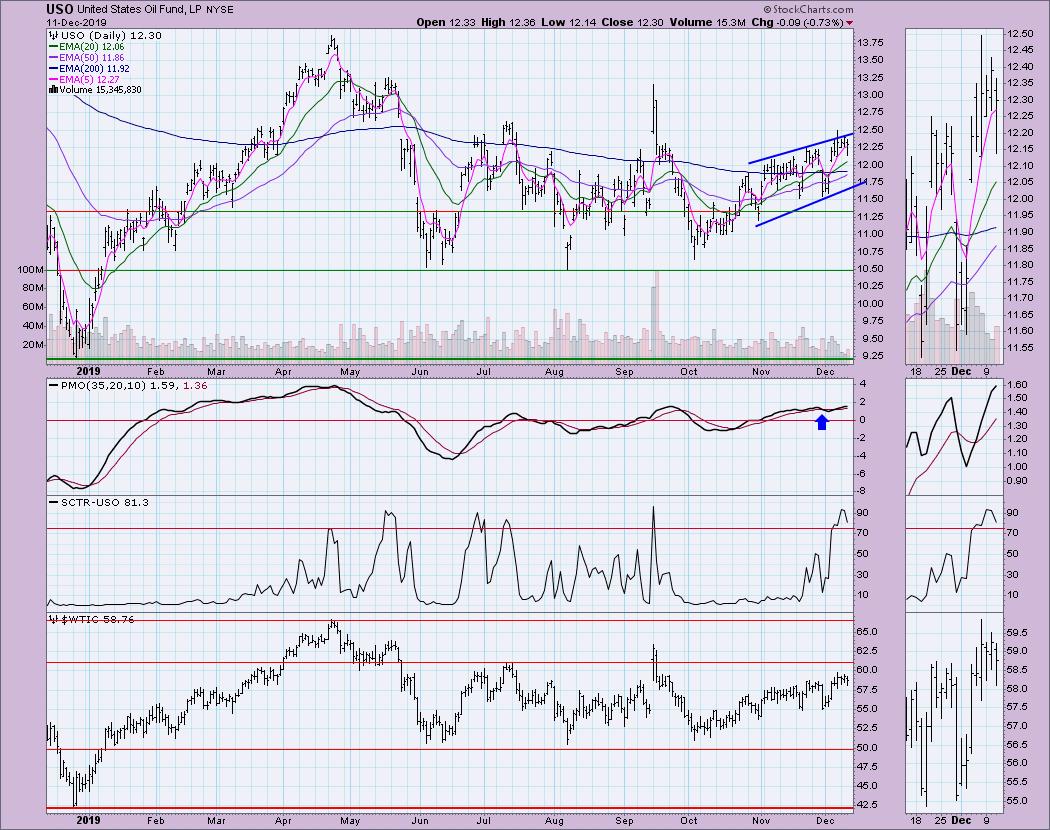

CRUDE OIL (USO)

IT Trend Model: BUY as of 11/6/2019

LT Trend Model: SELL as of 6/4/2019

USO Daily Chart: I believe the rising wedge is still in play despite last week's pop outside. The expectation would be a breakdown. However, I can't get that bearish on USO given the rising PMO and nice SCTR. I don't usually include the weekly charts, but I note that, on USO's weekly chart, important overhead resistance has been reached. Price needs to break out here.

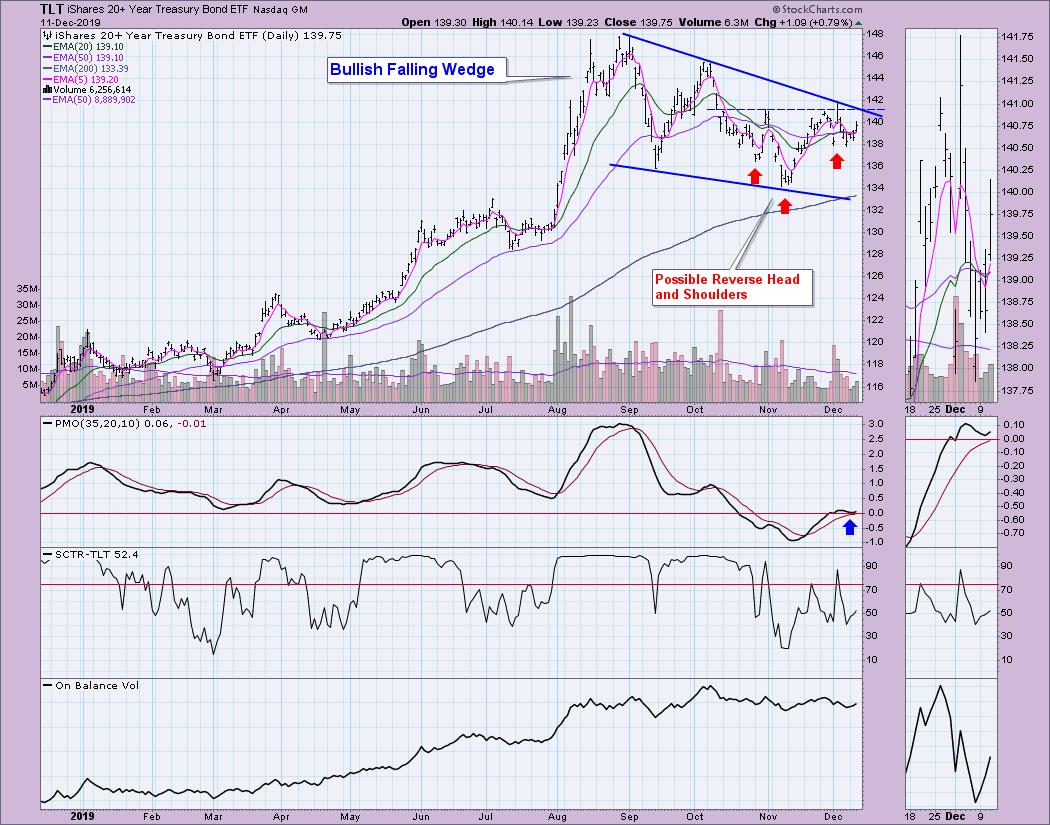

BONDS (TLT)

IT Trend Model: BUY as of 12/11/2019

LT Trend Model: BUY as of 1/2/2019

TLT Daily Chart: I've been bullish on bonds for sometime and I remain bullish. We have a bullish falling wedge in the intermediate-term and a short-term reverse head-and-shoulders. The PMO averted a drop below the zero line and is now rising again. The risk here is another failure at overhead resistance, which could take price down to the bottom of the wedge. However, the chart has a number of bullish features. Volume pattern is nice as we see volume rising on this current rally.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting! - Erin

Email: erinh@stockcharts.com

Do Not Miss Market Vision 2020 Online Conference!

I am so excited to participate in "Market Vision 2020", an online financial conference on Saturday, January 4, 2020 to kick off the new year. Make sure you're subscribed to the Market Vision 2020 newsletter in order to receive the latest updates on the event (and save a lot of money if you decide to attend!). *Click Here* to subscribe to the free newsletter. There will be lots of giveaways and free educational events for everyone who follows along – don't be left out!

Erin Swenlin will be presenting at the The MoneyShow Las Vegas May 11-13, 2020! You'll have an opportunity to meet Erin and discuss the latest DecisionPoint news and Diamond Scans. The conference is free to attend or view online!

**Don't miss any of the DecisionPoint commentaries! Go to the "Notify Me" box toward the end of this blog page to be notified as soon as they are published.**

NOTE: The signal status reported herein is based upon mechanical trading model signals, specifically the DecisionPoint Trend Model. These define the implied bias of the price index based upon moving average relationships, but they do not necessarily call for a specific action. They are information flags that should prompt chart review. Further, they do not call for continuous buying or selling during the life of the signal. For example, a BUY signal will probably (but not necessarily) return the best results if action is taken soon after the signal is generated. Additional opportunities for buying may be found as price zigzags higher, but the trader must look for optimum entry points. Conversely, exit points to preserve gains (or minimize losses) may be evident before the model mechanically closes the signal.

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)