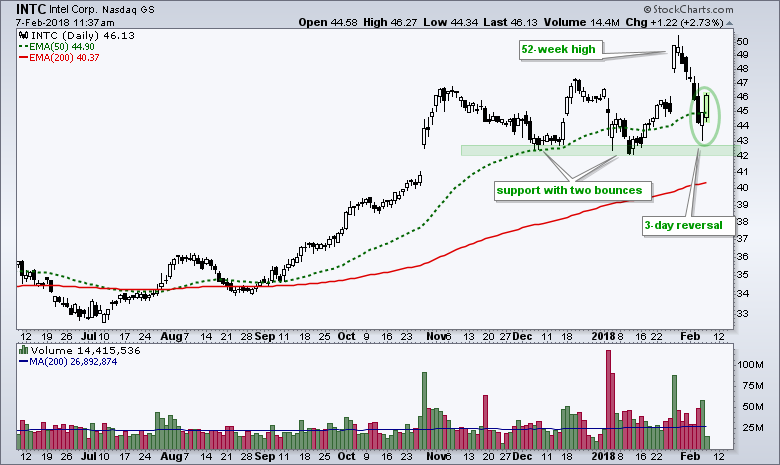

Intel (INTC) was hit hard the first three days of February, but the stock managed to hold support with a high volume reversal over the last three days.

Intel (INTC) was hit hard the first three days of February, but the stock managed to hold support with a high volume reversal over the last three days.

First and foremost, the long-term trend is up because Intel recorded a 52-week high in late January and the 50-day EMA is above the 200-day EMA.

Second, the stock has solid support in the 42-43 area. The stock tested this level with bounces in mid-December and mid-January. Intel managed to hold just above this support zone with Tuesday's low.

I expect this support zone to hold because Tuesday's reversal occurred on high volume. In addition, the stock followed through with further gains on Wednesday (provided they hold).

With the long-term uptrend intact and a successful support test, I would expect Intel to move higher in the coming weeks and hit a fresh new high.

Plan Your Trade and Trade Your Plan.

- Arthur Hill, CMT

Senior Technical Analyst, StockCharts.com

Book: Define the Trend and Trade the Trend

Twitter: Follow @ArthurHill