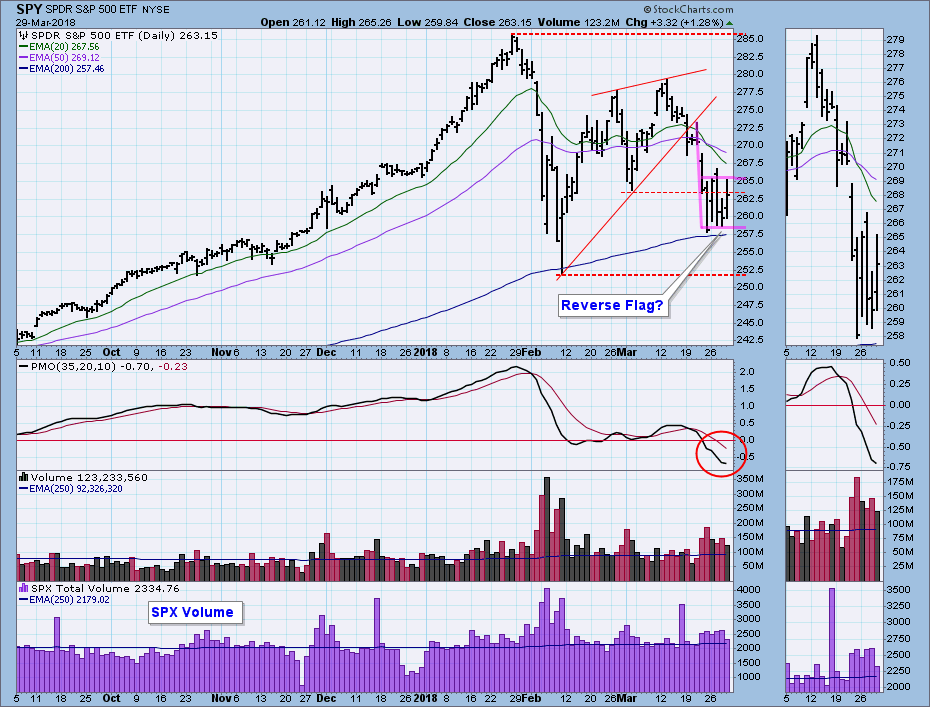

DecisionPoint March 29, 2018 at 07:36 PM

Last week the market broke down from a rising wedge pattern and dove into a scary decline. This week was choppy and wild, but price stayed within a somewhat ragged range that looks to me like a bearish reverse flag formation... Read More

DecisionPoint March 28, 2018 at 07:19 PM

The Dollar has been poised for a breakout for some time. The PMO has been rising nicely, but UUP has been banging its head on overhead resistance with not much success... Read More

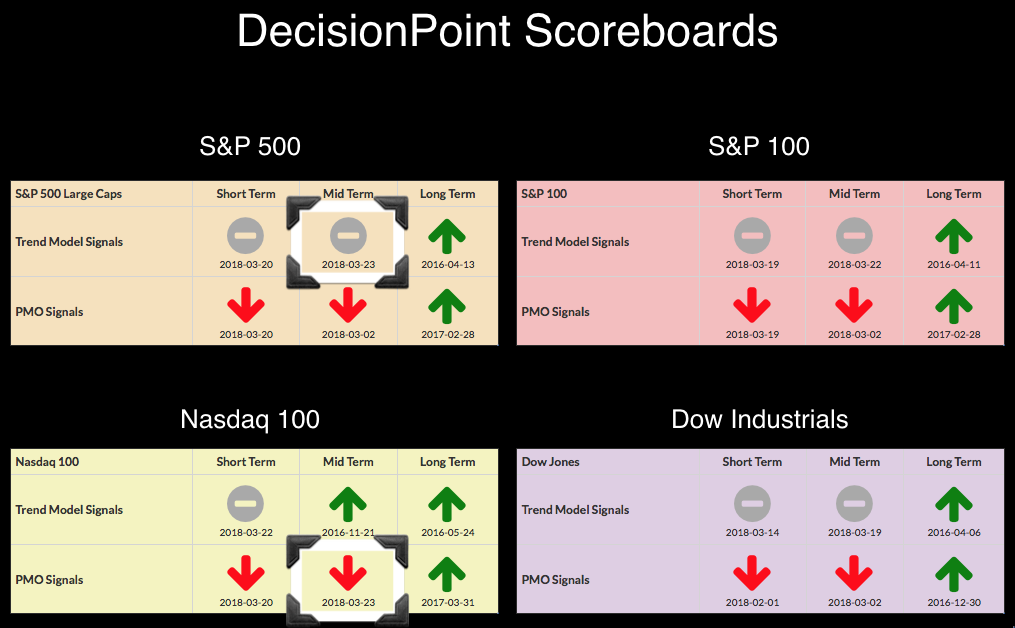

DecisionPoint March 26, 2018 at 06:35 PM

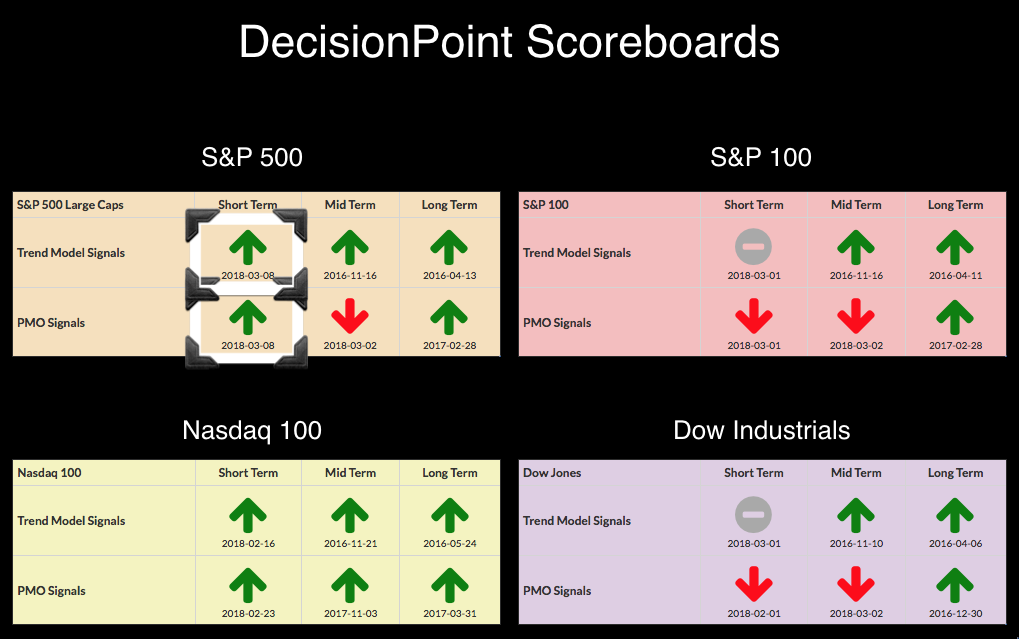

After day with the SPX up 2.72% and the NDX up 3.78%, it may seem strange to be talking about the loss of BUY signals on the DecisionPoint Scoreboards. My answer is that one day does not a bull market make... Read More

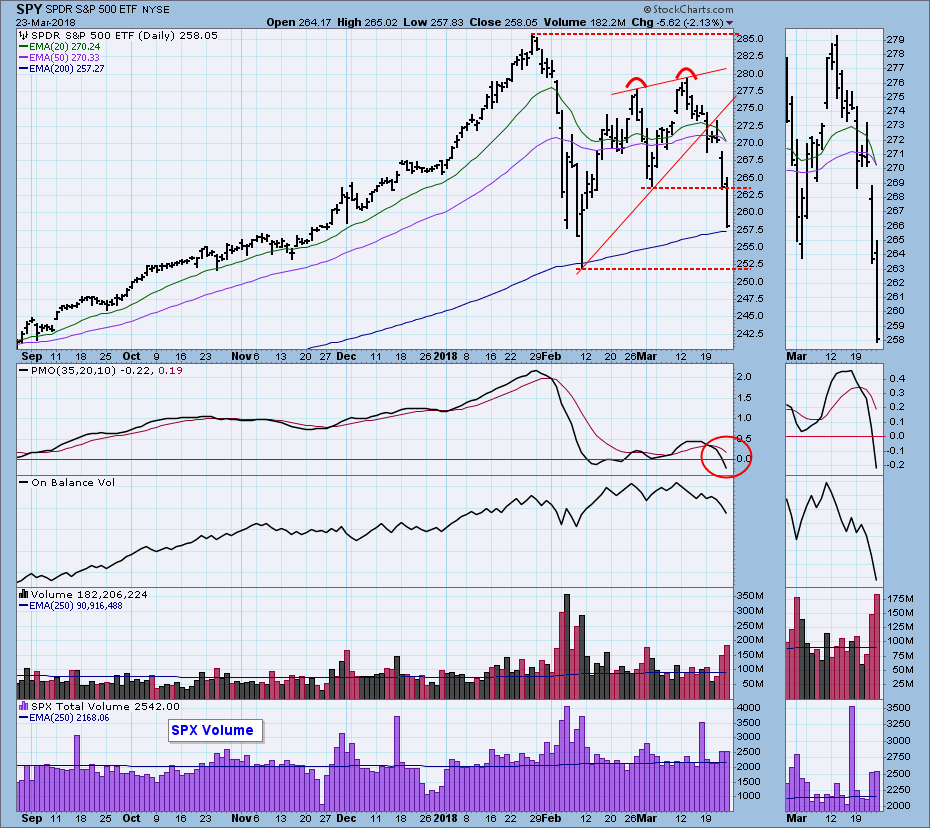

DecisionPoint March 23, 2018 at 07:49 PM

This week the rising wedge we had identified resolved downward, as expected. Once that happened, we needed to provide a context that could help determine an initial downside target, so we focused on the double top confirmation line, drawn across the low between the tops... Read More

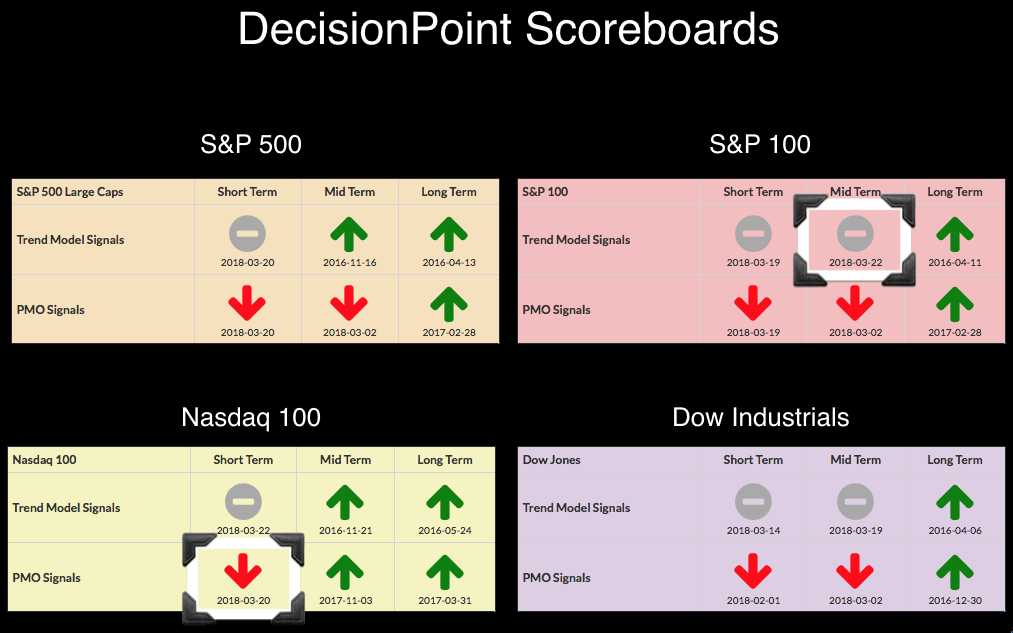

DecisionPoint March 22, 2018 at 07:07 PM

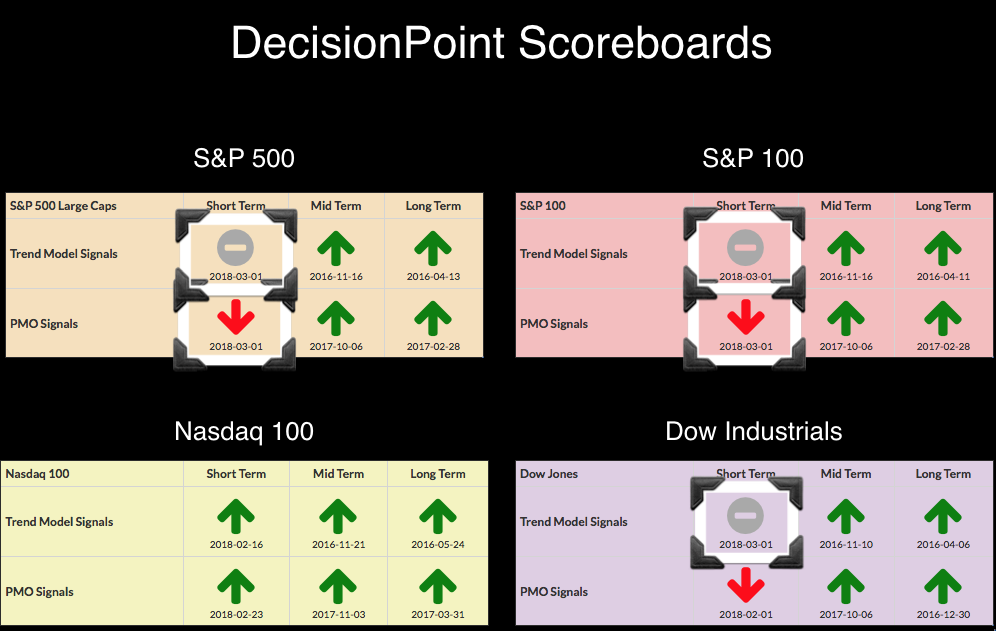

Two more BUY signals were lost on the DecisionPoint Scoreboards. We haven't seen the Intermediate-Term Trend Model Neutral signals on the Scoreboards in over a year... Read More

DecisionPoint March 21, 2018 at 08:12 PM

Below you'll find the latest DP Scoreboards. I've included a Sector Scoreboard that Carl and I will keep updated for analysis of sector rotation. The NDX is the only Scoreboard index holding its own... Read More

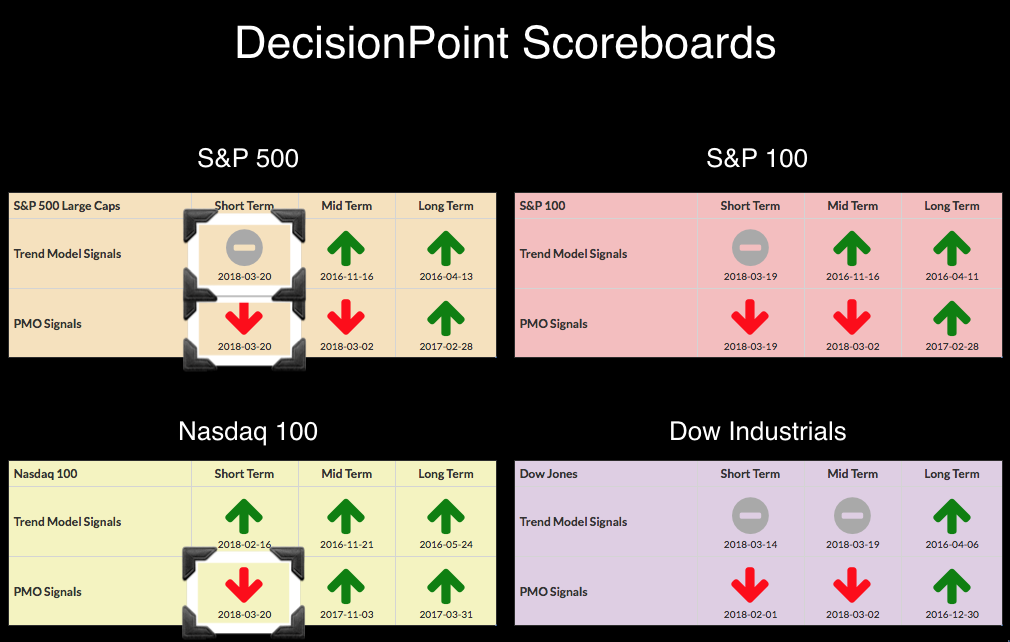

DecisionPoint March 20, 2018 at 06:57 PM

Just like dominos, the BUY signals on the DP Scoreboards are toppling and we're finally seeing some deterioration on the NDX. With Facebook (FB) and other technology stocks taking it on the chin the past few days, the NDX is finally succumbing to the downside pressure... Read More

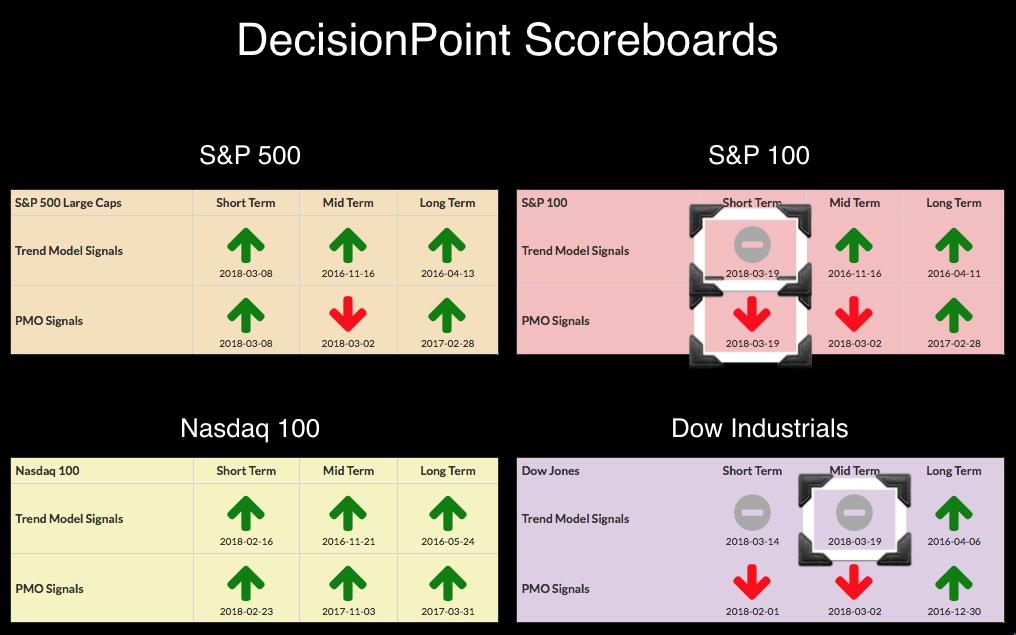

DecisionPoint March 19, 2018 at 08:03 PM

You'll note three BUY signals were lost today on the Dow and the OEX. The Industrials have been struggling. The Dow was unable to trigger a PMO BUY signal when the other three indexes had managed them with ease... Read More

DecisionPoint March 16, 2018 at 06:02 PM

First, the super high S&P 500 volume today was because of options expiration, so don't read anything else into it. Last Friday's encouraging breakout is looking like a short-term bull trap , as the market pulled back to the declining tops line support this week... Read More

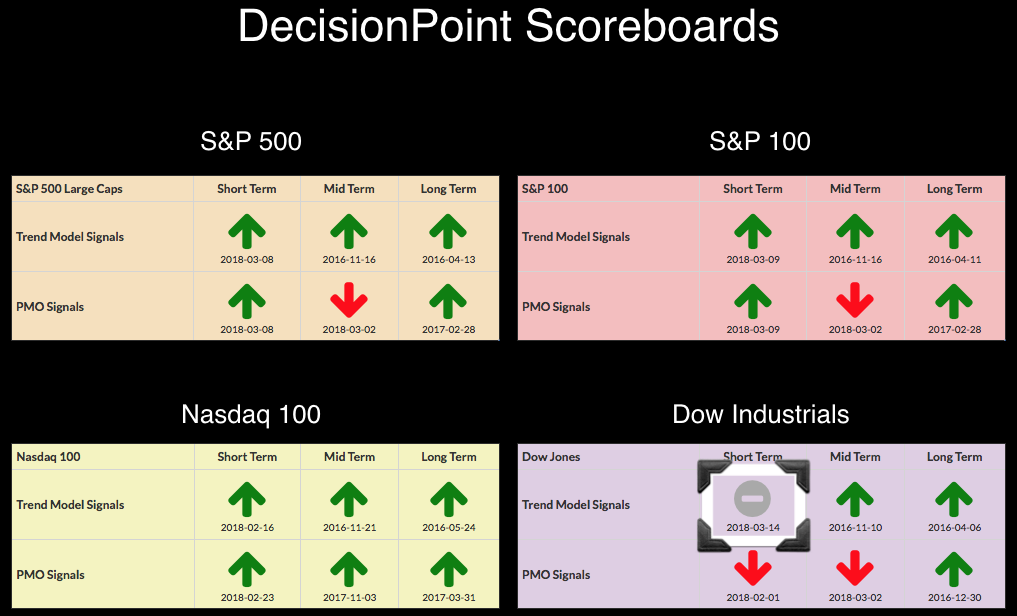

DecisionPoint March 14, 2018 at 07:46 PM

It was only yesterday that I added a new BUY signal to the Dow's Scoreboard and today, it's already gone. The Short-Term Trend Model (STTM) is based on 5/20-EMA crossovers. The Dow's 5-EMA crossed below the 20-EMA while it was above the 50-EMA--that constitutes a Neutral signal... Read More

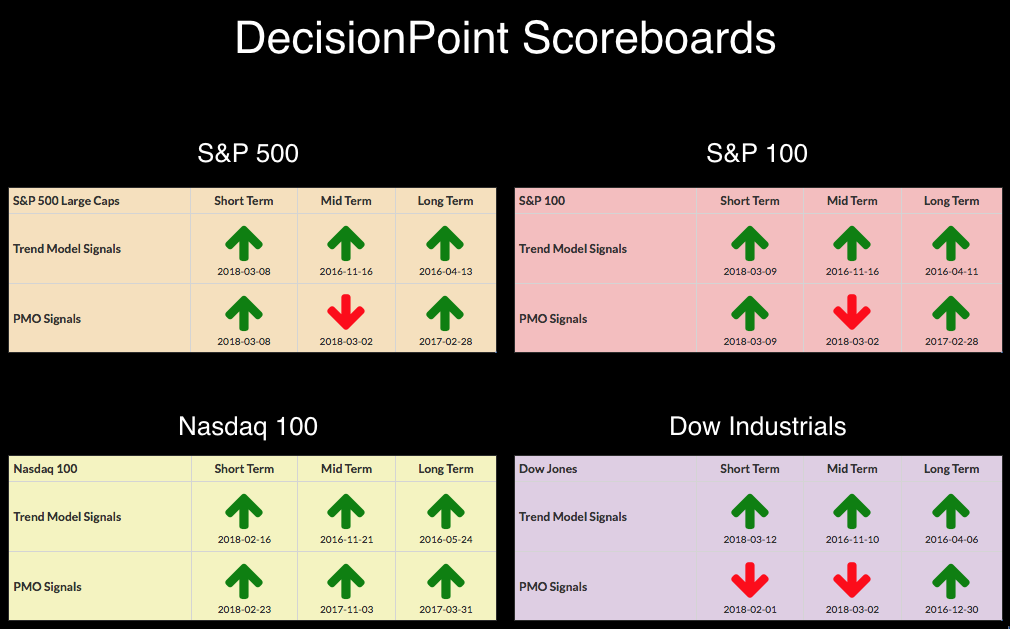

DecisionPoint March 12, 2018 at 06:33 PM

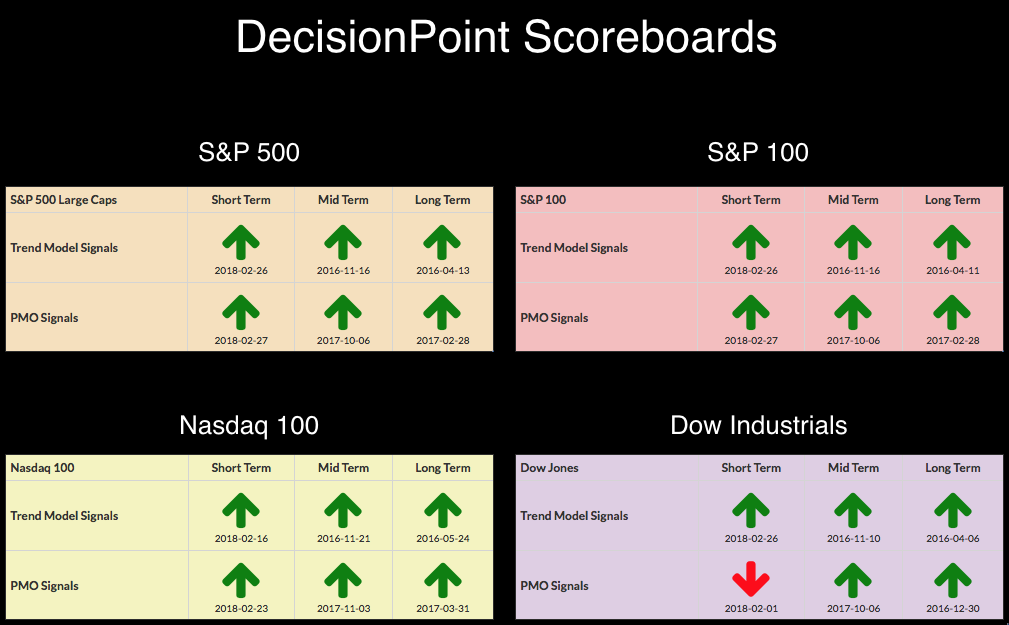

On Friday, the OEX managed to get both a new Short-Term Trend Model (STTM) BUY signal and a Short-Term Price Momentum Oscillator (PMO) BUY signal. At the time the Dow was the only Scoreboard to not have ST buy signals. Today that changed with a new STTM Buy signal for the Dow... Read More

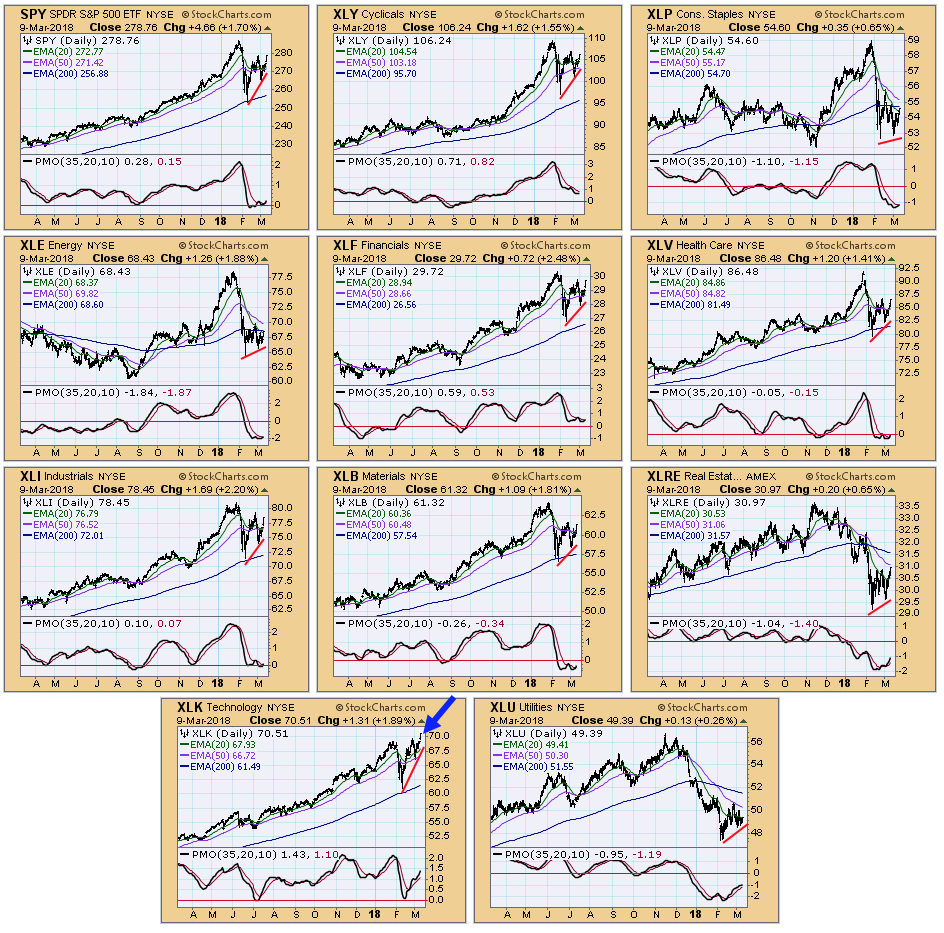

DecisionPoint March 09, 2018 at 07:19 PM

Friday was an exceptionally positive day, as prices advanced on good news regarding North Korea and jobs. Here are charts of the S&P 500 (SPY) and the 10 major sectors. The recurring theme we see is the double bottom... Read More

DecisionPoint March 08, 2018 at 07:53 PM

Let's get that title question answered right now...No, I don't think the correction is over. Yes, today we got both a ST Price Momentum Oscillator (PMO) BUY signal and an ST Trend Model BUY signal. The chart still has problems... Read More

DecisionPoint March 07, 2018 at 08:21 PM

It's days like today that I find it frustrating to write (probably why this is posted late). It's not really writers' block, but the many mixed messages or lack of messages I'm getting on the charts right now... Read More

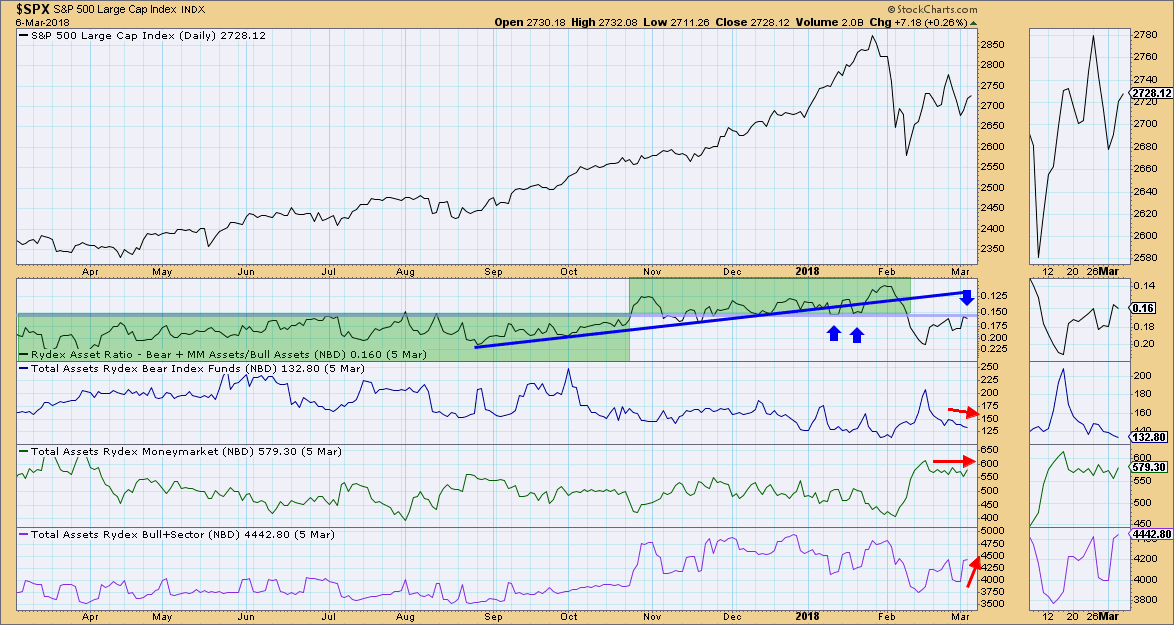

DecisionPoint March 06, 2018 at 07:04 PM

I decided to take a look at the Rydex Ratio today to see what the daily assets might be telling us as far as "actual money" sentiment. Here's a refresher for those new to the Rydex Ratio and sentiment readings in general... Read More

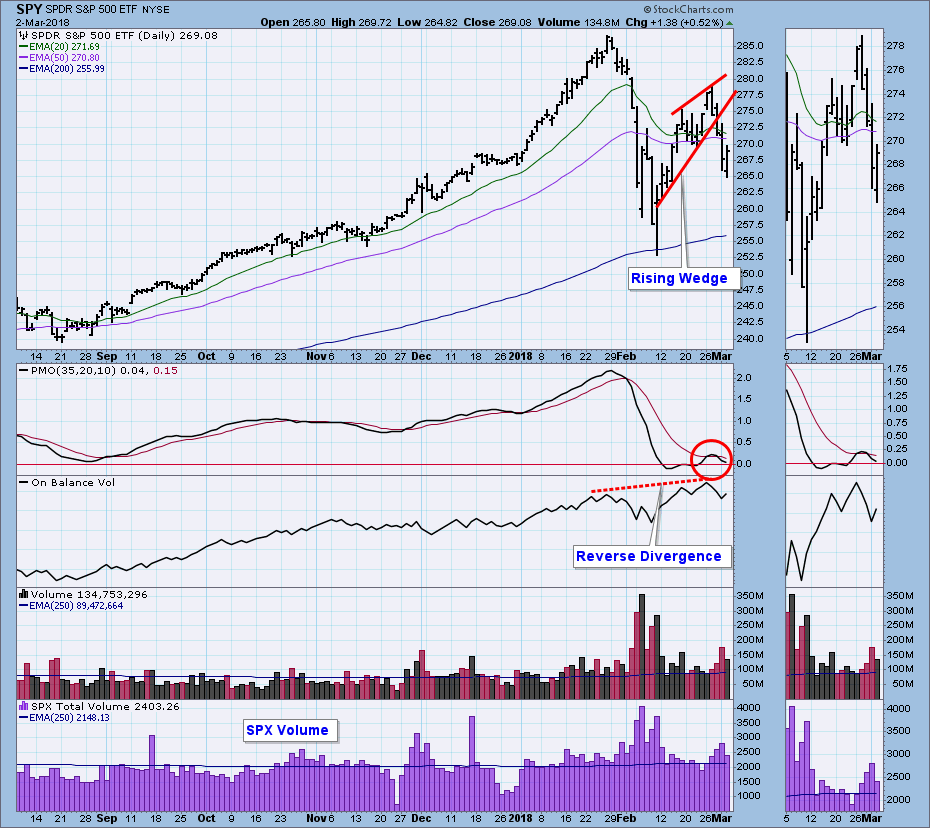

DecisionPoint March 02, 2018 at 06:29 PM

At last Friday's close we were faced with SPY pushing at the top of a bullish flag formation (not annotated). On Monday there was a strong breakout that proved to be a fakeout... Read More

DecisionPoint March 01, 2018 at 08:50 PM

After deep declines today, the DP Scoreboards lost most of their short-term BUY signals. Rising wedges had appeared on the daily charts and today's decline confirmed it. The expectation is a breakdown from the wedge... Read More

DecisionPoint February 28, 2018 at 08:25 PM

The market has closed on the final day of February. This means that DecisionPoint monthly indicators have "gone final" which is the perfect time to review those signals and take a long-term view of the markets and the DecisionPoint "Big Four"- $USD, $GOLD, $WTIC & $USB... Read More