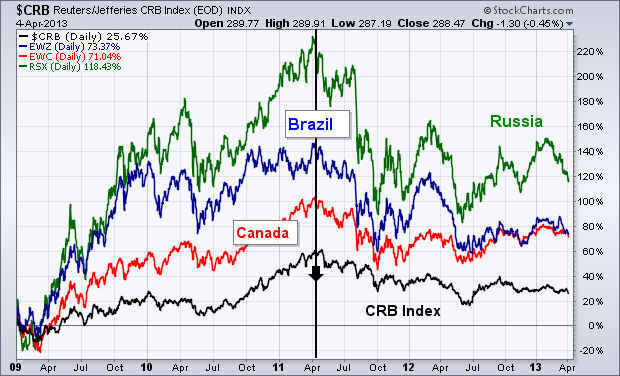

This is the same headline used in my March 21 message which showed how falling commodities were hurting stocks of countries that produced commodities. A rising dollar causes foreign stocks to underperform U.S. stocks, which has been the case since the dollar bottomed during 2008. A rising dollar hurts commodity prices. As a result, foreign countries that produce and export commodities take a double hit. The March 21 message showed the close positive correlation between commodity prices and Brazil and Canada. Today, I'm adding Russia to the mix. Chart 1 compares the trend in the CRB Index (bottom line) to Brazil (blue line), Canada (red line), and Russia (green line) iShares since 2009. You can see the visual correlations. All four markets rose together until the spring of 2011. The CRB Index peaked that spring (thanks to a rising dollar), and has continued to weaken. Brazil, Canadian, and Russian stock ETFs peaked at the same time and have continued to weaken along with commodities. Russia's stock market is especially sensitive to trends in energy, which is its biggest export market. Relative weakness in the Chinese stock market (which is the world's biggest importer of commodities) has also hurt demand for commodities and country stocks that produce them.