The same investment analysis seldom yields consistent conclusions over a period of time. As much as investors would like to believe they are predictably consistent in their analysis, I’d be willing to wager that this is seldom the case.

The same investment analysis seldom yields consistent conclusions over a period of time. As much as investors would like to believe they are predictably consistent in their analysis, I’d be willing to wager that this is seldom the case.

This is especially true if you are stalking similar equities, ETFs or mutual funds in the same industry or asset class. I find when I review my asset allocation baskets and focus on the “top” options (which I inventory on asset specific perf charts), my preferences for “best of breed” may vary from month to month.

Here’s a personal example. One of my Asset Baskets is USA Small Cap Stocks.

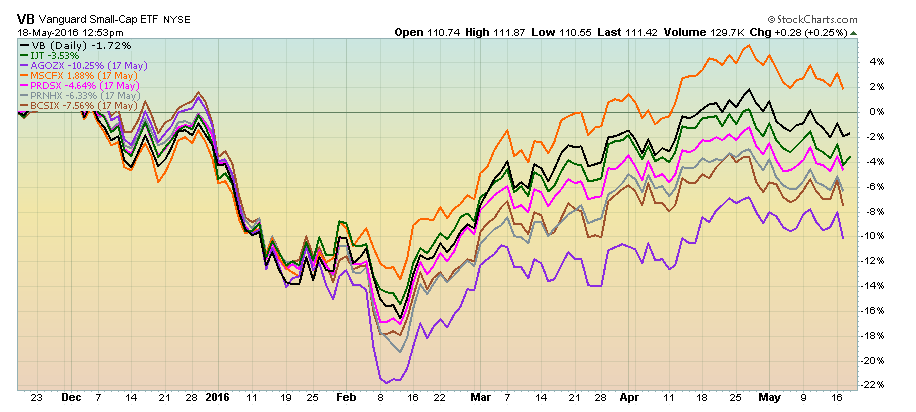

- From a potential pool of small cap ETFs – such as VB, IJT, IJR, SYLG (even RZG and RSV although I don’t get into growth versus value with Small Caps) – I have ranked VB and IJT as my two favorites in this arena.

- Then I investigate the mutual fund arena. BCSIX has a strong record, but Amy Zhang left Brown to take over AGOZX. (This is the institutional version and also has AOFAX and AOFCX) but the fees are crazy. So does BCSIX collapse with Zhang leaving? Have to monitor it and see. T. Rowe Price also has a couple of nice options, but PRNHX is closed so PRDSX is a consideration. Recently, MSCFX has been very interesting.

- All these candidates are loaded on a performance chart. My point is that these are the “best of the breed” candidates.

- I have available to me some back doors to get into institutional funds so I have a different collection of candidates then you might have. Nevertheless, my point is that your top choices can and will vary over periods of analysis.

I can only surmise that I am somewhat inconsistent in my abilities to perform exactly the same analysis time and time again. There is often some slight variation. It’s much like the popular novel, Fifty Shades of Gray. Top candidates have nuanced differences that bubble to the surface in different ways, depending on my mood, my perspective and the markets, all of which vary day by day. Think of yourself as a locksmith since the markets are constantly changing the locks.

The bottom line is that it’s human nature to have some shuffle back and forth amongst the leaders over time. What I look for is a consistency in the shuffle partners which convinces me that I’m truly choosing amongst a select number of equities vying for the title of “best of breed.”

What regular analysis often produces is an occasional dance partner (i.e. equity) that might join the party for a relatively brief period, but seldom reappears on a regular basis. It’s the regular dance partners that get labeled “best of breed” and those are where I flow my funds.

Trade well; trade with discipline!

-Gatis Roze, MBA, CMT

Presenter of the Tensile Trading DVD, Stock Market Mastery.

Developer of the StockCharts.com Tensile Trading ChartPack.

P.S. Click HERE for information on my future appearances & seminars.