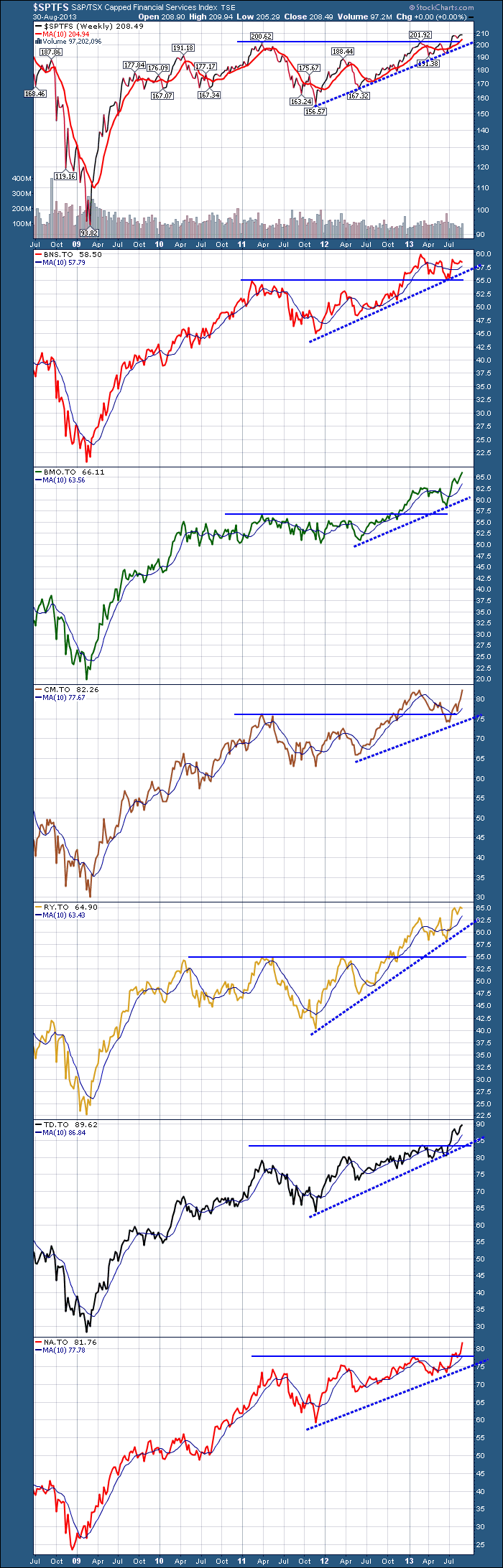

The vast majority of Canadian banks made new highs this week. Click here for a live chart.

It is not uncommon for volume to spike on earnings weeks. But the real story was Volume, Volume, Volume relative to history.

This week, one bank stock had 3 year volume highs, and many had 'top 2,3 or 5' volume weeks over a 2 year look back.

BNS had a good week. It did not test all time highs but it had a large volume candle on a flat week. Third largest volume week since 2011.

BMO made new highs this week, but had a weak Friday close. Who cares? The largest volume candle in over 2 years!

CIBC (CM) had a huge week. Up 3% on huge volume. The largest volume candle since 2010.

Royal (RY) is a whisker away from new highs. It came up short trying to break above July highs. It was a top 5 volume candle in the last 2 years.

TD broke out to all time highs. Highest volume on an up week in 2 years since 2011. Second largest volume candle (up or down) since 2011.

National (NA) had a huge week also. Soaring up almost 4% with a top 5 volume candle over the last 2 years. It cleanly broke above a cap at $79 to new all time highs.

Francis on BNN called the overall $TSX volume 'August light' volume. Hidden in the details were the Canadian bank volumes this week. The Canadian banks had buyers showing up for work in a big big way. It takes institutions to make these volume bars move. It takes a lot of institutions in the country to be buying to push these volume bars on the Canadian banks this high. If you looked at the US tickers of the Canadian banks, the volumes were much more muted.

There were Canadian buyers showing up and they are usually the 'buy and hold' buyers. Large Institutions. These are their footprints. So much for 'August light' volume! They could also be institutions selling large volumes into the breakout demand. But the sector continues to outperform so why would institutions sell their strongest sector? Its more likely they added to winning positions.

The SCU 101 and SCU 102 courses qualify for CE Credits for CFA's. We'll be holding them in Vancouver in January 2014.

You can subscribe to this blog as an RSS feed by clicking here. The Canadian Technician

You can subscribe to this blog as an email by clicking on the subscribe on the right hand side of the Canadian Technician blog page. Look for this area as shown below.

Good Trading,

Greg Schnell, CMT