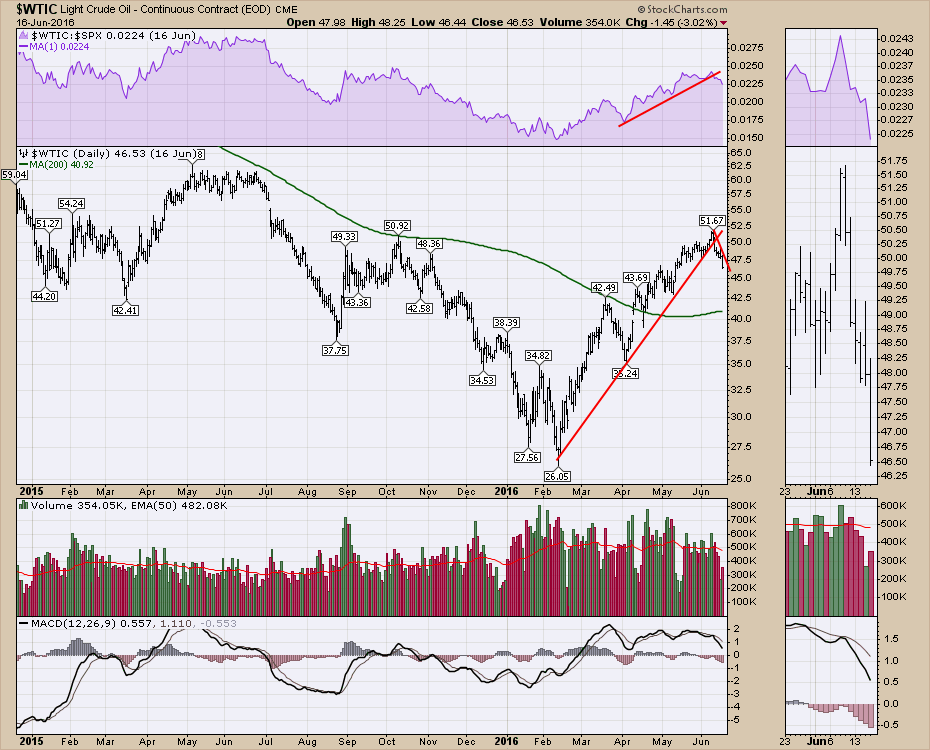

Oil has started a correction after doubling off the January lows. With crude oil inventories still high, some are betting on a major collapse, but the pullback has been gentle so far. Thursday accelerated with a 3% down day. The 200 DMA at $41 is support at this point.

On the webinar, we covered off a few topics. One particular discussion was the linkage between gold and commodities. Often, people want to link gold as a currency. It continues to behave as a commodity in my study of the larger trends.

"Commodities Countdown LIVE!" with Greg Schnell - 2016-06-16 17:00 from StockCharts.com on Vimeo.

Webinar // Gold, Silver 0:00 // Agricultural Commodities 16:00 // Lumber 27:00 // Energy 27:00 // Industrial Metals 39:00 // Gold as a Commodity 39:00 // $CRB Components 48:00 // Japan 51:00 //

On the GLD chart, we had a large reversal where we gapped to new highs and then retreated all day. This created an outside day on massive volume. Caution is still advised.

Silver had a bigger reversal on SLV. Here we see a complete reversal that took out the high and the low of the previous four days. This is a Tom DeMark reversal on a daily chart. So far on Friday, we gapped up a little but have closed lower all day again. Caution is advised.

Silver had a bigger reversal on SLV. Here we see a complete reversal that took out the high and the low of the previous four days. This is a Tom DeMark reversal on a daily chart. So far on Friday, we gapped up a little but have closed lower all day again. Caution is advised.

There are some who like to discuss Gold as a currency as I mentioned earlier. Working through a few charts on the webinar, I tried to convey why I think Gold is a commodity. I would encourage you to review the webinar and I'm ok if you agree or disagree. The important thing to keep in mind that the major big-picture lows and highs in Gold have also been replicated in most of the major commodities. Why is this important? Assuming Gold will not oscillate like a commodity will create significant drawdowns.

There are some who like to discuss Gold as a currency as I mentioned earlier. Working through a few charts on the webinar, I tried to convey why I think Gold is a commodity. I would encourage you to review the webinar and I'm ok if you agree or disagree. The important thing to keep in mind that the major big-picture lows and highs in Gold have also been replicated in most of the major commodities. Why is this important? Assuming Gold will not oscillate like a commodity will create significant drawdowns.

There are lots of other thoughts on the current market. I continue to watch Japan. There is a special section on the webinar about Japan. If Japan breaks, I think this will create a global issue and be the cause of significant market turmoil.

We really need to see the 15000 level hold on the $NIKK chart. I would expect some BOJ intervention when it gets to that level. How the market responds will probably decide the fate of the equities through the summer. A failure to rally will probably down draft the US equities as well.

There is lots more on the webinar replay. Thanks for following along on the Commodities Countdown and feel free to forward my articles to family and friends.

There is lots more on the webinar replay. Thanks for following along on the Commodities Countdown and feel free to forward my articles to family and friends.

You can subscribe to these articles by clicking on the Yes Button below. You can also follow me on Twitter @Schnellinvestor.

Good trading,

Greg Schnell, CMT, MFTA.